Summary:

- Tesla, Inc.’s robotaxi vision is flawed due to its reliance on the wrong technology and business model for Autonomous Ride hailing Services (ARS).

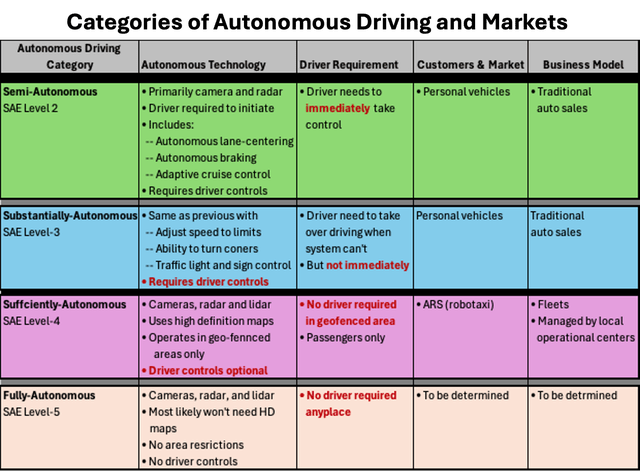

- Autonomous driving platforms are distinct and cater to different market needs, with the most important being sufficiently autonomous (SAE Level 4).

- Tesla’s approach primarily uses cameras, which is insufficient for the demands of autonomous ride hailing services (robotaxi) that require LiDAR and HD maps.

- Despite my admiration for Tesla vehicles, their current technology and strategy are not aligned with the requirements for achieving true autonomous ride hailing (robotaxi) capabilities.

- I believe that TSLA stock is substantially overvalued based on incorrect beliefs in its robotaxi strategy, and the stock will drop materially when this belief is shattered.

DNY59

Regular readers know I primarily focus on positive long-term opportunities, with few exceptions. When asked to consider the best stock opportunity for 2025, the most significant opportunity, by far, is to short Tesla, Inc. (TSLA, TSLA:CA) or sell it before it collapses.

Tesla’s unwarranted valuation is almost exclusively based on CEO Elon Musk’s robotaxi business, either potential or hype. For example, Ark Invest (ARKK) has a $2,600 stock price for Tesla by 2029, with a $2,250 value from the robotaxi service and $350 without it. That implies that Tesla’s robotaxi business could be valued at more than $5 trillion!

I am dumbfounded that many “experts” believe in Tesla’s (NASDAQ:TSLA) robotaxi myth and tout its more than $1.3 trillion valuation. If you understand the technology and business model for the robotaxi business (I refer to it as Autonomous Ridehailing Services), you will see the fallacy of Tesla’s strategy.

Even analysts I admire need help understanding this. I already mentioned Ark Invest. Wedbush’s Dan Ives sees Tesla reaching a $2 trillion valuation over the next 12 to 18 months as full-self-driving, autonomous penetration, and the Cybercab represent the “Golden Goose” for the automaker/technology company. (Tesla’s AI bet laying the foundation for a $2 trillion valuation — Wedbush.)

For six years, I’ve been researching autonomous driving, writing articles, and regularly updating my book, Autonomous Vehicles: Opportunities, Strategies, and Disruptions. In this article, I hope to clarify why Tesla has the wrong strategy for the robotaxi business, autonomous ridehailing services (ARS). My belief is not the typical opinion that Tesla Full Self-Drive won’t work; I actually drive it and am impressed. It’s a flawed strategy.

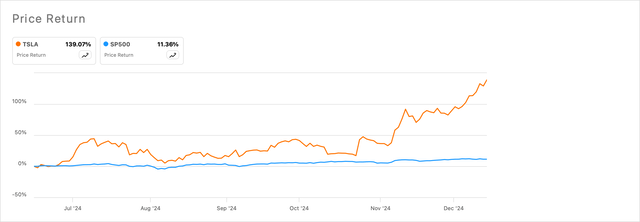

I previously wrote about the Tesla robotaxi on August 5th (Insights Into Tesla’s Trillion-Dollar Robotaxi Question From Elon Musk). Since then, much has changed. Elon Musk had his robotaxi “unveiling” on October 10th, clarifying its strategy. More surprisingly, the hype from this event dramatically increased the stock price and created even more risk. Since then, Tesla’s stock price has more than doubled from $199 to $463 for an absurd $1.3 trillion valuation with a 168X forward P/E.

Tesla Stock Price (Seeking Alpha)

Recently, Barron’s made similar points about Tesla’s extreme valuation based on its robotaxi business. (Barron’s.)

The current dissonance between investors and the Street—as well as the current price/earnings ratio—tells investors an important thing: Investors don’t believe Tesla’s earnings estimates. They think they’re too low. Investors believe two things will drive earnings estimates higher. One matters more than the other. That would be self-driving Robotaxis. It doesn’t appear to be reflected in Wall Street earnings targets yet. Analysts are waiting.

To trade at an average trillion-dollar P/E ratio, Tesla needs to earn roughly $50 billion a year. The car business is expected to earn about $10 billion in the coming years. Robotaxis need to earn roughly $40 billion a year to square Tesla’s valuation with the rest of the Magnificent Seven (plus Broadcom).

How much robotaxis will make is still anyone’s guess. But the expectations about robotaxi earnings aren’t a guess—they are high.

In this article, I want to explain clearly and convincingly why Tesla’s strategy for its robotaxi business is not viable. So, by extension, its valuation will drop when this becomes more apparent.

First, allow me to clarify two things. I love Tesla vehicles. I’ve owned one and driven one for four years. A few months ago, I drove beta test versions of FSD, which were incredible. Once, I took my grandson on a 25-mile trip through traffic and even a crazy intersection of five convergent roads with no traffic signal without taking control of the car until it stopped halfway up my driveway. As I’ll carefully explain, it is one of the best, if not the best, “substantially autonomous” vehicles, but it’s not “sufficiently autonomous” for autonomous ridehailing services. This distinction is critical!

Secondly, I don’t minimize the opportunity for autonomous ridehailing services. I believe the market opportunity for ARS will be huge. This will erode Uber’s business and eventually replace the need for many individually owned cars. With more than 150,000 paid driverless weekly trips, Waymo has proven the technology’s viability and market interest. It has also demonstrated the business model required, And this is different from the business model that Tesla is promoting. Again, this distinction is critical to understand.

Some SA analysts recently wrote excellent articles warning about Tesla for other reasons, and I won’t repeat their arguments. I refer you to the SA Tesla page to read them.

My case here is straightforward. If you understand autonomous driving and how it will transform transportation, you will realize the fallacy of Tesla’s robotaxi strategy and the likelihood that its valuation will collapse when the market catches on. But it’s essential to understand the facts rather than just following the hype.

I’ll explain all the flaws in Tesla’s robotaxi strategy, touch on other factors, and summarize my investment thesis and risks. First, though, let’s summarize the different categories of autonomous driving.

Categories of Autonomous Driving

There are four categories of autonomous driving. Each category uses a different autonomous driving technology platform, serves a unique market, and requires a different business model.

These platforms are not merely alternative solutions to the same challenge but are specifically designed to address different autonomous driving applications. Over the years, as the technology evolved, the distinctions between these categories became clearer, emerging from industry efforts to capitalize on particular market opportunities, which I categorize as follows:

Categories of Autonomous Driving (Author)

Semi-Autonomous (SAE Level 2)

Semi-autonomous driving is currently available as an option or standard feature in most higher-end new vehicles. It enables drivers to turn driving over to the vehicle as long as they pay attention and keep their hands on the steering wheel, so they can immediately retake control when needed.

Capabilities and Technology

This is primarily used for highway driving. The vehicle maintains its speed as set by the driver, adjusting it for the speed of the car ahead. It also keeps the vehicle centered in its lane and automatically brakes whenever needed. The autonomous driving technology platform for semi-autonomous driving uses an array of cameras and radar that provide data to a computer that translates this in real-time and directs the vehicle’s braking, speed, and steering.

It is primarily used as a feature for drivers who want it. I’ve driven thousands of miles in this mode, but most drivers with this feature have yet to use it. Most Tesla vehicles with Autopilot or earlier versions of FSD are classified as semi-autonomous.

Business Model

Semi-autonomous vehicles are sold through the current car dealer system. Tesla sells their cars online.

Substantially-Autonomous (SAE Level 3)

Sufficiently autonomous is a more advanced version of semi-autonomous driving. It adds capabilities such as turning right and left, stopping at traffic signs, following traffic signals, and proceeding along a selected route. This lets the driver sit back and let the vehicle drive along the chosen route.

Capabilities and Technology

In this category, the vehicle can drive itself 95%, maybe even 99% of the time, depending on how you measure this by driving events like turning or by miles. However, it can’t do 100% in this category. Right-turn-on-red signs and restrictions, for example, are not standard. They vary by state and municipality with time restrictions, cross-traffic restrictions, etc. This makes it virtually impossible for an autonomous vehicle to read and translate the sign. Examples of other limitations are the ability of a substantially autonomous vehicle to drive up a driveway, park in a garage, get into a gated community, or park itself on a field for an event.

The technology platform for this category is similar to semi-autonomous vehicles but with more advanced software capabilities. It does not require high-definition maps to control the vehicle. It uses more traditional GPS maps, with some variation, to select a route. There is no geofencing required for substantially autonomous vehicles. However, some companies, not Tesla, are beginning to use LiDAR and high-definition maps with geofencing for substantially autonomous driving.

Substantially autonomous driving could permit the vehicle to drive itself along a limited route. It might even go independently and pick up the children from school along a proven route. However, it will sometimes need a driver to retake control in unusual situations, so it will still require driver controls.

Business Model

These are private autonomous vehicles (“PAVS”), owned and operated by individuals.

Substantially autonomous driving creates the opportunity for personal autonomous vehicles. They could be driven entirely autonomously much of the time, but not everywhere or all the time. They will still need driver controls such as a steering wheel and brakes. The driver must return to the driver’s seat and take control when the vehicle reaches an impasse, such as the inability to find the proper parking spot. Vehicles in this category will continue to need driver controls.

The newer versions of Tesla’s full self-driving (“FSD”) fall into this category. Some other auto companies are introducing these capabilities, although more gradually.

Most importantly, substantially autonomous driving does not enable autonomous ridehailing services (robotaxis). Because they aren’t geo-fenced with a high-definition map, they can easily get on an infeasible route, stop, and be disabled without a driver to take over or even driver controls.

Sufficiently-Autonomous (SAE Level 4)

This is the primary category of interest. Sufficiently autonomous means the vehicle can drive fully autonomously along predefined routes to and from predefined locations. Hence, the term sufficiently autonomous, which means that it is sufficient for the limited routes permitted.

Sufficiently autonomous is the driving technology for autonomous ridehailing services (robotaxi), autonomous delivery, autonomous long-haul trucking, and several other applications.

Capabilities and Technology

This driving technology incorporates LiDAR (Light Detection And Ranging) and HD (high-definition) maps. The HD maps present a highly detailed pre-mapped representation of the vehicle’s surroundings, including lane markings, traffic signals (with characteristics), traffic signs, and specific reference points such as trees, posts, and buildings. Most importantly, they provide specific road geometry, including curve lines, gradients, and calculated angles to guide the vehicle.

The LiDAR in the vehicle scans all the details around it and generates a 3-D point cloud. Then, the vehicle’s computer compares this with the previously developed HD map. From this, the autonomous system uses the HD map to plan the route for upcoming turns and movement. Adjustments are made for any discrepancies, including temporary changes.

Business Model

The successful business model for autonomous ridehailing services (robotaxi) is built around a fleet of sufficiently autonomous vehicles serving a defined metropolitan area managed by a local fleet operations center.

This municipal fleet is based and maintained at the operations center, although some may be parked at distributed locations within the municipality. Fleet maintenance includes cleaning, charging, regularly calibrating the sensors, preventative maintenance, updating the vehicle software for local variations, and safety inspections required by regulatory approval and for public confidence.

The municipal operations centers perform several critical functions. They:

- Manage the ride-request and dispatch functions for that municipality,

- Modify the HD map routes and pickup/dropoff locations based on local conditions, including moving around construction zones and avoiding accidents, traffic, or emergencies,

- Manage the fleet charging schedules so that a sufficient number of vehicles are always available,

- Continually upgrade the municipal HD map with new routes and locations, expanding service in that area,

- Work with local first responders and provide training on how they can work with autonomous vehicles in emergencies,

- Remotely take over control of a vehicle or disable it as needed,

- Retrieve a disabled autonomous vehicle when required,

- Ensure fleet compliance with local regulations,

- Set fleet pricing based on local situations, demand, and competition, and

- Market and promote the ARS locally.

As you can see, municipal fleets and operational centers are critical for autonomous ridehailing services (robotaxis).

Fully-Autonomous(SAE Level 5)

Tesla’s robotaxi strategy requires fully autonomous driving, which must be 100.00%, not 99.9%, in handling all potential driving situations. For now, I think 100.00% is impossible.

Many of these limitations are not situations encountered while driving; they are unique circumstances in the environment. Here are three examples.

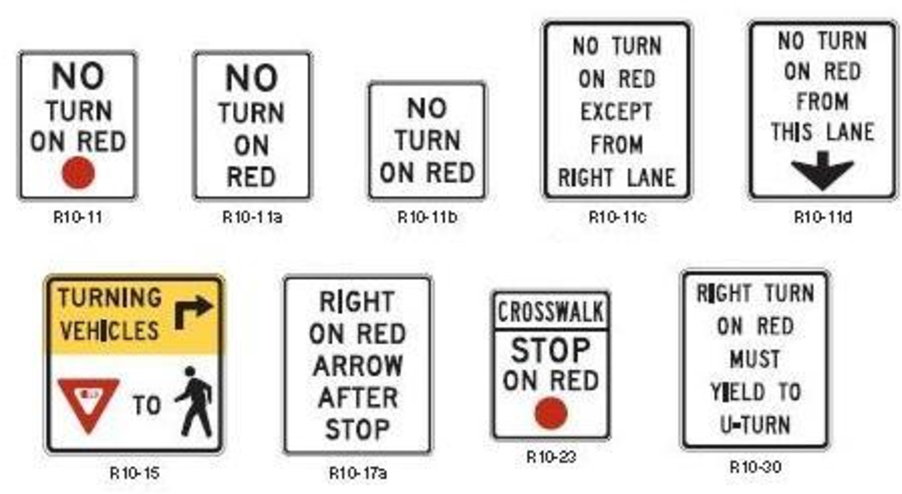

Right-on-Red Signs

“Right-Turn-on-Red” restriction signs are widely inconsistent because of local laws and efforts to address unique traffic concerns. Cities and towns sometimes create unique, non-standard signs to address specific traffic concerns. For example:

- No Right Turn on Red Except Between 7 AM-9 AM and 4 PM-6 PM, Monday to Friday

- No Right on Red Except Buses

- Poorly placed, or ambiguous icons often leave drivers unsure whether the restriction applies to them

- No Right on Red—Temporary Restriction Due to Event Traffic.

In New York City, right-on-red is prohibited citywide unless allowed explicitly by a posted sign, which is the opposite of the norm elsewhere in the U.S.

Right-turn-on-red signs (Semantic Scholar)

I’ve found that many of these signs are difficult even to see, let alone understand. This will be a problem for fully autonomous driving. In contrast, HD maps used for sufficiently autonomous driving can include a description of the specific regulations for that turn.

Gated Communities and Driveways

There are most likely tens of thousands of gated communities in the U.S. These typically require a gate code to be entered manually if you don’t have an authorization sticker. Fully autonomous vehicles will need to have a solution for this. Otherwise, the vehicle will get to the gate, stop, and stay there, blocking all other cars.

Eventually, there will be solutions by upgrading the gates to enable an electronic signal, but this will take many years and be enabled one at a time. In contrast, municipal operations centers can work with local gated communities over time to provide autonomous ridehailing services to their residents and add access to the geo-fenced area. Similarly, it will be difficult, potentially impossible, for a fully autonomous vehicle to park at a particular spot in a driveway or a reserved spot in an apartment parking lot or garage.

Drop-off at Airports and Hotels

Ridesharing drop-off and pick-up at many airports and large hotels are limited to defined areas, such as the first floor of a nearby garage. Drop-off or pick-up is not allowed at the main entrance or curb. Autonomous ridehailing services will need to follow these restrictions. If a passenger requests the airport terminal or hotel, the autonomous vehicle must know this location. A fully autonomous vehicle can’t know this for every hotel, airport, or sports stadium in the world. However, these could easily be defined for fleets in a metropolitan area.

The Fatal Flaws in Tesla’s Robotaxi Strategy

The success of Tesla’s robotaxi business is the primary assumption behind its extreme valuation. However, its strategy is flawed and won’t work. Let’s start by looking at the primary elements of Tesla’s robotaxi strategy.

- It intends to have and will require fully autonomous driving for its robotaxi.

- It uses a camera-only technology platform, without LiDAR or HD maps.

- It plans to offer unconstrained service, without geofencing, that will go anywhere and everywhere.

- It expects to use a hybrid fleet, including Tesla vehicles owned by individuals.

These elements of Tesla’s strategy are interdependent; it can’t change one because of the constraints of others. Let’s look at the flaws in this strategy in more detail.

Fully autonomous driving is required for its robotaxi.

Returning to the previous definitions of autonomous driving, Tesla’s FSD is substantially autonomous. For its robotaxi strategy to be successful, though, it needs to be fully autonomous. However, as I explained, being fully autonomous is yet to be feasible — and may not be for a very long time.

It does not matter how well Tesla FSD handles different traffic situations. It already does that very well and will get better. The limitation on fully autonomous driving has to do with different driving circumstances and surroundings. It fully needs to be 100.0%, not 99.9%.

Tesla may need remote human teleoperators when the program launches in Texas and California, as the FSD tech is not ready for prime time yet. The remote operators will monitor safety conditions and take over for complicated maneuvers or when vehicles get stuck in various situations. (Reuters.)

Tesla’s strategy requires fully autonomous driving, or it would need to be geo-fenced and not offer its service everywhere.

It plans an unconstrained service area.

Tesla does not plan for its robotaxi service to be geo-fenced. Its technology platform doesn’t incorporate HD maps that provide geofencing. Elon Musk has often criticized geofencing strategies as “not being scalable.” Tesla aims to deploy its robotaxis more broadly. Musk has boasted that Tesla would be unrestrained by any geographic limitations. In other words, true “Level 5” autonomy — a driverless car that could drive anywhere, under any conditions. (The Verge.)

Tesla has said it doesn’t want its autonomous vehicles to be limited to small geographical areas, like competitors are. Google’s (GOOGL) (GOOG) Waymo, the gold standard for robotaxis in the U.S., operates in growing regions of San Francisco, Los Angeles, Phoenix, and Austin. (Inside EVs.)

This strategy requires fully autonomous driving, since it can’t limit driving autonomously in specific locations. If Tesla attempts to use substantially autonomous driving as fully autonomous, there could be a significant backlash as its vehicles frequently run into inoperable situations. As has been the experience with autonomous vehicles, a backlash like this can trigger regulatory restrictions.

Waymo and others have proven the need to operate in a constrained geo-fenced area and continually expand those areas over time.

It doesn’t have the right business model.

Tesla’s strategy has the wrong business model for autonomous ride services. The correct model for autonomous ridehailing services uses sufficiently autonomous driving technology, which by definition means operating in a constrained area.

The correct business model is a fleet of sufficiently autonomous vehicles serving a metropolitan area under the management of a municipal operations center. You can go back to the earlier description of the functions of such a center and see everything that is required. These can’t simply be avoided, as Tesla plans to do with its business model.

Additionally, autonomous ridehailing services will initially penetrate Uber and Lyft’s ridesharing markets. The largest and most profitable ones are in metropolitan areas, with services more limited in rural areas.

The Cybercab is limited.

The Cybercab, introduced by Tesla on October 10th, is a fully autonomous EV designed primarily for autonomous ridehailing services. It does not have traditional driver controls such as a steering wheel, brakes, accelerator, mirrors, etc. It only seats two passengers. It has no plug-in charging but uses inductive charging from a mat below the vehicle. As a new technology, inductive charging is still developmental and has limitations in charging time, availability, and cost of charging stations, and lower efficiency (energy loss).

It is unlikely that the Cybercab could be successful as a personal autonomous vehicle. Its design has limitations. It only holds two passengers, and that will significantly restrict the market. Inductive charging will also be a limitation. It can’t charge at Tesla’s extensive charging network. Customers will need to convert to inductive charging mats (if the technology is successful), which could be inconvenient. Good luck installing a charging mat on your driveway to work in all weather conditions, like heavy rain and snow.

If the Cybercab is not fully autonomous (and as discussed previously, it wouldn’t be), it could not function as a private vehicle. The exceptions to the almost 100% could become big problems because there are no driver controls. Here is a sample of hypothetical but likely problems:

- “I can’t get my car to double park in my driveway, and my wife is angry.”

- I went to a football game, and the car wouldn’t park where they wanted it, so I was forced to leave.”

- “I can’t get my car to wait at the airport cell phone lot and then come pick me up.”

If Tesla cannot sell the Cybercab as a private autonomous vehicle, its strategy of relying on private vehicles for its network won’t work. It would be forced to finance its robotaxi fleet. A fleet of 100,000 Cybercabs would cost $3 billion, and 500,000 would cost $15 billion. As Waymo and GM/Cruise found out, autonomous ridehailing services is a capital-intensive business.

A customer-provided fleet is unrealistic.

Musk envisions Tesla operating some “Cybercabs” while allowing regular Tesla owners to deploy their vehicles to an Uber-like network and earn side income. (Inside EVs.)

This element of its strategy is compelling and most likely a reason supporting its valuation. The prospect excites Tesla owners and is an attractive way to finance an extensive fleet of AVs. However, it may need to be more realistic.

Creative Strategies recently described this mixed fleet strategy:

There will be two pools of Robotaxi’s (for simplicity’s sake, I’ll be calling the vehicle Cybertaxi and network of autonomous vehicle robotaxi from here on out): Tesla-owned and consumer owned. These will function in an autonomous ride share service, similar to Waymo. The Cybertaxi can be purchased and managed as a fleet designed for the ride share network of Robotaxi’s, or you can have it join the network while it’s not in use by the owner or even never have it join the network and function as exclusively your personal driver. All Model S, 3, X, Y, and Cybertruck seem to be capable of joining this autonomous rideshare network and function as a Robotaxi, with a specific focus on Model 3 and Model Y first. Again, this seems to be a choice. If you own a Tesla, you have the option to share it as part of the network, but you do not have to. I like this option and choice. You could, in theory, have the car pay for itself while you’re not using it. That’s an insane concept. (Creative Strategies.)

This expectation is unrealistic for several reasons. As already discussed, 100.0% fully autonomous is unrealistic. Will the vehicle start itself, open the owner’s garage, pick up passengers anywhere, take them anywhere, and return to the garage? Not realistic. When it encounters one of the unusual cases, such as the ones I mentioned, it will just stop, and the owner will have to retrieve it and deal with angry passengers.

Beyond this, there are quality and safety issues with a fleet of different vehicles from many owners. How will the safety and quality of the vehicle be ensured? Will it have the right software? Will all the sensors work? Will it be sufficiently charged? Will it be cleaned? Who is responsible for insuring the vehicle? There are too many questions and issues with this type of fleet.

And as we previously discussed, the Cybercab is not a realistic private autonomous vehicle.

Government regulations could be a headwind.

Government regulations for autonomous ridehailing services (robotaxi) are extensive, complex, and inconsistent. There are regulations at three levels: federal, state, and local.

The National Highway Traffic Safety Administration (NHTSA) has responsibility for establishing vehicle standards, including robotaxis. For example, it still requires driver controls in all vehicles, even if they are autonomous. It stalled the approval of the Cruise Origin for several years. With his significant influence in the new administration, Musk may be able to overturn these restrictions and establish new standards for autonomous vehicles, which would permit a Tesla Cybercab with no driver controls. However, this could take time.

Approval for testing and deployment of autonomous vehicles on public roads is done at the state level. They issue testing and operational permits, establish registration requirements and operator licensing, and regulate insurance. For example, California requires permits for testing autonomous vehicles, even with safety drivers, before issuing permits, and it requires detailed monthly activity reports. This will be the primary challenge for Tesla. Its strategy for a nationwide rollout would need approval from all states, and this will be a daunting task, if not impossible. Some people may believe that Elon Musk could get federal legislation to overturn the authority of individual states, but this is unlikely. It would require a majority of support from Congress, and most elected officials are reluctant to overturn the authority of their states.

Then there are local regulations. Municipalities have the authority to manage traffic regulations, curb usage, and issue permits for pick-up/drop-off locations. Some directly regulate autonomous vehicles. In New York City, for example, autonomous vehicles are regulated by the NYC Department of Transportation. It established specific regulations for the testing and conduct of all AVs in the city. Currently, it requires a safety driver on all AVs.

Local and state regulations are another primary reason municipal operations centers must manage autonomous ridehailing. A simultaneous national rollout is impossible because of regulatory restrictions, and without geofencing, Tesla can’t keep its vehicles from going to any state. These regulations could be headwinds that slow Tesla’s national rollout strategy.

It is ignoring the competition.

Tesla is ignoring the competition for autonomous ridehailing services. Google’s Waymo has a big lead. Waymo is already far ahead, providing 150,000 weekly driverless trips across Phoenix, Los Angeles, San Francisco, and Austin and opening for service in Miami in 2025.

Tesla has promised to initiate some services in Texas and California next year using existing vehicles, although I am skeptical about this. The Cybercab won’t be available until 2027, so any broad rollout won’t come until then. By then, Waymo may be well established in most primary metropolitan markets and doing several million miles weekly. There are other competitors expected to enter the market before then.

Tesla will face substantial competition. It will have few competitive advantages by then and must replace established competitors, especially if it is forced to revert to a municipal deployment strategy, as I expect it will.

Other Factors Reducing Tesla’s Valuation

Other factors that are concerning could also reduce Tesla’s valuation. I’ll just summarize them since they are not part of my primary thesis. (Again, I suggest reading other SA analyst articles on Tesla.)

1. Tesla will see increasing competition from itself.

So far, Tesla has had the unique advantage of not having any competition from its own used cars. But by early 2024, Tesla had sold well over 6 million cars (Wikipedia), and now many of these are available to people who want to buy a Tesla at a lower price point. For example, people could buy 3 million Tesla cars in 2025, but only 2 million might be new sales to Tesla. This is a new dynamic that threatens new car sales.

2. Elon Musk’s bonus payment may affect the stock price.

Musk’s potentially enormous bonus payout is in a legal dispute with the courts (NPR). Musk was given 10 years of performance targets to hit, targets that, when reached, would result in a payout of stock options. Musk could earn 303 million options—the number has been adjusted for stock splits—equivalent to about 12% of Tesla stock outstanding in 2018 and about 9.2% of current shares outstanding. Each option has a strike price of about $23 a share—adjusted for stock splits. I assume that stockholders in most companies would object to the dilution and sell the stock of a company that sold 9.2% of its stock at a 95% discount to the current price. However, that has not yet been the reaction to paying Elon Musk.

3. Elon Musk is increasingly distracted.

Some people think Elon Musk is Superman, but even Superman couldn’t be everyplace all the time; Elon Musk is getting spread too thin: Tesla, SpaceX and Starlink, X Corp (formerly Twitter), The Boring Company, Neuralink, and xAI. Now, he has been appointed to co-lead the newly established Department of Government Efficiency (DOGE), a federal initiative to reduce wasteful spending. These initiatives will likely drain time that could have been critical to Tesla.

4. The elimination of EV subsidies may not have a positive effect.

Some believe that Musk will get the new administration to eliminate EV purchase subsidies and that while these will hit Tesla, they will hurt his competitors more. However, the case could be made that this might hurt Tesla even more if it slows the overall adoption of EVs and makes used Tesla cars more price attractive.

Investment Thesis

I believe I’ve proven the fallacy of Tesla’s robotaxi business as a primary reason for its excessive valuation. When investors eventually realize this, in my opinion, they will abandon the stock, and the price will drop precipitously. Even giving Tesla a premium over General Motors (GM) and Ford (F), which trade at a P/E ratio of less than 6X, its stock price would be much lower than today. At 30X to 40X forward earnings, Tesla would be valued at approximately $230 billion ($83/share) to $310 billion ($110/share).

However, the timing of the drop is unclear because it’s based on when investors give up on Tesla’s robotaxi business. Promises for current Tesla models serving as robotaxis in 2025 may not happen, and investors could question the technology and issues of government regulation. Furthermore, by late 2025, investors may better understand the problems of Tesla’s strategy and its excessive valuation risk.

There is a possibility that Tesla could be forced to adapt its strategy to the more appropriate geo-fenced municipal model. This would take much of the shine off Tesla and put it on Waymo.

Risks to My Investment Thesis

To be sure, there are risks to my investment thesis. My belief about the failings of Tesla’s robotaxi could be flawed, and it could have millions of customer-owned Tesla autonomous vehicles driving passengers everywhere around the world. However, I spent many years studying this and can’t see that happening.

A more significant risk is that “Tesla Fan Boys” keep propping up the stock. This has happened in the past and could continue for a while. In particular, this could bring the timing of a stock price drop into question. It could take more than a year, maybe even 2–3 years, for the fallacy of its robotaxi business to set in. Timing is critical to anyone shorting the stock.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I may short TSLA at some time in 2025.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.