Summary:

- Devon Energy has strong performance, beating production guidance and generating substantial free cash flow.

- The company has an impressive portfolio of assets, particularly in the Delaware Basin, making it an attractive acquisition target.

- Devon Energy’s 2024 plan focuses on reasonable asset build outs, generating strong returns, and improving infrastructure and processing capabilities.

Kelvin Murray/DigitalVision via Getty Images

Devon Energy (NYSE:DVN) is an upstream oil company with quite some heft. Despite often being ignored in other conversations about large oil companies, the company has a market capitalization of more than $30 billion and a yield of more than 4%. As we’ll see throughout this article, the company’s assets will enable the company to drive substantial returns for shareholders, making it a valuable investment.

Devon Energy Performance

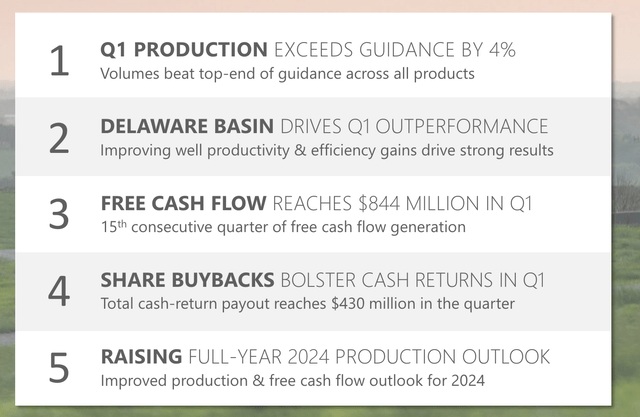

The company has continued to perform above its disciplined expectations.

Devon Energy Investor Presentation

The company’s Q1 production beat its guidance by 4% as the company has continued to outperform in the Delaware Basin. The company’s FCF hit a massive $844 million, annualized at a double-digit yield, and representing the company’s 15th consecutive quarter of FCF generation. The company has focused on giving substantial cash to shareholders, with more than $400 million in cash-return payout in the quarter.

The company managed to raise its outlook for the year, as it continues to target a disciplined 5% growth in volumes going forward. That, combined with an incredibly low net debt-to-EBITDAX of 0.7x, shows how we expect the company’s performance to continue.

Devon Energy Portfolio

The company has built an impressive portfolio of assets across the United States.

Devon Energy Investor Presentation

The company’s core production source continues to be the Delaware Basin, with 437 thousand barrels / day in production. The company has other assets throughout the United States, with a cumulative 223 thousand barrels / day of production, so just over 50% of the company’s Delaware Basin production. That shows how outperformance in the Delaware Basin continues to drive the company’s overall performance.

It’s worth noting the company’s incredibly strong acreage and assets in what is the strongest basin in the United States, and arguably the world, make it an interesting acquisition target in an era of substantial consolidation in the industry, with minimal baggage for an acquiring company.

Devon Energy Q1 2024 Performance

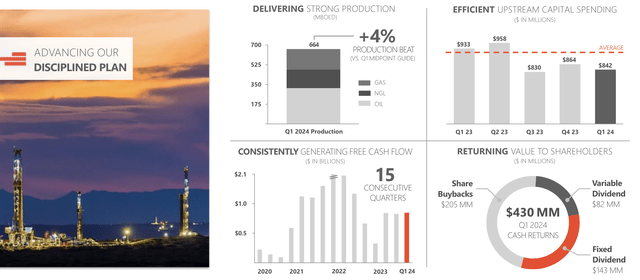

The company had strong Q1 2024 performance, driven by its strength in the Delaware Basin, where it has 400K net acres.

Devon Energy Investor Presentation

The company saw 4% growth in production, with more than 50% oil and the remaining split across gas and NGL. The company is continuing to build new assets to handle its gas and NGL production, increasing the margins of these assets. The company has achieved that production growth with increased efficiency, with upstream capital spending at a mere $842 million in the quarter.

The company returned $430 million to shareholders in the quarter, a more than 5% annualized yield, through a mix of dividends and share buybacks. Given the company’s current share price, we think that share buybacks are quite intelligent. The company’s strength in its wells is shown with successful wells achieving almost 6000 barrels / day IP30. These wells help de-risk numerous locations, such as the company’s Thistle 186H well with a 10K lateral.

The company’s 2024 program is seeing ~10% improvement versus its 2023 program, with ~4% improvement in drilling efficiency and ~5% improvement in completion efficiency. That shows the company’s focus on long-term returns and discipline.

Devon Energy 2024 Plan

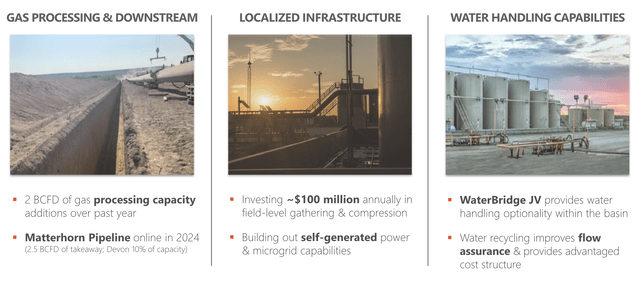

The company’s 2024 plan is focused on reasonable asset build outs and generating strong returns.

Devon Energy Investor Presentation

The company is building improved localized infrastructure and gas processing assets, along with an improved WaterBridge JV that will provide the company with improved water handling capabilities. The company has added 2BCFD of gas processing capacity additions over the past year, with the Matterhorn pipeline providing the company with 250MCFD in takeaway capacity.

The company is investing $100 million annually in field gathering and compression and is building out a microgrid of localized infrastructure to improve margins. The company has a multi-decade inventory depth at a ~$40 WTI oil prices, with numerous additional geologically viable properties, that it’s working to continue de-risking.

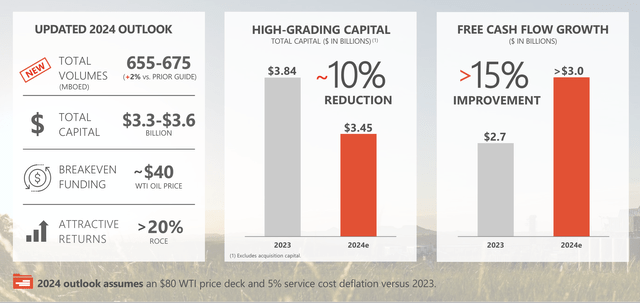

Devon Energy Investor Presentation

The company has increased prior guidance to ~665 thousand barrels / day in production for the year at $3.4 billion in capital. The company’s breakeven is at a mere $40 / barrel WTI and the company is expecting a 10% reduction in capital spending while continuing to grow production, which is exciting to see. This combination is expected to result in more than 15% in FCF growth to more than $3 billion for the year.

The company’s guidance at $80 WTI is ~10% shareholder returns. The company is allocating >60% of its capital to the Delaware Basin, showing the strength of the asset.

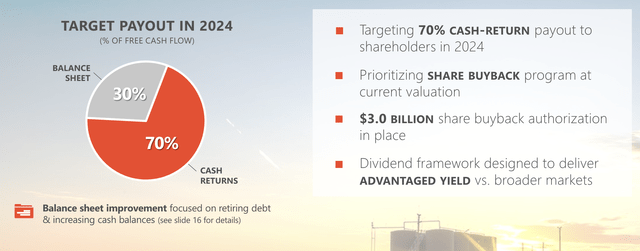

Devon Energy Shareholder Returns

Putting this all together, the company is continuing to target strong shareholder returns.

Devon Energy Investor Presentation

The company is putting 30% of the FCF on its balance sheet, with 70% on cash returns. The company has a $3 billion share buyback authorization in place, ~10% of its outstanding shares, which it’s prioritizing at its current valuation. It has $1 billion in maturities this year and next which it expects to retire, which we like to see given the cost of rolling over debt at current rates.

We’d like to see the company aggressively repurchase shares, supporting long-term dividend growth. The company can comfortably afford strong shareholder returns regardless of how it spends its cash, helping to highlight the company as a valuable investment opportunity.

Thesis Risk

The largest risk to our thesis is Devon Energy’s focus on oil prices and upstream oil in a commodity market. The company has a 9% FCF yield at $80 WTI (current prices), however, that drops to 7% at $70 WTI. The company needs these higher prices to justify investing, and weakness quickly hurts the value of investing in the company. Still, in a competitive market with minimal investment in new oil assets, we expect the company to outperform.

Conclusion

Devon Energy has an impressive portfolio of assets, and it’s one of the few upstream companies not saddled by a substantial amount of debt, with a substantial almost double-digit FCF yield. The company has an incredibly low leverage of 0.7x, and it’s continuing to pay down debt as it comes due, saving it from rolling that debt over in what’s a high interest rate environment for the company.

The company is continuing to pay a strong dividend yield of more than 4%, a dividend yield that it can comfortably afford. At the same time, the company is aggressively repurchasing shares under its $3 billion authorization. Given the company’s current valuation, we see repurchasing shares as something that’s very profitable for the company, and we’re a big fan of that decision.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.