Summary:

- Devon Energy Corporation has reported productivity gains and is efficiently restraining capital spending, leading to production growth and lower spending.

- The company is benefiting from higher oil prices and plans to boost production, as it is breakeven at $40/bbl while WTI prices are above $80/bbl.

- Devon Energy is using its large cash flows to repurchase shares and has reduced its share count while still paying solid dividends.

mysticenergy

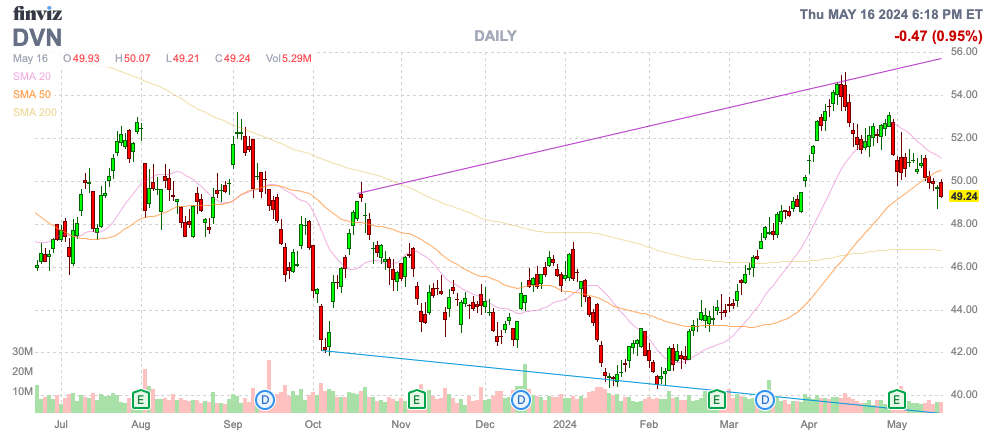

Devon Energy Corporation (NYSE:DVN) finally saw the stock rebound during March, but the stock has now given up a portion of those gains. The energy company likely shouldn’t trade in such a wide volatility range. My investment thesis remains ultra-Bullish on Devon, with higher oil prices leading to a profit boost and big dividend payout.

Finviz

Productivity Gains

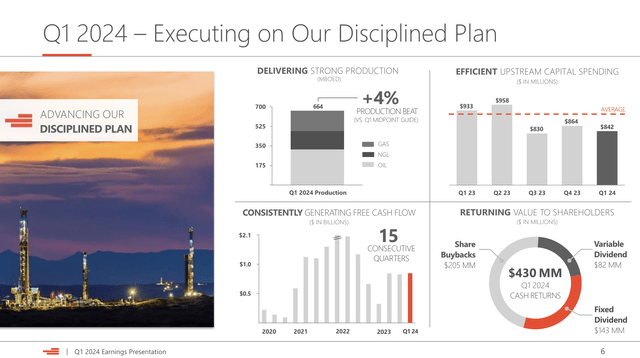

Devon Energy reported a great start to the year in early May. The energy company delivered a production beat of 4% to average 664,000 Boe per day, which resonates with higher cash flows due to a world where so much production is off-line.

Devon Energy Q1’24 Presentation

Just as important, Devon Energy is efficiently restraining capital spending. The company has cut capital spending by 10% from the 2023 levels with the goal of maintaining production.

The result was 4% production growth, while quarterly capital spending of $842 million was nearly $100 million below the level spent in Q1’23. The energy company plans to spend $3.45 billion on capital in 2024, down 10% from the $3.84 billion spent last year.

In essence, Devon Energy is spending less and producing more. Typically, the energy market producing more just leads to lower oil prices, but domestic producers are now benefitting from OPEC sticking to oil production cuts.

WTI prices recently soared above $85/bbl in April, while Devon is breakeven at just $40/bbl. The company has every incentive to boost production under the current dynamic where so many countries are restraining oil production despite attractive prices, with Brent currently above $83/bbl.

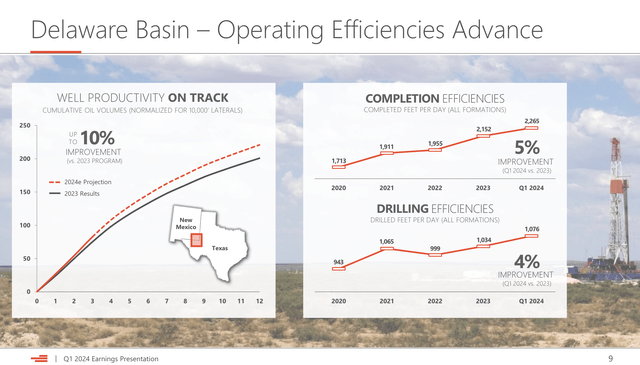

On the Q1 ’24 earnings call, CEO Rick Muncrief discussed the big boost in well productivity leading to the production growth:

On average, these high-impact wells exceeded our top curve expectations with strong well productivity in the Delaware Basin, once again, driving our results. Overall, this activity achieved initial production rates that were more than 20% higher than those that we placed online last year. As we progress through this year, I anticipate that these strong recoveries will continue.

The Delaware Basin wells are forecast to have 10% production gains in 2024. The company continues to drill more and more feet per day each year, leading to efficiency gains. At one point, the market theory was that the most productive wells would be drilled first, leaving energy companies with less productive wells to drill in the future.

Devon Energy Q1’24 Presentation

Capital Return Machine

Normally, an energy company doesn’t really see many benefits from higher supply, as this usually leads to lower energy prices. The net impact can be limited benefits to the producing company from exceeding production goals.

Currently, Devon Energy can use the large cash flows produced by the higher energy prices to repurchase shares after paying solid dividends. Historically, oil companies have only focused on paying large fixed dividends and the energy companies have even shifted capital returns to paying variable dividends to restrict the amount tied to dividends.

Devon Energy still generates a 9% fee cash flow yield with WIT at $80/bbl due to the cheap stock price. The company spent $205 million on share buybacks during the quarter to retire 4.7 million shares.

The diluted share count is down to only 632 million shares from 647 million for Q1 ’23. Devon has reduced the share count by 15 million over the last year while still paying a fixed dividend of $0.22, equivalent to a yield of 1.8% with a variable dividend of $0.13 pushing the annualized dividend yield to 2.8%.

The company paid the variable dividend based on a quarter when the realized oil prices were only $75.15/bbl. Even worse, natural gas prices were only $1.62 while prices have jumped back to $2.50/mcf. The variable quarterly dividend has regularly topped $0.20, suggesting the current yield is more of a baseline with plenty of upside.

Devon should produce higher earnings in Q2 with the current energy prices and OPEC expressing no interest in hiking oil production.

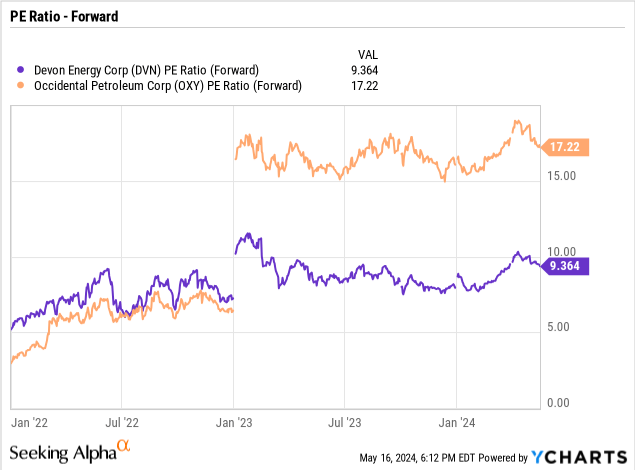

Earnings aren’t necessarily the best way to value energy stocks, but Devon Energy still remains a massive bargain compared to Occidental Petroleum (OXY). The stock trades at half the P/E ratio where Warren Buffett is willing to purchase shares of Occidental.

In total, Devon Energy returned $430 million to shareholders in Q1 alone despite on a path to spend $3.45 billion on capex this year. Even better, the energy company has limited net debt of $5 billion in a sector where companies regularly run up large debt balances to finance heavy capital spending.

Takeaway

The key investor takeaway is that Devon Energy remains a solid investment in the energy space. Despite the rally off the lows, Devon Energy Corporation stock remains a bargain due to strong capital returns and higher energy prices likely boosting future capital returns.

Investors should continue loading up on Devon Energy on weakness.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start May, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.