Summary:

- I reiterate a ‘Strong Buy’ rating on Dell with a one-year target price of $210 per share, driven by robust AI server growth.

- DELL reported 9.5% revenue growth and 14% adjusted EPS growth, primarily fueled by record-high AI server orders and strong enterprise customer traction.

- Despite weaker Consumer PC business growth, Dell’s new AI server products and partnerships with Nvidia, AMD, and Intel position it well for future growth.

- I anticipate Dell’s AI server business to grow significantly, contributing 6% to topline growth from FY25 to FY27, with overall margin expansion expected.

Thinglass

I assigned a ‘Strong Buy’ rating on Dell (NYSE:DELL) in August 2024, highlighting their strong growth in Servers and Networking business. Dell delivered 9.5% revenue growth and 14% adjusted EPS growth in Q3 FY25, driven by the strong growth in AI servers. Dell experienced a weaker-than-expected growth in its Consumer PC business. I think their AI server growth momentum will remain strong, and I reiterate a ‘Strong Buy’ rating with a one-year target price of $210 per share.

AI Server Growth Momentum Continued

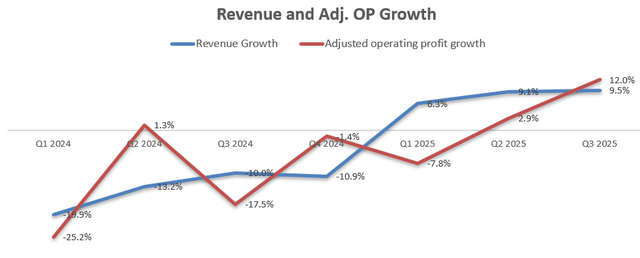

Dell reported its Q3 FY25 result on November 26th after the market close, delivering 9.5% revenue growth and 12% adjusted operating profit growth. Dell has experienced an accelerated business growth in recent quarters, as depicted in the chart below.

The growth acceleration was driven by their strong growth in AI servers. Notably, Dell achieved $3.6 billion in AI server orders, marking a record high, with 50% year-over-year growth in sales pipelines. During the earnings call, the management noted that they continued to gain traction with enterprise customers, totaling over 2,000 enterprise clients.

On November 18th, Dell announced three new server products: the PowerEdge XE7740 and PowerEdge XE9685L, and updated Integrated Rack 5000 (IR5000) series. These products are tailored for AI computing and GPU workloads. As noted during the call, IR5000 can support up to 96 GPUs per rack using a traditional 19-inch rack design, making it ideal for enterprise AI inference workloads.

My key takeaway from the quarter was the management’s strong confidence in AI-driven growth across servers, storage and networking devices. I think the company is well positioned to capitalize on the rising demands for AI servers. In addition, the recent challenges faced by Super Micro Computer (SMCI) could potentially allow Dell to gain more market share in the liquid-cooling server market, in my view.

Outlook and Valuation

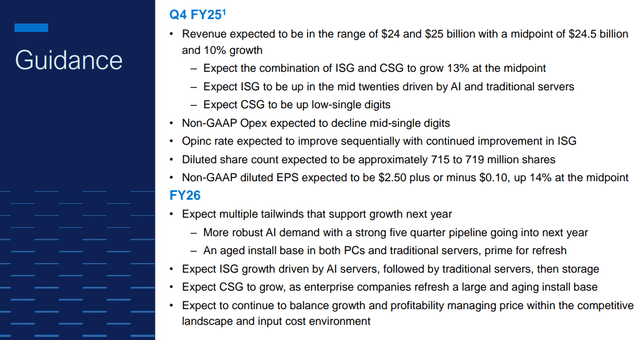

Dell is guiding for 10% revenue growth for Q4 FY25 at the mid-point, as detailed in the slide below. In addition, the management expressed a strong confidence in FY26’s growth, underpinned by AI demands and PC/traditional server upgrade cycles.

As discussed in my previous article, I believe AI server will be a major growth driver of Dell’s future growth. The company’s partnerships with Nvidia (NVDA), AMD (AMD), Intel (INTC), as well as major hyperscalers could potentially help the company capture a larger market share of data center market. In addition, Dell has established a huge enterprise customer base in the traditional server market, and I think Dell is well-positioned as enterprises are more likely to adopt AI inference workloads in the future.

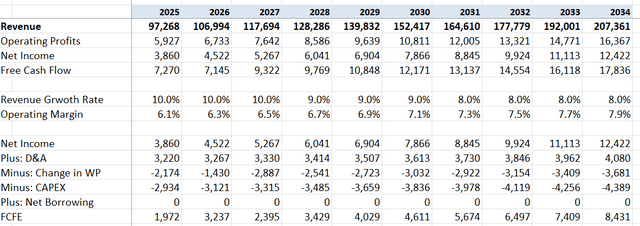

Currently, AI server represents around 12% of total revenue. I anticipate AI server business will grow by 50% annually from FY25 to FY27, as hyperscalers are investing heavily in AI training infrastructure. When the AI technology shifts toward inference phase, I anticipate Dell’s AI server business will grow by 30% from FY28 to FY30; before stabilizing at 10% growth from FY31 onward, as AI investments near maturity. As such, I calculate that AI-related business will contribute 6% growth to Dell’s topline from FY25 to FY27, 5% from FY28 to FY30 and 4% from FY31 onwards.

In addition, I anticipate the traditional several and storage business will grow in line with the overall market growth, contributing 3% to the overall topline growth.

Lastly, consumer and commercial PC businesses represents around half of total revenues. The segment growth will be driven by the PC/workstation upgrade cycles. During the earnings call, the management remained optimistic about the upcoming PC refresh cycle, citing the aging install base and the end-of-life for Windows 10 in 46 weeks. I anticipate Dell’s PC business will contribute 1% growth to the overall topline, assuming the segment will grow in line with the overall PC market growth.

I anticipate Dell will achieve 20bps annual margin expansion, driven by 10bps from gross margin growth and 10bps from reduction in SG&A expenses. The cost of equity is calculated to be 9.7% assuming: risk-free rate 3.6%; beta 0.87; equity risk premium 7%. I calculate the free cash flow from equity (FCFE) as follows:

Discounting all the future FCFE to the year of FY25, the one-year target price is calculated to be $210 per share, as per my estimates.

Downside Risks

During the quarter, Dell experienced a weaker-than-expected growth in their Consumer business, with revenue declining 18% year-over-year, due to continued challenges in end-market demand. As noted during the call, the PC refresh cycle has been deferred to 2025. I think this weakness was primarily driven by the challenging macroeconomic environment and the normal cyclicality of PC markets. As AI computing will drive the next PC upgrade cycle, I think Dell’s PC business will recover in the near future.

Closing Thoughts

Although the market is disappointed by the weak growth in the Consumer PC business, I believe this is merely a temporary headwind, and Dell is well positioned to capitalize on growth in the AI server market. I reiterate a ‘Strong Buy’ rating with a one-year target price of $210 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DELL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.