Summary:

- Hedge energy inflation by investing in oil/gas producing assets away from the Middle East military conflict, such as Devon Energy in Texas.

- Devon has a strong track record of free cash flow generation, manageable debts, and the return of shareholder capital through dividends and share buybacks.

- This investment is solidly positioned to take advantage of any rise in energy prices, with the potential for significant gains in the event of a global supply shock.

ogichobanov

If you are worried about the possibility of sudden, overnight changes in the supply of crude oil from the Middle East, how can you hedge a portfolio against the outlier chance oil inflation is about to take off in the economy? Well, with rising odds Iran could soon create trouble in the Persian Gulf area of the world as retaliation for Israeli attacks in the region, you need to look for oil/gas producing assets as far away from military conflict as you can. The farthest and safest point to search for an oil investment might be deep in the heart of Texas, alongside other assets scattered across the central and western U.S.

And, one of the top names in the U.S. large-cap petroleum category, with an enviable track record of nearly eight consecutive years of free cash flow generation (outside of a few quarters during the pandemic-induced 2020 crude oil bust) is Devon Energy Corporation (NYSE:DVN).

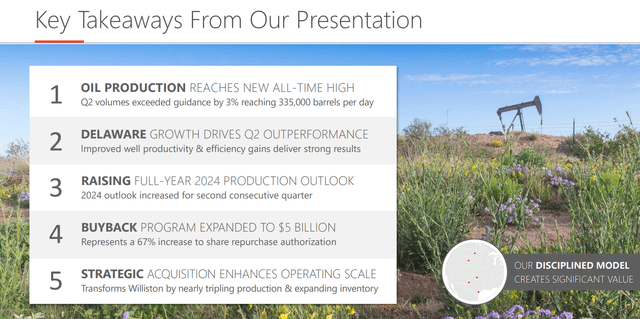

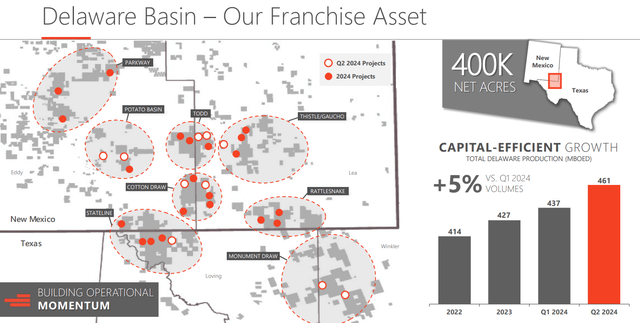

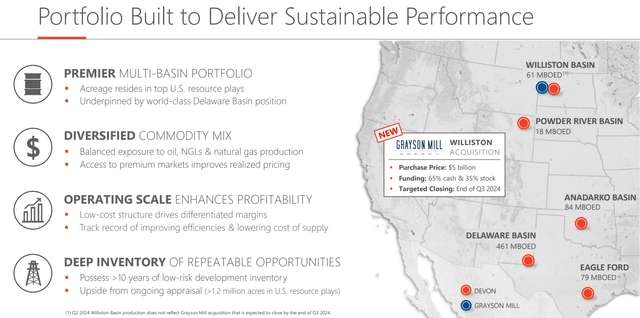

Devon Energy – Q2 2024 Earnings Presentation Devon Energy – Q2 2024 Earnings Presentation Devon Energy – Q2 2024 Earnings Presentation

The company’s stock valuation is again fair vs. its trading history over the last decade, debts are manageable and sliding as a ratio of cash flow generation, production levels are steady to increasing, profit margins are already quite strong at US$75 a barrel crude oil and US$2 natural gas prices, and management is laser-focused on “free” cash flow (keeping CAPEX under control), while dividends and buybacks remain a main priority for shareholders.

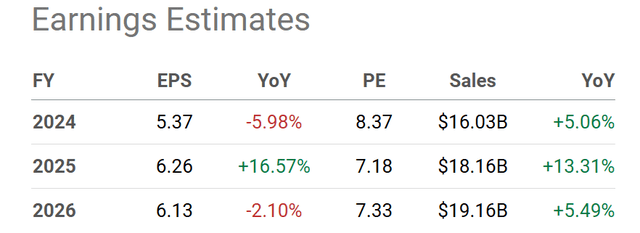

Seeking Alpha Table – Devon Energy, Analyst Estimates for 2024-26, Made August 9th, 2024

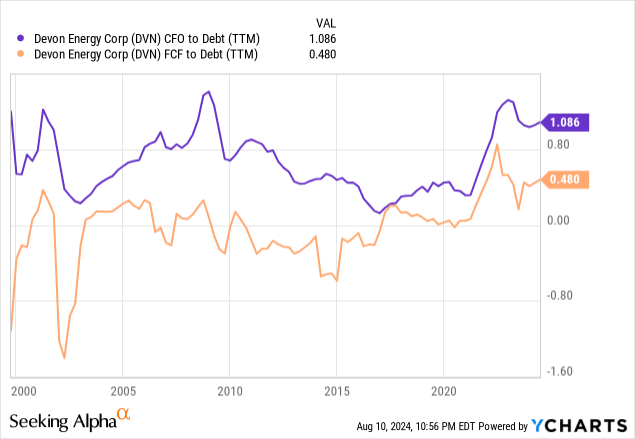

With annual cash flow running the same as total debt, and free cash flow theoretically able to pay off all debt over roughly two years, any and all price increases for oil/gas commodities should travel directly to shareholder pockets on rising dividends and buybacks (per management formulas). In the end, the base cash flow to debt backdrop is about as positive for ownership interests vs. any other time over the last 25 years, outside of late 2022.

YCharts – Devon Energy, Annual Cash Flow vs. Debt, 25 Years

To me, Devon is perhaps the best-situated of the blue-chip choices in Big Oil, with the right business model and management team, to take advantage of any spike in energy quotes.

Has it been the strongest performer in the oil patch during 2024 so far? No, stock returns have been rather pedestrian vs. peers and competitors, with a slight share price loss and 4.5% for a trailing dividend yield. Nevertheless, Devon’s prospects could change rapidly on a monster jump in crude oil during a Middle East supply-shock scenario.

The scuttlebutt news clips I have been reading in recent days suggest a peace deal (or at least a ceasefire) between Israel and Hamas fighting in Gaza are Iran’s immediate request before launching another attack on Israel. A hastily called meeting between the warring parties is slated for August 15th to try and reach a long-sought deal (pushed by nations both inside and outside this oil-rich part of the globe). So, time may be running out before a major escalation in regional fighting.

Fortunately for those purchasing Devon over the last week, attention has been focused on Wall Street’s selloff on punk employment numbers and concerns about a recession with sliding oil/gas demand. Potential Middle East supply problems are not front and center in the conversation between bulls and bears. Like I said, that could all change rather quickly.

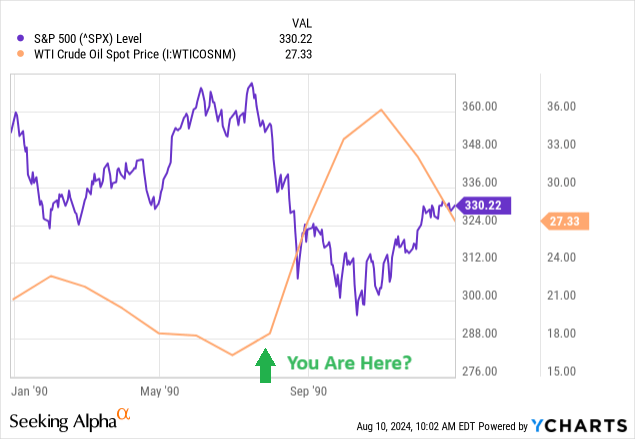

The whole stock market and economic situation reminds of the 1990 Persian Gulf War period, where U.S. and a coalition of other nations provided military might to push Saddam Hussein out of Kuwait (which Iraq invaded for oil reserves). This event led to a 100% spike in crude oil and 20% bear market in stocks, both working to drop the U.S. economy into recession.

YCharts – S&P 500 vs. WTI Crude Oil Price, 1990, Author Reference Point

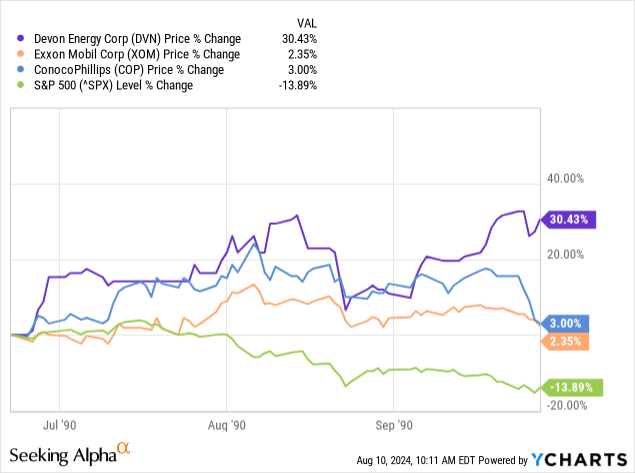

In terms of what I am envisioning, we could see a similar zigzag in the oil sector, where pure-play U.S. producers like Devon rise in the face of falling equities on Wall Street. Just like the summer and early autumn experience of 1990, the largest integrated oil names also proved a great place to hide money (playing defense), but a sliding economy would hurt demand for retailing and refining operations.

YCharts – Devon vs. Integrated Oils and S&P 500, Price Change, June – Sept 1990

Normalized Valuation Data

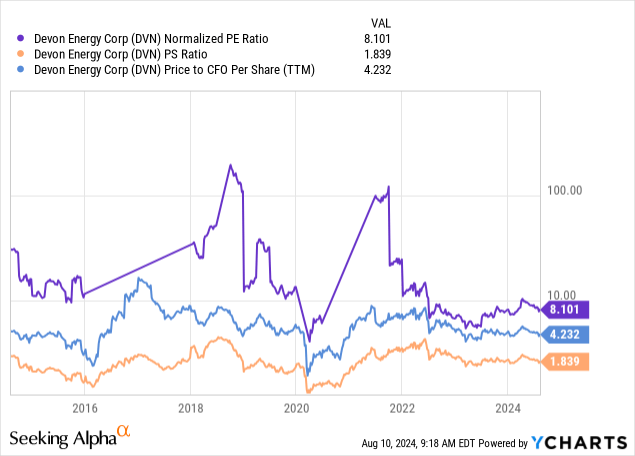

Clearly not the bargain-basement valuation of the once-in-a-lifetime pandemic bust period during 2020, or the exaggerated overvalued setup reached right after the Russian invasion of Ukraine in the first half of 2022, Devon’s current valuation seems to be in a normalized setting. The stock appears to be discounting a soft-landing with flattish oil/gas prices over the next 12 months.

On the 10-year graph of price to trailing earnings (8.1x), sales (1.8x), and cash flow (4.2x), DVN is back to 2019’s valuation zone, likewise about the same as the end of 2014.

YCharts – Devon Energy, Price to Earnings, Sales & Cash Flow, 10 Years

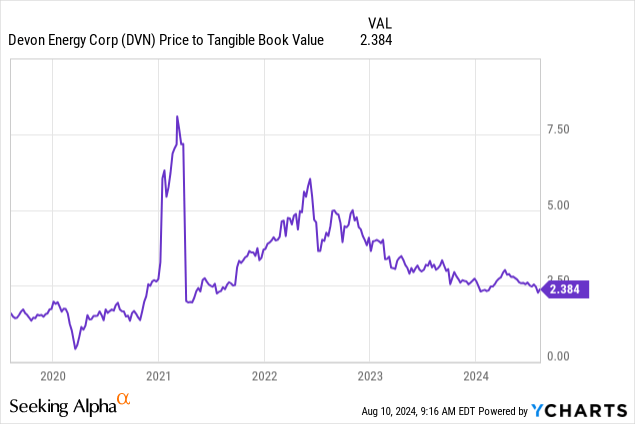

After a number of acquisitions over the years, the price to tangible book value reading (2.4x) is again approaching the same level as 2019, pre-COVID.

YCharts – Devon Energy, Price to Tangible Book Value, 5 Years

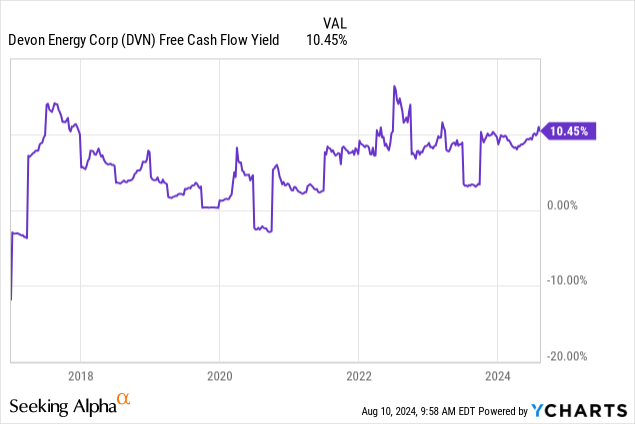

The really good news is DVN’s current free cash flow yield of 10.4% at $45 per share remains near the top of its 8-year range. Management can boast it has kept free cash flow in positive territory consistently for much longer than the majority of alternative producer choices.

YCharts – Devon Energy, Trailing Free Cash Flow Yield, 8 Years

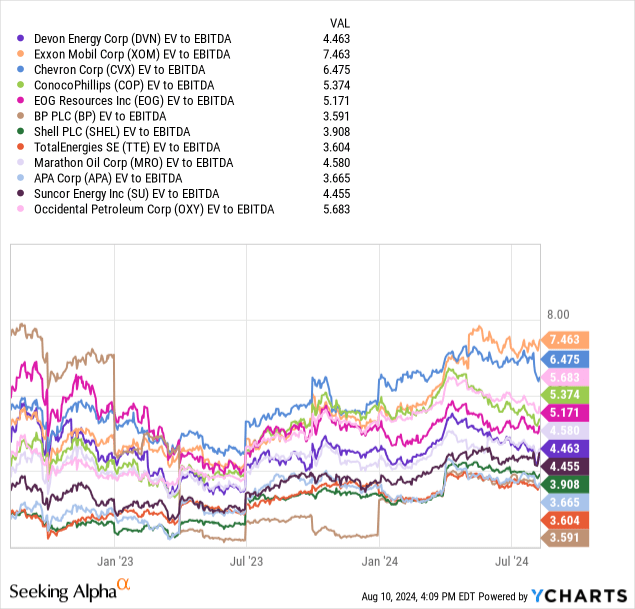

Devon is sitting in the middle of the industry pack for enterprise value (debt + equity – cash) to EBITDA valuations. My sort group includes Exxon Mobil (XOM), Chevron (CVX), ConocoPhillips (COP), EOG Resources (EOG), BP (BP), Shell p.l.c. (SHEL), TotalEnergies (TTE), Marathon Oil (MRO), APA Corp. (APA), Suncor Energy (SU), and Occidental Petroleum (OXY).

YCharts – Devon Energy vs. Big Oil Names, EV to EBITDA, 1 Year

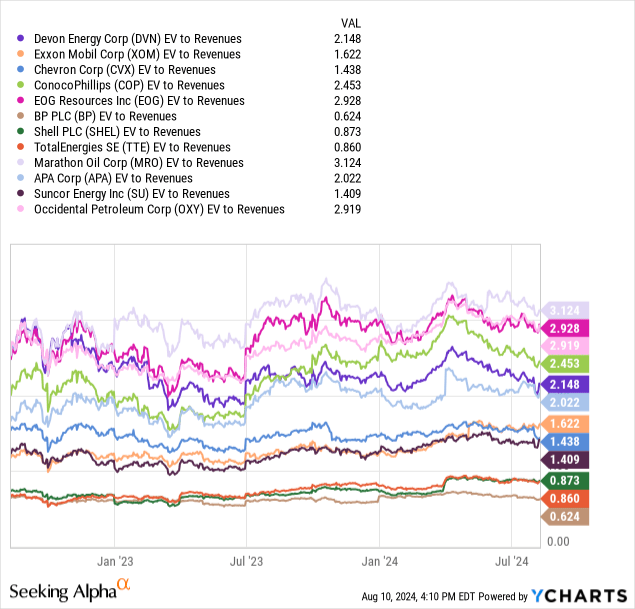

On EV to Revenues of 2.15x, less debt and higher margins help to support a slightly above-normal industrywide valuation.

YCharts – Devon Energy vs. Big Oil Names, EV to Revenues, 1 Year

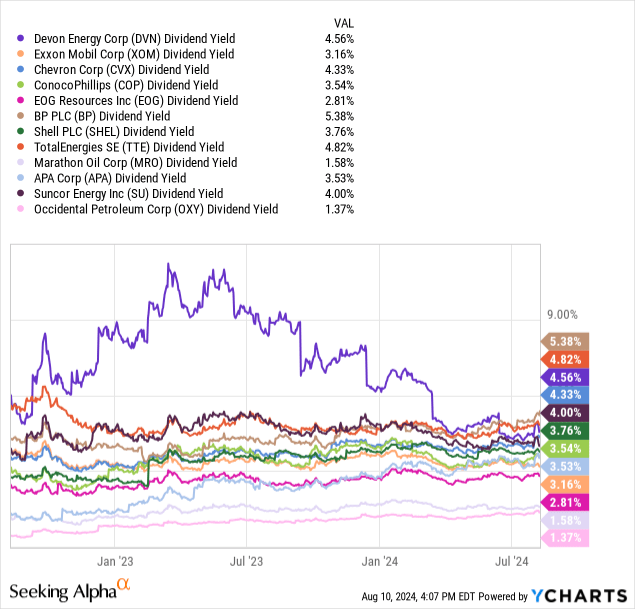

Let’s not forget, Devon has been the top cash dividend payer in the group over the last two years for investors. Plus, share buybacks have amounted to a reduction in outstanding share count by nearly 5% over the same span.

YCharts – Devon Energy vs. Big Oil Names, Dividend Yield, 2 Years

Technical Trading Picture

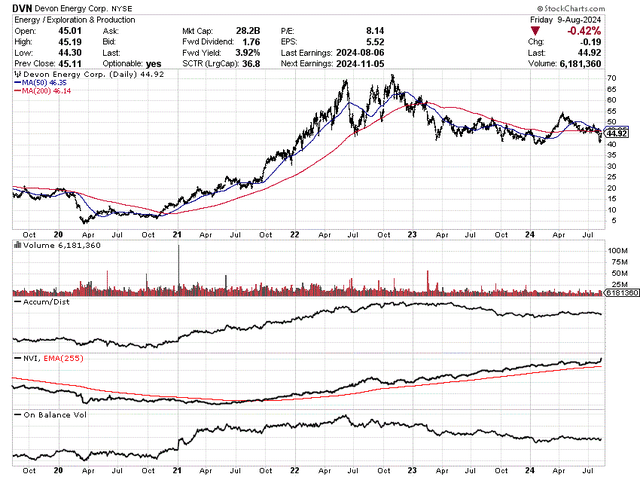

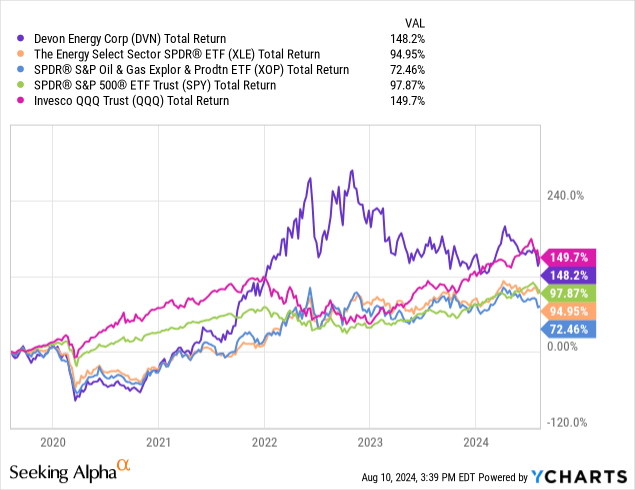

On the 5-year chart below, you can review the wild swings in price since 2019. Over the whole period, Devon’s quote has doubled, with a total return including dividends of roughly +150%.

Of course, the road to oversized gains has been volatile, and stock price losses have been a reality since October 2022. However, technical momentum indications have been improving throughout 2024. For example, the Accumulation/Distribution Line, Negative Volume Index, and On Balance Volume numbers have been rising since January. The last time all three were rising robustly in combination was June 2022.

StockCharts.com – Devon Energy, 5 Years of Daily Price & Volume Changes

Since the middle of 2019, DVN’s compounded annualized total return of +20% has easily bested the industry as represented by the Energy Select Sector SPDR (XLE) or the SPDR S&P Oil & Gas Exploration & Production ETF (XOP). This result is indicative of terrific management decisions over time, productive Texas assets owned, and limited debt usage. Believe it or not, holding DVN has far surpassed the equivalent return from the SPDR S&P 500 ETF (SPY), and ended the span mimicking the gains achieved by the Big Tech Invesco QQQ ETF (QQQ) over the past five years.

YCharts – Devon Energy vs. Oil/Gas ETFs, S&P 500 & NASDAQ 100 ETFs, Total Returns, 5 Years

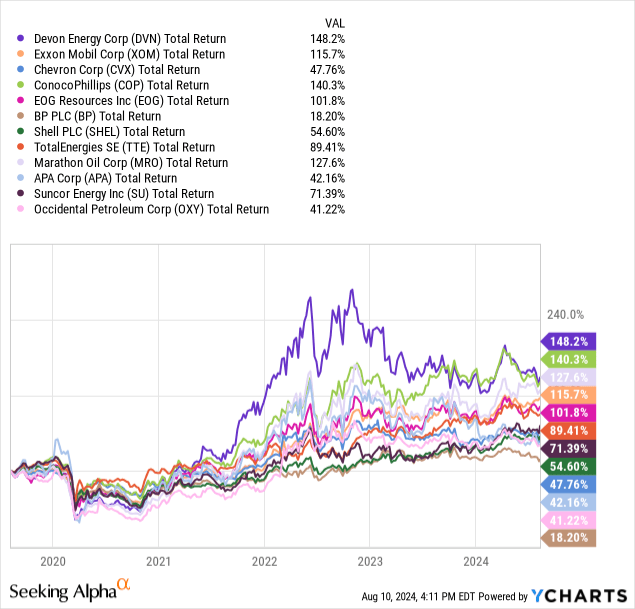

Honestly, Devon has been leading the pack for 5-year total return gains out of the peer group including integrated international oils and the largest U.S. oil/gas producers for equity market cap.

YCharts – Devon Energy vs. Big Oil Names, Total Returns, 5 Years

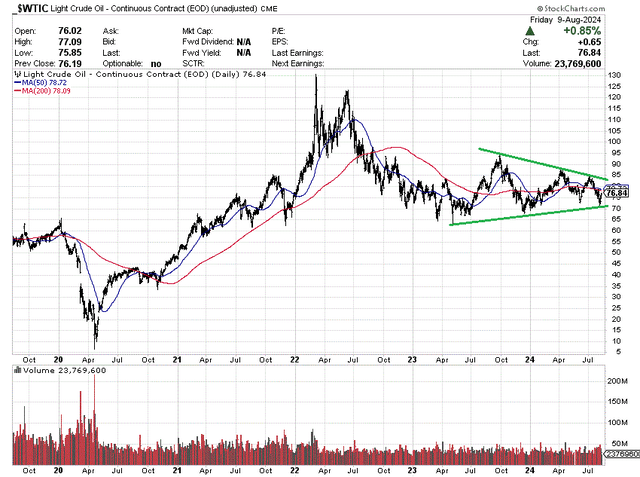

What about commodity pricing? The crude oil chart has been basing for almost two years, trading between US$95 and $65. Further, price has been compressing inside a triangle pattern for better than a year, highlighted below with green trend lines. If price can rise above $85, something of a breakout should be underway.

StockCharts.com – Nearby WTI Crude Oil Futures, 5 Years of Daily Price & Volume Changes

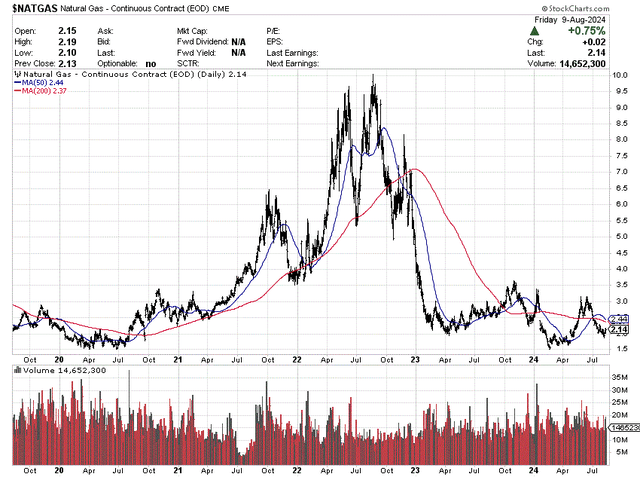

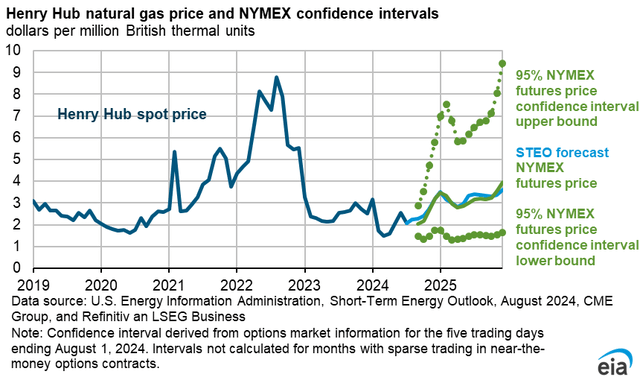

Natural gas prices are well off $10 per MMBtu in August 2022, going for around $2 today. When you adjust for CPI inflation, natural gas is now at a record low (often an unwanted byproduct of U.S. shale-related crude oil production). For example, to reach the same CPI-adjusted level as 2005’s high after Hurricane Katrina hit Texas and Louisiana, prices closer to $23 per MMBtu would be necessary in 2024!

So, upside potential in natural gas is quite substantial, especially considering the transition to battery technologies and AI data centers will require new electricity generation in America and the world. With gas-powered plants still an economical and relatively clean option vs. coal, demand trends are pointing higher for many years (+2.5% volume growth estimated globally for 2024).

StockCharts.com – Nearby Natural Gas Futures, 5 Years of Daily Price & Volume Changes

Final Thoughts

For sure, Devon Energy’s price will follow the price ups/downs in crude oil and natural gas. If peace breaks out in the Middle East next week, and the global economy continues to slow, energy pricing will surely decline, as will DVN’s quote.

On a positive note for contrarian traders/speculators, I would say investor interest in energy names during July-August has been quite lacking. After a 2-year decline in prices for oil/gas stocks, hot money has moved on to Big Tech and AI investment ideas. At this stage, a spike in crude oil to $150 a barrel (doubling like 1990) is not really on the radar of the typical analyst or retail investor.

In my opinion, any crude oil supply shock from the Middle East could lead to truly outsized gains in Devon (and other U.S.-focused producers). Depending on how the economy would react, I am modeling gains of +50% to +100% in DVN are possible over the next 6 to 12 months IF oil supply from the Persian Gulf region is disrupted for months. Given higher crude oil prices than 2022’s zenith and stronger production levels by Devon today, eclipsing the $72 share quote in October of that year should be within reach.

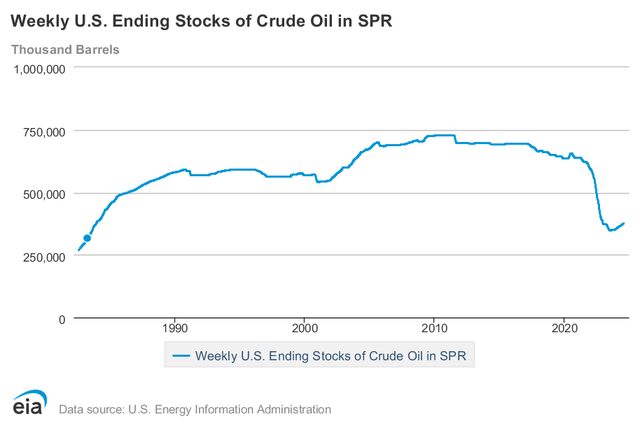

Why the potential for even greater gains in Devon vs. 1990? It has to do with the lack of U.S. Strategic Petroleum Reserves. We are today understocked for an emergency at less than half the peak SPR level of 2011, and a good -40% lower number than 1990. I believe Wall Street would freak out on the news of major crude oil disruptions in supply from the Middle East. We don’t have anywhere near the same inventory cushion as in years past to ease market concerns of a long-term global shortage. Although U.S. and Canadian production can support most of America’s energy consumption needs (with greater production now vs. 1990), almost immediate shortages overseas and fears of one developing in the U.S. could cause a rush of money into producers like Devon.

EIA Website – U.S. Strategic Petroleum Reserves, Since 1982

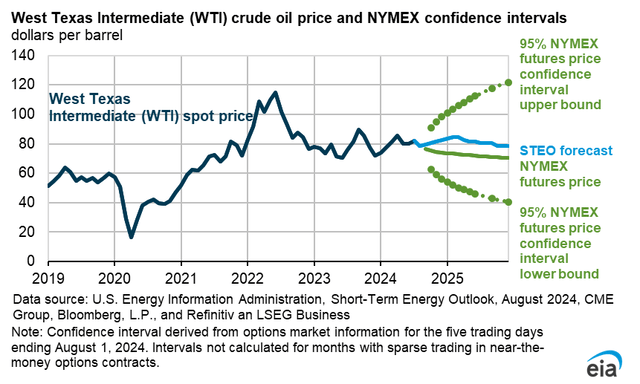

Otherwise, the lack of global investment in new oil production (largely replacing quickly depleted resources) since the pandemic bust of 2020 could cause serious long-term headaches to supply in the world. Both potential Middle East trouble and tightening supply/demand dynamics in a soft-landing or no-landing economic scenario may provide the logic for Warren Buffett‘s Berkshire Hathaway (BRK.A) (BRK.B) continuing to hold its massive stake in Chevron, while aggressive buying Occidental Petroleum almost weekly this summer. On top of these bullish oil supply and demand variables, U.S. production is projected to peak around 13.5 million barrels a day in 2024-25, absent a material jump in prices to provide the incentive for new drilling activity.

EIA 2025 Forecast, U.S. WTI Crude Oil, August 2024 Report EIA 2025 Forecast, U.S. Natural Gas, August 2024 Report

So, it appears the reward side of the equation is tilting heavily in Devon Energy’s favor, with risks mostly of a short-term nature hinging on whether we get an oil/gas demand recession or not into 2025.

My conclusion is DVN remains an excellent choice in the oil/gas sector of the market. If you want to increase your exposure to energy, I would suggest this name for the top of your research list. I have written on other smaller-cap energy plays over the last month, including oil service companies Patterson-UTI (PTEN) here and NOV Inc. (NOV) here, in addition to minor explorer/producer Vital Energy (VTLE) here.

Devon Energy is one of my personal favorites right now and the largest oil holding in my diversified portfolio. It seems to have the smartest combination of factors working to your advantage at current energy pricing, with nice leverage to climbing prices in the future.

I rate Devon a Buy below $45, with Strong Buy territory under $38 if a recession hits first. Remember, I am using a 12-month outlook for my bullish buy-and-hold forecast. If trouble in the Middle East causes a supply shock with more immediate gains to $60 or $70 per share for DVN, I will undoubtedly lighten my position.

In summary, I am very attracted to an average valuation setup from one of the best performing large-cap oil/gas producers or integrated international names available for investment, using less leverage than historical comparisons, paying a strong dividend vs. the industry, and returning capital through major share buybacks.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN, NOV, VTLE, OXY, PTEN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.