Summary:

- Devon Energy acquired Grayson Mill for $5b, adding 307,000 net acres in the Williston Basin and increasing daily production by 100Mboe/d, resulting in an expected 15% increase in FCF.

- Devon’s strategic investments in operational efficiencies and new producing assets have led to improved well performance despite a -10% reduction in total capital investments.

- Management announced an improvement to shareholder benefits with a $5b share repurchase program and the potential for a dividend increase in 2025.

GoodLifeStudio

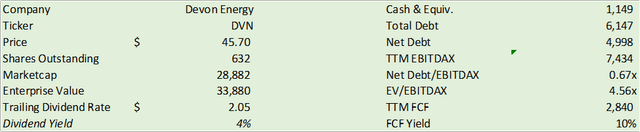

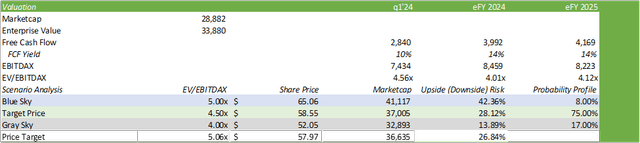

Devon Energy (NYSE:DVN) announced a major $5b acquisition of Grayson Mill on July 8, 2024, that will add 307,000 net acres in the Williston Basin to Devon’s inventory and increase daily production by 100Mboe/d with a forecast of 765Mboe/d going forward throughout eFY24. The firm has performed exceptionally well in a sequentially down oil market on the back of a -10% reduction in total capital investments through improved well performance. Despite slightly lower average cash margins across most basins, Devon continues to invest in improving operational efficiencies and new producing assets. Given the firm’s growth path going forward, I reiterate my BUY recommendation for DVN shares, with a price target of $58/share at 5x eFY25 EV/EBITDAX.

Be sure to review my initial coverage of Devon Energy here:

Devon Energy Changes The Playbook For The Better

Devon Energy Operations

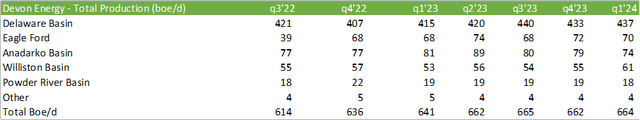

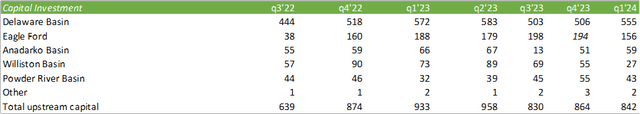

Devon is actively increasing their total production through improved well performance and M&A activity, which I will get into in the next section. Management increased their eFY24 guidance to 655-675Mboe/d of production, a 2% increase from previous guidance. This figure will significantly increase by 100Mboe/d of production to 765Mboe/d with the acquisition of Grayson Mill. Total oil production post-close of the acquisition is expected to be 375Mbbl/d. Through improved well production, all this was done on the back of a -10% reduction in capital investments from FY23, suggesting that the firm’s strategic well spacing, refracing, improved D&C cycle time, and EOR is working to their advantage. In addition to this, Devon was able to lower their infrastructure costs in the Delaware assets as the firm made strategic investments in localized gathering & compression and a self-generated microgrid in the basin. These strategic investments have allowed for Devon’s breakeven price to remain at $40/bbl of WTI, consistent with FY23.

Devon spent much of q1’24 developing their Wolfcamp formation, yielding an average of 3,200boe/d per well. The firm’s largest development in the quarter was their Van Doo Dah location within Cotton Draw, adding 13 wells in the New Mexico region. This formation averaged 4,000Boe/d per well and 30Mbbl/d of gross production. The firm is also developing their Wolfcamp B assets. The Thistle location at appraisal achieved a production rate of 5,900Boe/d. Wolfcamp B is expected to begin production in eFY25 as part of their multi-zone development program.

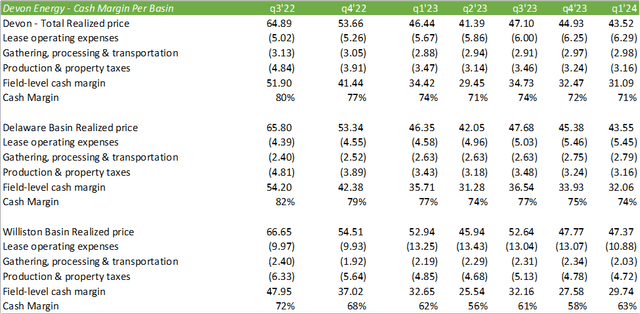

In q1’24, the Delaware Basin produced 437Mboe/d, 73% of which were liquids. This is slightly down from 74% in q1’23, suggesting that new wells are becoming slightly more gaseous than previously seen in the basin. Production was held relatively flat sequentially across the other basins, with the exception of the Williston Basin, which realized an improvement in production of 6boe/d. Realized prices declined across all basins and cash margins reflected this decline, with the exception of the Williston and Delaware Basins. The firm’s total realized cash margin was 71% with an average realized price of $43.52/boe and a cash margin of $31.09/boe, a -4% decrease from q4’23.

As of q1’24, Devon was running 16 rigs and 4 completion crews. Management mentioned in the q1’24 earnings call that the firm will bring back their dropped frac crew towards the end of eFY24 or early eFY25. As for now, management is focusing on building DUC inventory, which I expect will likely be completed and brought online as part of management’s 2025 plan.

Devon Energy & Grayson Mill M&A

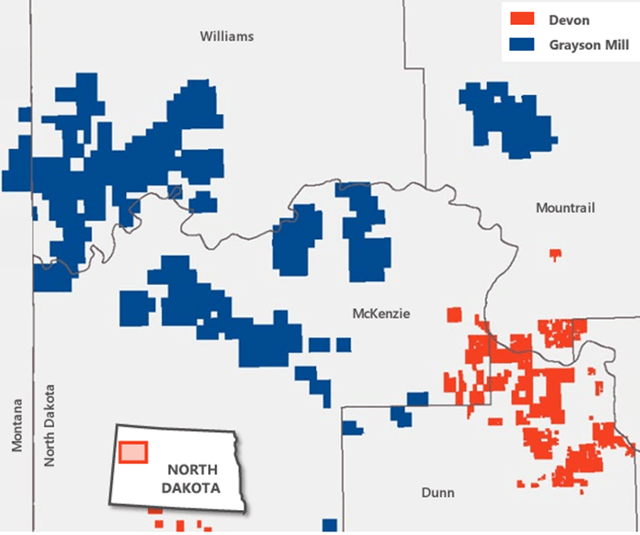

Devon announced their acquisition of private operator Grayson Mill on July 8, 2024, a deal that expanded Devon’s inventory in the Williston Basin by up to 10 years. Devon purchased Grayson for $5b at under 4x EBITDAX. The purchase was split between $3.25b cash and $1.75b in stock. As of q1’24, Devon had $1.15b in cash on the balance sheet, suggesting that the firm will need to issue debt in order to execute the cash payment. Though a cash raise was not directly mentioned in the announcement, I believe it wouldn’t be far off to presume the $2.5b mentioned in debt extinguishment is associated with the capital raise in order to execute this acquisition.

This deal will significantly bolster Devon’s Williston Basin assets, increase production through acquisition, and potentially create operational cost synergies in the basin, saving $50mm in average annual cash flow. As a result, management anticipates the acquisition will improve free cash flow generation by 15% going forward.

Though the assets aren’t necessarily stacked right next to Devon’s existing properties, these assets are well-grouped together in the western portion of the Bakken and Three Forks shale at an 80/20% split.

The acquisition will add 307,000 net acres on top of Devon’s 123,000 acres in the Willison Basin and will triple in-basin production to 150Mboe/d. Grayson’s assets produce 80% liquids, 55% of which are oil, and 20% natural gas, which plays well into Devon’s goal of maintaining a portfolio of oilier assets. The acquired assets differ in rock formation when compared to Devon’s existing Williston assets in which the assets have tighter rock formations, which management said should allow for more refracing and well spacing opportunities to bolster production on existing pads. In total, the acquisition adds 800 well opportunities, 500 of which will be new wells and the remainder enhancements.

In addition to the lease assets, Devon will also be acquiring midstream assets that should benefit the firm in terms of cost synergies. This includes a network of gathering systems, disposal wells, water, and crude storage terminals. These assets should allow for Devon to be more opportunistic in pricing, as well as giving the firm the flexibility to store produced oil during times of less appealing prices.

This acquisition is somewhat surprising given management’s capital investment plan per basin. As a percentage of total upstream capital investments, investments in the Williston basin have declined from 10% in q4’22 down to 3% in q1’24. This is a decline from $90mm to $27mm.

The rationale should be quite obvious when comparing the basin cash margin to Devon’s average and their top-producing asset, the Delaware Basin. For the sake of space, I only included the Delaware and Williston Basins for comparison purposes.

It costs nearly twice as much to produce in the Willison Basin as it does in the Delaware Basin. From a cost perspective, this raises questions as to why Devon would acquire higher cost assets outside of their core strategy. This may play into management’s refrac strategy to enhance oil production within the basin, which may potentially lower overall production costs. Despite the sharp decline in investment activity in the basin, Devon had increased production in the Williston Basin by 9% in q1’24. This may also play into buying in anticipation of additional infrastructure being placed within the basin. The additional midstream assets Devon acquired in the Grayson acquisition may also play a huge role in improving production and investments within the Williston Basin.

Devon Financials

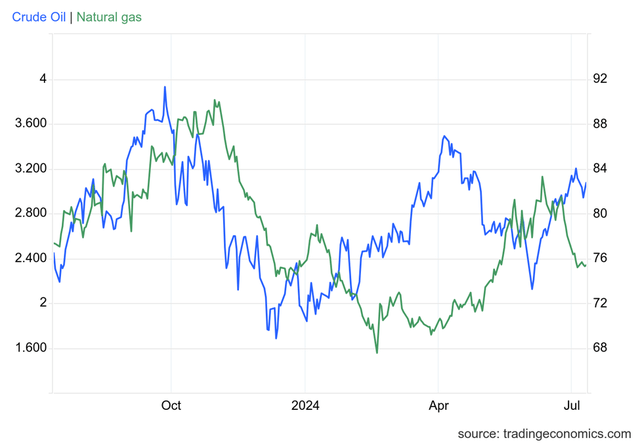

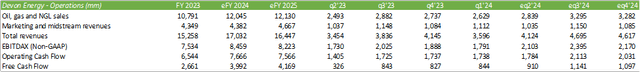

Total firm revenue came in at $3.6b, a -6% decline on a year-to-year basis on the back of a -6% decline in average realized price per barrel of equivalent. Devon may report a similar result as oil prices ranged from the low-$70s-to-low-$80s throughout the quarter. Looking ahead past eq2’24, CME prices WTI above $80/bbl for the duration of q3’24, suggesting that Devon may realize a sequential improvement in revenue and margins. This factor may be slightly amplified with the additional 100Mboe/d from their acquisition of Grayson.

Including the Grayson Mill acquisition in q3’24, value should be expected to drop from the top-line down to free cash flow. Given the lower cash margin in the Williston Basin and the increased mix in total production from the basin as well as the gassier assets when compared to Devon’s in-basin production, I anticipate margins to compress slightly as a result. With the addition of these assets, Devon will have the ability to generate close to $4b in free cash flow in eFY24 and should improve in eFY25 as the firm realizes higher margins as a result of their well enhancement strategy. Again, my model begins to include Grayson in e2h24.

Valuation & Shareholder Value

(Summary not inclusive of share dilution as a result of the Grayson Mill acquisition. Using July 8, 2024 as the reference date, the $1.75b stock portion of the deal should translate to ~38mm shares.)

In the announced acquisition of Grayson Mill, management announced their new capital allocation plan with a 67% increase to share repurchases, raising the total from $3b to $5b. Management also suggested that Devon will seek to increase the dividend payout as a result of the increased production. In addition to this, Devon will be paying down $2.5b of debt throughout the next 24 months post-acquisition. Management will seek to maintain a leverage ratio under 1x debt/EBITDAX.

Considering DVN’s low valuation of 4.56x EV/EBITDAX, I anticipate management to continue to favor share repurchases over dividend increases. Given management verbiage relating to increasing the dividend, I do anticipate investors to buy into DVN shares as a strong equity income strategy. Given the state of the broader market, this may be good timing for DVN shares as investors may seek a more income-oriented investment strategy if the economy takes a deeper downturn. This economic outlook is in reference to the contractionary ISM-PMI readings for June across both services and manufacturing. Given these factors, I maintain my BUY recommendation for DVN with a price target of $58/share at 5x eFY25 EV/EBITDAX.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.