Summary:

- Denison Mines has multiple uranium projects, including the flagship Wheeler River project.

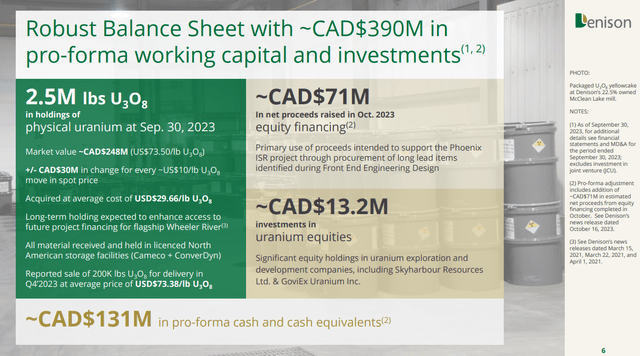

- DNN’s balance sheet has improved with the increase in the price of uranium and an equity raise.

- We update our views in light of the recent run-up.

Manuel Augusto Moreno/Moment via Getty Images

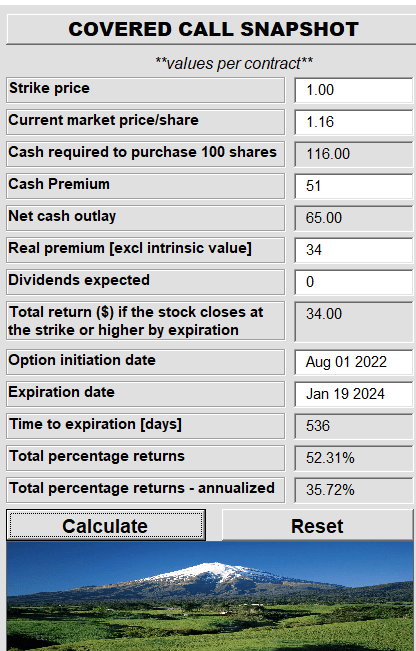

Denison Mines Corp. (NYSE:DNN) was one of the rare mining plays that we gave a buy rating. The rationale was a depressed commodity set to rise (uranium, of course), alongside a clean balance sheet and ownership of projects that offered value at current commodity pricing. We suggested investors play it with a defensive covered call as the high implied volatility offered radioactive returns, even if the stock declined by 15%.

Valuation Is Compelling For This Uranium Play

That, of course, has played out as the stock was well above $1.00 per share when the option expired. Investors made 52.31% total returns with the least amount of volatility (thanks to the large premium). We examine the situation today and update our views.

The Company

Denison is no one-trick pony and has its hands in several different uranium projects.

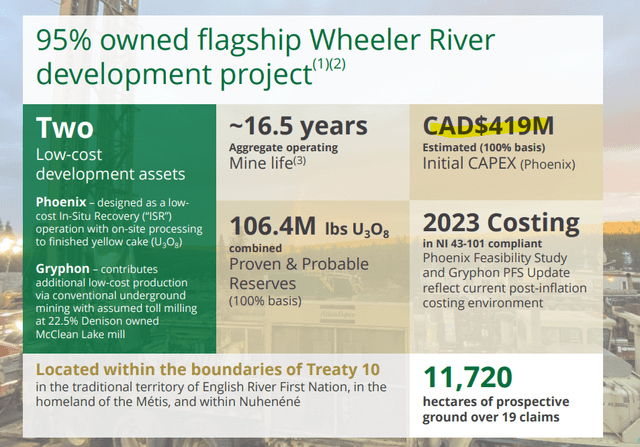

Effective 95% interest in flagship Wheeler River project – largest undeveloped uranium project in the infrastructure rich eastern Athabasca Basin

22.5% interest in Strategic McClean Lake Uranium Mill, which has excess licensed annual capacity, and authorization for significant expansion of tailings management facility

67.41% interest in emerging Waterbury Lake project, with Preliminary Economic Assessment stage development plans for the The Heldeth Túé deposit (formerly J Zone).

Participating interests in key development-stage assets operated by uranium “majors”, including 22.5% in McClean Lake (Orano), 25.17% in Midwest (Orano), and an effective 15% in Millennium (Cameco) through 50% ownership of JCU (Canada) Exploration Company, Limited

2.5M lbs U3O8 of physical uranium held in North American storage facilities – acquired at an average cost of US$29.66/lb U3O8, as a long-term investment expected to enhance access to future project financing for Wheeler River

~300,000 hectares of prospective exploration ground in the Athabasca Basin

Source: Denison

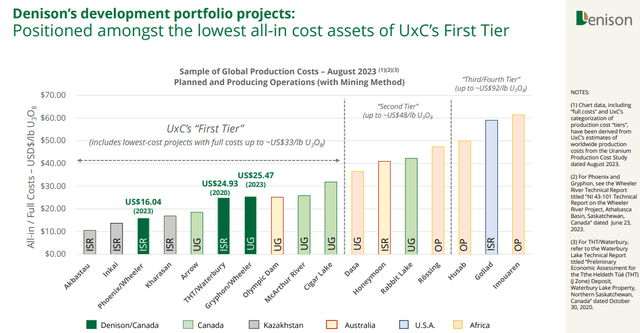

But the key one is, of course, the Wheeler River one, and that is the one we talked about previously. While the costs associated with completion of these projects tend to go up over time, Denison has stuck with its earlier estimates. Even the cost of mining on a per-pound basis remains incredibly low.

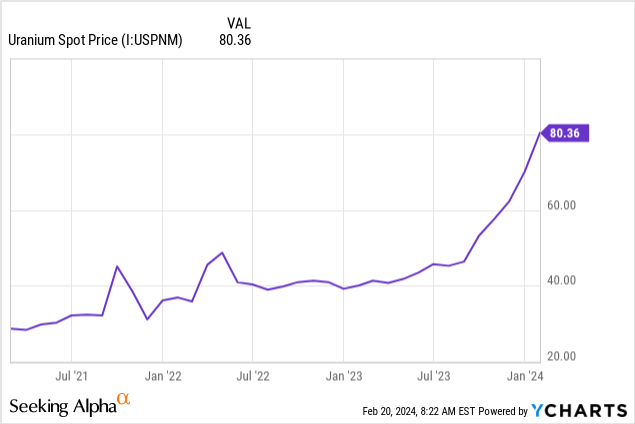

That is because Wheeler project is one of the richest uranium mines and extraction costs will be low relative to lower grade mines around the world. In addition to this, the setup that made Denison appealing was the strong balance sheet, which would survive the years from planning to first production. That balance sheet is actually stronger today. Denison held 2.5 million pounds of physical uranium on its balance sheet (wonder who volunteers to audit that) and the price of uranium has gone vertical over the last 12 months.

So, automatically, Denison got a big boost from the price increase. 2.5 million pounds into $40 is another $100 million of current assets for the company. Denison also did an equity raise in October 2023 just as the price was flying. Overall, the balance sheet is now in better shape than when we last wrote on it.

Outlook

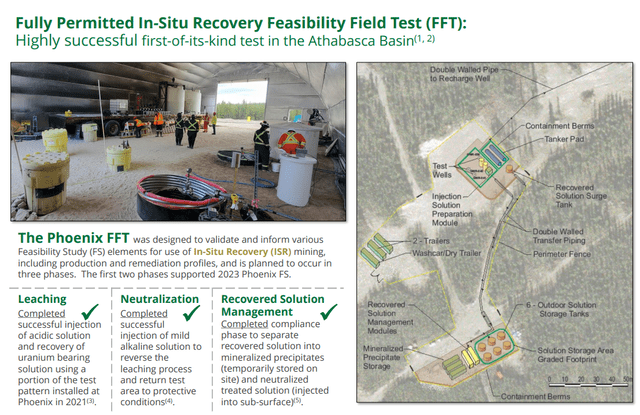

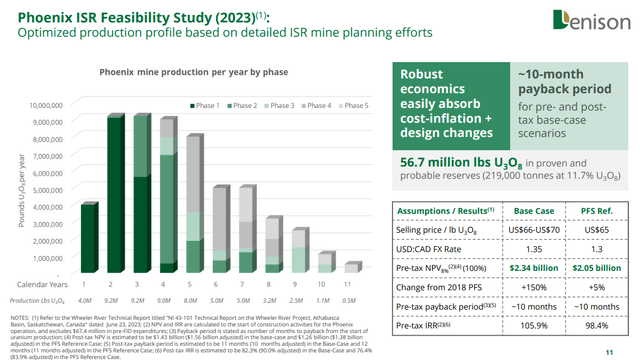

Denison completed feasibility work for Phoenix, and we are now at the permitting stage for this project.

Estimated timelines are possibly the end of 2024 (optimistic) to the second quarter of 2025 (most likely). Investors tend to forget that even the best projects have long lead times in mining and, even the lowest-cost ones, are expensive.

We are fairly certain that by the time the first uranium pound comes up from the ground, that cost will be north of $500 million. Also, keep in mind that based on estimated construction lead times, we are looking at 2028 for the first production. Then the following mine profile will apply if everything goes right.

In the interim, there is the cash burn to deal with. This cash burn for 2024 does not even include any construction costs. Those come in 2025-2028. The company will likely burn at least $40 million in 2024, though the liquidity is high enough that this won’t be a bother.

Valuation & Verdict

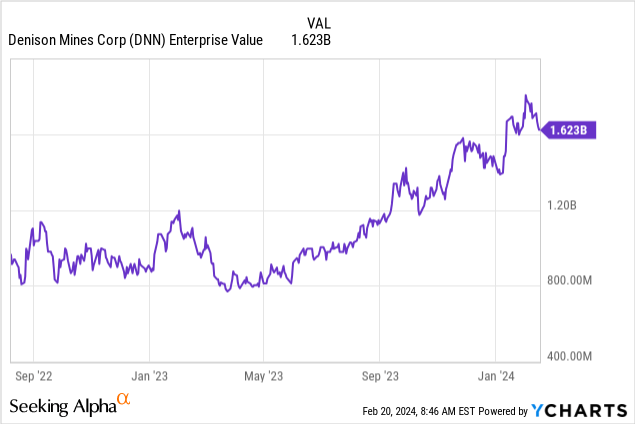

On such long lead times, pricing a development project is fraught with difficulties. You have to project costs to completion accurately and also be certain those reserves will really jump out of the ground like fluffy bunnies. Of course, the key parameter is the price of uranium itself. There you can see all kinds of projections from uranium returning to $60/pound (most sell side analysts are using this to calculate NAV) to all the way to $500 a pound. What we can tell you with a fair degree of certainty is that Denison is nowhere near as cheap as our covered call entry price of $1.00 per share. In fact, adjusting for the capital raise that was just done, and the share price appreciation, the enterprise value has about doubled since then.

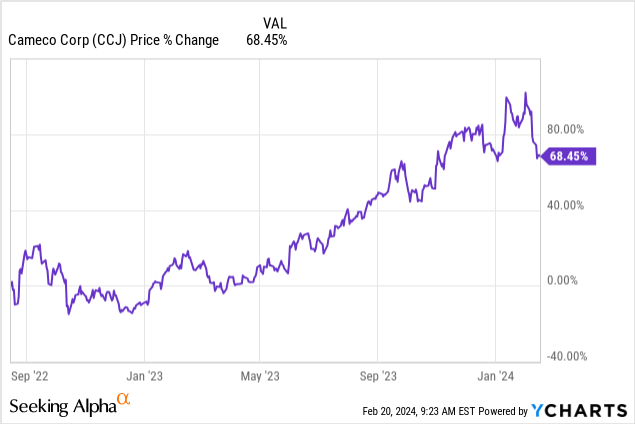

Denison is hardly alone, though. Cameco Corp. (CCJ) the sector leader and one sporting a far bigger market capitalization, has also moved substantially since then.

Yes, the uranium price is higher, but there are no guarantees it will stay here over the next 4 years. If you run a NAV analysis here at $60 pounds of uranium and a 10% discounting of cash flows, you will come to a price lower than the stock price today. If you use $80 pounds, you likely come out ahead, but then this is a speculative asset, and you should aim to make a boatload if you are right. At present, we think a long, healthy consolidation is the most likely course as investors digest the gains and the company makes its progress towards construction. We are moving this to a “hold” rating and would look for opportunities to initiate covered calls near the $1.30-$1.40 price zone.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

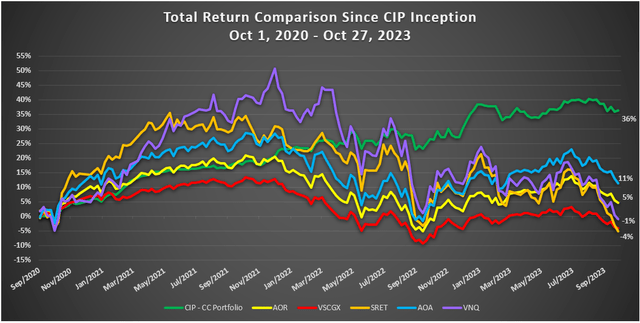

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with an 11-month money guarantee, for first time members.