Summary:

- Denison Mines has been in the uranium mining business for seven decades. Its Wheeler River project is one of the best in the world, measured by AISC, grade, and resource base.

- Denison’s balance sheet has zero debt and carries 2.5 million pounds of uranium, while the share dilution is minimal. The company owns 22.5% of McClean Mill, too.

- DNN is for sale at a significant discount using NAV calculations with a $50/lb uranium price. These reasons are more than enough to give Denison a strong buy rating.

RHJ

Thesis

Gold, uranium, Latin America, and banking are my passions as a researcher and investor. Recently, I presented my thesis on why uranium is poised to be one of the best investments of the current decade, illustrating how to bet on it using NexGen (NXE) among the top uranium miners. Today, I will share another enticing uranium stock, Denison Mines (NYSE:DNN). DNN is one of the most significant holdings in my portfolio, with double-digit weight.

Denison and NexGen develop the best uranium deposits outside Kazakhstan, measured with AISC, grade, and resource base. DNN has zero debt and owns an inventory of 2.5 million lb of uranium. Denison is one of the oldest companies in the business that has survived all the ups and downs since post-World War 2.

Last month, all uranium equities, including DNN, made strong upside moves. Despite that, DNN is still undervalued based on NAV. That said, I give Denison a strong buy rating.

Denison Mines overview

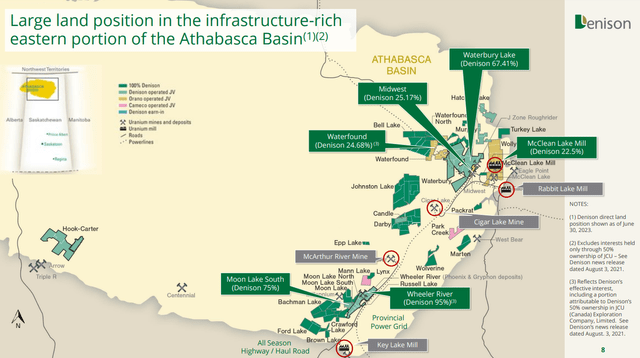

Denison assets are in the Saskatchewan province Athabasca basin. The latter is the most prominent uranium mining region in the Western Hemisphere. The map below from the last company presentation shows the location of DNN’s mines, Cameco (CCJ), and NexGen assets.

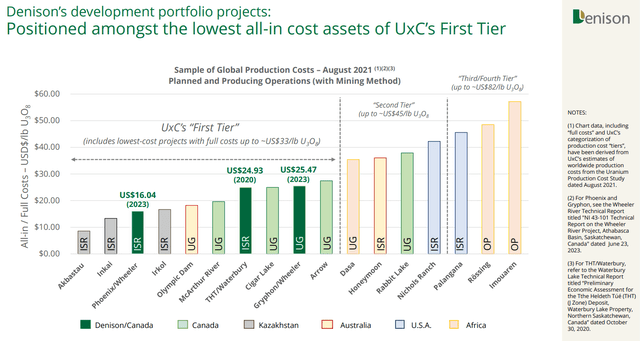

Denison major asset is the Wheeler River project. It is divided into two areas: Phoenix and Gryphon. Both have outstanding parameters such as grade, AISC, and resource base. The cost of extraction is crucial for any mining enterprise. Many uranium miners have AISC above $50/lb, except Kazakhstan deposits, the Olympic dam in Australia, and Cameco’s mines. That said, companies in Namibia, Niger, Canada, and the US barely reached their breakeven until last year. Besides, some are not profitable yet, even at the current spot price of $67.5/lb.

The chart below illustrates the AISC quartiles by region and companies.

Cameco Cigar Lake and McArthur River are the only operating mines in the Western Hemisphere, with AISC below $30/lb. NexGen and Denison projects will change that. AISC below $30/lb provides Denison with an undisputable moat. Once the Wheeler River projects are complete, and they start to deliver uranium, it will put DNN in line with Cameco and Kazatoprom.

I picked Denison over NexGen due to two subtle advantages. DNN holds a massive inventory of 2.5 million pounds of uranium and a 22.5% share of McClean Lake Mill. Orano owns the remaining 75%. The uranium extracted from Cigar Lake is processed in McClean. In 2022, that was 14% of the global uranium production. McClean has an annual license capacity of 24 million lb of uranium. This is more than close to 18% of the total annual output. That said, McClean is not just a strategic asset in Denison’s balance sheet. It is a geopolitical asset crucial for national defense.

Consider the scenario of further fragmentation of uranium supply due to a few potential factors:

- Possible ban on Russian uranium imports by the US

- Deepening strains in Niger’s uranium export to Europe

- Last but not least, the possibility of Russia banning uranium exports to the EU and US

The last is a purely speculative statement. However, the uranium industry represents a negligible percentage of Russia’s GDP, and much of its production is sold to its geopolitical allies. Cutting exports to the EU and USA will not strain the Russian economy. However, both are still dependent on Russian uranium imports. In other words, Russia, with minimal effort, could potentially achieve these outcomes.

Company Financials

All major uranium developers have impressive balance sheets in my view. Below, I present you with DNN’s metrics assessing its solvency and liquidity. The data was taken from the last financial report.

|

Quick ratio |

3.47 |

|

Current ratio |

3.70 |

|

Long-term debt/Equity |

0.11% |

|

Total debt/Equity |

0.11% |

|

Total liabilities/Total assets |

15.1% |

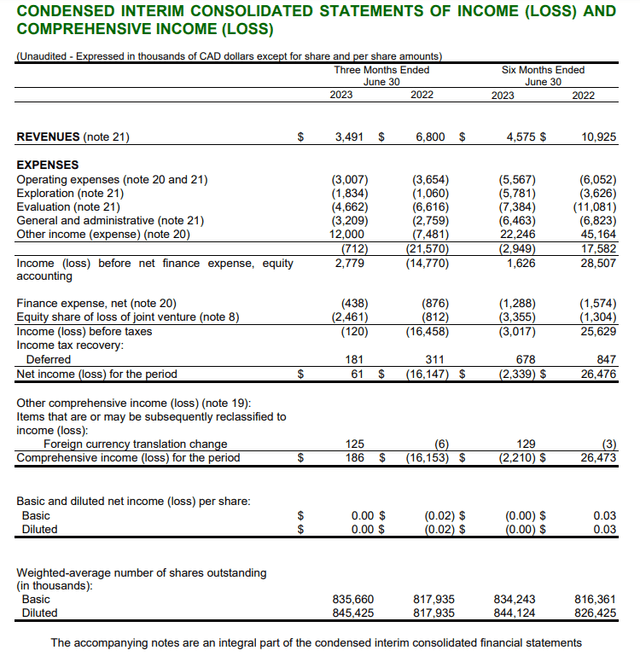

Given the costs of developing mines, having zero debt is an outstanding achievement. Usually, mining companies dilute the shareholder base excessively during the development stage. In the meantime, their balance sheets are looking neat and clean. The case with Denison is different. The company has increased the number of fully diluted shares by a mere 2.1% over the last six months. The image below shows the company’s previous income statement with share capital at the bottom.

Denison Mines financial report Q2 2023

Buying stock in the company in the development stage means accepting a share dilution. The point is not to be excessive. Denison seems to prudently undergo share dilution, thus not really harming its shareholders in my opinion.

Valuation

Denison is not producing uranium yet. Thus, to estimate its value, I will use NAV, but instead of owner earnings per unit of production, I will apply the company’s pilot projects, Gryphon and Phoenix NPV:

- Net asset value, including Gryphon and Phoenix’s NPV

- Plausible Reserves/Fully Diluted Shares and EV/Plausible Reserves

I use the following formulas to estimate plausible reserves and net asset value:

PR (plausible reserves) = 100% * P&P Reserves + 50%*M&I Resources + 30%*Inferred Resources

NAV = 0.8*NPV + cash + inventories + total receivables – total liabilities

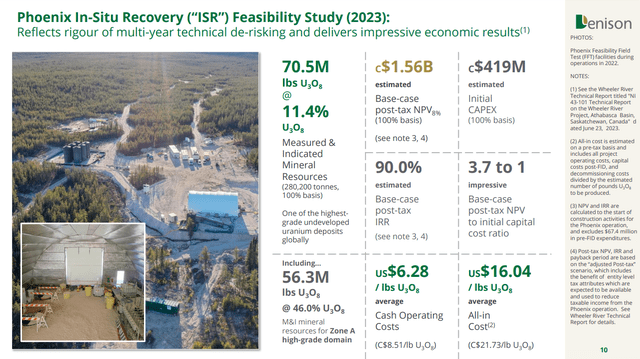

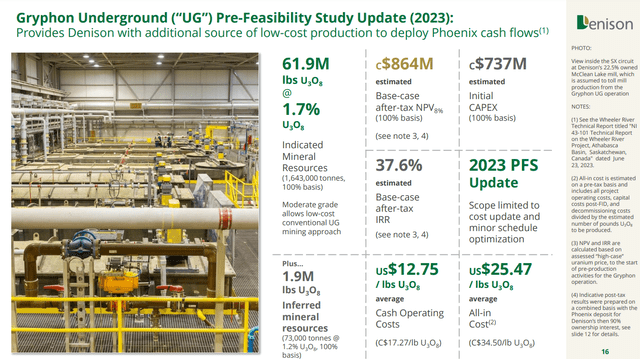

The following two images illustrate Phoenix and Gryphon metrics.

Phoenix Feasibility Study (FS) 2023 overview:

Gryphon pre-feasibility study update (PFS) 2023:

I must point out two things. I multiply the stated NPV figures by 0.8, given that I assume the discount rate is 8.8-9.2%. Second, I use two scenarios with uranium price at $50/lb (conservative case) and $60/lb (base case) instead of $65/lb.

- Cash $35 million

- Short Term Investments $6.4 million

- Inventory $150 million (at uranium spot $60/lb)

- Total receivables: $4.3 million

- Total Liabilities $61.1 million

- Fully diluted shares 854 million

- Gryphon After-tax NPV (uranium at $50/lb) $0.53 billion

- Gryphon After-tax NPV (uranium at $60/lb) $0.64 billion

- Phoenix After-tax NPV (uranium at $50/lb) $0.96 billion

- Phoenix After-tax NPV (uranium at $60/lb) $1.15 billion

Conservative case NAV = $1.74 billion

Conservative NAV per share = $2.03

Base case NAV = $2.034 billion

Base NAV per share = $2.38

Denison’s current market price = $1.57 on Sept 22, 2023

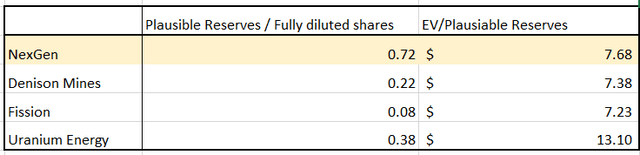

I compare Denison with similar-sized companies developing projects in Canada and the US:

- NexGen Energy

- Fission Energy (OTCQX:FCUUF)

- Uranium Energy Corp (UEC)

I use Plausible Reserves/Fully Diluted Shares and EV/Plausible Reserve to measure how cheap or expensive DNN is.

NexGen offers the most value per share measured in uranium pounds, and Denison is third. On the other hand, Denison and Fission are the cheapest estimated with EV/Plausible reserves. Besides that, Denison is deeply undervalued, even in my conservative assessment, with a spot price of uranium at $50/lb.

Risk

Denison carries the usual risks as any miner does. More pronounced are metallurgical, economic risks, and operational risks. Geology finds the ore; however, metallurgy tells us how to extract it. The latter means the cost per unit. Phoenix and Gryphon seem to be among the uranium mines under development, but until the mines start producing, we are not guaranteed that AISC will match the FS and PFS figures.

The economic risk means high inflation and rising interest rates. The former will push the building and operating costs, while the latter will increase the cost of financing. Considering the AISC below $30/lb projects, the inflation pressures will squeeze that mush projects NPV and mine operation once complete.

The operational risk is too tough for retail investors to assess. However, considering the quality of the management team, I believe operational risk is under control. On top of that, Denison has almost seven decades of history navigating uranium market uncertainties.

Canada is a commodity powerhouse. As such, doing mining business there carries relatively low risks. Of course, the risk varies between the provinces, but Saskatchewan is among the best jurisdictions. All required services and infrastructure have been there for decades. Regulatory issues are still present but are well-known and thus manageable.

The market risk is always present. With the recent hawkish Fed pause, all equities took a nose dive. However, uranium stocks realized lower declines compared to the broad market. Keep in mind uranium is a commodity in its own league. Its market is too tiny compared even to coal and zinc. Thus, demand is not subject to recession fears or growth expectations in my view.

Conclusion

Investing is an art of exclusion. In the mining business, that statement has even more profound implications. Many projects prove nothing more than shareholders’ capital destroyers and, too often, a milking cow for their founders. Following that trope, investing in uranium stocks becomes easy once you discard all enticing “promising” ideas.

In the uranium segment, a few companies shine NexGen, Cameco, and Denison. In my portfolio, I hold Cameco LEAPS call options and Denison equity. I chose Denison over NexGen because of its flagship project, Phoenix, large uranium inventory, and its share in McClean Mill. On top of that, DNN is for sale at a significant discount using NAV calculations with a $50/lb uranium price. These reasons are more than enough to give Denison a strong buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DNN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.