Summary:

- Dell Technologies shares have increased over 200% due to AI hype.

- The company’s revenues declined in 2023 but showed improvement in Q1 2024, with margins increasing.

- AI-optimized servers and AI capabilities in PCs driving growth, with conservative DCF model valuing shares at $185.

JHVEPhoto

Introduction

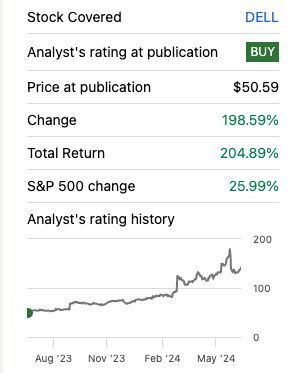

I wanted to revisit Dell Technologies Inc. (NYSE:DELL) to see how it performed throughout 2023. Since my first article on the company, I said that the company is a solid pick even with conservative estimates, and that there are many growth opportunities in the AI-optimized server space. Fast forward a year, and we can see that the enthusiasm surrounding AI has lifted the company’s shares to over 200% increase, so if you got in when I first recommended the company, congratulations!

Seeking Alpha

Most of the company’s share price performance came from the enthusiasm of AI, with AI-related revenues accelerating, while the rest performed quite poorly in 2023. With an updated conservative DCF model, I still believe there is a lot of room for growth in the future, so I am reiterating my buy rating, as AI hype continues and PC markets rebound.

Briefly on Financial Performance

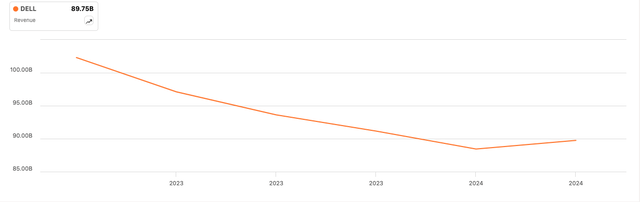

Over the last year, the company’s revenues seem to have been on a steady decline until it hit 2024, where now it seems to be recovering, which was helped by exceptional growth in servers, and a start to recovery of the PC business.

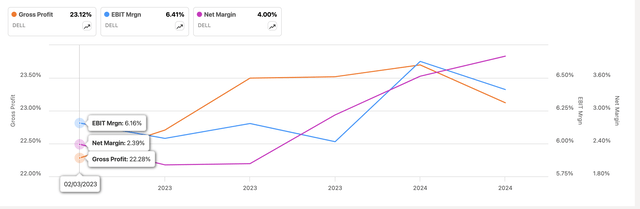

In terms of profitability and efficiency, the company’s margins across the board have increased throughout the year. The management team was able to manage the company’s costs well, which led to an improvement across the board, even during the tough PC market cycle throughout 2023.

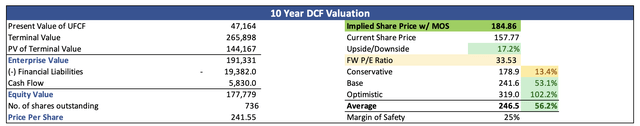

In terms of the company’s financial position currently, as of Q1 ’25, which was filed on June 11, 2024, DELL had around $5.8B in cash and equivalents, against $19.3B in long-term debt, which has been reduced by around $3B since I last covered the stock a year ago, so that is progress. It is still on the higher end, and many investors may still be put off by it, however, is it a problem operationally? Let’s see. In the latest quarter, EBIT came in at $940m, while interest expense on debt came in at $343m, which means the company’s interest coverage ratio is around 2.74x. Many analysts agree that an interest coverage ratio of at least 2x is considered healthy. I would consider a 5x to be safer, just because I am a little more conservative. Nevertheless, I don’t think it’s an issue for DELL. If it continues to pay it down, the interest expense burden will be reduced considerably.

Overall, the company’s slight improvement in margins, while revenues saw a decline in low double-digits over the year with just a slight rebound in Q1’25, doesn’t support the company’s fantastic performance since I covered the company back in June of 2023.

What Caused this rally?

Dell’s share price has steadily increased in the last year and is up over 210% as of writing this update. The big moves came in at the beginning of 2024 as the company’s share price has doubled YTD. So, what is causing such enthusiasm in a company that is not growing much at all? The answer is of course AI hype. Even as Q4 saw an 11% decrease in total revenue, the company’s Infrastructure Solutions Group saw a 10% sequential increase due to the AI-optimized server revenue. On the day of the full-year announcement, DELL saw its share price skyrocket by around 38% before giving back around 20% the following week. This I believe was the true beginning of the hype for AI-optimized servers. On top of that, the company mentioned that it is positive that it will return to growth in fiscal 2025. I’m sure the rallies of NVDA and SMCI helped DELL a month later to achieve such enthusiasm because people were looking for some other company that would be getting involved in the AI server space. Since then, the company’s ratings have been upgraded by many analysts, as the Street seems to love the AI plays of the company. The most recent update on the company came from Morgan Stanley as it reiterated its Top Pick for DELL, with a bull case valuation of $200 a share.

Comments on Outlook

The recent dip after Q1 earnings I believe was only due to many investors taking some profits. Any sort of bad news was going to send the shares down and given the weaker guidance in the short term and an expected decline in gross margins, this was enough to send the company’s shares down 16%.

AI Hype is Alive and Well

I believe the AI hype is going to provide the company with a lot more growth going forward, and I do agree that the company will see quite a rebound in top-line growth going forward because of it. In the latest quarter, the server and networking revenue saw a whopping 42% increase driven by AI-optimized server demand. With the recent partnership agreement between DELL and NVIDIA Corporation (NVDA) to offer new Blackwell GPUs, the AI push remains strong and may continue to push the company’s share price up, despite the views that it is overvalued. I believe the decrease in margins will be short-lived and the company will see margins recover as per Bank of America analyst Wamsi Mohan citing: “Over time, AI server margin should improve as deferred revenue from Services is higher in margins as well as mix shift from Tier 2 (lower margins) to Enterprise (higher margins).”

PC Market to See a Rebound

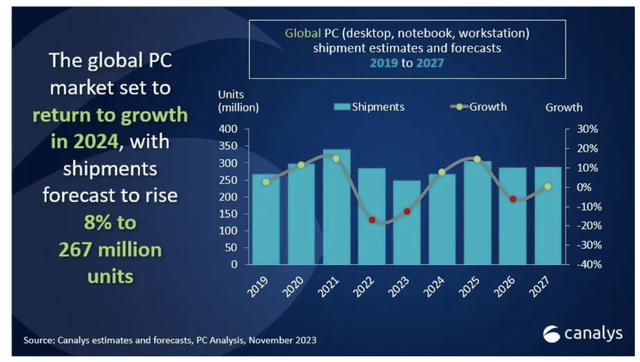

It’s been a tough couple of years for the PC market. After the COVID surge of people updating their setup for working from home environment, PC sales saw double-digit declines in 2022 and 2023. With the advent of AI, many companies are developing AI-optimized laptops and PCs. Canalys projects that 19% of PCs shipped in 2024 will have some sort of AI capabilities. That number will increase to around 60% by 2027, which points to widespread commercial adoption. Many analysts expect a rebound in sales in 2024, which will of course benefit DELL tremendously given that the future offerings of its flagship laptops will be powered by the new Snapdragon X Elite chips that have on-device AI capabilities. So, 2024 seems like the year for a rebound, however, the years after that are projected to see growth accelerating as more and more people opt for an updated product to see what the AI capabilities truly are and how useful it is. Canalys forecasts almost 10% growth in 2024 and further acceleration in 2025.

In summary, I believe there are a lot more positives in the next two years or so for DELL. The recovery of the PC market and the hype surrounding AI capabilities will continue to show strong demand in the server space and the PC market going forward. So, let’s look at an updated DCF forecast model.

Valuation

I will keep it on the conservative end as always. It is better to be safe than sorry when it comes to investing.

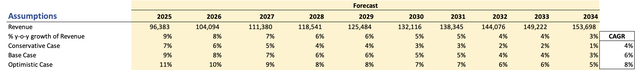

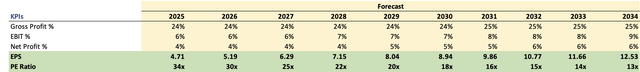

For revenue growth, I went with around 6% CAGR over the next decade, which I think is rather on the conservative end. With the growth that the AI products exhibit, I could see the company’s revenues grow at low double-digits in the next couple of years, while the recovery in the PC market also helps. I also modeled a more conservative and more optimistic scenario to give myself a range of possible outcomes. Below are those estimates with their respective CAGRs.

For margins, and EPS, I decided to go with the company’s GAAP metrics instead of adjusted numbers because I want to keep it a lot more conservative. That way I am getting more margin of safety and more room for error in my estimates. As you can see my EPS estimates for FY25 are much lower than what analysts and the company are guiding, which is at around $7.70 per share, which grows to around $12 a share by 2029. My estimates will get the company’s EPS to around $8 a share by 2029 and $12.50 a share by FY34. Below are those estimates.

For the DCF model, I am using the company’s WACC of 6.3% as my discount rate, and a 2.5% terminal growth rate because I would like the company to at least match the US long-term inflation goal. Additionally, I am going to discount the final intrinsic value by 25% to give myself even more room for error in my estimates. With that said, DELL’s conservative intrinsic value is around $185 a share, which means even after such a runup, the company is still trading below its fair value.

Risks to the Thesis

The competition is getting fierce in the AI server space. If the company drops the ball here, it may lose its advantage to some of the competitors who may be able to produce these servers at a lower price, undermining DELL.

The company’s margin may fall more than anticipated and it may continue to fall for much longer than what management has guided recently, which will bring in a lot of volatility to the share price, as investors may look for any reason to lock in profits and move on.

The PC market may not rebound as expected, which will continue to weigh on the company’s top-line performance.

Inflation being so sticky, which makes interest rates stay higher for longer, will continue to put pressure on input costs, which will continue to drive down the company’s profitability. It is already quite low as we saw in the first section.

Closing Comments

So, even after a fantastic run, it looks like the shares are still trading at a decent discount to their fair value. Should you invest here if you have no position? It’s a tough question to answer for sure. A lot of people believe that the company is trading at a massive premium due to the enthusiasm regarding AI, however, I did use conservative numbers to gauge where the company should be valued. If I was going to use adjusted numbers, the fair value would have been much higher. Therefore, I am reiterating my buy rating, but I fully understand the hesitancy since the company went up 200% in one year since I covered it the first time.

I believe the company still has a lot of room for growth in all of its segments and with a forward PE ratio of 18, I don’t think it’s too expensive currently.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.