Summary:

- Denison Mines has seen a significant increase in the uranium price during the fall, leading to a 38% YTD increase in the stock price.

- The recent bought deal and sale of uranium has resulted in a substantial cash position for Denison.

- The valuation of Denison’s assets ranges from $2.0B to $3.5B based on different uranium prices, making it an attractive investment.

RHJ

Overview

During the summer, I wrote an article on Denison Mines (NYSE:DNN), following the release of the feasibility study on Phoenix and updated pre-feasibility study on Gryphon. This is a follow-up on that article as we have seen a significantly higher uranium price during the fall.

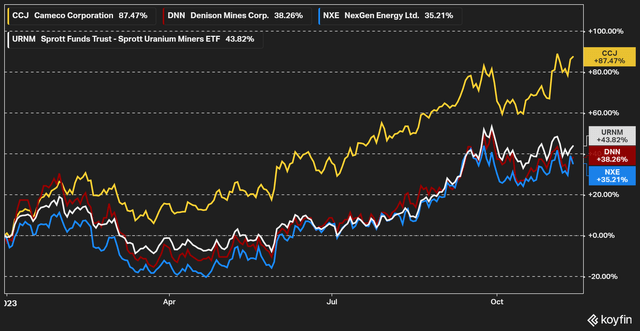

Denison is up 38% YTD and has performed in-line with many uranium peers, as the chart below illustrates.

The $55M bought deal that was announced and closed in October of this year has likely had a negative impact on the stock price, compared to how it would have done without the financing. However, many uranium stocks, with Cameco (CCJ) being a notable exception, are down some from the highs seen in late September.

We have also seen a very marginal decline in the spot price of uranium, even though the spot price has climbed again over the last week and is now at $73.95/bl, which is less than $1/lb below another 15-year high.

Figure 2 – Source: TradingView

Denison Assets

I delved more into Denison assets in the last article during the summer. Relatively little has changed with the asset base since then, even though we have seen a much higher uranium price since during the fall.

Denison gets most of its value from the Wheeler River project, which is in turn comprised on Phoenix and Gryphon. Phoenix is the larger of the two, closer to production, with more attractive costs. Phoenix is also an ISR project, while Gryphon is a conventional mining project. There is also the earlier stage Waterbury Lake project, which presently has preliminary economic assessment in place.

Following the recent bought deal and announced sale of 200Klbs of uranium, Denison also has a substantial cash position. Part of the cash will probably be spent before a construction decision on Phoenix, but likely not all of it, as we are now looking at above $100M in cash. This figure includes the cash as of Q3-23, money from the October bought deal, together with the expected cash from uranium sales and options. There is also 2.3Mlbs of uranium on the books, after the recently announced sales.

Figure 3 – Source: Denison Q3-23 FS & MDA

Please note that I have not included the 22.5% ownership in the McClean Lake Uranium Mill, nor the $15M strategic investment in F3 Uranium (FUU:CA) in the valuation, as they have more marginal value in my view. The reason the ownership in the mill is less material is because Denison has already been paid for the toll milling fees the mill receives from processing the Cigar Lake ore.

Valuation

If we add up the assets mentioned above, using a few different uranium prices, we get the following combined values. Where we can see that Denison’s total value is in the $2.0B to $3.5B range using a $70-100/lb uranium price. The values are primarily derived from the technical reports, even if there is more uncertainty at the higher prices, due to the lack of details in all the technical reports.

Figure 4 – Source: My Estimates

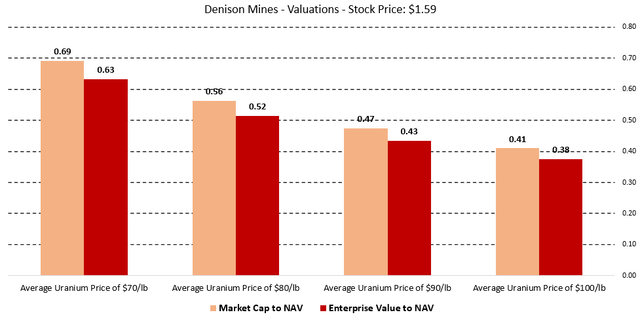

In the chart below, we can see the market cap and enterprise value in relation to the estimated value of Denison’s total assets at various uranium prices. The EV to NPV is for example 0.52 at a $80/lb uranium price. That is still a relatively attractive price for a company with some of the best uranium projects in the world when things like location, grade, scale, projected operating costs, and IRR are considered.

Figure 5 – Source: My Estimates

Conclusion

Denison Mines is a relatively late-stage uranium developer, which is primarily focused on getting the Phoenix ISR project permitted over the next couple of years. This is the main risk to consider with an investment in Denison, as ISR uranium mining has not been used in Saskatchewan, Canada before, even if it is the more common uranium mining method elsewhere in the world.

I am not overly concerned about the execution risk otherwise, as the field test program has shown excellent results. Given the sizable cash position and uranium investments on the books, the financing risk should not be a major hurdle for Denison either. Especially when we consider that Phoenix has an IRR of 90%, with a uranium price of $70/lb.

Denison does still offer good value at the current level, given that we now seem to be in a higher uranium price environment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DNN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like this article and are interested in more frequent analysis of my holding companies, real-time notifications on portfolio changes, together with macro and industry analysis. I would encourage you to have a look at my investing group, Off The Beaten Path.

I primarily invest in turnarounds in natural resource industries, where I have a typical holding period of 1-3 years. Focusing on value offers good downside protection and can still provide great upside participation.