Summary:

- Devon Energy remains a strong investment after a disciplined strategic acquisition of Grayson Mill Energy, enhancing production and free cash flow.

- The energy company has a strong balance sheet, ensuring financial stability.

- The company’s Q2 performance highlights record oil volumes and significant free cash flows, supporting shareholder returns through dividends and buybacks.

- The stock is cheap with Devon still projecting an 11% free cash flow yield, presenting a lucrative opportunity for investors at current stock prices.

Jaromir Ondra

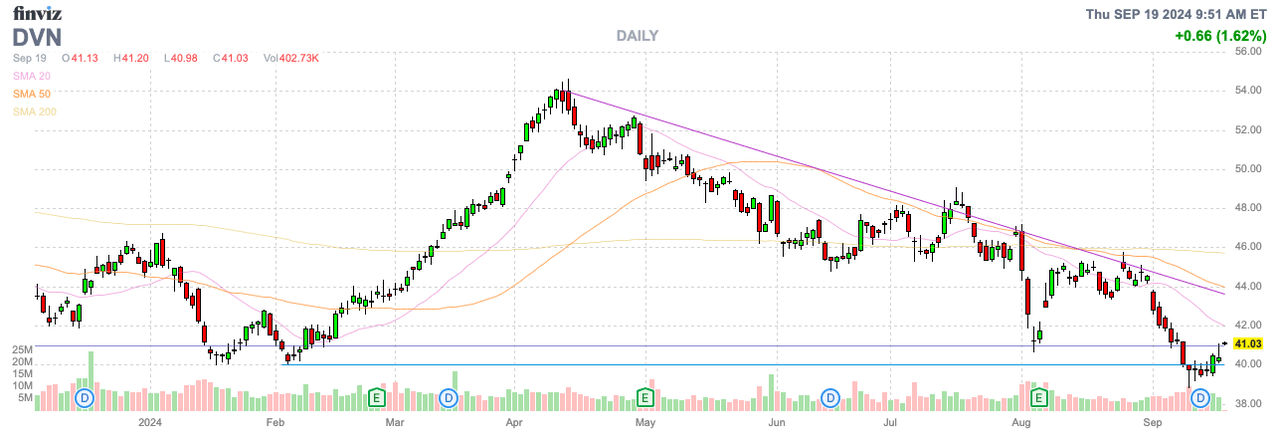

Despite ongoing strong results, Devon Energy Corporation (NYSE:DVN) trades right back to the yearly lows. The independent energy company is a cash flow machine, yet the market doesn’t like the stock. My investment thesis remains ultra-Bullish on the high yielding and disciplined energy play.

Source: Finviz

Strategic Deal

Back in July, Devon made a strategic acquisition to acquire Grayson Mill Energy for $5 billion. The transaction consists of $3.25 billion in cash and $1.75 billion in stock to the sellers at a price of ~$47 for 37.2 million shares.

The key here is that Devon has a strong balance sheet and the deal size avoids any normal regulatory and integration risk. The energy giant came into the deal with a low debt balance of only $5 billion, easily allowing for a cash deal.

Devon only paid 4x EBITDAX with a free cash flow yield of 15% based on $80 WTI prices. Of course, WTI dipped below $70 in September, suggesting maybe the energy company jumped into the merger too soon.

Regardless, the deal is expected to be accretive on per-share financial measures, with a limited amount of shares issued to acquire ~100,000 mboed at 55% oil. The company should be able to utilize the free cash flows from Grayson Mill to help repay the debt while only having to issue 37 million shares for the acquisition while boosting production by 15% to 765,000 mboed and further hiked to 777,000 mboed based on Q2 earnings numbers in August.

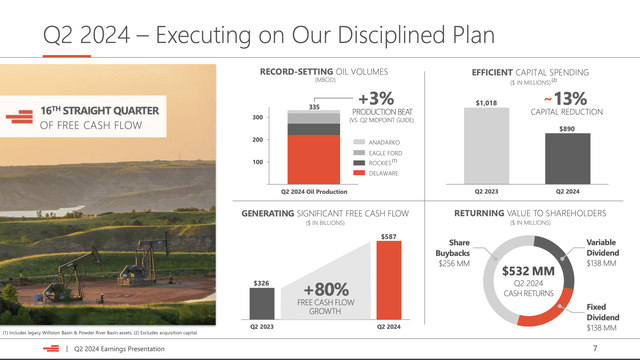

Another Strong Quarter

The reason Devon Energy remains an attractive investment is the disciplined plan. The company produced record Q2 oil volumes of 335,000 bbl/d while cutting capital spending by 13% to $890 million in the quarter.

Source: Devon Energy Q2’24 presentation

Devon doesn’t over spend on capex, leading to strong free cash flows, reaching $587 million in Q2. The company uses those strong cash flows to return capital to shareholders with $532 million in capital returns in the last quarter led by $0.44 per share in combined dividend payments.

The Grayson Mill deal will shift ~30% of higher free cash flows to repay $2.5 billion in debt to cover 50% of the acquisition price of $5.0 billion. At that point, Devon would only have $6.25 billion in net debt while having spent 70% of FCF over the last 2 years for large capital returns.

Naturally, WTI prices are down to only $70/bbl now. Devon had average realized prices of $80 in Q2, so results going forward will produce lower free cash flows.

The company still suggests a 9% free cash flow yield on $70/bbl WTI prices. The yield was actually 11% at the time on the Q2 earnings report, based on the higher stock price and higher WTI price.

The stock has fallen to $40 with a $25 billion market cap and the FCF target of $70 WTI equates to an 11% yield. Prior to the Grayson Mill deal, Devon forecast annual FCF somewhere in the $2.75 billion range.

The Grayson Mill deal offers a $750 million free cash estimate based on a 15% yield with $80 WTI. Naturally, oil prices are down here, but the acquisition price isn’t altered.

Devon now plans to spend $5 billion on share buybacks, after spending $2.7 billion so far. The energy company has ~$2.3 billion worth of authorizations remaining amounting to nearly 10% of the outstanding shares while the Q2 dividend amounts to a nearly 4.3% yield.

The market still doesn’t appear to appreciate the dividend broken into a fixed and variable portion. The fixed portion is only $0.22 for what amounts to a slightly above 2% yield, while the variable portion is based on quarterly cash flows.

Investors are actually paid dividends based on the volatile financials of Devon, not a flat amount that can place the company in financial distress.

Takeaway

The key investor takeaway is that Devon Energy offers a great opportunity to buy a disciplined energy play at the lows. The independent energy company has strong capital returns and just completed an accretive deal with the regulatory and integration risks of larger deals.

The stock will remain volatile with the price of energy, but investors don’t have to worry about Devon being over extended on debt. Investors should use the weakness to load up and enjoy the large capital returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market in September, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.