Summary:

- Dell Technologies returned to the S&P 500 Index, but the stock remains undervalued after a significant dip post-Q1 FY2025 earnings miss.

- Recent Q2 FY2025 results exceeded expectations, with $25 billion revenue and $1.89 EPS, showing strong growth and improved supply availability.

- Dell’s ISG growth is expected to increase due to a higher revenue share, indicating rapid earnings growth and a reasonable price for investors to buy DELL stock.

- Positive sentiment in 2025-2026 should help Dell outperform the market and recover fully from its current dip.

- I believe Dell’s market prospects and modest valuation indicate a potential for decent gains, making the stock a “Strong Buy” despite recent struggles.

Thinglass

Intro & Thesis

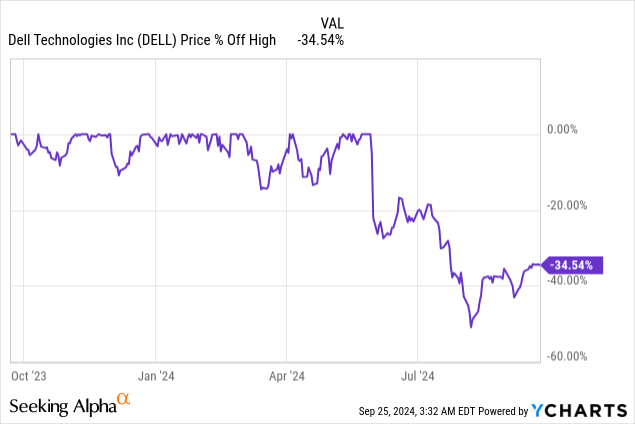

Dell Technologies Inc. (NYSE:DELL) returned to the S&P 500 Index (SPX) (SP500) this week for the first time since 2013 when the Texas-based company went private, Seeking Alpha reported. I think it’s a great achievement by the management team; however, the stock still keeps struggling after it posted Q1 FY2025 numbers in late May (at the time the firm missed on EPS, leading to the stock’s plunge of over 17% in just 1 trading session). To this day, the DELL stock hasn’t recovered from that heavy dip:

I think we should look at the company’s more recent results (Q2 FY2025 numbers were released in late August) as well as the end market environment, which, I believe, should provide plenty of tailwinds for Dell Technologies going forward. In my opinion, DELL stock is currently too cheap given this outlook, and promises potential investors decent gains in the future. I hope that we will see a much more positive sentiment in the calendar years 2025-2026 and that the stock will outperform the market and fully recover from the current dip in full. Hence, my “Buy” rating today.

Why Do I Think So?

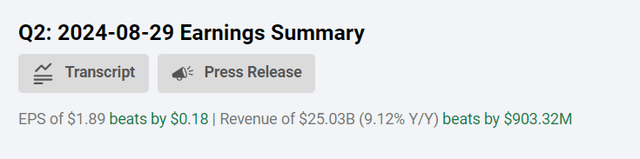

The Q1 earnings miss from Dell is still quite fresh in the market’s memory, but the more recent Q2 numbers came out actually way more positive than Wall Street anticipated, as the firm has managed to beat on both the top and bottom lines this time:

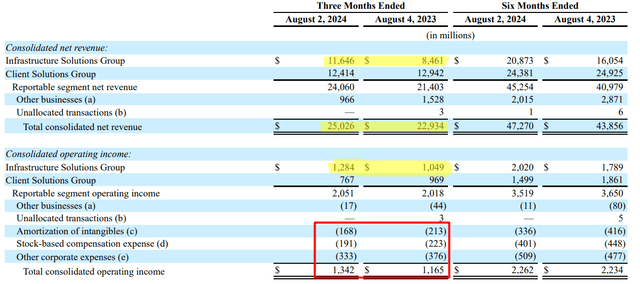

As you may see above, DELL’s $25.0 billion revenue topped consensus expectations by ~$900 million and grew 9.1% YoY, while the non-GAAP EPS of $1.89 was $0.18 ahead of Street estimates due to “improved supply availability and a better PC mix”, rising also by ~9% YoY.

Fueling the results was the Infrastructure Solutions Group (ISG) segment, which achieved record revenue of $11.6 billion, up 38% YoY, where much of the growth was driven by AI-optimized servers (they saw 3.2 billion in orders, up 23% QoQ). Revenue for the Client Solutions Group (CSG) was down 4% YoY to $12.4 billion, while the Consumer segment’s revenue also fell 22% to $1.9 billion, with commercial client revenue remaining flat at $10.6 billion. So ISG is clearly standing out, now occupying 46.5% of consolidated revenue (compared to 36.9% last year).

What I particularly liked about Q2 – we saw better non-OPEX cost management. Yes, for the quarter, EBIT was $1.3 billion, which is up only 15% YoY – increased competition contributed to lower gross margins that went down the income statement. But thanks to lower D&A, SBC, and other corporate expenses, the GAAP EPS was $1.17, up 86% year over year (the non-GAAP EPS was $1.89, up 9% over the same period).

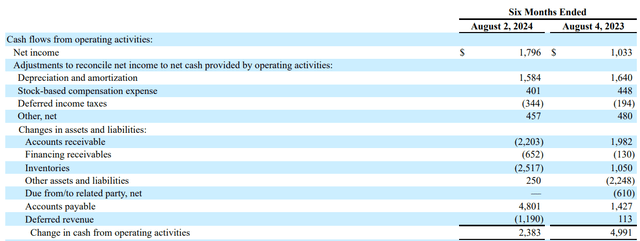

DELL’s 10-Q, the author’s notes

The cash flows from operations declined for 1H FY2025; however, it was mainly driven by the working capital changes that we may interpret in different ways.

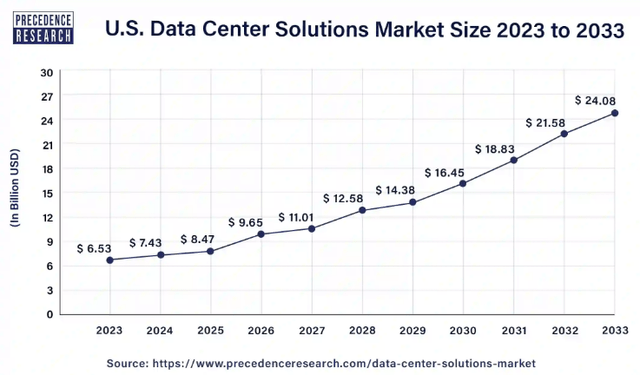

I think the growth in inventories and receivables actually reflects the growth in demand for DELL’s ISG segment and its products. The company is a key supplier of server components for data centers in the U.S., where the addressable market is poised to grow at a CAGR of almost 14% from 2024 to 2033, according to Precedence Research data.

BofA, proprietary source [September 2024] Precedence Research data![BofA, proprietary source [September 2024]](https://static.seekingalpha.com/uploads/2024/9/25/49513514-17272494452399902.jpg)

I think Dell’s leadership in this niche should give the company a huge boost to EPS, as almost half of its revenue now comes from servers. This share is likely to keep expanding from now on. Until recently, any gains in ISG have been partially offset by weakness in PCs and other sub-segments, but that should come to an end in calendar years 2025-2026, in my opinion. In general, Dell Technologies’ situation is somewhat similar to that of Advanced Micro Devices (AMD), whose revenues were also too diversified until recently, and the company was not given enough operating capacity to capitalize on the GPU boom the way Nvidia (NVDA) did.

Dell itself forecasts that by FY2025, ISG revenue (the business that it expects to be a key growth area over the next five years) will be between $95.5 billion and $98.5 billion, for growth of about 30%, driven by “demand for AI and traditional servers”.

Going back to Dell’s financials, I’d like to note, that of the $1.3 billion in cash flow from operations generated in Q2, Dell returned $1 billion to shareholders through share repurchases and dividends. The current FWD dividend yield is at 1.52%, but still, it’s something – if the buybacks keep going in today’s amounts, we should see a total shareholders’ yield of ~5% for calendar 2025, which is a lot. At the same time, DELL’s balance sheet remains rock-solid as they closed the quarter with $6.0 billion in cash and investments. The company reduced net debt by $1 billion and closed the quarter with a core leverage ratio of 1.4x. From what I see, Dell continues to aggressively streamline its cost structure and employ AI to optimize business processes and productivity, so more to come on this side.

According to the recent management commentary, Dell’s pipeline for AI servers has increased, so I think the company is well-positioned to take advantage of the continued growth in AI demand for Tier-2 cloud service providers and enterprise customers. DELL is also preparing for an anticipated refresh cycle in PCs, which is driven by the “replacement of an aging installed base” as well as new AI-enabled architectures.

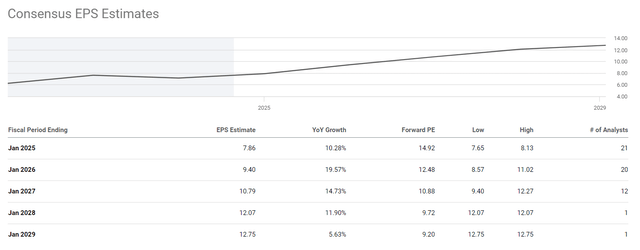

In my view, Dell has become one of the cheapest AI plays right now, with quite solid growth rates amid rapidly declining P/Es for the next few years.

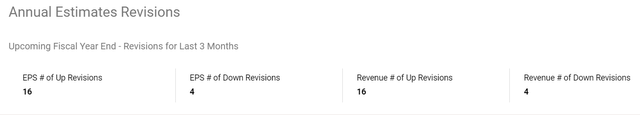

Nothing is cheap for no reason, I understand it, and I have an explanation of why the current discount in Dell exists. First, it’s about lagging market sentiment. The fall in the stock price after the ugly Q1 miss was a shock to many, who have been enjoying the ride since mid-2023. I guess that the absence of a strong reaction to Q2 numbers was mainly a result of those sentiments/fears. Thinking logically, I believe the stock should have reacted in a way more positive way because the Street got bullish on the firm’s next few quarters (and even years), based on the earnings estimates changes:

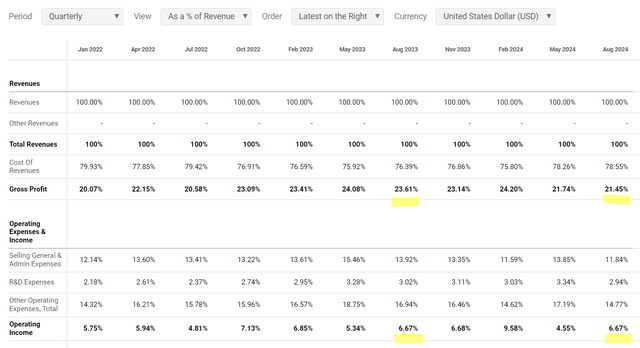

The second reason probably lies in the deterioration of Dell’s gross margin – fierce competition is eating into the company’s full profit potential.

Seeking Alpha, the author’s notes added

The management noted that the consolidated gross margin rates will likely decline modestly soon from a “higher mix of AI-optimised servers”, but this decline is expected to be offset by “further efficiency improvements and expense controls.”

Anyway, I think these reasons are not enough to justify the continuing decline in the stock price. I believe that given the initiatives we saw from the management, following this down year (FY2025), Dell appears well-positioned for growth and margin expansion as its end markets normalize over the next few quarters.

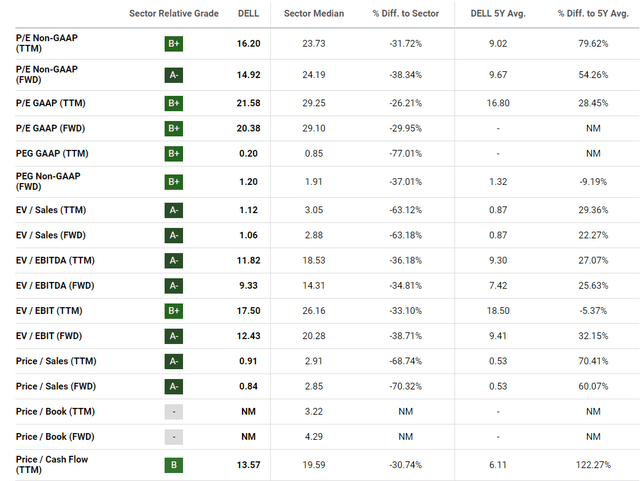

The stock still has quite a modest valuation, trading at just ~15x earnings for FY2025 and 12.5x for FY2026, which is 11% and 27% lower than the 3-year median P/E, respectively. At the same time, Dell’s relatively low dividend yield is the only thing preventing the stock from receiving at least a “B+” valuation grade based on Seeking Alpha’s Quant rating:

Seeking Alpha, DELL’s Valuation

Again, I should note here that Dell’s low dividend yield is fully compensated by its relatively good total shareholders’ yield I mentioned above.

Given the firm’s strong positioning in the servers’ end-market, I believe even the existing fierce competition shouldn’t explain the stock P/E of 15x for FY2025. The fair multiple should lie in the range of 20-25x, closer to the IT sector’s median figures. Let’s say that by the end of the calendar 2025, the stock will be trading at only 20 times its FWD earnings (the consensus expects $3.62/share). In this case, we’re talking about a $72.4 stock – the upside potential of 102% looks unbelievable, but I don’t think it’s impossible given how quickly DELL went from October 2023 lows (~$25.6/share) to May 2024 highs (~$38.6/share).

Where Can I Be Wrong?

I may be wrong in my understanding of the working capital changes Dell has reported for Q2. Here’s how Envision Research, another Seeking Alpha analyst, assesses the situation:

I now see increased short-term price pressure and return uncertainties in the next 1-2 years due to the inventory buildup and reduced earnings guidance.

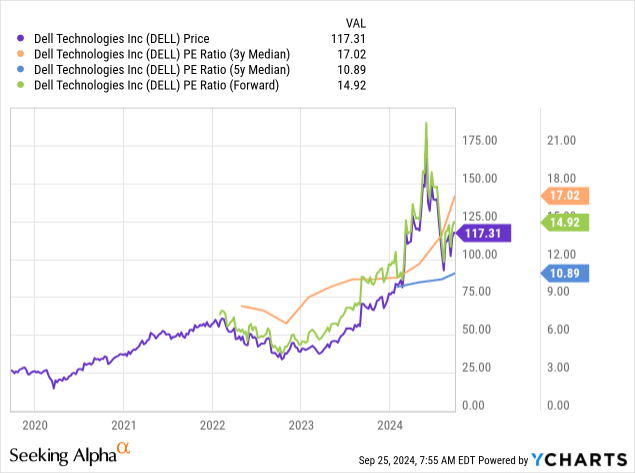

Furthermore, the stock might actually turn out to be a bit too expensive today because if we compare the historical P/E ratios of the last 5 years (and not 3 years, as in my analysis above), we come to the conclusion that Dell’s forwarding P/E ratio is already quite high:

In addition, Dell may continue to suffer from negative sentiment from investors – I can’t predict exactly when this sentiment will reverse. Argus Research analysts (proprietary source, September 2024) describe a similar risk as follows:

Dell has so far sidestepped any pressures to split its PC business from its infrastructure solutions business. In the current environment, in which low-margin CSG is doing better than higher-margin ISG, Dell likely gets a pass from investors.

The Bottom Line

Despite the abundance of risks, I believe that Dell Technologies today represents one of the most promising cases of a company trying to be flexible and adapt to new trends in order to become even more established in its addressable markets. It is at the same time a “growth” and “value” company with a long history that is changing before our eyes – in my opinion for the better. With an expected tailwind in the data center market, Dell should continue to grow earnings rapidly, as its ISG’s growth will now be more pronounced due to a higher revenue share. At the same time, I don’t think investors are overpaying by any means if they buy DELL stock today. Yes, the P/E ratios look expensive by historical standards, but here we have to understand that we’ll likely be dealing with a completely different company in 2-3 years if the current AI boom continues. And it looks set to continue.

Based on the above and taking into account my valuation analysis results, I rate the DELL stock as a “Strong Buy” today.

Thank you for reading!

“Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 14. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!“

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DELL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!