Summary:

- Devon Energy has closely followed the price of WTI crude oil, with both trading sideways since 2022. Devon reported a strong set of Q2 results, including hiking guidance.

- The company is set to grow earnings with ongoing revenue gains and is committed to returning capital to shareholders.

- Despite a modest acquisition, a major debt-heavy deal is unlikely, positioning Devon well for future growth and shareholder value.

- I highlight key price levels to monitor on the chart as we get closer to 2025.

bjdlzx

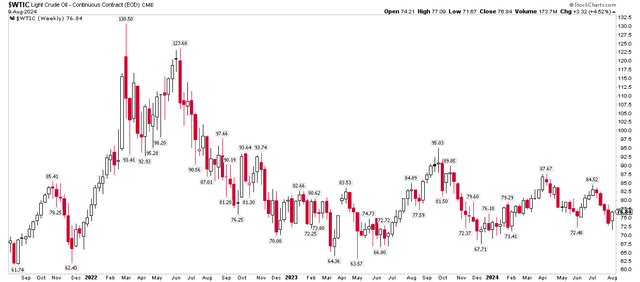

Devon Energy (NYSE:DVN) has followed the price of WTI crude oil for the last several quarters. Both oil the commodity and DVN shares have traded largely sideways since the 2022 pop and drop in the Energy sector. The $28 billion market cap Oil and Gas Exploration and Production company is set to grow earnings in the out year with ongoing revenue gains.

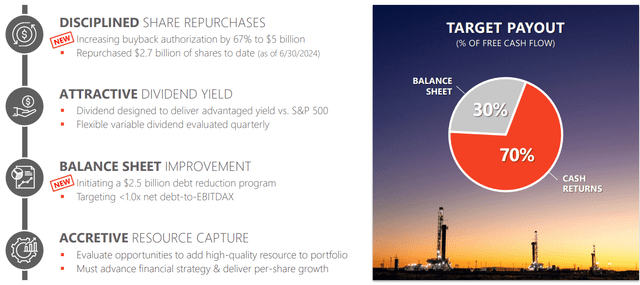

For shareholders, the management team is committed to returning capital via dividends and buybacks, while its free cash flow is very strong. What’s more, after a modest acquisition earlier this summer, a major debt-heavy deal is unlikely in the near future, which is a positive from a balance-sheet perspective.

I reiterate a buy rating on the stock. I am increasing my fair value target following solid Q2 results and will take a refreshed look at DVN’s technical situation at the end of the article.

WTI Crude Oil: Ranging Near $80

Stockcharts.com

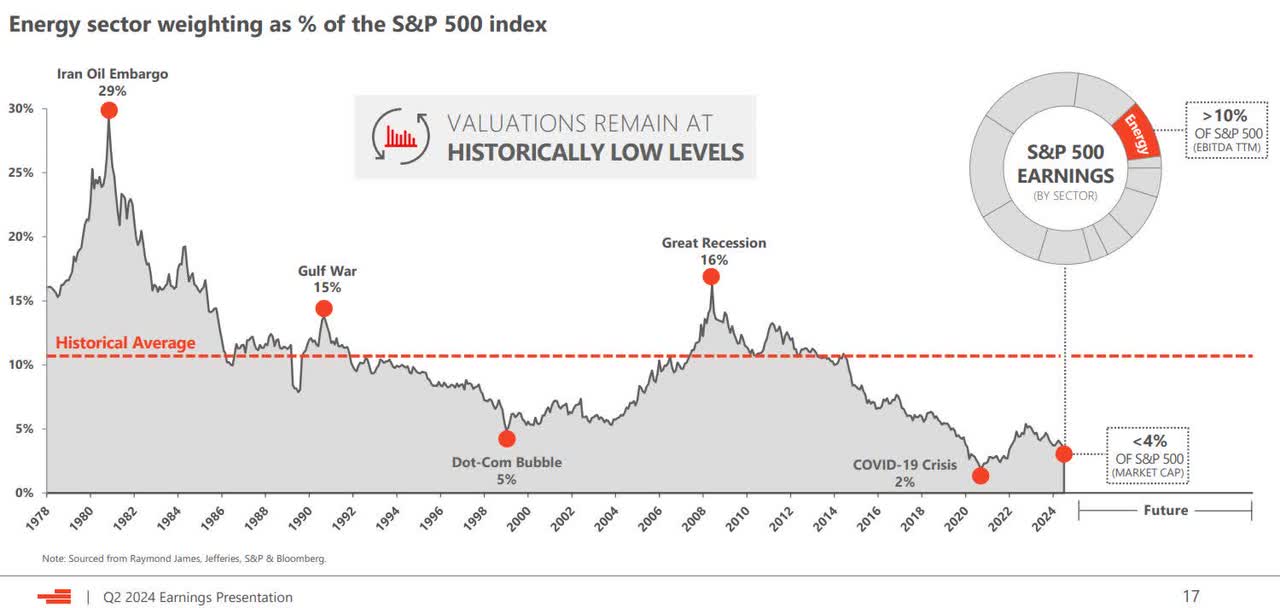

Energy sector weighting as % of the S&P 500 index: 29% in 1980, 4% today, >10% of SPX EBITDA

Devon IR

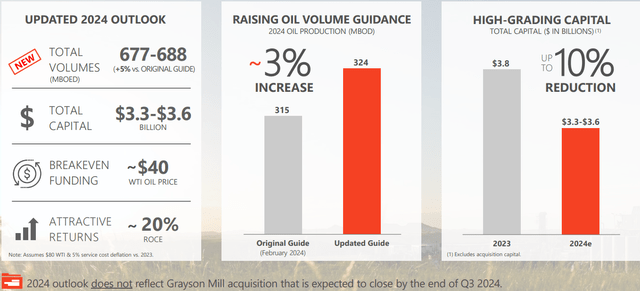

In August, Devon reported a solid set of quarterly results. Q2 non-GAAP EPS of $1.41 topped the Wall Street consensus estimate of $1.27 while revenue of $3.9 billion, up close to 14% from year-ago levels, was a modest $30 million beat. Shares traded higher after the report, and it was actually the first positive stock response following a quarterly announcement going back to May 2022, so I was particularly encouraged by that reaction.

It was an all-around beat across metrics. Devon posted impressive EPS, EBITDA, and free cash flow figures and raised guidance. Solid operations results and production levels were a boon despite crude oil prices that remained under $90 per barrel throughout the quarter – sharply down from prices seen just two years ago.

Its Permian assets performed well, and there’s optimism for continued robust growth from that region. Importantly, the management team raised its full-year 2024 production outlook for the second time in 2024, which also puts Devon in a strong position heading into 2025.

Guidance Increased Following a Healthy Q2

Devon IR

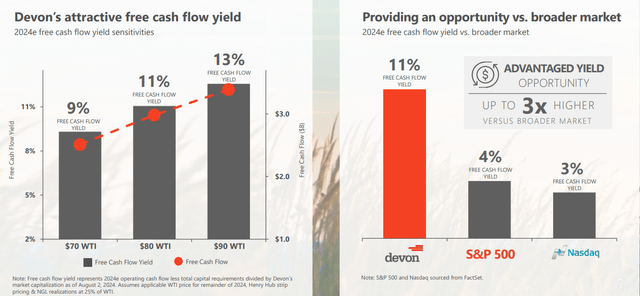

Positioned for Significant Free Cash Flow Generation

Devon IR

Disciplined Return of Capital to Shareholders

Devon IR

Devon was also on the acquisition trail in July when it acquired assets in the Bakken shale region for about $5 billion. The move was financed with cash, stock, and debt. While that might come as a concern to investors who want to see the firm maintain low leverage, it’s likely a net positive as it reduces the possibility of a larger debt-heavy deal anytime soon.

Operationally, the deal with Grayson Mill could result in higher production amounts and increase its presence in the Williston Basin, too. I like this incremental move, and it still leaves plenty of room for higher dividends and buybacks.

Key risks include lower oil prices should a macro slowdown take place, adverse regulatory changes in key shale areas, higher-than-expected capital expenditures and acquisitions financed with debt, and loftier market interest rates.

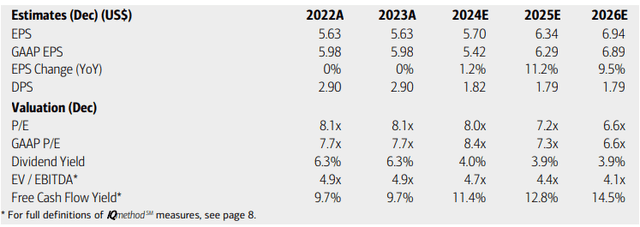

On the earnings outlook, analysts at BofA Global Research see operating EPS rising just 1% this year, but then growing at around a 10% annual rate through 2026. The current Seeking Alpha consensus forecast calls for a strong FY 2025, but a softer 2026. But Devon’s top line is seen increasing at a mid-single-digit pace this year, with an acceleration to more than 13% in the out year.

Dividends, meanwhile, are projected to hold near $1.80 per share – keep in mind that Devon’s shareholder value construct includes buybacks, a fixed dividend, and a variable dividend. With a high free cash flow yield, I see solid overall shareholder-accretive activities in the quarters to come.

Devon: Earnings, Valuation, Dividend, Free Cash Flow Yield Forecasts

BofA Global Research

If we assume normalized EPS of $5.80 over the next 12 months and apply the stock’s 5-year average non-GAAP price-to-earnings multiple, then shares should trade near $61, a modest increase from my previous valuation given the earnings beat and likely profitability jump with more visibility in 2025.

The operating P/E fell another handle from 9.5 to 8.4 in the last three months.

Devon: The P/E Multiple Falls Another Point From Mid-May

Seeking Alpha

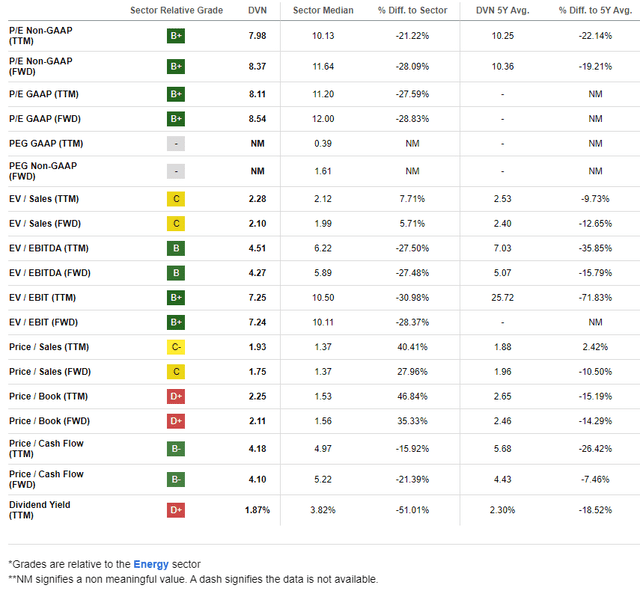

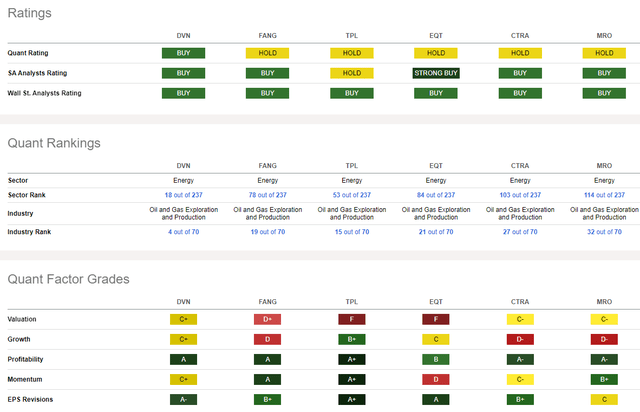

Compared to its peers, Devon features a lukewarm valuation rating, while its growth trajectory has been somewhat weak. But with a solid 2025 likely, the growth outlook is more sanguine. Moreover, Devon has some of the best profitability metrics you’ll find in the domestic E&P space and there has been a slew of bullish sellside EPS revisions in the past 90 days – 12 earnings upgrades compared to just a trio of downgrades.

Finally, share-price momentum has been admittedly lackluster, but I will note key support and resistance levels on the chart to monitor as we head closer to year-end.

Competitor Analysis

Seeking Alpha

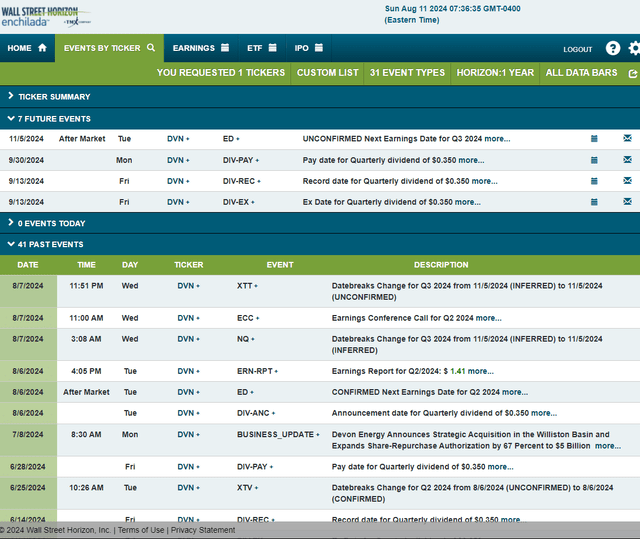

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3, 2024 earnings date of Tuesday, November 5 AMC. Before that, shares traded ex a $0.35 dividend on Friday, September 13. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

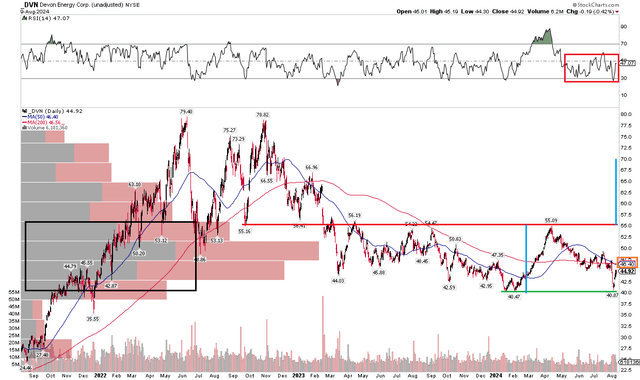

The Technical Take

With an attractive valuation, and improving fundamental and operational trends, Devon’s price action is less than stellar. Notice in the chart below that support has emerged at the $40 mark. Shares dipped under previous support in the low to mid-$40s back in the first quarter, extending the downtrend off the mid-2022 all-time high close to $80. Today, I see resistance between $54 and $56. That makes for a roughly $15 trading range ongoing. If we see DVN rally through the April peak, then a bullish upside measured move price objective to about $70 would be in play.

Also take a look at the long-term 200-day moving average. It has flattened out in its slope, suggesting that the protracted downtrend over the past two-plus years has eased. The onus is now on the bulls to regain control of the primary trend. For clues on that, I encourage investors to review trends in the RSI momentum oscillator at the top of the graph – it ranges in a bearish zone between 20 and 60. I’d like to see momentum improve there alongside an upside stock price move.

Overall, DVN appears to be in a new trading range, so the technical situation is neutral.

Devon: Emerging Trading Range, Weak RSI Momentum Trends

Stockcharts.com

The Bottom Line

I have a buy rating on Devon. I see the Energy-sector stock as undervalued with strong free cash flow and shareholder-focused policies. Its chart is less impressive, but there are clear levels to monitor in the months ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.