Summary:

- AbbVie’s stock dropped 17.3% due to Emraclidine’s phase 2 trial failure, but management is expected to replace Humira revenues and grow the top line.

- Skyrizi and Rinvoq are projected to surpass Humira’s peak revenues by 2027, indicating strong future growth in the immunology segment.

- Oncology and neuroscience segments show promise with acquisitions like ImmunoGen and Aliada, despite setbacks in schizophrenia drug development.

- Investors can benefit from a 3.95% dividend yield, supported by robust free cash flow and a solid financial position.

hapabapa

Investment Thesis

AbbVie (NYSE:ABBV) is a biopharma company, made famous by its blockbuster Humira, at one point the best-selling drug in the world. As biosimilars have eroded Humira ABBV has gone on an acquisition spree to replace lost Humira revenues while also bolstering the future pipeline of the company.

ABBV’s stock price has fallen to a 2024 low after the Schizophrenia drug Emraclidine failed phase 2 trials. The drug was the original keystone to the $8.7 billion Cerevel acquisition in August 2024. Based on projections for peer drug Cobenfy (formerly known as KarXT), peak sales would’ve been between $3-4 billion per year, less than 7.0% of ABBV’s 2024 projected revenues.

We are confident that management will be able to make up the Humira shortfall and continue to grow the top line through both organic development and continued acquisitions. In the meantime, ABBV pays out a strong 3.95% yield or around 60% of earnings.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY25 EPS (Earnings Per Share) times P/E (Price/Earnings)

EFV = E25 EPS X P/E = $12.00 x 18.0 = $216.00

An 18.0 P/E would put ABBV back to its long-term average.

|

E2024 |

E2025 |

E2026 |

|

|

Price-to-Sales |

5.3 |

5.0 |

4.6 |

|

Price-to-Earnings |

19.6 |

18.0 |

16.6 |

ABBV, BuildingBenjamins ABBV, BuildingBenjamins

Double Drug Bet – Immunology

|

Drug |

Peak Quarterly Estimate (millions) |

Current Quarterly Revenues (millions) |

Initial Approval |

|

Humira |

$5,600 (Peaked in 3Q22) |

$2,227 |

Dec 2002 US, Sept 2003 EU |

|

Rinvoq |

$2,500 |

$1,614 |

Aug 2019 US, Dec 2019 EU |

|

Skyrizi |

$4,250 |

$3,205 |

Apr 2019 US EU |

Bold indicates mature drugs, others indicates below-peak. Quarterly revenues as of the quarter ending September 2024.

Since the February 2024 expiry of ABBV’s exclusivity rights, 10 biosimilars have been taken to market. While some analysts have pointed to the roll off being slower than expected, evidence points to existing PBM (pharmacy benefit manager) agreements. The largest of these, United Health and Cigna, will begin removing Humira starting in January 2025. ABBV now expects to end the year with Humira at $7.4 billion in sales, or approximately 13.2% of total revenues.

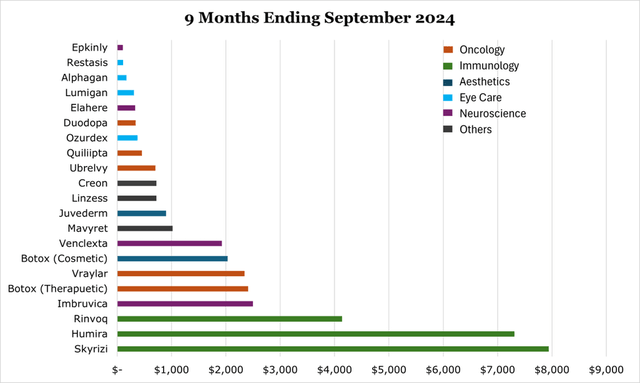

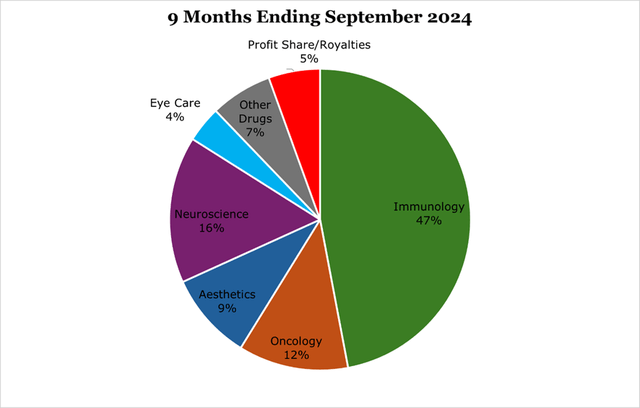

Skyrizi and Rinvoq are considered the revenue-replacements for Humira, combined they have already surpassed Humira’s current revenues, and are expected to surpass peak Humira revenues ($21.2 billion) in around 2025, and peak at a combined $27 billion in 2027. This is more than $6 billion ahead of previous estimates. In our view it is possible that the revenue peak comes later and higher than estimated given the wide breadth of clinical applications. For the 9 months ending September 2024, Skyrizi saw $7.9 billion in sales, a 47.9% year over year change. As of the 9 months ended September 203, Rinvoq saw $4.1 billion in sales, a 52.4% year-over-year increase.

Compared to other areas, the pipeline in immunology is slightly smaller with much of the development work still focused on applying Rinvoq and Skyrizi to new pathologies. We feel that this will likely remain the case for the near-term.

Oncology

|

Drug |

Peak Quarterly Estimate (millions) |

Current Quarterly Revenues (millions) |

Initial Approval |

|

Imbruvica |

$1,300 (Peaked in 3Q20) |

$828 |

Nov 2013 US, Oct 2014 EU |

|

Venclexta |

Likely at Peak |

$677 |

Apr 2016 US, Dec 2016 EU |

|

Epkinly |

$43 |

May 2023 US, June 2024 EU |

|

|

Teliso-V |

N/A |

Submitted Sept 2024 US |

|

|

Elahere |

$139 |

Mar 2024 US, Nov 2024 EU |

Bold indicates mature drugs, others indicates below-peak. Quarterly revenues as of the quarter ending September 2024.

ABBV is starting to focus heavily on Oncology ADCs (antibody drug conjugates, non-chemo cancer drugs). ABBV closed on a $10 billion acquisition of ImmunoGen who has more than 40 years of experience in the ADC space.

On the near-term approval pipeline from the ImmunoGen acquisition is Teliso-V, an ADC lung cancer drug which already has breakthrough therapy approval. The more conservative Wells Fargo estimate put peak Teliso-V revenues at around $1.8 billion annually, but AstraZeneca’s own estimates for its ADC-peer-drug Dato-DXd are peak sales of $5 billion annually. We feel the higher end of this estimate could be more accurate, with ABBV stating that it will seek to expand the therapeutic applications of Teliso-V with a new payload under the name ABBV-400.

Over the medium term we expect the oncology segment to grow as a percentage of revenue. For the 9 months ending September 2024, the oncology segment saw 10.4% revenue growth year over year.

Neuroscience

|

Drug |

Peak Quarterly Estimate (millions) |

Current Quarterly Revenues (millions) |

Initial Approval |

|

Botox Therapeutic |

Peak of Current Clinical Uses |

$848 |

~1989, continues to seek approval for new uses |

|

Vraylar |

Likely at Peak |

$875 |

Sept 2015 US, July 2017 EU |

|

Vyalev (replacement for Duodopa) |

$250 |

$111 |

Initial Jan 2015 US, ~2004 EU. New Formula Oct 2024. |

|

Ubrelvy |

$269 |

Dec 2019 US, Nov 2024 EU |

|

|

Quilipta |

$176 |

Sept 2021 US, Aug 2023 EU |

|

|

Others |

N/A |

$84 |

N/A |

Bold indicates mature drugs, others indicates below-peak. Quarterly revenues as of the quarter ending September 2024.

As previously discussed, ABBV’s previously promising Schizophrenia drug Emraclidine failed phase 2 testing. While it is possible that in a higher dose the drug could work, or have another therapeutic use like for Alzheimer’s psychosis, our view is that ABBV will likely shelve the drug.

ABBV has been moving its way into Alzheimer’s therapy, including a recent $1.4 billion acquisition of Aliada. We expect a similar trend over the medium term as Alzheimer’s still does not have a strong on-market treatment for prevention or symptom mitigation.

Other Segments

As previously stated, ABBV purchased Allergan in 2020 for $63 billion – a 45% premium at the time. Allergan has leadership in aesthetic medicine, including being the primary global producer of Botulinum Toxin A, commonly marketed as Botox.

Botox has led the aesthetic medicine market since its introduction in the late 80s and holds substantial brand recognition and a long product cycle, with aesthetic medicine requiring several injections over a long period.

For this reason, our view is that Botox offers a large sales funnel for other aesthetic products over a much longer period than in non-aesthetic medicine and should provide a strong baseline for ABBV. For the 9 months ending September 2024, aesthetics saw a 1.2% decline in sales fully due to new competition and headwinds in China for Juvederm, a dermal filler.

Risk

The largest risk facing ABBV is drug failure. Typically, internally developed drugs take around $1 billion to bring to trial and acquiring trial drugs trade at 3-5x peak sales. In the case of Cerevel, the failure of Emraclidine brought down peak revenues from the acquisition from around $3.5-$4.5 billion per year down to just $500 million – $1 billion.

Financials

Overall, we expect revenues in 2027 to be between $65-70 billion, recovering to pre-Humira biosimilar levels by 2025. The main short-term headwind is margin and earnings pressure from Humira rolling off PBMs before Skyrizi and Rinvoq reach peak-Humira replacement levels in the latter part of 2025. For the full year 2024, ABBV expects the impact to earnings to be a 1.5% decrease compared to the full year 2023, ending the year at around $10.94/share.

We expect free cash to recover quickly in 2025 with uptakes of new approvals and the end of rebating. Early in a drug’s lifecycle there is often aggressive rebating to encourage adoption and secure a PBM deal, which can lower margins and free cash generation.

ABBV has a net debt to EBITDA of 2.5x for the trailing twelve months, which is in line with other biopharma majors. We do not see substantial risk on the balance sheet, with ABBV holding more than $7.2 billion in cash and generating $5.2 billion in free cash for the quarter ending September 2024.

Conclusion

Despite a strong organic and acquisition pipeline, ABBV’s stock price has tanked on the heels of a drug trial failure. We are confident in management’s ability to replace Humira revenues in the immunology segment while also continually targeting growth opportunities elsewhere. In the meantime, investors can take advantage of the 3.95% dividend yield backed by strong quarterly free cash generation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.