Summary:

- Devon Energy plans to purchase Grayson Mill Energy assets in the Williston Basin.

- Comparison to Diamondback Energy shows Devon’s “diworsification” strategy.

- Hess reporting indicates low profits from United States assets, suggesting the Hess Bakken acreage has high costs.

- Diamondback Energy has very roughly the same free cash flow as Devon on far less production.

- Diamondback Energy reported more GAAP profits in the first quarter on far less production than Devon.

bashta

Devon Energy Corporation (NYSE:DVN) recently made an offer to purchase the assets of Grayson Mill Energy, which operates in the Williston Basin. Supposedly, the offer is a combination of stock and debt that should make this an accretive transaction. However, the Williston Basin generally has higher costs than the Delaware Basin, where Devon has most of its production. In fact, the estimates on higher costs vary between $10 and $15 per BOE. Now, for a long-term accretive transaction, Devon would have to run a very tight cost-conscious organization. That is not something that the company is known for.

Comparison To Diamondback Energy

Diamondback Energy (FANG) is a company that has focused on the Permian and keeping costs in line. Devon has done the opposite by entering several basins in the name of diversification. Detractors have called this “diworsification” and we are about to see why.

| First Quarter 2024 | |||

| Devon | Diamondback | ||

| Production (BOED) | 664,000 | 461,100 | |

| Cash Flow From Operations | $1.74 | $1.30 | |

| (GAAP) in Billions | |||

| Free Cash Flow (millions) | $844 | $791 | |

| GAAP Earnings (millions) | $596 | $768 | |

The above information was obtained from the first quarter earnings press releases from Devon (also supplemental schedules) and Diamondback. Note that the figures are rounded.

Devon actually has a very similar production level in the Delaware Basin part of the business to the Diamondback business reported. Therefore, any difference in earnings can be assumed to be due to the other basins that Devon operates in.

The Delaware Basin is widely assumed to be one of the most profitable locations in North America. What is interesting is that Devon claims a breakeven of $40 BOE, whereas Diamondback claims a breakeven of less than $40 BOE in their respective reporting. Admittedly, both claims are close. But in the energy business, every penny difference often shows up as a profitability difference.

Furthermore, as the chart above shows, for roughly 50% more production, Devon is not getting anything close to that in more GAAP cash flow and that difference nearly disappears in the free cash flow discussion.

Those are fairly dramatic differences that would stop me from being any further interested in Devon just from the initial perusal. One would need to find plenty of extenuating circumstances to justify what is happening at a very high level between these two companies.

Then, when, GAAP earnings are reported, Diamondback Energy has higher first quarter earnings on far less production. Again, at a very high level, the diversification of Devon into other basins does not appear to be well-supported by additional profits.

Hess Reporting

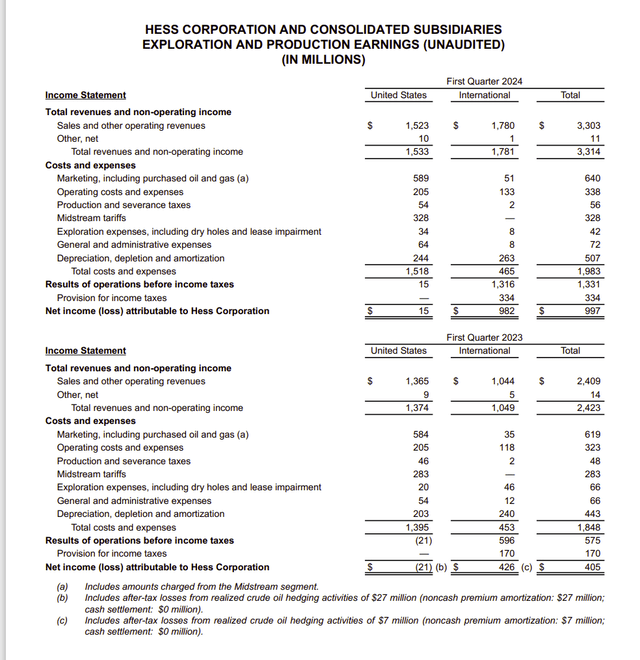

Hess (HES) is one of the larger operators in the Williston Basin. This company actually breaks apart the earnings from Guyana and the earnings everywhere else, which is mostly the Williston Basin (and a little from the Gulf of Mexico).

Hess Corporation Earnings Breakdown Between Guyana And The Bakken (Hess Corporation First Quarter 2024, Earnings Press Release)

Backing up what is sort of seen with Devon is the Hess reporting above showing that it is making “next to nothing” from the United States assets which are mostly production from the Bakken Leases.

This also would appear to give some credence to the report that the Bakken breakeven is considerably higher than the Permian Basin acreage. Note that is a very rough estimate from a very high level. There can be both good and bad acreage in both basins. Operator experience in any basin can vary widely.

Devon Acquisition

At the top level, it would appear that the last thing anyone would want to do is diversify into the Bakken. Yet, that appears to be precisely what Devon wants to do.

The main part of the offering:

“has entered into a definitive purchase agreement to acquire the Williston Basin business of Grayson Mill Energy in a transaction valued at $5 billion, consisting of $3.25 billion of cash and $1.75 billion of stock to the sellers”

The source of the above statement is the press release by Devon Energy.

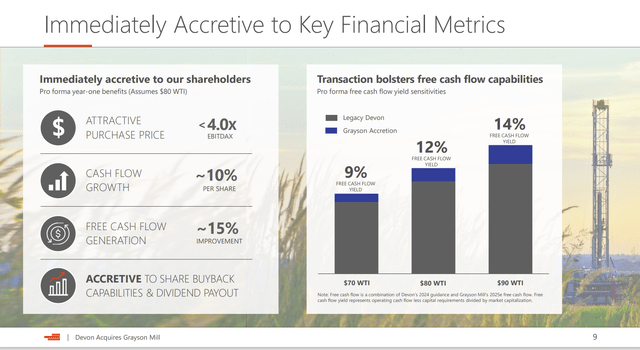

Devon Energy Underlying Assumptions And Key Tenants Of The Acquisition (Devon Energy Corporation Presentation Of Grayson Mill Energy Acquisition)

The assumption underlying all those wonderful benefits (and it is a whopper) is that the WTI price will be $80. The problem with that is the price does not go there frequently and when it does go there, it does not stay there all that long.

That makes most of what is shown above questionable. In fact, it adds further concern to Devon’s diversification program. After all, Hess admitted to not exactly making a “killing” in the Bakken with that first quarter report. In its own way, Devon appears to be making the same claim, as very few expect the future WTI price to average $80 any time soon. It would be highly optimistic to assume that WTI price when breakeven points shown above are around $40.

Summary

The results of Devon Energy’s acquisition and diversification show in the stock price.

Devon Energy 10 Year Stock Price History And Key Valuation Measures (Seeking Alpha Website July 10, 2024)

The stock price hit $40 per share (roughly) towards the end of 2016 and the beginning of 2017. It has not done much since that time. To me, this latest acquisition does not bode well for future stock price appreciation. Instead, that very aggressive WTI pricing assumption would seem to indicate “more of the same” at best. If something were to go wrong, the downside could far exceed the upside potential of this acquisition.

What is needed for the acquisition to succeed is for the acreage acquired to prove to be unusually profitable Bakken acreage. Given the company’s stock price record so far, I would prefer to wait on the sidelines for that kind of proof and for that type of superior acreage to prove to be significant to the results of the company. In short, I do not like the odds of success at all.

Diamondback Energy Common Stock Price 10 Year History And Key Valuation Measures (Seeking Alpha Website July 10, 2024)

On the other hand, here is the Diamondback Energy common stock price history for the same 10-year period. Notice that the common stock has more than doubled since the end of 2016.

As a side note, when Diamondback Energy makes an acquisition, they often commit to raising the dividend (usually significantly) as well as repurchasing stock. That commitment shows through in the above long-term price action.

This ten-year period has the big oil price decline in 2015 followed by the COVID-19 challenges of 2020 and a very short oil price rally in 2018. Most of the industry prefer to forget that challenging period. Nonetheless, it is clear that Diamondback Energy management found a better way to handle the period for their shareholders.

An article like this is really meant to start the research possibilities that would go into a final decision. Nonetheless, it is clear to me that Diamondback Energy Rewarded and likely will continue to reward shareholders better than Devon Energy. I would do a lot more research to back that up before I took more action, though.

Devon Energy appears to have issues with profitability despite possessing some of the best acreage in the Permian. This would appear to mean that Devon management is not detail oriented, nor is management hard driving enough to get the maximum out of the acreage. Instead, as I noted years ago, this management appears to be satisfied with “good enough” results because it owns some of the best acreage in the Permian. That acreage will produce above-average results even with less-than-optimal operations.

That has never been good enough for me. It makes Devon a sell until I see a much better situation than I see now. I cover far too many “good enough” managements that eventually get their shareholders into trouble while collecting salaries and bonuses. Frankly, I do not need all of that in my portfolio. This common stock is for traders only that really know what they are doing. It is far too complicated for the average shareholder to make a decent return.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FANG HES either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.