Summary:

- I’ve been Broadcom’s shareholder since 2018. Added regularly, doubled down in 2022, and realised my last meaningful purchase in Q4 2023.

- I’m very impressed with the Company’s robust M&A activity that resulted in some of the most effective deals in the technological space.

- Broadcom’s ability to capitalize on the AI revolution is often neglected as the Company doesn’t focus on GPUs as, for example, Nvidia does. However, its networking solutions lead the market.

- Currently, AVGO represents ~4.5% of my portfolio and is one of the most essential technological players I own.

- As I recognise some better opportunities and that AVGO has to grow into its valuation, I put Broadcom on ‘hold’.

imaginima

Before bulls express their concerns, stating that Broadcom (NASDAQ:AVGO) is an essential tech holding in any portfolio, especially for those investors who value the income side of the stock market, let me tell you: I AGREE, as AVGO is one of my top technological holdings dating back to 2018 that I don’t intend to sell (probably ever).

I’ve been Broadcom’s shareholder since the announcement of its CA Technologies acquisition in 2018, when the Company set its first significant milestone in the software market, leading to the balanced software vs hardware structure that we enjoy today. Since then, I’ve been adding regularly but doubled down when large language models (LLMs) emerged in the broad global awareness thanks to the OpenAI’s ChatGPT launch in 2022. Currently, AVGO represents ~4.5% of my portfolio and is one of the most essential technological players I own, and the second-largest business oriented around hardware supporting the ongoing AI revolution.

So, I believe that should reassure all bulls that I believe in AVGO, respect its business model, and am a happy holder with no intention to sell. With that said, let’s dive into AVGO’s business and some aspects I’m especially proud of. Towards the end of this article, I’ll provide you with my investment thesis and reasons why I decided to seize my reinvestments (my last meaningful addition occurred in Q4, 2023).

Outstanding Business Model Expansion Led By Some Of The Most Prominent Acquisitions In The Industry

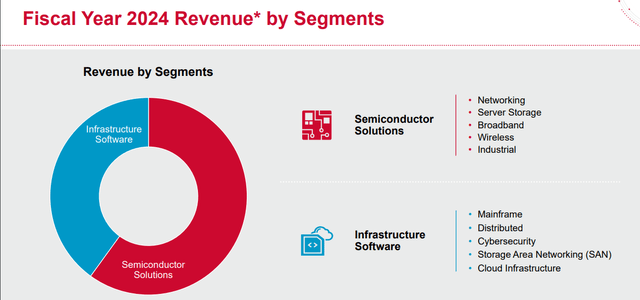

By the Business Model Expansion mentioned above, I mean the development of a software-oriented segment of AVGO’s business. The Company has truly entered this segment with the acquisition of CA Technologies in 2018 and Symantec’s Enterprise Security Division in 2019.

Prior to that, Broadcom was predominantly a hardware-focused business operating in the semiconductor space. The Company didn’t have dedicated platforms for cybersecurity, IT management, etc., then, but that changed with the abovementioned deals:

- CA Technologies brought the competencies in automating large-scale IT infrastructure to the table through its mainframe software, DevOps, and IT management platform.

- On the other hand, Symantec deal allowed AVGO to enter the cybersecurity space with email and web security tools or other solutions, such as Endpoint Protection or Data Loss Prevention.

Effective scanning of the market and closing the deals resulting in acquisitions of the above entities enabled AVGO to benefit from the already existing, leading solutions, so the Company didn’t have to commit resources to develop them organically. In 2023, AVGO closed another deal, acquiring VMware, which further solidified its increasing software orientation, providing Broadcom with:

- cloud computing and enterprise virtualization competencies

- synergistic effects with its hardware portfolio

- large customer base for enterprise IT solutions

- higher exposure to the recurring revenue sources

That way, Broadcom positions itself as a business capable of providing a comprehensive pallet of services for most aspects of modern technological environments, such as cloud solutions, enterprise IT, and data centres.

Broadcom’s Investor Presentation

AI Revolution Is Not Just A Story, And Broadcom Is Here To Capitalize On It

The best thing about the whole AI hype is that we don’t have to rely on retail investors’ opinions. We can benefit first-hand from the data and opinions presented by the most prominent figures in the field, and we don’t have to search long for specialistic expertise on the matter.

For instance, Amazon (AMZN) expresses strong optimism about the long-term impact of AI:

We remain very bullish on the medium to long-term impact of AI in every business we know and can imagine. The progress may not be one straight line for companies. Generative AI especially is quite iterative, and companies have to build muscle around the best way to solve actual customer problems. But we see so much potential to change customer experiences.

Microsoft (MSFT) represents the same approach, investing heavily in the development of top-tier AI solutions within their Microsoft 365 and Azure environment, which continue to increase adoption across the most prominent global organisations:

Now, on to future of work. Copilot for Microsoft 365 is becoming a daily habit for knowledge workers, as it transforms work, workflow, and work artifacts. The number of people who use Copilot daily at work nearly doubled quarter-over-quarter, as they use it to complete tasks faster, hold more effective meetings, and automate business workflows and processes.

Copilot customers increased more than 60% quarter-over-quarter. Feedback has been positive, with majority of enterprise customers coming back to purchase more seats. All-up, the number of customers with more than 10,000 seats more than doubled quarter-over-quarter, including Capital Group, Disney, Dow, Kyndryl, Novartis. And EY alone will deploy Copilot to 150,000 of its employees.

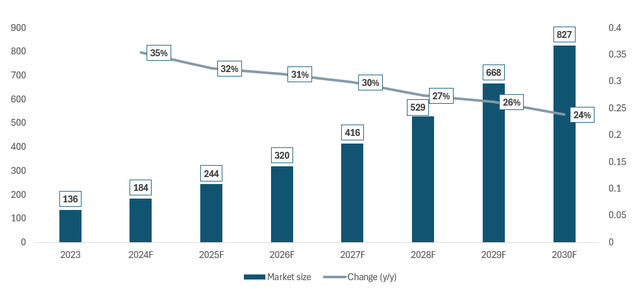

No wonder, major research organisations expect robust growth in the global AI market, which Statista projects will record a CAGR of 29.4% by 2030 and will approach $827B.

Where does Broadcom stand in the AI revolution?

When people think of AI, NVIDIA (NVDA) is probably the first business that comes to mind, as no other is better prepared to capitalize on it, due to its leading competence on the GPU front. However, that may lead to some underappreciation of other complementary hardware solutions that make the revolution possible.

I’ve recently provided an example with Micron Technology (MU), a leading memory solutions provider that is set to benefit from the AI force. I believe AVGO is another one that will capitalize on these trends but doesn’t compete with the likes of NVDA.

AVGO concentrates on the networking and connectivity aspect of data centres, which are the backbone of the ongoing revolution. That’s where large language models are tested, and everything we have seen during the last few years has emerged. Broadcom’s specialized products ensure a sufficient pace of data transfer inside data centres and the high data throughput required during the LLM training. Essentially, AVGO provides the best state-of-the-art networking and connectivity solutions in the market that make the revolution possible.

Financial Stance and Valuation Outlook

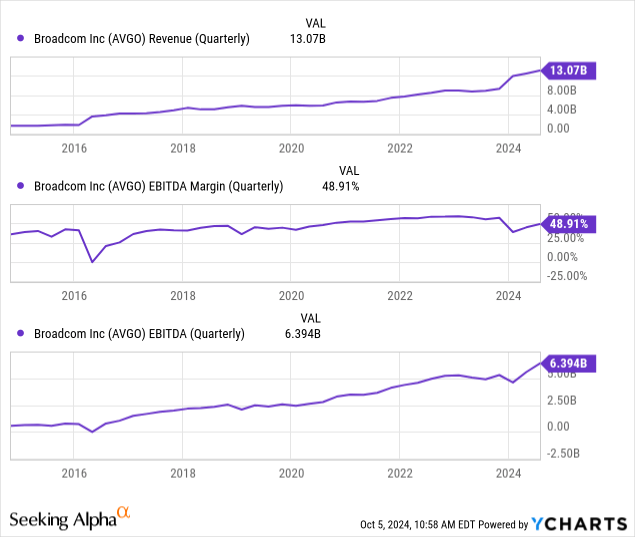

At Cash Flow Venue, we like profitable businesses that continue to increase their scale while upholding margins. That’s the case for AVGO, which consecutively increased its quarterly revenue and EBITDA, supported by sustainable margins typically ranging from 40% to 50%. AVGO continues to deliver on this front, and I don’t believe that will change.

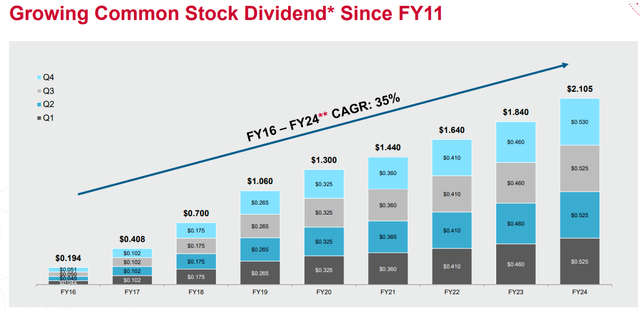

The Company has also proved to be one of the best dividend growers in my portfolio, recording a DPS CAGR of 35% since 2016 (I have participated in that since 2018). Naturally, the DPS growth in recent years was more modest, as the 35% CAGR was tied to the low base effect. Nevertheless, 14.1% DPS growth in FY 2024 vs FY 2023 is still very impressive.

Broadcom’s Investor Presentation

As an M&A advisor (a fancy name for advising on buying and selling businesses), I usually rely on a multiple valuation method, which is a leading tool in transaction processes. It allows for accessible and market-driven benchmarking.

I use this method because many investors fail to recognise a business’s value by concentrating too much on the stock price. This isn’t a reasonable benchmark, as one has to factor in changes in the business’s scale and the number of shares outstanding (due to buybacks or issues).

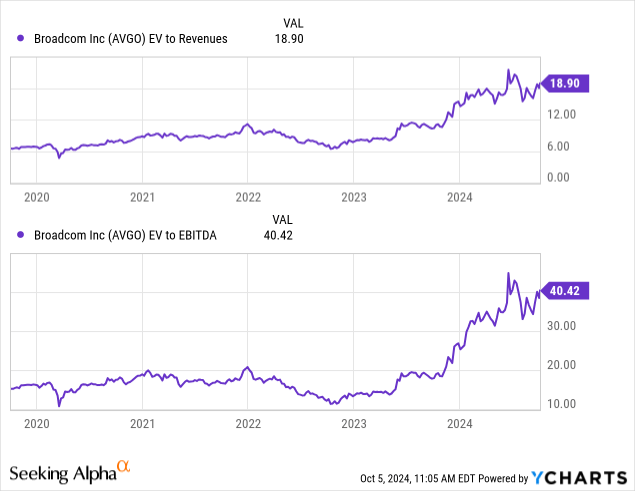

With that said, let’s look at the leading EV multiples: EV/Sales and EV/EBITDA.

As we can observe, investors’ sentiment toward AVGO has been outstanding since the beginning of 2023 and even more since the beginning of 2024. I can’t blame them, as I am a huge AVGO fan myself and enjoyed its performance and business developments. Nevertheless, the growth of enterprise value significantly outpaced the growth of revenue or EBITDA, driving the EV/S and EV/EBITDA multiples up significantly.

Investment Thesis

Investors expect AVGO to continue its dynamic growth pace, as the forward-looking EV/EBITDA stands at ~28x, substantially lower than looking at the trailing twelve-month EBITDA. I won’t dispute that, as I expect solid growth from AVGO myself. Quite frankly, I don’t consider these multiples sustainable and think that AVGO has to grow into its current valuation.

Therefore, despite all my love and respect for Broadcom, I’m willing to search for better investment opportunities and see how the numbers proceed going forward. I would certainly consider adding into AVGO at a potential pullback, which we may as well experience, as the stock is very volatile.

Each investor has a different approach when it comes to diversification. Still, my experience gathered as an M&A advisor (fancy name for advising on buying and selling businesses) taught me not to keep all eggs in the same basket. Thus, I am happy with my current (~4.5%) position in AVGO, but I put the ‘hold’ rating due to the relatively high valuation that the Company has to grow into and the fact that I consider some other businesses as better investment opportunities in the current market.

Nevertheless, I intend to hold on to AVGO and collect the dividends along the way, monitoring its valuation closely with the hope of some unreasonable pullbacks. I strongly advocate for Benjamin Graham’s margin of safety approach, and I don’t see that margin being wide enough for me to increase my position in Broadcom.

As always, please keep in mind that each stock market investment comes with market and company-specific risk factors, which, in the case of AVGO, include:

- the uncertainty regarding interest rates and the economic environment

- geopolitical tensions that can disrupt the supply chain

- failing to uphold the competitive edge over other players

- failing to deliver promptly and with sufficient quality

- risk factors related to the intense M&A activity

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU, AMZN, MSFT, NVDA, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.