Summary:

- AbbVie is a leading pharmaceutical company with a diverse portfolio of products and strong revenue growth.

- The company has a solid track record of increasing dividends and offers an attractive current yield.

- Despite the loss of exclusivity on its blockbuster drug Humira, AbbVie has other growth opportunities and a capable management team.

Hailshadow

Introduction

The healthcare sector has always been fascinating to me. It combines innovative approaches that can achieve a significant premium for its products with essential products. Therefore, these companies tend to be more resilient to economic uncertainties. One such company is AbbVie (NYSE:ABBV), which I analyzed almost two years ago. I hold shares in the company in my dividend growth portfolio.

The company is a leading pharmaceutical giant that had to deal with the loss of exclusivity of the patent on its blockbuster drug Humira. In this article, I analyze the company again and explain my BUY thesis for the company despite the end of exclusivity. The company is a decent addition to the dividend growth portfolio.

Seeking Alpha’s company overview shows that:

AbbVie discovers, develops, manufactures, and sells pharmaceuticals worldwide. The company offers Humira, a therapy administered as an injection for autoimmune, intestinal Behçet’s diseases, and pyoderma gangrenosum, Skyrizi to treat moderate to severe plaque psoriasis, psoriatic disease, and Crohn’s disease, Rinvoq to treat rheumatoid and psoriatic arthritis and more. The company was incorporated in 2012 following a spin-off from Abbott Laboratories and is headquartered in North Chicago, Illinois.

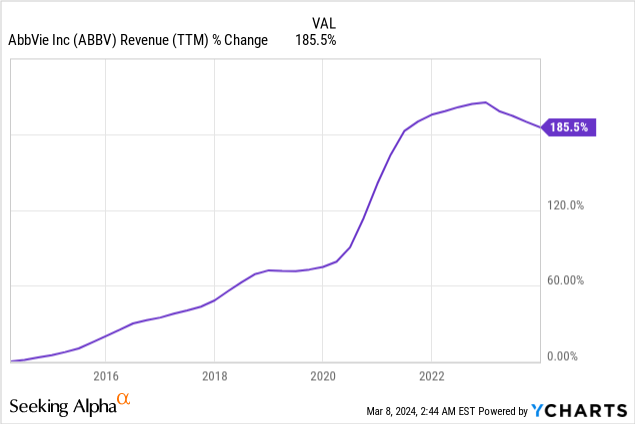

AbbVie offers a combo of solid fundamentals with a decent valuation

Revenues of AbbVie have been growing significantly over the last decade with a 186% increase. This growth is associated with the organic growth of Humira sales and other drugs in the company’s portfolio and acquisitions. The company has acquired Allergan as a dominant aesthetics player and ImmunoGen and Cerevel to extend its neuroscience and oncology footprint. In the future, as seen on Seeking Alpha, the analyst consensus expects AbbVie to keep growing sales at an annual rate of ~4.5% in the medium term.

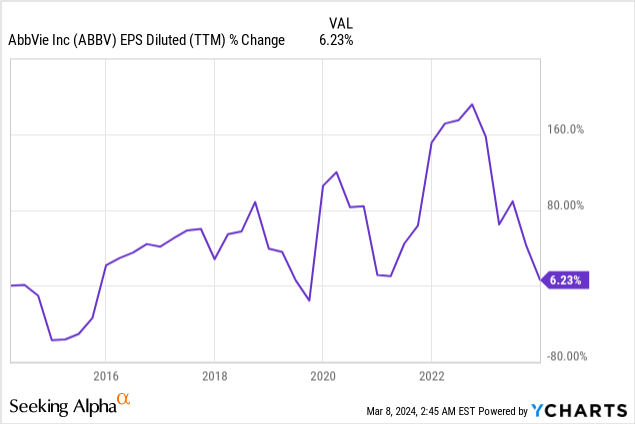

The EPS (earnings per share) during the same period has increased by 6%. However, it is a misleading GAAP EPS as it includes non-cash one-time items. The non-GAAP EPS increased 234% as the company improved its margins by raising prices in addition to the sales increase. In the foreseeable, as seen on Seeking Alpha, analysts’ consensus forecasts that AbbVie will keep growing EPS at an annual rate of ~6.5% in the coming three years.

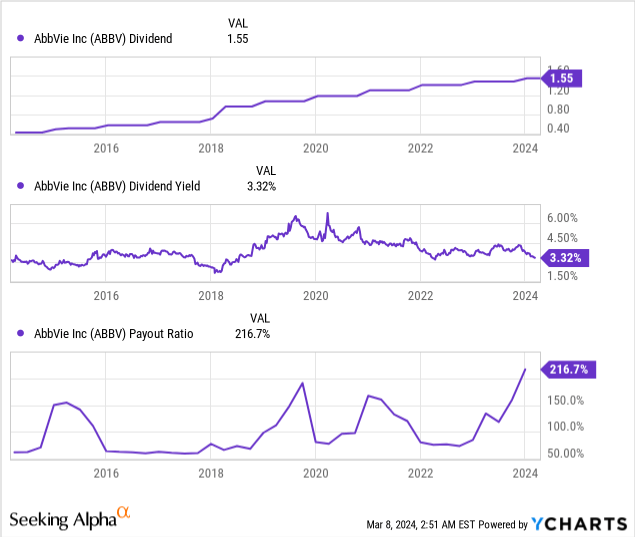

The company is a dividend king with over 50 years of dividend increases, including its joint history with Abbott. The company increased the dividend by 5% last October, and the current yield is attractive at 3.3%. The payout ratio looks highly elevated when using the GAAP EPS at 217%. However, using the non-GAAP EPS, the dividend is likely to be safe with a payout ratio of 54%. Investors should expect additional mid-single-digit increases aligned with the company’s growth rate.

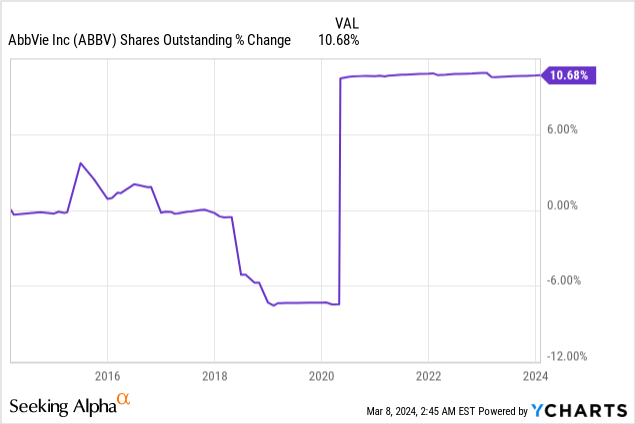

In addition to dividends, companies tend to return capital to shareholders via buybacks. These share repurchase plans support EPS growth by lowering the number of outstanding shares. AbbVie has been buying back shares until the Allergan acquisition, and since then, it has prioritized debt reduction. As its balance sheet recovers and the net debt to EBITDA is in line with its pre-acquisition status, there is room for buybacks that will negate the 10% increase in the number of shares following the acquisition of Allergan.

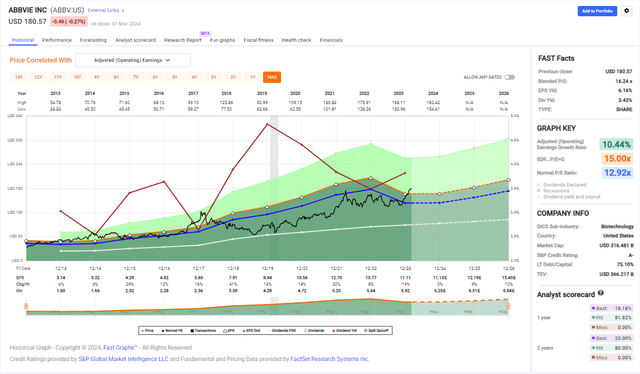

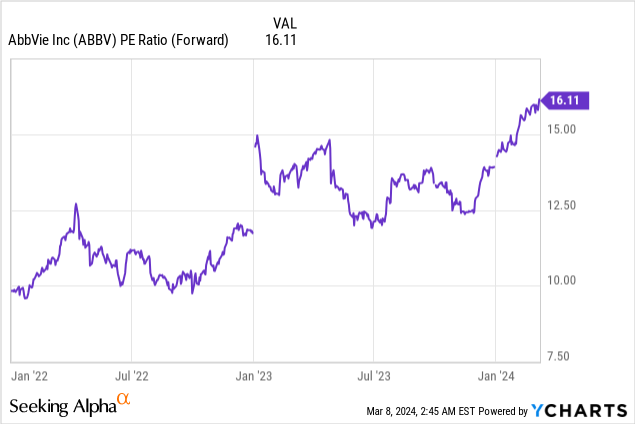

The company offers excellent fundamentals. Therefore, investors shouldn’t be surprised that it trades for the highest valuation over the last twelve months. Still, a P/E ratio of 16, when using the 2024 EPS estimates, is not expensive for a growing company with a diversified portfolio of products. This valuation still serves as a decent entry point for long-term investors. Despite the patent cliff, the company is growing, which proves its resilience and justifies that valuation.

The graph below from Fast Graphs shows that the company is trading for a premium. Since the spin-off from Abbott, the average growth rate stood at 10.5%, and the average P/E ratio was 13. Today, the average growth rate is 6.5%, and the P/E ratio is 16. While that makes the company look overvalued, the premium is justified.

The company is still dealing with the Humira patent cliff but has other growth opportunities to replace Humira’s lost sales. So, while 2024 is challenging, in 2025 and 2026, the expectations are for a 10% annual EPS increase. That growth rate will come with a more diversified portfolio of products, justifying a premium.

Despite the patent loss of Humira, AbbVie has growth opportunities that eclipse it.

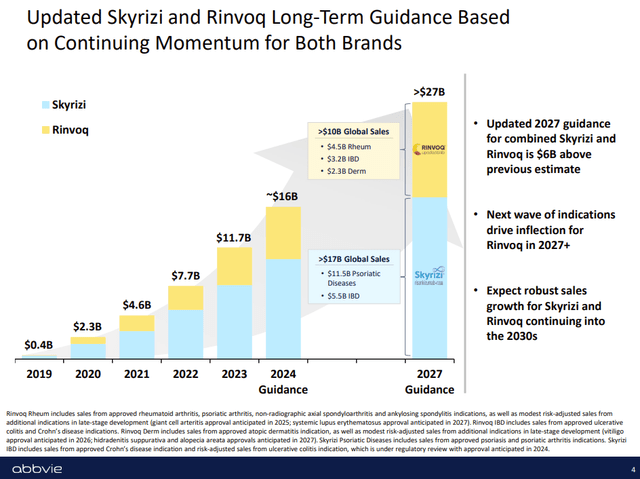

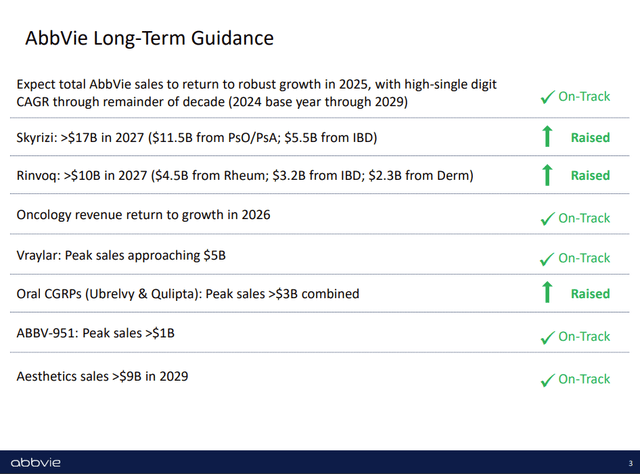

The company has two main blockbusters likely to be Humira’s replacement. Skyrizi and Rinvoq have sold for $11.7B in 2023, and the company expects a 33% increase in 2024. In 2027, these two drugs will sell for more than Humira at its peak. Moreover, the company is working on approving these drugs for additional indications. This strategy has worked well with Humira, extending the patent and increasing sales.

Most importantly, each of our five key growth areas outperformed our initial expectations.

(Rob Michael, President & Chief Operating Officer, Q4 2023 Conference Call)

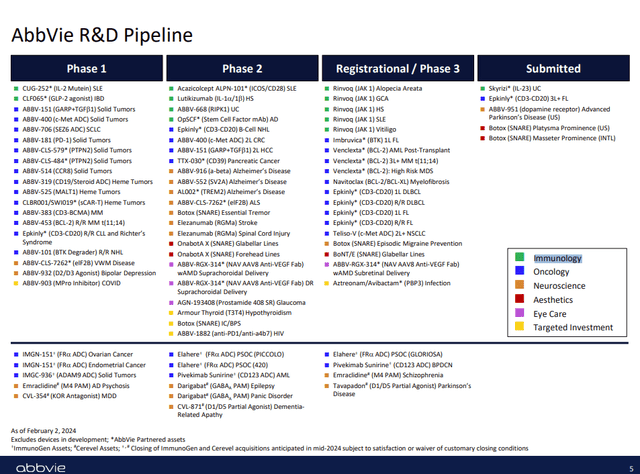

AbbVie is a global leader in immunology, and it’s pursuing growth by expanding its presence in oncology and neuroscience. Over the last three months, it has made two significant acquisitions. It acquired ImmunoGen, including its flagship cancer therapy, Elahere, for $10B, and Cerevel Therapeutics to strengthen the neuroscience segment for $9B. These two acquisitions will improve the pipeline, diversify the company, lower dependence on immunology, and help AbbVie become a stronger company. The company has a vast diversified pipeline to push it forward even before additional M&A.

Another opportunity for investors is the company’s management team. They have proved to be extremely capable of capital allocation and execution. They have diversified the company and saved it from a painful and costly patent cliff. A management team that constantly manages to be on track regarding its guidance and raises it is an asset. The company is transforming, and having a capable team with a long-track record supports future growth endeavors.

On the other hand, there are risks to the investment thesis. First and foremost, it’s the loss of exclusivity on Humira. Global Humira revenues were $14.4B in 2023, and in Q4, they have seen a 40% decrease in sales compared to Q4 2022. While the company manages to replace Humira’s sales, if the sales decline faster than anticipated, it may hinder its ability to grow both sales and EPS. Therefore, a fiercer biosimilar competition may be a medium-term challenge even as the company expands its initiatives.

Another long-term challenge is the regulation risk. The company relies on regulatory approvals for its drugs to grow significantly. The regulators must approve its drugs, mainly in the U.S. and Europe. If the company fails to achieve regulatory approvals, it may lose market share and grow slower. In the past, regulatory approvals helped AbbVie grow, but they also delayed the launch of Skyrizi and Rinvoq. Therefore, investors in pharmaceuticals should always consider that risk.

Another short-term risk is the challenge of integrating the company’s new acquisitions. Over the last three months, it has spent almost $20B on its two acquisitions. Integrating acquisitions is always challenging as it requires cost-cutting to achieve synergies and incorporate the new assets in the legacy company. If it takes longer than anticipated for AbbVie to do it, it may hurt the margins in the short term. However, I believe that the management that proved to be great at execution will be able to deal with that short-term risk.

Conclusions

To conclude, AbbVie is a formidable blue-chip company in the pharmaceutical sector. It offers some excellent fundamentals with sales and EPS growth leading to a reliable growing dividend. While the valuation is higher than average, the company is transforming into a new, more diversified AbbVie. I believe that this capable management team deserves this slight premium. Moreover, the company has a solid track record of rewarding long-term shareholders.

Its long-term opportunities in immunology, oncology, and neuroscience are promising. Its aesthetics business also keeps growing, allowing it to diversify its portfolio even further. These growth opportunities are promising, and despite the risks, I believe AbbVie is a BUY at the current price. More cautious investors may want to be into the company gradually over the coming months if they are uncomfortable with the valuation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.