Summary:

- Dell is gaining strength in the AI server market, positioning itself for long-term growth in this high-demand sector.

- The anticipated 2026 PC upgrade supercycle offers a major revenue boost opportunity.

- Dell’s diversified business model reduces risk, balancing weaker PC sales with strong AI server growth.

- A forward P/E of 13.5x makes Dell an attractive value play in the tech hardware sector.

- Dell’s focus on proprietary IP enhances margins and differentiates it from low-cost competitors.

JHVEPhoto

Investment Thesis

Dell (NYSE:DELL) is quietly building its position as a dominant force in the AI data center server supply chain. Its revenue trends mirror the early sales dynamics of Super Micro (SMCI), which has been grabbing the headlines in this space.

I think this surge is being masked by the temporary slowdown in other areas of Dell’s product portfolio, like the personal computer ‘PC’ market, but that’s just how cyclical companies are. The good news is that Dell’s revenue is diversified, so, the ups of one segment offset the downs of another. Plus, industry pundits expect the PC market to recover going into 2025. In 2026, I expect a disruptive change in Microsoft’s (MSFT) Windows operating system, creating a super PC upgrade cycle, and Dell is in an excellent position to capitalize on this opportunity.

With a Forward P/E ratio of 13.5x, I think Dell is a compelling opportunity in the Technology Hardware space.

A Personal Computing Supercycle

We are on the cusp of a significant laptop and desktop upgrade cycle as software companies develop next-generation, AI-enhanced operating systems that are fundamentally different from current platforms, prompting a laptop and desktop upgrade supercycle.

The infrastructure for software developers has been laid out, with Intel (INTC) and AMD (AMD) developing CPU chips with embedded neural processing units ‘NPU’ late last year, allowing for localized AI functions; Intel Core Ultra and Ryzen AI series, respectively.

Until now, generative AI applications have been exclusively run on the cloud, accessed via the Internet. I believe this is about to change with desktop and laptop CPUs with embedded NPUs. Our personal computers will become self-maintaining, and operating systems will be as unique as our personality traits. With simple natural language prompts, we will be able to change our laptop and desktop settings, unlocking the robust features even available on current PCs. Businesses will be able to optimize settings of their employees’ PCs to enhance productivity.

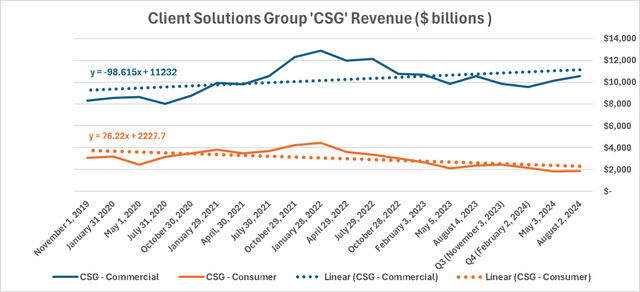

With a 17.4% market share in the global personal computer market, Dell is in an excellent position to capitalize on these future trends. This idea overshadows the recent volatility we’ve seen in Dell’s PC segment, which it calls the Client Solutions Group ‘CSG’.

CSG is further divided into Commercial and Consumer sub-segments. What we’ve seen in recent periods is a decline in the consumer segment as the higher cost of living weighs down on people’s purchasing power. Think higher bills, mortgage, and grocery bills. The commercial CSG sales are also off their peaks.

Chart created by the author based on Dell filings

Late Bloomer?

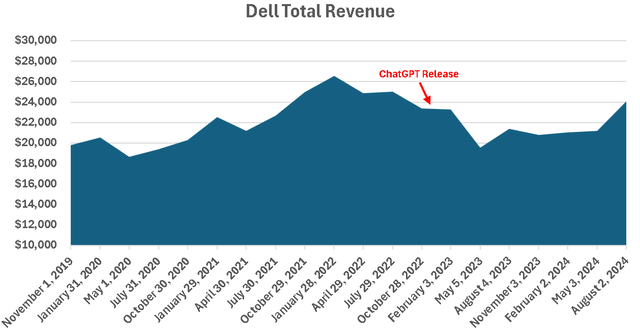

Given Dell’s fluctuating sales in the past few quarters, retail investors might jump to conclusions about Dell’s ability to capitalize on the Data Center AI boom that began in late 2022 with the rollout of OpenAI’s ChatGPT.

Graph created by the author based on Dell filings

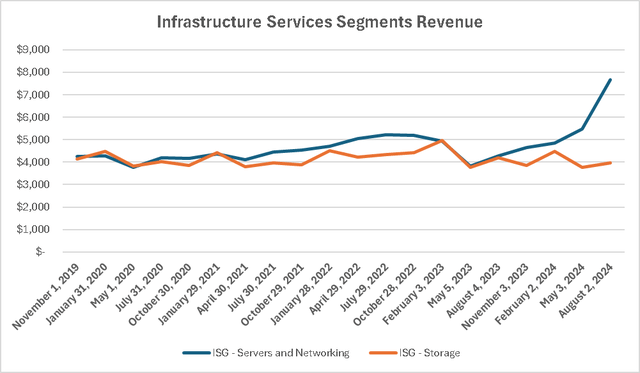

But when we look closer at the Infrastructure Services Group ‘ISG’ segment sales, a much more encouraging picture emerges. The chart below shows the sales of ISG’s two sub-segments; ISG-Storage and ISG-Servers and Networking. The latter includes sales of NVIDIA-powered servers.

Graph created by the author based on Dell filings

Last quarter, Dell’s ISG-Servers and Networking sales surged. This coincides with earnings misses on Super Micro’s side.

Technologically, Dell is far superior to SMCI. Dell sells products with higher propriety intellectual property ‘IP’ content than SMCI. Nearly 25% of Dell’s sales are software solutions. But from my understanding, SMCI excelled in low-cost, scalable assembly line operations, which meant it could install NVIDIA and AMD’s GPUs in a server quickly and efficiently, with value-added services confined to the limits of power supply and cooling systems.

With last quarter’s exponential surge in ISG-Servers and Networking sales, I think Dell has finally picked up its act in the AI hyper-scaler data center market, where the real money is made. So, Dell is certainly not out of the AI race, it is just perhaps a late bloomer.

Profitability

Selling servers and personal computers is a very competitive business, and the technological moat differs widely among participants. What we’re seeing right now is an increasing number of low-tech moat new entrants who are largely assemblers of third-party components. When I was browsing laptops on Amazon the other day, I stumbled upon many brands I never heard of, many of which had components that didn’t exactly match together, such as a high RAM capacity and low CPU capacity, or vice versa. The high-end component is often highlighted as a key selling point at the top of the description section, but in reality, the overall performance of such systems would likely be subpar because of this imbalance. For example, on the surface, this Tuofudun laptop seems like a bargain, with 32Gb RAM and a large screen, but paired with a Celeron N CPU, a low-performance processing unit.

What sets Dell apart is its brand name. They don’t typically use such sales tactics that would harm the brand.

But most importantly, there is more Dell propriety IP content per server or PC than competitors, which is mirrored in their operating margins.

| Company | Operating Margin | Gross Margin |

| Cisco (CSCO) | 24% | 64% |

| IBM (IBM) | 15% | 56% |

| Toshiba (OTCPK:TOSBF) | 3% | 40% |

| Hewlett Packard Enterprise (HPE) | 8% | 34% |

| Fujitsu (OTCPK:FJTSF) | 4% | 31% |

| Razer Inc. (OTCPK:RAZFF) | 3% | 24% |

| LG Electronics (066570.KRX) | 15% | 24% |

| Inspur (596.HKG) | 4% | 23% |

| Dell (DELL) | 6% | 22% |

| HP Inc. (HPQ) | 8% | 22% |

| AsusTek (OTCPK:ASUUY) | 6% | 18% |

| Lenovo (OTCPK:LNVGY) | 4% | 17% |

| Super Micro Computer (SMCI) | 8% | 14% |

| MiTac International (3706.TPE) | 1% | 13% |

| Micro-Star International (2377.TPE) | 4% | 12% |

| Gigabyte Technology (2376.TPE) | 5% | 11% |

| Acer (OTC:ACEYY) | 2% | 11% |

| Quanta Computer Inc. (OTC:QUCCF) | 5% | 8% |

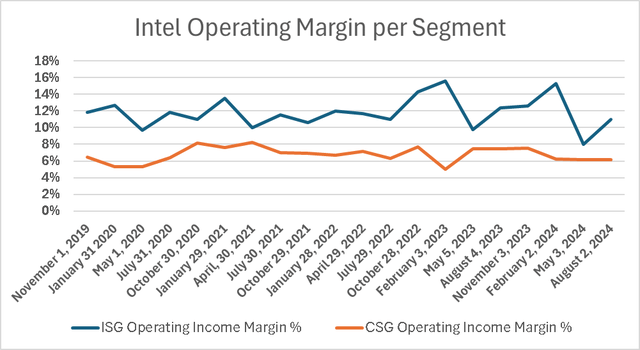

Dell’s ISG segment’s operating margin declined in recent quarters, but the rebound is encouraging. Margin movement suggests initial ramp-up costs weighing on profitability in Q1, with incremental economies of scale following soon after in Q2 2024 (three months ended August 3, 2024).

Graph created by the author based on Dell filings

Valuation

Dell’s strong performance will likely continue going into the second half of its fiscal year (three months ended January 2025). I think consumer and enterprise spending has hit the bottom. So, the Storage Solutions sub-segment and the CSG segment won’t be dragging on revenue going into 2025. As for the Servers and Networking sub-segment, all indicators point to stronger demand. NVDA expects sales to double in the second half of its fiscal year, which, similar to Dell, ends in late January or early February of each year. In fiscal year 2026 (twelve months ended January 2026), NVDA expects sales to be nearly three times that of sales in FY 2024. So, we’re looking at short-term and medium-term tailwinds for Dell.

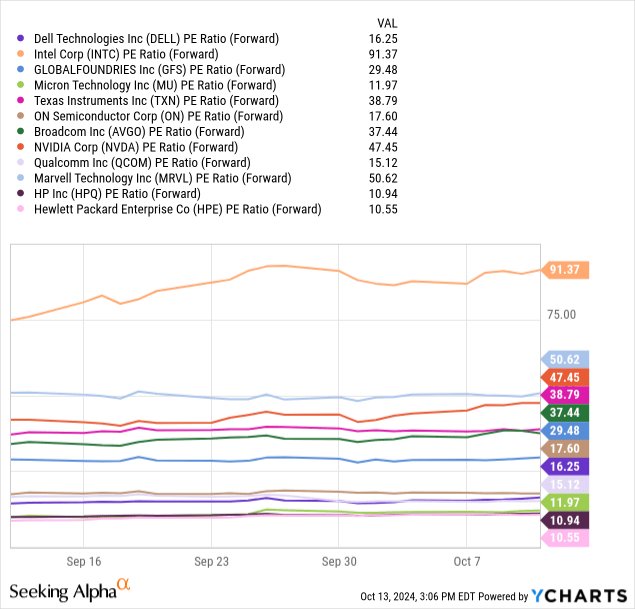

In that context, when looking at Dell’s sales in the next 18 months, it doesn’t seem overvalued at all, with a Forward PE ratio of 13.5x based on FY 2026 (twelve months ended Jan 2026). That’s down from its 23.5x Trailing Twelve Months PE ratio.

Comparatively, it falls at the lower limit of the industry range, adding to the appeal of this AI investment opportunity.

Final Thoughts and How I Might Be Wrong

I think the main risk to investing in Dell now is if its revenue and earnings disappoint. The rapid revenue growth of the ISG segment in the second quarter was great, but I might have built too much of this. What if it was just a temporary one-time spike in demand because SMCI was facing some supply chain issues and temporarily redirected its loyal customers to Dell until it ramps up production? Dell has never been the low-cost mass production manufacturer that hyper-scaler tech companies want its server suppliers to be. Dell is more of a high-value-added kind of hardware manufacturer who wants to put as much propriety IP in its products to expand margins. Can a company like that engage in a pricing war with SMCI if the latter decides to undercut its prices to maintain market share? This is a risk that investors should consider before investing. Things might not go as anticipated in this rapidly changing market. These are exciting times, and there are many opportunities, but also a lot of risk, so manage your risk accordingly.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.