Summary:

- Dell investors were hit as the company’s outlook at its recent earnings release disappointed.

- However, its AI growth inflection is expected to remain intact, suggesting the selloff seems overstated.

- Given SMCI’s audit challenges, Dell’s ability to gain more share against Supermicro in the hyperscaler market shouldn’t be ignored.

- Dell is well-positioned to penetrate the enterprise base and tier-2 cloud computing providers, potentially scaling its growth prospects for AI-optimized servers.

- I argue why the recent pullback represents a remarkable buying opportunity for DELL investors.

Jerod Harris/Getty Images Entertainment

Dell: Given Up Much Of Its November Gains

Dell Technologies Inc. (NYSE:DELL) investors have suffered a stuttering pullback as downstream headwinds in its consumer PC segment impacted its performance and forward outlook. Despite that, DELL has outperformed the S&P 500 (SPX) (SPY) since my previous update when I upgraded the stock of the Michael Dell-led company. However, the stock has given up much of its November 2024 gains as investors reassessed the sustainability of its AI-growth inflection. The sequential fall in server and networking revenue in Q3 could have spurred some concerns, suggesting the growth momentum seems weaker than anticipated.

In my previous Dell article, I highlighted its outperformance against its arch-rival. Super Micro Computer, Inc.’s (SMCI) audit and regulatory compliance headwinds have torpedoed the market sentiments in the stock, leading to a reallocation toward its rivals like DELL. Dell is also well-positioned to capture market share against Supermicro, given its more well-established exposure to the enterprise and tier-2 cloud service providers. Moreover, given the uncertainties facing SMCI, I assess that Dell is in a prime position to capitalize on improved hyperscaler growth prospects as the industry executes a pivotal architectural transition of Nvidia Corporation’s (NVDA) AI chips (from Hopper to Blackwell).

Dell’s AI PCs Headwinds Have Become A Near-Term Liability

In Dell’s fiscal third-quarter earnings release, the company’s FQ3 performance is assessed to be “mostly in line with expectations.” However, investors are justifiably disappointed with Dell’s forward outlook, as management cited several constraints hampering a more robust guidance. Accordingly, Dell has encountered supply chain headwinds as Nvidia’s Blackwell AI chips are in the process of production ramp for deliveries through CY2025. Therefore, Dell’s downward revision in its outlook suggests a more gradual ramp profile through the first half of CY2025 as the company manages the reported supply chain challenges with Nvidia. Given DELL’s stellar surge from its August 2024 lows as the stock outperformed the market and its tech sector (XLK) peers, the de-rating is justified, as the market reflected higher execution risks in Dell’s ramp profile.

Furthermore, the AI PCs upgrade cycle seems to be delayed through CY2025, worsened by potentially elongated replacement cycles. As a result, the anticipated growth inflection driven by the broader adoption of AI PCs has not lifted underlying momentum in Dell’s commercial and consumer PC segment. Although the commercial PC business posted a tepid 3% revenue uptick in FQ3, the consumer PC division disappointed investors with an 18% YoY decline in revenue. Therefore, the bullish thesis in Dell’s more cyclical opportunities has not panned out accordingly, potentially extending the recovery prospects for the company through CY2025.

Secular Growth In AI Servers Critical

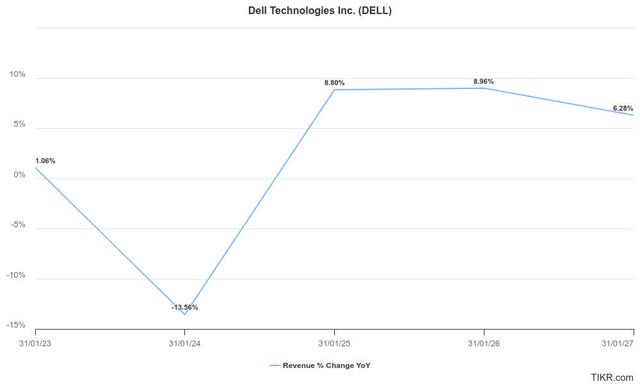

Dell revenue estimates (TIKR)

Notwithstanding my cautious assessment, Wall Street has remained relatively optimistic, even though analysts penciled in downward revisions on Dell’s revenue and earnings estimates. In addition, the company is still expected to post a 10% increase in revenue in FQ4 (based on the midpoint outlook), bolstered by the underlying growth in its Infrastructure Solutions Group business.

Accordingly, management telegraphed its confidence in delivering an anticipated growth of about 25% in its ISG unit while assessing a growth profile of less than 5% in its Client Solutions Group business. Hence, it suggests that headwinds that affected the company in FQ3 aren’t expected to be structural, notwithstanding the supply chain snafu affecting the production ramp of its AI-optimized servers.

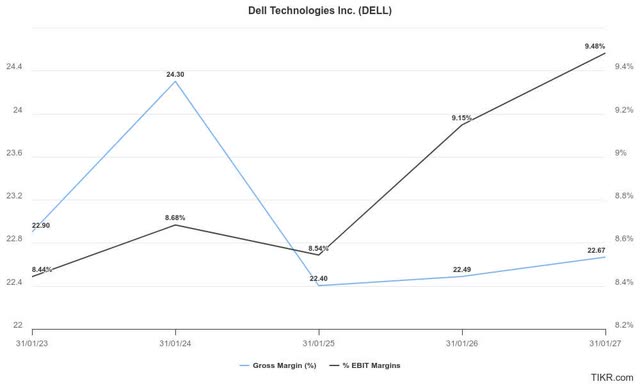

Dell profitability estimates (TIKR)

Dell’s ability to deliver a more robust profitability growth inflection will likely be scrutinized in its bid to lift investor sentiments. As seen above, Wall Street is confident in Dell’s ability to bolster its margins over time, given its market leadership in the traditional but more profitable server business. In addition, Dell’s ability to offer a holistic solutions ecosystem to customers (including hardware and software) should appeal to enterprise customers seeking to accelerate their deployment of AI servers.

Hence, management’s commentary on transitory near-term dilution attributed to the more competitive pricing landscape in AI-optimized servers is assessed to be justified. As Dell scales its AI solutions to its enterprise customer base, it should help bolster a more robust and sustained uplift in its profitability profile, bolstered by the sustained infrastructure investments in AI through the decade.

DELL Stock Isn’t Expensive When Adjusted For Growth

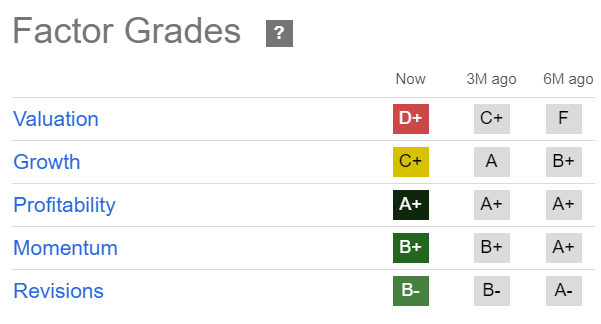

DELL Quant Grades (Seeking Alpha)

Accordingly, DELL’s “C+” growth grade likely reflects the market’s pessimism on its growth profile, downgraded from an “A” rating over the past three months. Given that the stock has declined more than 30% from its May 2024 highs through its lows this week, bullish investors could argue that significant pessimism has likely been baked into its valuation.

DELL’s forward adjusted PEG ratio of 1.49 is more than 20% below its tech sector median, corroborating my observation. In addition, the bear market has also not reversed its generally bullish momentum (“B+” momentum grade), underpinning my confidence in buying DELL’s dips.

Despite that, investors mustn’t understate the potential of over-relying on the AI infrastructure investments thesis to drive Dell’s growth further. Given its exposure to the cyclical PC headwinds and more mature traditional server market, a significant valuation re-rating seems unlikely. Unless management can present a more robust outlook for FY2026 at next quarter’s earnings conference, the market will likely adopt a more cautious near-term stance.

Is DELL Stock A Buy, Sell, Or Hold?

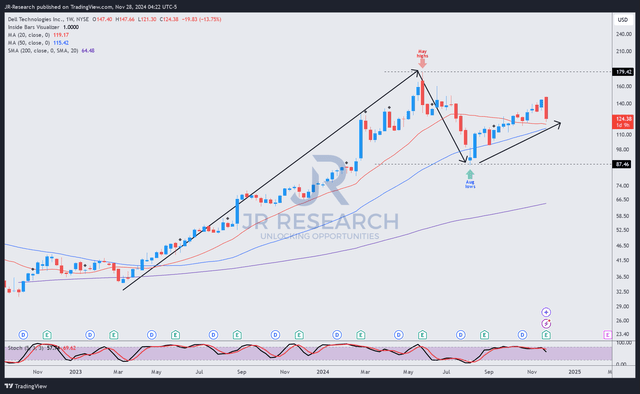

DELL price chart (weekly, medium-term, adjusted for dividends) (TradingView)

DELL’s price action suggests its upward momentum has not been dislodged from its bullish bias. As seen above, the steep pullback from its May 2024 peak came after an incredible rally from its early 2023 lows. Moreover, buyers returned decisively in August 2024 to underpin its bottom, helping the stock recover above its 50-week moving average (blue line).

Although the stock has given up much of its November 2024 gains, there isn’t a definitive bearish reversal against its uptrend momentum, corroborated by its solid momentum grade enunciated earlier. Coupled with DELL’s relatively attractive PEG ratio and secular growth opportunities in AI-optimized servers, I assess that a bullish rating remains apt.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMCI, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I may initiate a long position on DELL over the next 72 hours.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!