Summary:

- Denison’s Wheeler River Project has a Reserve of 106.4Mlbs (P&P) of U3O8.

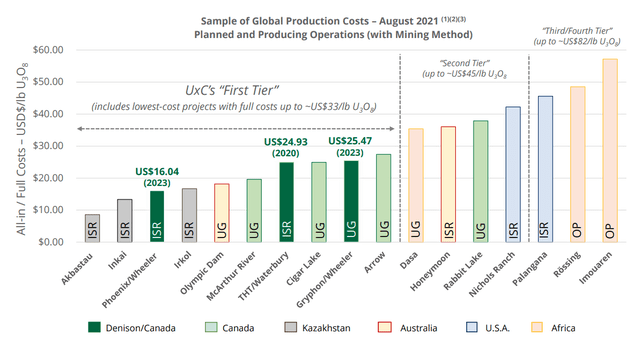

- The Phoenix phase will have some of the lowest all-in costs of any Tier 1 uranium project.

- The recently issued Feasibility Study and PFS show the potential of the Wheeler River Project.

JacobH

The price of uranium has pulled back slightly since it peaked just below $58/lb after a run up in early June. That’s quite a move when you consider that the metal was trading below $50 per pound as recently as March. So, given the magnitude of the move it’s no surprise that yellow cake is taking a bit of a breather.

But the long-term fundamentals for uranium still look extremely solid as projected demand continues to grow, geopolitical concerns surrounding Russia continue to overhang the market, and changing public perception towards nuclear energy opens new possibilities. And that’s not even to mention the growing momentum behind Small Modular Reactors (SMRs).

All of that puts Denison Mines Corp. (NYSE:DNN) in an advantageous position. Denison’s August earnings recently came out but there was no surprise here. The humdrum news revealed Q2 GAAP EPS of $0 on revenue of C$3.5 million. In June, however, the company issued a Feasibility Study for its high-grade ISR Phoenix project and accompanied it with updated cost numbers for its Gryphon project PFS, the original PFS had been issued in 2018. I discussed the PFS in a previous article in March where I rated the stock a Buy noting how the Feasbility Study would bring greater cost and timeline clarity. And now that those numbers have been released we see that they look pretty good. In this article, we’ll review the new projections for both the Phoenix and Gryphon projects and discuss what they may mean for Denison’s share price.

The Uranium Market

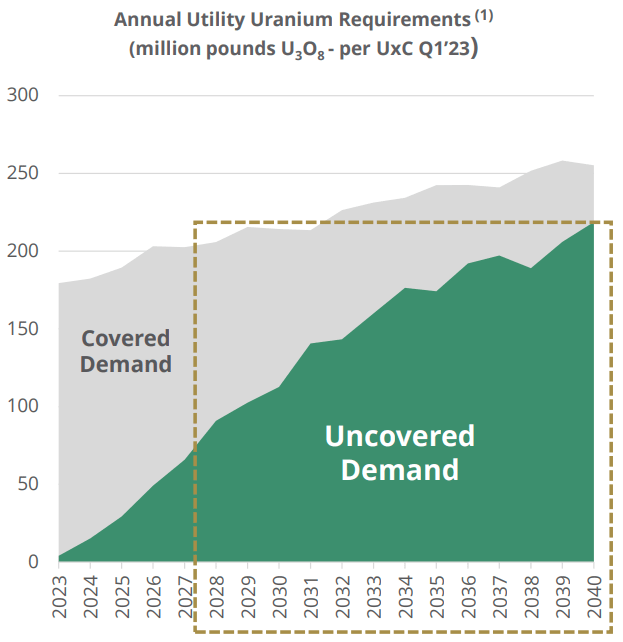

Developments in the uranium space point to the long-term bullish thesis for the actinide continuously growing stronger. First, if we look at the numbers, annual yearly utility requirements are not only projected to grow steadily far into the future, but much of that projected demand remains uncovered. That means that utilities, which cannot go without and cannot use a substitute for the fuel, will be forced to buy greater and greater amounts of the metal as the years tick by.

Investor Presentation

And as many readers are probably well aware, the US and Europe continue to rely on Russia to meet part of their uranium needs. If relations between Russia and the West were to deteriorate any further, something that is definitely not outside the realm of possibility, one can imagine a scenario in which Western governments would be forced to embargo the import of Russian U308; such a scenario would make Western electric utilities’ task of filling that uncovered demand even more difficult.

But investors need to look at more than just the supply side of the equation. The start of commercial production at Unit 3 of Georgia Power Co.’s Vogtle Plant in July is a reminder that nuclear power is not completely dormant in the United States. Granted, it still faces a lot of opposition from the environmental lobby. After all, if the world were to fully switch over to this very reliable source of carbon-free baseload electricity, many within the environmental lobby would be without work.

If we look further afield though, nuclear is beginning to play a bigger role in the energy policies of numerous countries. Many readers are probably well aware that nuclear energy has been an integral part of China’s energy mix for decades, but changing public perception is also leading countries like Canada to consider the expansion of existing nuclear facilities as well as the construction of new reactors. Several Eastern European countries are also demonstrating renewed interest; in fact, the Polish government approved the construction of a new nuclear plant just last month. The cumulative impact of all these individual decisions will eventually lead to greater demand for uranium. And Denison Mines will be well positioned to fill some of that demand.

Denison Mines

Denison has several projects at various stages of development and stakes in numerous assets, such as its 22.5% interest in the McLean Lake Uranium Mill. But its main area of focus is its flagship Wheeler River Project, a two-stage undertaking which will first see Denison construct a low-cost In-Situ Recovery (“ISR”) operation, named Phoenix, to be followed by the addition of a conventional underground mine called Gryphon.

The ISR portion of the project, which was the subject of a previous article on the company, was Denison’s main focus for quite some time. In-Situ Recovery is used to extract uranium in mining operations all over the world. It is used extensively by Kazatomprom (KAP.L), the world’s largest uranium miner, in Kazakhstan and it’s also used by Cameco Corporation (CCJ) at its Inkai mine, which is also located in Kazakhstan.

However, the method had never been used to extract uranium in Canada, and there was a great deal of uncertainty as to whether the soil of the Athabasca Basin, the area within the Canadian province of Saskatchewan in which the Wheeler River Project is located, would be receptive to the method. But last year Denison laid those doubts to rest when it successfully proved that ISR could in fact be used to recover uranium in Canadian soil. And doing so not only enabled the company to de-risk the project, but it also helped ensure that the Phoenix will be one of the lowest cost uranium projects in the world.

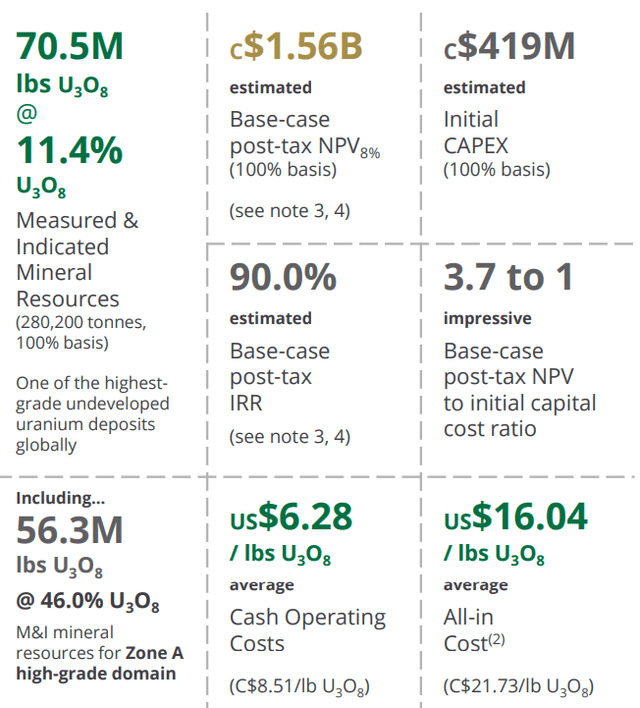

Lower all-in costs would have been a key factor in deriving the recently released Feasibility Study. It lists the Phoenix phase of the project as having an after-tax NPV8% of C$1.56 billion and an after-tax IRR of 90%. It’s based on a uranium sales price of $66-$70/lb U3O8. Capex is also at a very reasonable C$419 million.

Phoenix Feasibility Study Results (Investor Presentation)

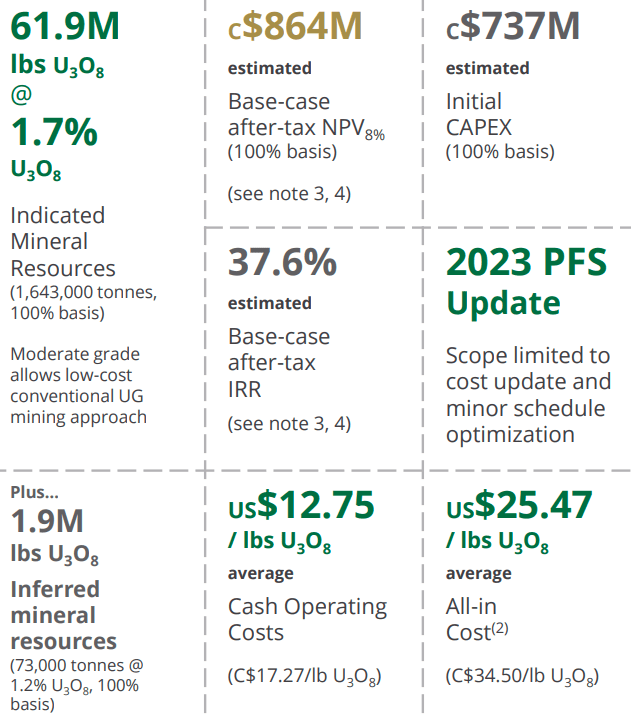

The Gryphon phase’s all-in costs will come in at a higher rate of about $25.47/lb, which is understandable given that Gryphon will be a conventional underground mine. Nevertheless, its recently released PFS does list some decent numbers. The mine is projected to have an after-tax NPV8% of C$864 million and an after-tax IRR of 37.6%. The base case uranium selling price used deriving these numbers was $75/lb.

Gryphon PFS Results (Investor Presentation)

Risks

The primary risk to this thesis comes from the long-term price of uranium. No one can predict with certainty where prices will go, and a sharp fall in the price of U3O8 would probably have a very negative impact on DNN’s stock.

Additionally, it’s worth remembering that the numbers provided by both the Feasibility Study as well as the PFS are only projections. Sustained inflation could result in actual CapEx or all-in sustaining costs coming in higher than projected. If that were to occur, the impact on project NPVs and IRRs could be negatively impacted.

Takeaway

The combined Phoenix and Griffin NPVs sum to about C$2.4 billion or about US$1.8 billion if one uses a 1.33 USDCAD exchange rate. That means that Denison, which currently has an Enterprise Value of $1.1 billion, trades at ~60% of NPV. However, it should be noted that Denison also currently has physical uranium holdings of 2.5M lbs, worth about $140 million at current prices, which could be converted to cash if necessary. Therefore, if we adjust Denison’s EV to factor out these holdings, its Enterprise Value falls to about $960 million, giving us an Adjusted-NPV/EV of 53%.

Given that the company has been making steady progress in advancing its Wheeler River project and given the growing demand picture for uranium in the years to come, Denison appears to still be very reasonably priced for a project at this stage of development. For those reasons, Denison is rated a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DNN, CCJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.