Summary:

- Dell Technologies Inc. remains a strong investment due to its positioning in the growing AI market and upcoming PC refresh cycle.

- Positive news and analyst ratings, coupled with Dell’s focus on AI and efficiency, suggest significant undervaluation and potential for growth.

- Dell’s Q3 and Q4 outlooks are promising, with expected revenue growth driven by AI server demand and potential Nvidia Blackwell shipments.

- Despite short-term gross margin concerns, Dell’s long-term free cash flow growth and market opportunities make it a buy for long-term investors.

Thinglass

The AI Investment Thesis

Dell Technologies Inc. (NYSE:DELL) has received much attention lately and recently reported earnings on August 29 th, 2024. Given the recent news updates and the decline in share price, I am revisiting my investment thesis for Dell.

In this article, I explain why I believe the stock is still a great investment, despite souring sentiment. With a lower stock price and a higher margin of safety, Dell may be a great way to play the large and growing AI market. Dell looks to emerge as one of the leaders in data center and enterprise AI while also capturing tailwinds from the next PC refresh cycle that is expected to come in the next several quarters.

With 30% growth in ISG revenue this year, Dell is showing strength in the right area, artificial intelligence. A simple reverse DCF model shows that Dell only needs to grow free cash flow at a 5% CAGR over the next ten years to be a solid investment. When applying what I believe to be reasonable medium-term growth rates beyond the next three years of analyst’s estimates for forward free cash flow, Dell appears to be significantly undervalued.

What Has Changed?

Dell has received some positive news lately. The stock has risen roughly 5%, after having been included in the S&P 500. After the announcement, analysts are raising or maintaining high price targets on the stock. Citigroup (C) maintained a buy rating and set a$160 target, citing Dell’s EV-EBITDA multiple of 9.8, striking, “a balance that reflects both opportunity and risk.” Meanwhile, UBS lists Dell as its top pick in the Hardware and Electronics Manufacturing Services segment, thanks to strong earnings results and its positioning in AI and for the coming PC refresh cycle. Susquehanna is more neutral on the stock, initiating coverage with a $120 price target.

Dell is also cutting its workforce and focusing on increased efficiency, taking a $328 million reduction charge in Q2. Q2 results were strong, but the market did not like the company’s outlook for gross margins, prompting a sell-off of the stock.

Why Dell Has Fallen

Artificial Intelligence applications and services are the main reason I am interested in Dell. In May, I wrote about how I believed Dell was the safer way to chase AI investment gains but cautioned readers to resist chasing a run-up in the share price. Sure enough, the price was $147 when I submitted my article for publication, and the stock price was $160 by the time it published. Officially, my returns since that article are -33% (based on the $160 price). I also questioned whether Dell would revise its estimates further. I understood that expectations are critical in this market, and sentiment would likely be more important than revenue growth or long-term tailwinds in the minds of investors.

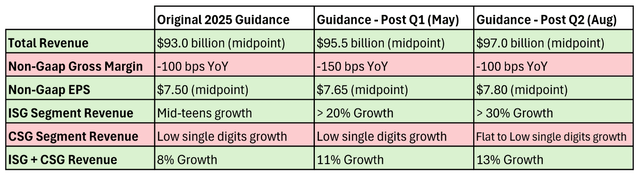

Sure enough, after Q1, Dell raised its revenue and non-GAAP EPS guidance from its original FY 2025 outlook. However, the stock took a major hit due to the company lowering non-GAAP gross margin guidance. After Q2, Dell once again raised revenue and EPS guidance while lowering gross margin guidance, once again shaking the stock. The market has grown fearful of contracting gross margins. Normally, this would concern me, but the increased EPS guidance makes me think the inflationary pressures and competition in AI server deployment are not as bad as they seem.

The evolution of fiscal 2025 guidance since Dell reported Q4 2024 results in February can be seen in the chart below. Positive revisions are highlighted in green, and negative are highlighted in red.

Author-Generated from Dell Presentations

Underneath the headline figures, Dell continues to raise ISG revenue guidance while tempering CSG segment expectations. This shows Dell is chasing growth in the highest opportunity area, AI products and services, which is reflected in ISG. It also indicates that the PC refresh cycle that Dell is looking forward to is being delayed, impacting expectations for a return to growth in CSG.

Forward Outlook Should Improve

Dell expects Q3 to be solid and Q4 to be even stronger. Given the full-year midpoint expectation of $97 billion and $24.5 billion in Q3, the company essentially told us it would do at least $25.2 billion in Q4. This would represent a 10% and 13% YoY growth rates in Q3 and Q4, respectively. I wouldn’t be surprised to see Dell again raise top-line and EPS guidance when it next reports. The expected growth acceleration between Q3 and Q4 lines up with the potential timing of Nvidia’s (NVDA) beginning of Blackwell shipments. If so, any relative weakness in Q3 will likely result from supply issues rather than demand weakness.

If we listen to what management said in the Q2 2025 earnings call, it would confirm that demand is not an issue for Dell. COO Jeff Clarke told analysts that Dell continues “to see an increase in the number of enterprise customers buying AI solutions each quarter.” Clarke reiterated Dell’s belief that enterprise is a significant opportunity. It is also a market where margins tend to be higher, and many of its potential customers are still in the early stages of AI adoption, leaving a long runway for growth. This opportunity comes with a total addressable market, or TAM, of $174 billion that is expected to grow 22% annually over the coming years, according to management. This is also an increase from the last time management reported this TAM ($154 billion and 20% CAGR).

Within this massive TAM, Dell aims to handle most aspects of data center networking and design for its customers, touting its ability to compete for large AI deals. This is a massive opportunity, and I think that short-term gross margin losses at the cost of faster top and bottom-line growth are precisely the way to play this opportunity. If Dell can compete on price and capture large AI projects now, it can parlay this into longer-term revenue.

How Dell Could Beat The Market

Non-GAAP gross margin was $21.4 billion in FY 2024 on a non-GAAP gross margin of 24.3%. I think Dell will once again raise guidance after Q3, and given the steady revenue and earnings beats, it seems likely to generate a full-year revenue figure of at least $100 billion. The company expects FY gross margin to decline 180 basis points, which would be 22.5%. If Q4 sees a pickup in deliveries in AI servers, particularly with Nvidia’s Blackwell chips, Dell could see margins pick up slightly in Q4. Let’s assume Dell achieves an FY 2025 non-GAAP gross margin of 22.7% on $100 billion. That is good for a gross profit of $22.7 billion, only 6.1% better than 2024.

Now, if Dell can see an acceleration of sales in 2025, thanks to Blackwell and other product sales picking up steam throughout the year and the PC refresh cycle beginning, the company could have a chance to achieve 15% top-line growth in 2025. In this case, a 22.7% gross margin would deliver $26.1 billion in gross profit. This would represent a 2-year CAGR of 10.4%.

With reductions in headcount and SG&A expenses declining as a percentage of revenue, the company can benefit from operating leverage and potentially accelerate free cash flow growth well beyond 10%.

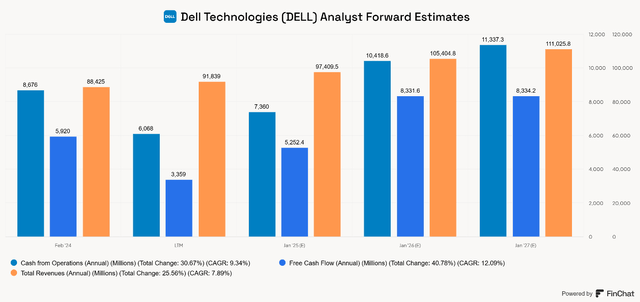

Perhaps this is what analysts are seeing too. If we go on analysts’ estimates, free cash flow should grow at a CAGR of 12.1% over the next three years (including fiscal 2025, which is half completed).

Dell Forward Revenue and Cash Flow Estimates (FinChat)

Valuation

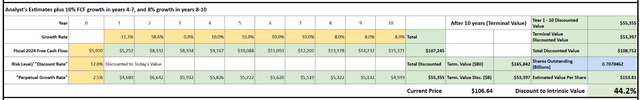

Using analysts’ estimates of free cash flow over the next three years, I constructed a basic DCF model. I assume that Dell generates the above estimated FCF figures of $5.252 B, $8.332 B, and $8.334 B over the next three years. Then, I assume Dell can maintain a 10% FCF CAGR in years 4-7. This assumes that data center build pipelines are stretched out at least seven years from now, which aligns with my analysis in my Modine Manufacturing (MOD) article and information from Dominion Energy (D). In years 8-10, I assume that FCF growth slows to a CAGR of 8%.

Using a 2.5% terminal rate, allowing for GDP to GDP-plus growth in perpetuity and a discount or hurdle rate of 12%, which would likely make DELL a market-beating stock, DELL trades at a potential discount of 44.2% to the current share price of $106.64.

DCF Model using Analyst and Author’s FCF Estimates (Author-generated DCF Model)

Risks

Dell is at the mercy of a market ready to either explode higher or sell everything. I don’t know what to make of the short term, so my focus is on the long term with Dell. In other words, it’s the season of AI jitters, so don’t be surprised if the stock sells off because of macroeconomic fears or another AI stock reports less-than-stellar earnings. Another risk is that Dell faces stiff competition and is unable to be one of the big winners in the AI market.

Conclusion

I believe that Dell has a large opportunity it is chasing and that the company is showing signs that it is ready to capitalize on the growing AI hardware and services TAM. The proof comes in the growth in AI server revenue. Despite contracting gross margins, I see the potential for impressive free cash flow growth. The recent addition to the S&P 500 could be a slight near-term catalyst, and investment banks are turning bullish again. The stock currently trades with a pretty healthy margin of safety and may only require moderate free cash flow growth to be fairly or undervalued. I rate Dell as a buy for long-term-minded investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DELL, MOD, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.