Summary:

- Dell Technologies’ PC and enterprise server markets are in the midst of a cyclical upturn.

- The company is benefiting from the adoption of Artificial Intelligence, which is driving growth in its Infrastructure Solutions Group (ISG) business.

- Although the stock’s valuation may seem high to some, its solid earnings growth and future prospects warrant investors’ attention.

JHVEPhoto

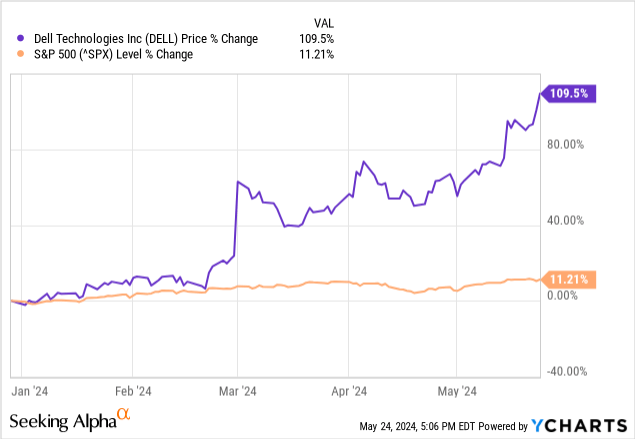

Dell Technologies (NYSE:DELL) is an information technology (“IT”) infrastructure and services provider that offers customers everything from data center equipment and enterprise IT solutions to personal computers (“PCs”). The company’s industry is cyclical, and in recent years, Dell’s products and services have been in a major downturn. The market has recently taken a major interest in the stock for two reasons. First, the company’s most important end markets, PCs and enterprise servers, appear to be at the beginning of an upcycle. Second, the company should be a significant beneficiary of Artificial Intelligence (“AI”) adoption in the enterprise space. The stock price has gained considerable traction year-to-date, beating the S&P 500 Index (SPX) returns by miles.

This article will discuss the potential cyclical upturn in Dell’s end markets, how AI is a revenue growth driver for the company’s end markets, briefly discuss what to expect when the company reports results on May 30, and briefly review its debt situation and additional risks. Last, this article will discuss the stock’s valuation and why growth investors can buy the stock at current prices.

A potential rebound in the enterprise server and the PC market

As of the end of the fiscal year (“FY”) 2024, Clients Solutions Group (“CSG”), Dell’s branded personal computer (“PC”) business, made up 60% of its annual segment net revenue, and Infrastructure Solutions Group (“ISG”), Dell’s enterprise storage, server, and networking business, was 40%.

The PC market started deteriorating as high inflation and rising interest rates began stunting demand in the third quarter of 2022. A Gartner (IT) press release stated the following (emphasis added):

“The anticipation of a global recession, increased inflation and higher interest rates have had a major impact on PC demand,” said Mikako Kitagawa, Director Analyst at Gartner. “Since many consumers already have relatively new PCs that were purchased during the pandemic, a lack of affordability is superseding any motivation to buy, causing consumer PC demand to drop to its lowest level in years.” “The enterprise PC market is also being impacted by a slowing economy,” added Kitagawa. “PC demand among enterprises began declining in the third quarter of 2022, but the market has now shifted from softness to deterioration. Enterprise buyers are extending PC lifecycles and delaying purchases, meaning the business market will likely not return to growth until 2024.“

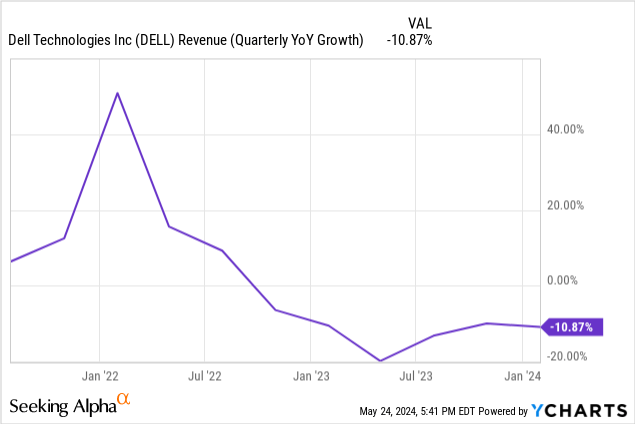

The server market took slightly longer before it too began deteriorating. In 2023, traditional server sales dropped significantly for the first time in over a decade. Business analyst Omdia reported that server unit shipments declined 25% year-over-year in the second quarter of 2023 as higher demand for AI servers lowered demand for traditional servers. Practically, the only company that benefitted significantly from high AI server demand in 2023 was Supermicro (SMCI). Companies reliant on traditional server sales, like Dell, had a more challenging time. Year-over-year growth in servers, networking, and storage in Dell’s ISG segment went negative in the first quarter of FY 2024 (calendar 2023).

Because both its primary end markets suffered downturns over the last one to two years, the company’s quarterly revenue growth declined from over 40% year-over-year at the beginning of 2022 to a negative 10.87% as of the fourth quarter of FY 2024.

Fortunately for the company, the revenue headwinds from the severe PC, server, and storage downturns are turning into tailwinds. Industry researcher IDC stated in an article on April 8, 2024, “After two years of decline, the worldwide traditional PC market returned to growth during the first quarter of 2024 (1Q24) with 59.8 million shipments, growing 1.5% year over year, according to preliminary results from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker.” The potential drivers behind the PC market’s return to growth are the need for both consumers and businesses to replace outdated PCs and refresh Windows after pushing off the buying decision for nearly two years.

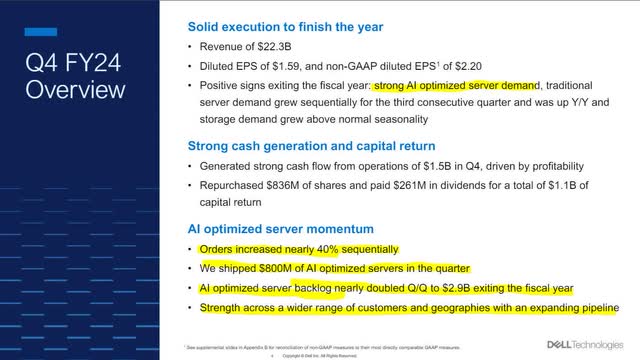

As for servers, Omdia stated in an April 2024 article, “Conventional server shipments recovered from their slump in 2Q23 as the server refresh cycle started to affect the older servers neglected by cloud service providers (CSPs) significant artificial intelligence spending.” Dell has already seen signs of growth return to the traditional server market. In its fourth quarter FY 2024 performance review slide, the company stated, “Traditional server demand grew sequentially for the third consecutive quarter and was up Y/Y and storage demand grew above normal seasonality.”

In addition to its end markets returning to growth, Dell expects an additional boost to sales from building AI functionality into PCs and the enterprise server industry adopting AI.

Expect AI to be a growth driver

One question you might have is why Super Micro benefitted so much from AI server adoption in 2023 and Dell didn’t. Part of the reason is that Super Micro caters more to large cloud providers, which engaged in a heavy build-out of AI server capability in 2023. Dell is more focused on enterprise on-prem servers, which was less active in developing AI capabilities in 2023. Additionally, Dell only started ramping up AI servers in the second half of 2023, a bit later than Super Micro. Dell believes there will be a high demand for AI in the enterprise server market, similar to last year’s high demand for AI servers in the cloud market. At the Morgan Stanley Technology, Media & Telecom Conference on March 5, 2024, Dell ISG Business President Arthur Lewis said (emphasis added):

In terms of [AI] deployments, I think it’s important to start with the fundamental fact that 83% of the world’s data sits on-premises. And there’s gravity to that data. And the reason why there’s gravity to that data is because of cost, performance and security. 82% of the customers that we’ve surveyed definitely trends towards a preference on-prem for the deployment of generative AI. When you have information that touches proprietary company information, proprietary financial information, proprietary IP, CIOs and CEOs and Boards really don’t want to adjust their data strategy. So I think there’s probably a stronger argument to make for repatriation than for more data going to the cloud because of cost, security and performance. What we see is a lot of customers are testing out workloads in the cloud, just to prove out concepts. But when it comes to putting AI in production, they’re coming to us to help them think through an on-prem solution.

Statista projects the AI market to reach $184 billion by the end of 2024 and grow at a compound annual growth rate (“CAGR”) of 28.46% to reach $826.70 billion by the end of 2030 — a huge potential growth tailwind. If Arthur Lewis’ statement proves true and enterprise demand is heavy for AI on-prem servers, Dell could have solid revenue growth from its ISG business segment in FY 2025.

Dell Fourth Quarter FY 2024 Performance Review.

Management also expects its CSG business to benefit significantly from AI adoption over the long term. Except, they expect it to happen in the latter half of the calendar year 2024. Right now, no one knows what capabilities an AI computer will have or all of the use cases for an AI computer. Still, there is a good chance people and businesses will buy an AI computer to future-proof their purchases. No one wants to buy a standard computer today and learn a year later that AI computers are necessary for running several top-rated applications that make the standard computer obsolete. CFO Yvonne McGill said at the Morgan Stanley conference:

And so we’re thinking that we’ll start to see more of AI capabilities being embedded in PCs that are towards the — starting the refresh cycle, right, which we — I already said was we think it’s going to be towards the latter half of this year. I think it’s — I expect a lot more capabilities. You’re going to want to have those capabilities embedded in your device because when the technology is delivered, you don’t want to have to refresh your PC again, right?

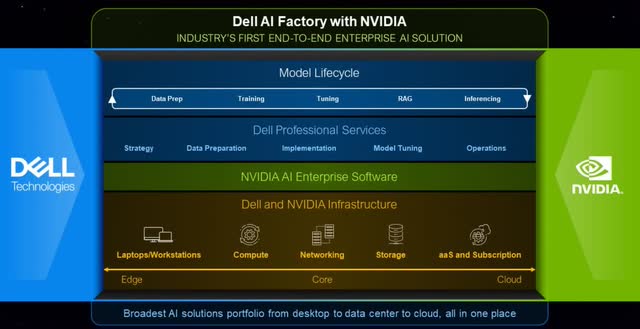

I will discuss the company’s expectations for growth from AI later in the article. First, let’s discuss a recent collaboration between Dell and NVIDIA (NVDA) to build AI factories.

Dell AI factory with NVIDIA

What are AI factories? The following is a quote from NVIDIA CEO Jensen Huang defining AI factories from NVIDIA’s fourth quarter FY 2024 conference call (emphasis added):

We now have a new type of data center that is about AI generation, an AI generation factory. And you’ve heard me describe it as AI factories. But basically, it takes raw material, which is data, it transforms it with these AI supercomputers that NVIDIA builds, and it turns them into incredibly valuable tokens [newly generated data].

What these new data centers do is process data generated in the real world through an AI supercomputer to create tokens or “synthetic data” that people can use to train AI models. In my last article on NVIDIA, I gave an example of an AI factory manufacturing synthetic data to train self-driving cars, as that may be a use case that makes the idea more understandable. The following excerpt from an NVIDIA blog from its website discusses the concept of synthetic data (emphasis added):

Synthetic data is annotated information that computer simulations or algorithms generate as an alternative to real-world data. Put another way, synthetic data is created in digital worlds rather than collected from or measured in the real world. It may be artificial, but synthetic data reflects real-world data, mathematically or statistically. Research demonstrates it can be as good or even better for training an AI model than data based on actual objects, events or people.

This synthetic data can save time when developing many applications. For instance, instead of paying people to drive one billion miles to collect data for self-driving cars, researchers can use tokens or synthetic data from AI factories to drive that exact one billion miles virtually in a much shorter period. There are many different applications for AI factories. Imagine using synthetic data to create cures for cancer or develop better materials for solar panels or batteries. Scientists might better understand physics and accelerate the development of quantum computers or fusion reactors.

The NVIDIA blog later cited a synthetic data report by Gartner that “predicted by 2030 most of the data used in AI will be artificially generated by rules, statistical models, simulations or other techniques.” So, data factories have the potential to provide long-term revenue-generating benefits for Dell and NVIDIA. The following image comes from a Dell blog describing its AI factory collaboration with NVIDIA.

Dell website

The following section will cover what investors should expect when Dell reports earnings on May 30 and later during the year.

What to expect in the future

On October 5, 2023, Dell management presented its long-term value creation goals to analysts at Dell Technologies Securities Analyst Meeting.

Dell Technologies Securities Analyst Meeting

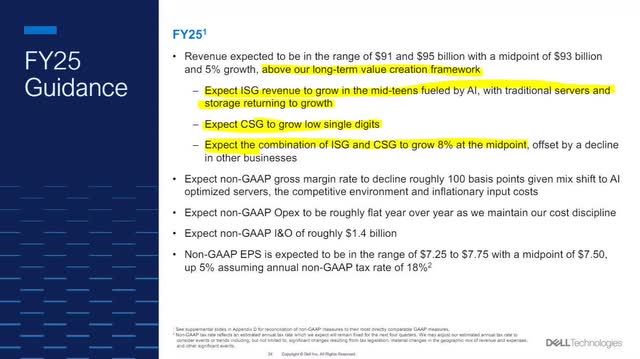

In addition to guiding for total revenue growth of 3-4% at the October meeting, shown in the above image, the company guided ISG revenue to produce 6% to 8% annual growth, a step up from 3-5% annual growth from the company’s forecast at an Analyst Day three years ago. When the company reported revenue guidance for FY 2025, it exceeded its long-term framework. The image below shows that the company ratcheted up ISG revenue guidance to the mid-teens level and total revenue to 5% for FY 2025.

Dell Fourth Quarter FY 2024 Performance Review.

Dell’s stock is up nearly 70% to the May 24 closing price since it released the above FY 2025 guidance. Investors may have gotten excited by this guidance because there is clearer evidence that AI provides the company with a revenue tailwind. Some investors may not have been so sure that would be the case, as there was little evidence up until recently that enterprises would spend on AI for on-prem servers. The company’s fourth quarter FY 2024 results and guidance for FY 2025 show Dell has an AI tailwind in its ISG business. The best part is that this may be only the first inning for AI-boosted growth.

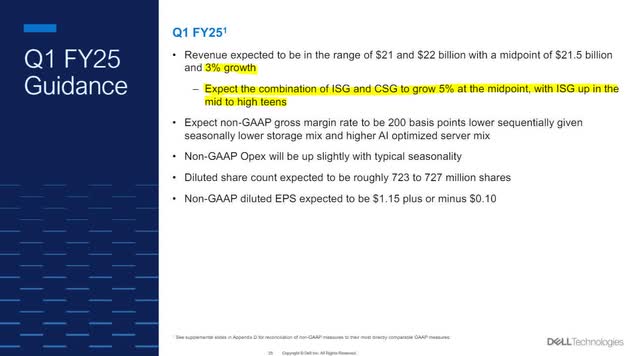

Dell Fourth Quarter FY 2024 Performance Review.

The guidance for the first quarter of FY 2025, showing 3% growth in total revenue and the combination of CSG and ISG producing 5% revenue growth, would end the year-over-year declines in revenue growth if the company hits its mark. This return to revenue growth could signal a new upcycle in the PC and server business.

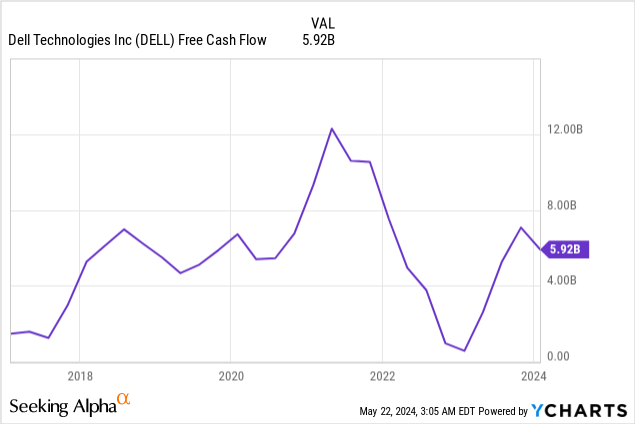

Another potential reason investors liked the company’s fourth-quarter results is that the company maintained robust free cash flow (“FCF”) of $5.92 billion, well above the calendar year 2023 lows.

When Dell reports its first quarter 2024 results, investors want to see the company maintain solid FCF for several reasons. First, the company has a history of returning most of its cash flow to investors.

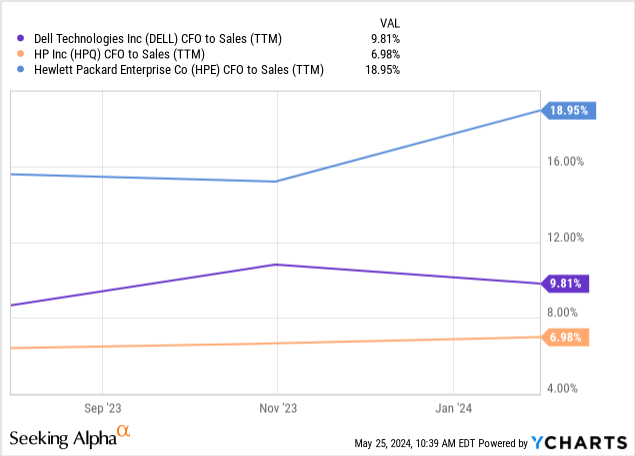

Dell Technologies Securities Analyst Meeting

The second reason FCF is important is that Dell has a significant amount of debt, which the article will discuss in the next section. The company needs to produce enough cash flow to pay down the principal and interest on its debt. If management fails to get the company to produce enough cash flow, investors may find the stock unattractive. One metric to monitor moving forward is the company’s cash flow from operations (“CFO”) to sales ratio. Dell’s latest CFO-to-sales ratio is 9.81%, which means that for every dollar of sales the company produces, approximately $0.10 becomes CFO. If this number starts tailing off over multiple quarters, investigate further, as it could signal impending problems producing FCF.

Right now, the company’s intentions to continue raising the dividend have increased investor confidence that robust FCF generation is coming down the pike. The company’s fourth quarter FY 2024 earnings release stated, “We’re optimistic about FY25 and are increasing our annual dividend by 20%—a testament to our confidence in the business and ability to generate strong cash flow.“

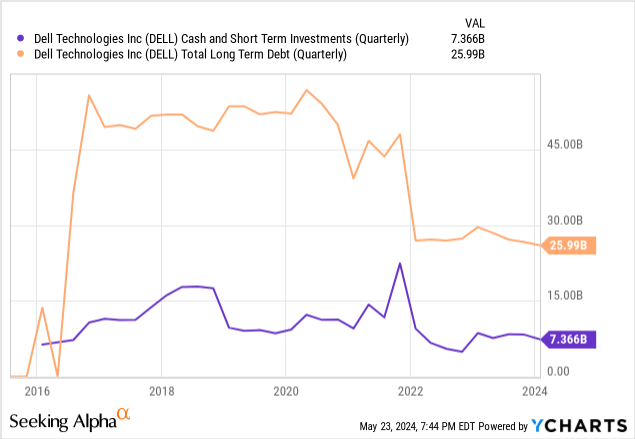

The company uses heavy leverage

Dell has a significant amount of debt. It has $7.366 billion in cash and marketable securities against nearly $26 billion in long-term debt. The company has a debt-to-equity (“D/E”) ratio of -10.81, meaning it has more liabilities than assets. For some investors, a negative D/E would be a significant cause for concern because it raises the risks of substantial financial problems. The company has an interest coverage of 4.00, which means Dell’s operating income can cover its interest expenses. It has a net debt-to-EBITDA ratio of 1.94, which means it can still pay down its debt. However, the company doesn’t have much room for error. Suppose the net debt-to-EBITDA ratio rises over 4.0; that might be a red flag and signal that the debt situation has gotten out of hand, especially if accompanied by a debt rating downgrade.

The company’s heavy reliance on debt may handicap its ability to take advantage of future growth opportunities, as a considerable amount of its cash flow goes to paying down debt. Its heavy debt load also means the risk that it may not survive a massive economic downturn is much higher. Dell’s existing debt also has covenants, so there is a limitation to how much debt it can continue to raise — limiting its flexibility. Additionally, if the capital markets deteriorate and Dell loses its ability to raise funds, its financial results could deteriorate. The company’s FY 2024 10-K states (emphasis added):

The debt and capital markets may experience extreme volatility and disruption from time to time, which could result in higher credit spreads in such markets and higher funding costs for us. Deterioration in our business performance, a credit rating downgrade, volatility in the securitization markets, changes in financial services regulation, or adverse changes in the economy could lead to reductions in the availability of debt financing. In addition, these events could limit our ability to continue asset securitizations or other forms of financing from debt or capital sources, reduce the amount of financing receivables that we originate, or negatively affect the costs or terms on which we may be able to obtain capital. Any of these developments could adversely affect our net revenue, profitability, and cash flows.

If you purchase shares, monitoring Dell’s debt situation is vital.

Additional Risks

Between inflation for components like graphics processing units (GPUs), aggressive competition, and more of its sales shifting to lower margin products, Chief Financial Officer (“CFO”) Yvonne McGill expects FY 2025 gross margin pressure. On the fourth quarter FY 2024 earnings call, she said, “Given the higher mix of AI-optimized servers, inflationary input costs, and the current competitive environment, we expect our [FY 2025] gross margin rate to decline roughly 100 basis points.” You can look at gross margins as a measure of a company’s growth potential. A declining gross margin generally equals a decreased ability to grow revenue and earnings. Although a 100-basis point loss in gross margins is not a deal breaker, the stock could lose its allure for investors if gross margins continue to shrink.

The company faces considerable competition in all its markets. Dell’s most significant competitors in the PC business are Lenovo Group (OTCPK:LNVGY) (OTCPK:LNVGF) and HP (HPQ); where there is little differentiation between these companies’ end products and services, and they mainly compete on price — a commoditized market. The PC business also has thin margins and suffers from extreme cyclicality.

Its competitors in the enterprise server and storage industry are Hewlett Packard Enterprise (HPE), HP, Super Micro (SMCI), International Business Machines (IBM), and Lenovo. Like the PC market, the enterprise segment also consists of companies struggling to produce a lasting differentiating factor. The server market is also commoditized, cyclical, and thin-margin.

Valuation

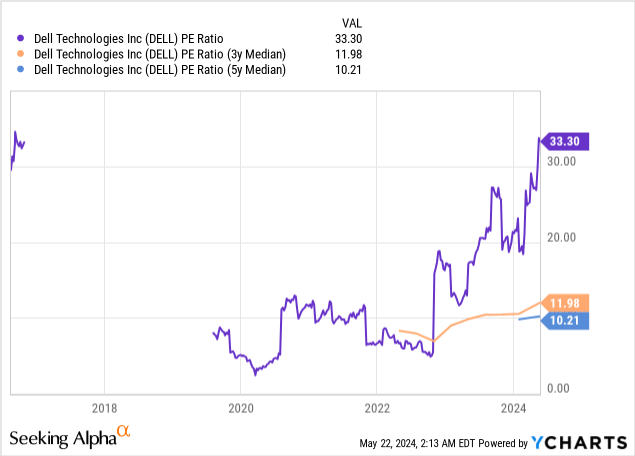

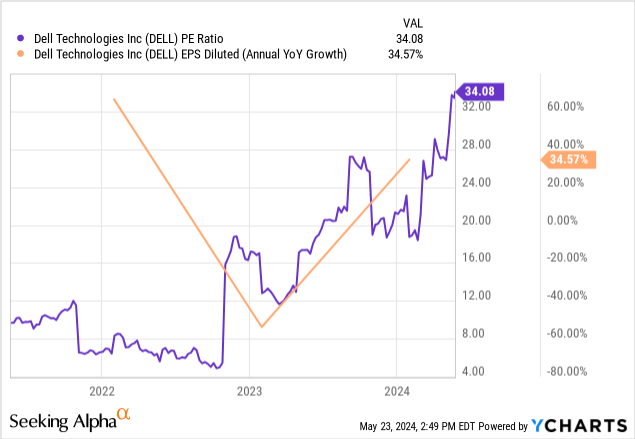

Dell’s price-to-earnings (P/E) ratio is well above its three- and five-year median, suggesting the market may overvalue the stock.

However, considering the company’s quarterly and annual year-over-year earnings growth rate has picked up substantially over the last year, a trailing 12-month (“TTM”) P/E of 34.08, slightly under its diluted annual EPS growth rate of 34.57%, suggests the stock may be fairly valued.

Considering that TTM figures are backward-looking and the market often values a stock based on its future, let’s look at some forward-value estimates. Dell has a one-year forward P/E ratio of 16.53, which nearly matches its estimated growth in fiscal 2026, suggesting the market fairly values the company’s fiscal 2026 earnings growth.

Seeking Alpha

Analysts have ramped up earnings revisions significantly over the last six months, suggesting these earnings growth rates could grow further and that the market may undervalue the stock. The following image shows the percentage rise in Dell’s earnings revisions over a one-, three- and six-month period.

Seeking Alpha

Normally, I would do a reverse discounted cash flow (“DCF”) analysis of Dell. However, the company is a cyclical stock, and reverse DCF works best with companies whose FCF rises fairly steadily, while Dell is the opposite. For instance, the company’s annual FCF was $9.325 billion in FY 2021; by FY 2023, it was only $562 million. It jumped to $5.920 billion in FY 2024. When results are erratic, reverse DCF results can be very unreliable.

Dell is still a buy at current levels

Although the market may fairly value the stock at current prices, it still has upside. Dell is coming off the bottom of a severe downcycle in its primary end markets, boosted by AI adoption. There is an excellent chance that analysts have underestimated the company’s future revenue, earnings and cash flow generation. The company has a history of beating top and bottom-line numbers. If the company produces beat and raise quarters moving forward, which is possible at the beginning of an upcycle, the stock price will continue its climb.

Suppose you are a growth investor that is scared off by the high-flying valuations of some AI stocks like NVIDIA, put Dell on your buy list, as it still sells at a reasonable valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.