Summary:

- Denison Mines is a Canadian uranium development company listed in the U.S. and Canada, with recent stock price volatility.

- Denison’s main asset is the Wheeler River Project, including Phoenix and Gryphon, with strong projected economics.

- Denison is well-capitalized with no debt, trading at an attractive valuation, with an enterprise value to NAV ratio of 0.5 using current uranium prices.

HT Ganzo

Overview

Denison Mines (NYSE:DNN) is a Canadian high-quality uranium development company with several interesting assets. The company is listed in the U.S. and Canada (TSX:DML:CA). I have covered Denison a few times with my first article on the company in 2020, the prior articles can be found here.

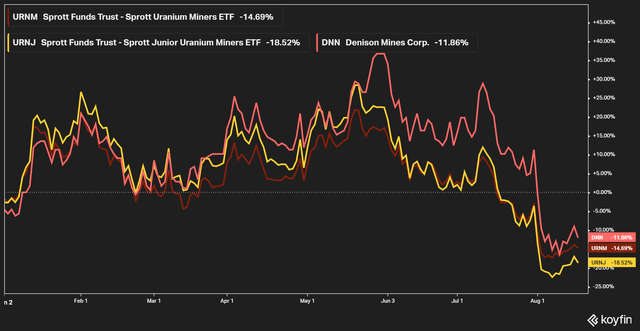

The stock price of Denison had its recent lows around $1 a little over a year ago, it then had a strong run in the back half of 2023 into 2024 as the price of uranium recovered from very depressed levels.

Figure 1 – Source: Koyfin

Figure 2 – Source: Koyfin

More recently, the stock has taken a beating along with most uranium equities following some general market turbulence, a slight pullback in the spot price of uranium, and a poor overall sentiment for uranium stocks.

This has caused the valuation to now be very attractive as the price of Denison has corrected more the spot price of uranium. It is also worth pointing out that the long-term contract price for uranium, which is probably more relevant to Denison, has continued to climb unabated to now above $80/lb. That is a 16-year high for the long-term contract price.

Figure 3 – Source: Cameco & Numerco

Assets

The main asset of Denison is the Wheeler River Project, which is comprised of Phoenix and Gryphon. Denison owns 95% of Wheeler River and did last year release a feasibility study (“FS”) on Phoenix and an updated pre-feasibility study (“PFS”) on Gryphon, from where I have derived much of the valuation of those assets.

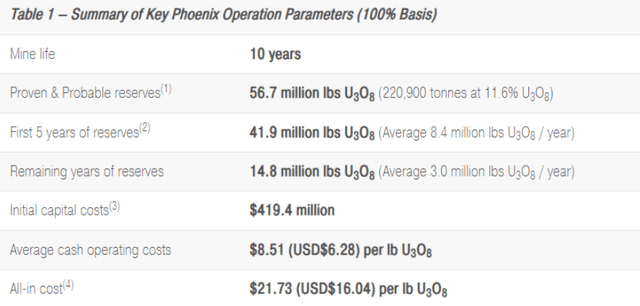

Figure 4 – Source: Denison Press Release

Phoenix is an ISR project currently in permitting, where the company has communicated some progress, and a permit approval is likely expected sometime during 2025.

The projected AISC is below $20/lb for Phoenix and the after-tax net present value is around $1.3B using current uranium prices. The initial capital cost is relatively manageable as well at C$419M. The internal rate of return (“IRR”) is above 90% at current uranium prices, so the margin of error is pretty good if we see some cost creep for either the construction capital or on the operating side.

Figure 5 – Source: Denison Press Release

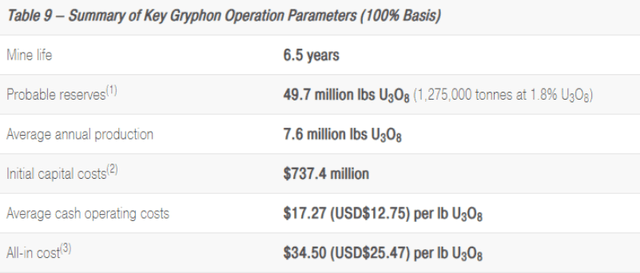

Gryphon is a number of years behind Phoenix in the development pipeline. AISC is projected to be below $30/lb, which is very competitive globally, but the initial capital cost is a more substantial C$737M. The cash flows from Phoenix are expected to finance the construction of this mine. The after-tax net present value is around $800M at current uranium prices, which is impressive, but the IRR is more modest than Phoenix, which is in a league of its own.

Denison had the very good foresight to purchase 2.5Mlbs of uranium for $29.6/lb in 2021, that uranium has appreciated a lot in value since then. The company has sold some of the uranium over the last year, but still owns 2.2Mlbs worth around $180M today.

The company also owns 22.5% of McClean Lake, which has mill with an annual licensed production capacity of 24Mlbs or uranium. Cigar Lake is currently processing its ore at the mill, but Denison has monetized the toll milling cash flow for the Cigar Lake ore. So, the ownership in the mill is more of long-term interest.

McClean Lake also has a deposit where uranium production is expected to commence in 2025 using the SABRE mining method. We are talking about more minor amounts of production, but this project still has the potential to provide some cash flows going forward for Denison.

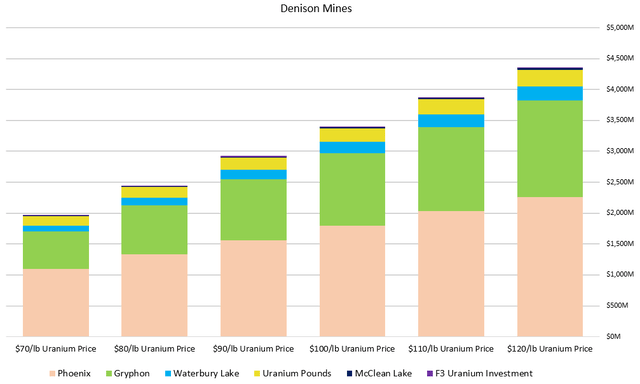

Denison also owns 69% of the Waterbury Lake project, did last year make a C$15M convertible investment in F3 Uranium (FUU:CA), and also owns a few more uranium exploration & development assets. Waterbury Lake has a value just above $100M using current uranium prices, but the other assets and investment have more marginal values.

In the chart below, we can see the various assets mentioned in this section and my estimated values at different uranium prices. At a uranium price of $80/lb, the combined net asset value (“NAV”) is around $2.4B and it increases to about $3.4B using a uranium price of $100/lb.

Figure 6 – Source: My Estimates

Denison has no debt and did at the end of Q2 2024 have C$121M in cash, not included in the assets above. If we count the 2.2Mlbs or uranium worth around $180M as liquidity, Denison is very well capitalized and that together with the quality assets is likely the reason why the stock has performed better than many peers over the last few years.

Valuation & Conclusion

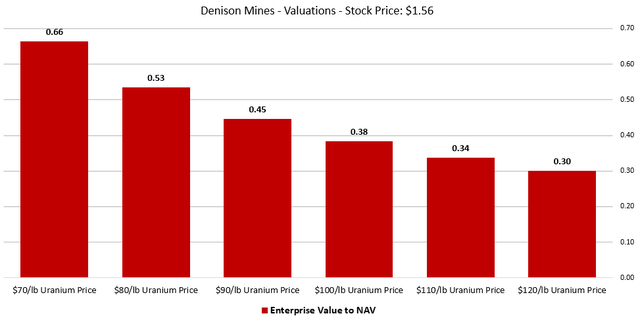

The latest share price of Denison was $1.56 and the fully diluted share count was 905.5M as of the 8th of August. That gives us a market cap of $1.4B and an enterprise value of $1.3B, the market cap and enterprise value are down down materially from the peak just a few months ago.

Figure 7 – Source: My Estimates

Denison is consequently trading with an EV to NAV around 0.5 using a uranium price of $80/lb and 0.4 using a uranium price of $100/lb, which I think is probably more appropriate given the current uranium deficit. Based on how few high-quality uranium developers there are, with assets of scale in good jurisdictions, this is a very attractive valuation in my view. The recent pullback has provided a good opportunity for anyone that missed the rally that started in 2023.

Permitting uranium projects is never risk free though, where delays are very prevalent. Given that Phoenix is an ISR project, which has not been used in Saskatchewan before, even if it is the most common uranium mining method globally, adds a bit of risk to the permitting process.

However, when you factor in the very high internal rate of return for Phoenix and how well-capitalized the company is, I consider Denison Mines one of the better risk reward investments in the uranium industry today.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DNN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like this article and are interested in more frequent analysis of my holding companies, real-time notifications on portfolio changes, together with macro and industry analysis. I would encourage you to have a look at my marketplace service, Off The Beaten Path.

I primarily invest in turnarounds in natural resource industries, where I have a typical holding period of 1-3 years. Focusing on value offers good downside protection and can still provide great upside participation. My portfolio has had the following returns: 81% in 2020, 39% in 2021, -8% in 2022, 12% in 2023, and 14% YTD2024.