Summary:

- Devon Energy has shown resilience and growth potential, backed by solid fundamentals, making it a compelling investment in the energy sector.

- The company is experiencing operational improvements in cost control and infrastructure development, which bodes well for its future performance.

- Devon is committed to delivering shareholder value through aggressive buybacks and dividends, offering potential upside for investors.

Bet_Noire

Introduction

In the past few months, I have spent an unusual amount of time discussing energy stocks – even for me.

That won’t change today, as we will talk about Devon Energy (NYSE:DVN), a company that has been brought up by readers countless times in recent weeks.

My most recent article on the company was written on March 8, when I went with the title “Value Vs. Growth: Why Devon Energy Is The Smarter Investment.”

Here’s a part of the takeaway:

As the market fixates on AI and tech, I’ve turned my attention to energy, where undervalued opportunities await.

Despite recent underperformance, companies like Devon Energy show resilience and growth potential, backed by solid fundamentals.

With oil prices rebounding and a strategic focus on reducing debt, DVN emerges as a compelling investment.

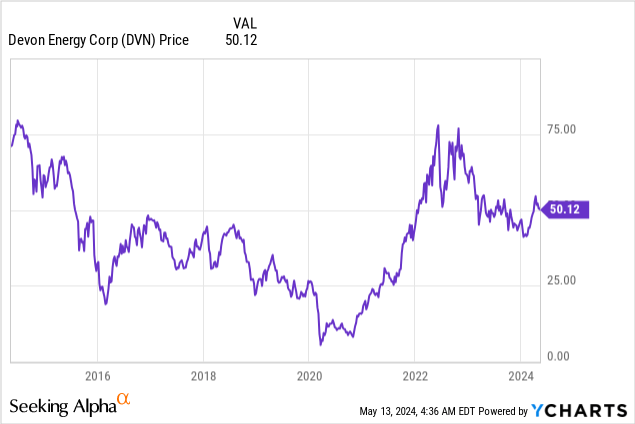

I still stand by everything said back then, and I am glad to see the market is increasingly rewarding the value Devon brings to the table. Since that article, it has returned roughly 10%, beating the S&P 500’s 1% return by a substantial margin.

With that said, in this article, I’ll update my thesis and explain why I remain bullish on Devon despite some headwinds from very low natural gas prices in the Permian basin.

The company is growing production faster than expected, is seeing higher takeaway capacity in critical areas, and is increasingly focused on buybacks to capitalize on what it considers to be undervalued equity.

So, let’s dive into the details with help from its recently released 1Q24 earnings!

Output Growth, Cost Control, And Better Takeaway

Devon is doing well, especially when it comes to growing output.

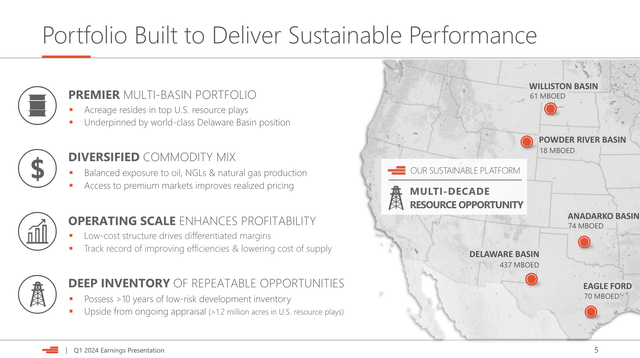

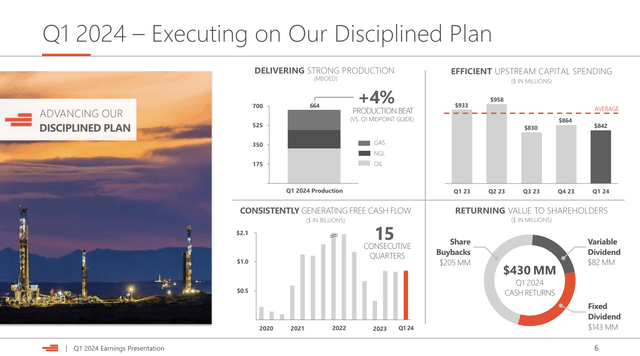

In the first quarter, the company’s production averaged 664,000 barrels of oil equivalent (“BOE”) per day, driven by outstanding well productivity, improved cycle times, and infrastructure improvements.

Furthermore, this number exceeded guidance by 4% and fits the company’s bigger plan to grow output by 5% annually.

Especially in the Delaware Basin, the company saw up to 10% improvement in well productivity, 5% higher completion efficiencies, and 4% drilling efficiencies.

As we can see below, the Delaware Basin, part of the mighty Permian Basin, is the company’s crown jewel, responsible for more than 430 thousand BOE of production, more than all other areas combined.

On a side note, readers who follow my work may know that my largest position is Texas Pacific Land (TPL), which I recently discussed in this article.

Devon is one of its biggest tenants in the Delaware Basin, which makes it an important oil company for me as well, despite not having any exposure after consolidating my portfolio.

Anyway, going back to Devon’s operations, the producer is showing great progress in lowering costs in an inflationary environment, as it delivered operating costs 3% lower than its guidance and was able to keep CapEx subdued despite faster-than-expected growth.

It has kept upstream CapEx below its average for three consecutive quarters and has grown production by 4%.

On a side note, it also has generated positive free cash flow for 15 consecutive quarters, but more on that later.

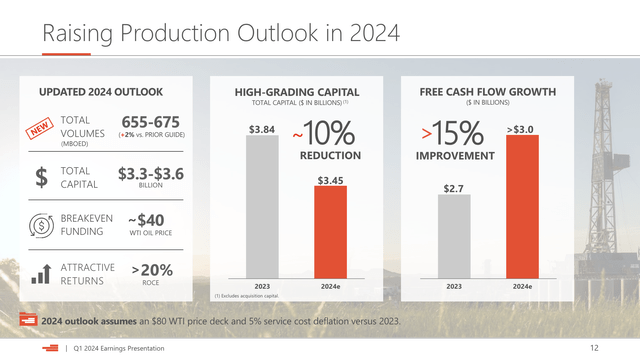

Due to this strong performance, the company raised its guidance for 2024, increasing the production target by 15,000 BOE per day (+2% from prior guidance) to a range of 655,000 to 675,000 BOE per day.

Meanwhile, the company maintained its original capital budget while expecting higher free cash flow generation compared to the previous year.

It expects at least 15% higher free cash flow, which is based on $80 WTI and 5% service cost deflation versus last year.

With that said, the company has one major issue. Roughly half of its production consists of non-oil products.

In 1Q24, for example, the company produced 664 MBOED, as I already briefly highlighted. Of this, 319 thousand barrels were crude oil. Natural gas liquids accounted for 165 thousand barrels. The remaining output was natural gas.

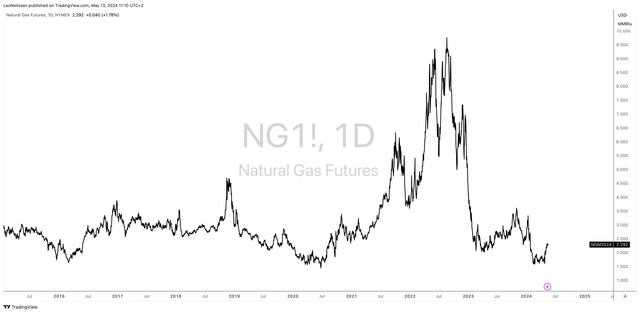

While I am bullish on natural gas on a long-term basis, the company had two issues:

- Natural gas prices are currently very subdued, pressured by mild winter weather and high output.

- In the Permian Basin, (associated) natural gas production growth is so strong that prices are negative in certain areas.

U.S. spot power and natural gas prices turned negative in Texas, California and Arizona for Tuesday as pipeline maintenance trapped gas in the Permian Shale in West Texas amid low demand for energy and ample hydropower in the West.

Negative prices signal there is too much power or gas being produced in a region. Energy firms can either reduce output, pay someone to take their power or gas, or, if they can get a permit, flare the unwanted gas. – Reuters

To add some color here, in 1Q24, the company realized an average natural gas price of $1.62 per Mcf. In its Delaware operations, the realized price was just $1.19.

This is a major reason why (some) investors have prioritized other oil companies.

- Some picked oil-focused producers in the Permian.

- Other investors looking for natural gas exposure bought pure-play natural gas companies in lower-cost basins with better takeaway capacity.

In other words, its elevated non-oil exposure and capacity constraints are an undeniable headwind for the DVN ticker.

The good news is that progress is being made.

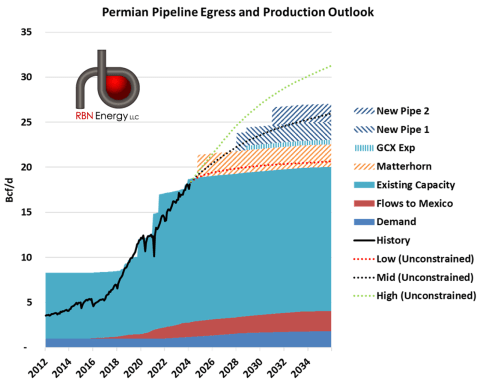

On the gas side, we are experiencing weakness in WAHA pricing within the Permian. But as a reminder, our exposure is limited given our firm takeaway and basis hedging. Looking ahead, we expect the situation to improve with the Matterhorn pipeline scheduled to come online later this year. – DVN 1Q24 Earnings Call (emphasis added)

Devon Energy is a co-owner of the Matterhorn pipeline, which is expected to come online this year and take away 10% of Devon’s capacity.

As we can see below, this new pipeline should significantly ease takeaway tightness in the basin until future capacity supports further output growth through the end of the 2020s.

RBN Energy

This brings me to DVN shareholders.

So Much Shareholder Value!

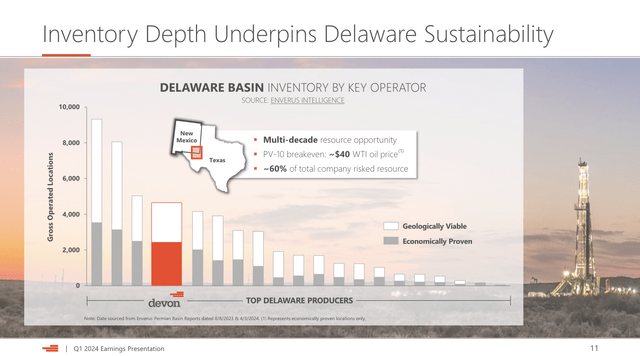

In addition to the company’s 1Q24 successes, it is also a producer with a wide range of other advantages, including a PV-10 breakeven at roughly $40 WTI.

Essentially, PV-10 is a calculation of the present value of a company’s estimated future oil and gas revenues after expected direct expenses and discounted at an annual rate of 10%.

It also has more than 20 years of high-quality reserves, which allow it to use free cash flow for shareholder distributions instead of being “forced” into M&A projects to support future production.

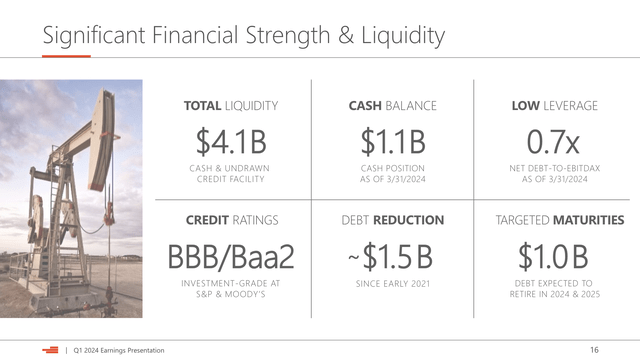

It also has a healthy balance sheet, as it ended the first quarter with a cash balance of $1.1 billion and maintains a healthy net debt ratio of 0.7x EBITDA.

Going forward, it aims to use excess free cash flow to retire maturing debt, with the next debt maturity of $472 million due in September of this year.

Using the overview below, it has $1.0 billion in maturities through 2025. Its current liquidity can easily cover this.

This brings me to shareholder distributions.

So far, it has the perfect foundation to return cash to shareholders:

- Deep reserves to protect it against “forced” M&A to maintain a steady output.

- Low breakeven prices allow the company to generate substantial free cash flow at elevated oil and gas prices.

- It has a healthy balance sheet, which means it can distribute most of its free cash flow to shareholders.

- Past investments in infrastructure are about to pay off (like the Matterhorn pipeline).

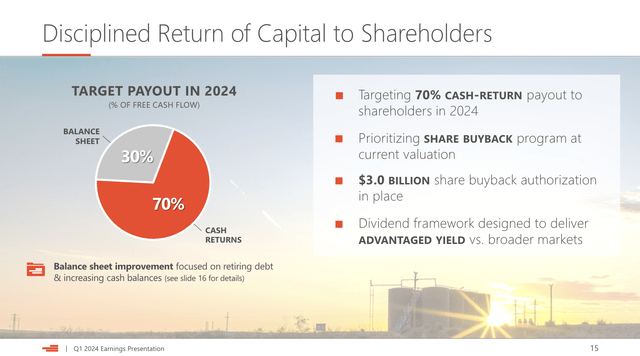

Hence, for this year, the company targets to return 70% of cash to shareholders, with the other 30% going towards debt reduction.

It currently has a $3.0 billion buyback plan, which translates to roughly 9.4% of its $32 billion market cap.

The company prioritizes buybacks due to its current valuation. Or, to put it differently, the company believes it is too cheap.

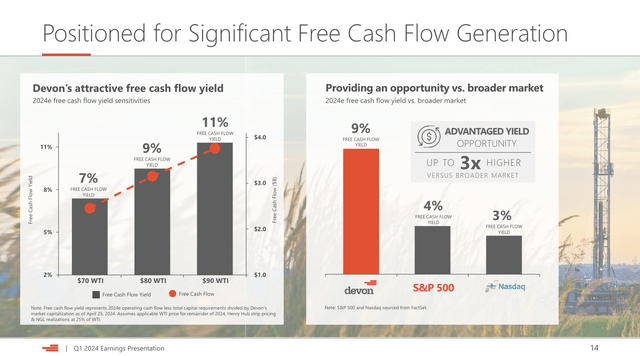

To give you an idea of how powerful the Devon cash machine is, we can use the chart below.

At $80 WTI, the company expects to generate roughly $3.3 billion in free cash flow. That’s roughly 10% of its market cap. Please note that the market cap was a bit higher when DVN made this chart (using April 25 data).

Furthermore, at $90 WTI, the company has a free cash flow yield of roughly 12%.

In other words, if WTI remains at $80, the company has the potential to return 7% of its market cap to shareholders on an annual basis (70% of the implied 10% free cash flow yield).

That is a big deal!

In 1Q24, the company returned $430 million. $225 million of this came from dividends (regular + special).

This translates to an annualized yield of 2.8%.

While this is a very low dividend, I have little doubt that the company will find the right balance between buybacks and dividends, making the stock a great investment for both income-focused investors and the ones who like buybacks.

For now, however, it seems the company prioritizes buybacks to capitalize on “the incredible value that Devon offers at these historically low valuations,” as we can see in the quote below.

Given that the equity market is still heavily discounting valuation to the energy sector, we plan to continue to prioritize share buybacks over the variable dividend to capture the incredible value that Devon offers at these historically low valuations. – DVN 1Q24 Earnings Call (emphasis added)

I have to say that I fully agree.

Because of “issues” like poor takeaway capacity and its high non-oil exposure, the company continues to trade at a very subdued valuation.

In fact, it is one of the cheapest oil stocks on my radar!

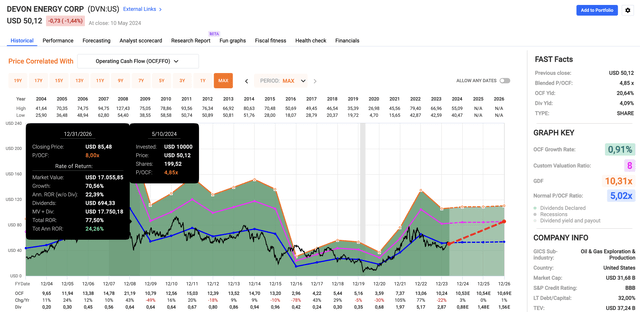

As we can see below, DVN currently trades at a blended P/OCF (operating cash flow) ratio of just 4.9x. While this is just 0.1 points below its long-term normalized multiple of 5.0x, it needs to be said that this low multiple includes many years when “nobody” trusted U.S. shale producers.

Until 2021, U.S. shale producers were rapidly growing output, supported by new technologies and cheap money, often hurting themselves in the process, as strong output growth caused oil prices to implode whenever demand weakened.

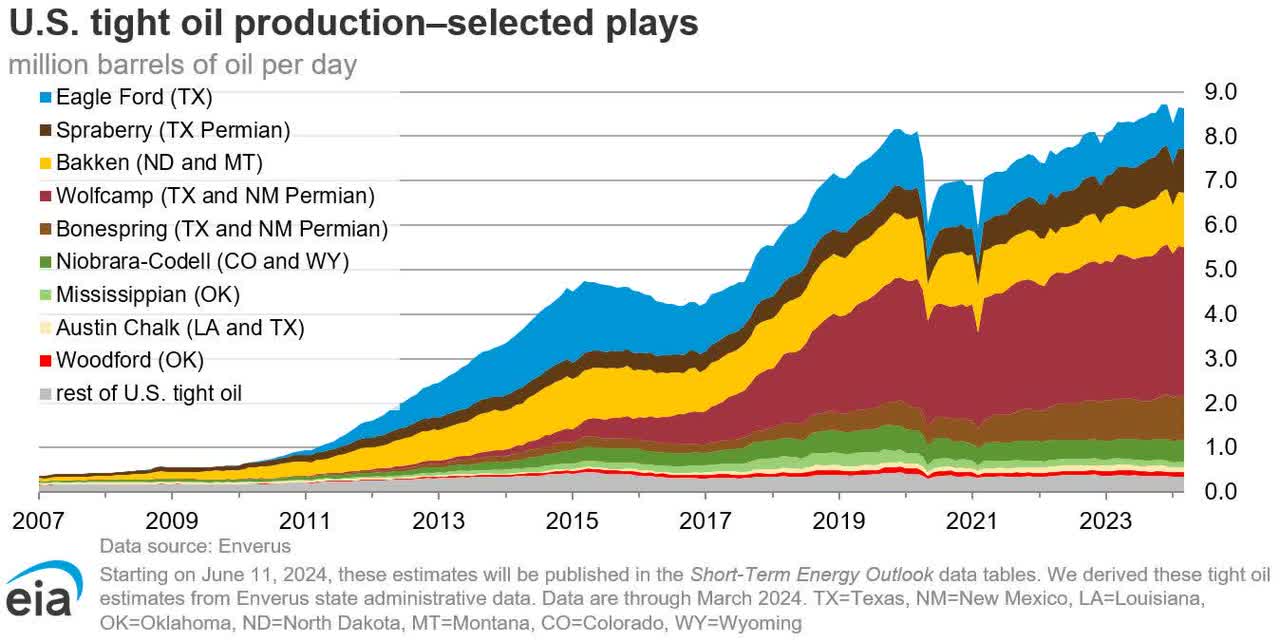

Between 2007 and 2020, the U.S. shale output grew from roughly 0.5 million barrels per day to more than 8.0 million barrels per day! Now, growth has come down, as production is barely higher compared to 2020.

Energy Information Administration

On top of that, DVN has massively de-risked its balance sheet, expanded its footprint through M&A, and shown the market that it is serious about buybacks and dividends.

While I would still give the stock a discount versus peers like Exxon Mobil (XOM), who tend to trade between 9.0-9.5x OCF, I believe DVN should not trade below 8.0x OCF.

Based on the FactSet data in the FAST Graphs chart above, analysts expect the company to generate roughly $10.70 in per-share OCF over the next three years.

Please bear in mind that changing oil prices will have a meaningful impact on these numbers.

However, based on the current environment, the company has a fair stock price of roughly $85 (8 x $10.70).

This is roughly in line with the target I gave in my prior article and 70% above the current price.

Especially if oil prices continue to trend up, potentially fueled by a global synchronized growth recovery, I expect DVN shares to move well beyond $85, making it one of my favorite oil plays, despite current natural gas and takeaway headwinds.

Takeaway

Despite challenges like low natural gas prices, Devon’s resilience shines bright.

With strategic debt reduction and production growth plans, DVN has emerged as a compelling investment.

Its operational improvements in cost control and infrastructure development bode well for its future, as the upcoming Matterhorn pipeline promises relief in takeaway constraints.

Moreover, Devon’s commitment to shareholder value, supported by robust buyback plans, underscores its potential.

Trading at a discount, DVN’s future looks bright, especially if the oil bull market continues.

As I maintain my bullish stance, Devon remains a top pick in the energy sector, which comes with both value and growth.

Pros & Cons

Pros:

- Resilience: Despite challenges, Devon has shown resilience and growth potential, backed by solid fundamentals.

- Operational Strength: Devon’s focus on cost control and infrastructure expansion bodes well for its future performance and price realization.

- Shareholder Value: The company’s commitment to shareholder distributions through aggressive buybacks and (special) dividends adds to its appeal.

- Potential Upside: Trading at a discount, DVN’s future looks promising, especially as I consider oil prices to remain “higher for longer.”

Cons:

- Natural Gas Headwinds: Exposure to subdued natural gas prices poses a challenge, particularly with current takeaway constraints.

- Dependency on Oil Prices: Devon’s performance is heavily influenced by oil price movements, which adds volatility and commodity risk.

- Non-Oil Production: A significant portion of Devon’s production consists of non-oil products, potentially impacting investor sentiment during periods of natural gas price weakness.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.