Summary:

- Devon Energy’s share price has appreciated 28% since my last analysis.

- Q1 results will be held back by weather impacts and 1st half weighted CAPEX spending.

- The easy money has been made with DVN. I encourage investors to invest counter-cyclically, below $50/share.

- The second half of 2024 has the potential to have significant improvements in FCF.

Mark Segal/DigitalVision via Getty Images

Thesis

Devon Energy (NYSE:DVN) is scheduled to release Q1 results on May 1st, 2024. Investors may be disappointed with the results against strong market expectations resulting from a healthy crude rally throughout the quarter. Now that crude prices have stabilized in the low $80/barrel range, investors may be expecting more.

Devon should still provide positive free cash flow, but the results will be tempered by extreme winter weather in North Dakota and a CAPEX program that is heavily weighted toward the beginning of the year. I project Q1 results to still yield a 4%-5% annualized total yield for investors.

Despite the meager results in Q1, I expect that the investments made during the first half of this year will result in significant improvements as the calendar progresses through the year. The second half of the year will have the table set for significantly higher levels of free cash flows as CAPEX spending drops off and volumes rise from capital employed during Q1 and Q2.

After a 28% rise in share price from my last analysis on DVN, I recommend a HOLD rating. This is due to moderate near-term performance against rising expectations for profitability that are associated with a crude rally.

The Crude Oil Rally (CL1:COM)

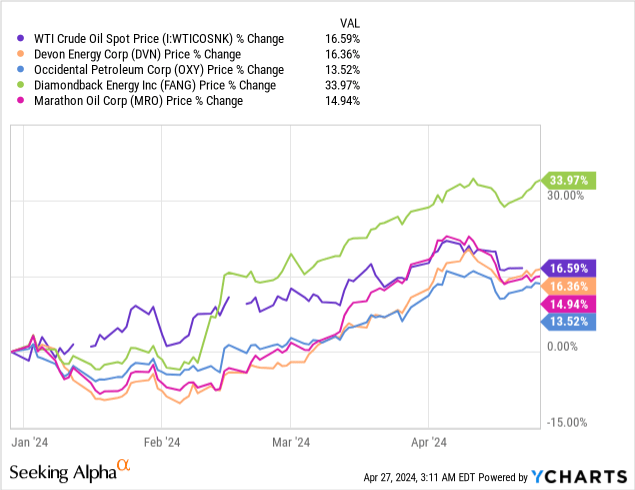

2024 started off bleak for oil prices, but gained momentum throughout Q1. That rally has sustained into the second quarter while dragging the E&P space along with it. Devon Energy’s stock, as well as several of its large cap peers, has enjoyed a modest rally in share price as a result.

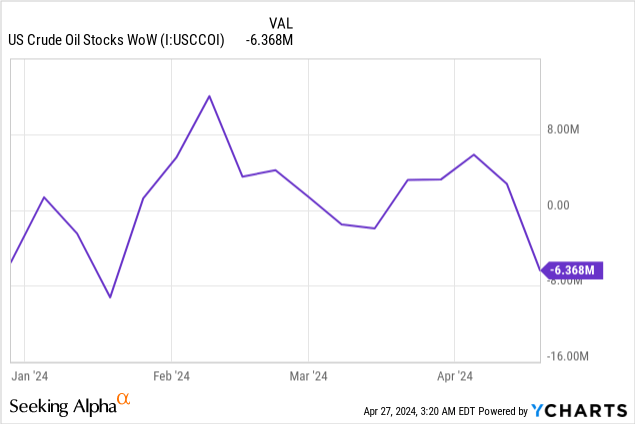

Fundamentally, this rally has been supported by stable crude stocks, geopolitical tensions, as well as the extension of OPEC+ production cuts to keep the supply and demand balancing act in check. In fact, crude prices have been range bound between $70/barrel and $85/barrel since the beginning of 2023.

Barring a large economic upset, or a shift in OPEC+ policy, I expect this trend to continue as the global economies remain resilient to inflationary pressures.

Q1 Earnings Projections

As part of the Q4 earnings package, DVN provided Q1 and full year 2024 production guidance. Quarterly projections are easy to develop using this data and actual commodity prices once the quarter has ended. The EIA tracks the monthly average price for commodities to make this process even easier.

As a result of the winter storms in North Dakota, Devon Energy’s production figures were announced to be reduced by approximately 2%. The table below lays out an estimate of how revenue will be generated during the quarter using midpoint production guidance.

|

Avg Rate |

Quarter Days |

Realized Price ($) |

Revenue ($M) |

|

|

Oil (MBbls/d) |

307 |

91 |

$75.23 |

$2,100 |

|

NGLs (MBbls/d) |

162 |

91 |

$19.39 |

$286 |

|

Natural Gas (MMcf/d) |

1025 |

91 |

$1.38 |

$130 |

In total, DVN is set up to generate approximately $2.5 billion in revenue during the quarter. This is a slight bump down from Q4 that saw the generation of $2.7 billion on slightly higher oil prices.

Unfortunately for DVN, the reduced production levels do not translate into lower production costs in Q1. The dilutive effect of higher volumes is lost in Q1 as a result of the previously mentioned winter storms. Q1 production costs are projected to be $9.55/boe at the midpoint in comparison to $9.22/boe in Q4. Overall, operating costs will be flat quarter over quarter for less production, putting a slight squeeze on FCF.

Devon’s operating plan for 2024 involves running a 4th frac crew through the first half of the year. Doing so results in a high CAPEX spend in the first half of the year, but significant savings in the back half. Q1 guidance shows $940 million in CAPEX spending. This elevated spend rate and flat production costs results in approximately $530 million in FCF generation in the Q1 FCF model.

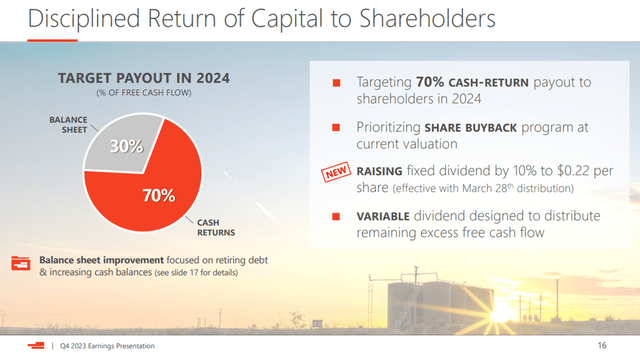

Devon’s return of capital program is now structured around a cumulative 70% return of FCF in the form of both cash and share repurchases. In Q1, I project this pool will total approximately $400 million. This number is slightly aided by a $20 million contingent payment related to its sale of assets in the Barnett shale in 2020. At the current share price of $52.71/share, this yields a total cash yield of 4.7%.

Note: Total cash yield includes both dividend payments and share repurchases.

Full-Year Earnings Estimates

As mentioned earlier, we have two important dynamics in play that are not reflected in the Q1 earnings report.

1. CAPEX spending should drop rather significantly once the 4th frac crew is dropped in H2, 2024. Average quarterly CAPEX spending should drop to roughly $785 million, freeing up $155 million in FCF per quarter on average. This amount alone is more than sufficient to fund the base dividend.

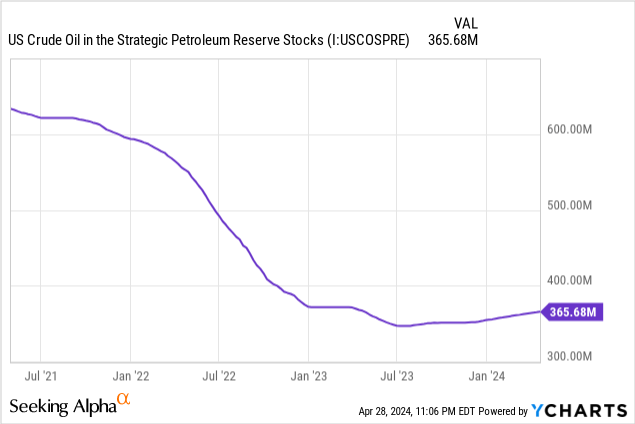

2. For Q2 specifically, WTI prices are averaging north of $84/barrel as the 1st month rolls to a close. As the US enters peak driving season, and the SPR still depleted following the crude price spike in 2022, there appears to be strong support for oil prices in the near term.

The combination of these two factors could be significant going forward. The reduced CAPEX expense results in nearly a 30% increase in FCF for Devon’s shares. Further, every $5/barrel increase in WTI also results in an additional $125 million increase in quarterly FCF at the full-year production rate.

If WTI prices prove capable of maintaining north of $80/barrel, the second half of the year stands to be quite profitable for DVN. Using this WTI price as an input to the FCF model boosts free cash flow to approximately $800 million, nearly a 50% increase from Q1. This level of return yields a hypothetical total cash yield of 6.7% at the current share price.

Potential Upside Variables to Estimated Free Cash Flow

There are two key variables in the Q1 projections that differ from previous quarters. Both of these variables could lead to inaccuracies in the FCF model.

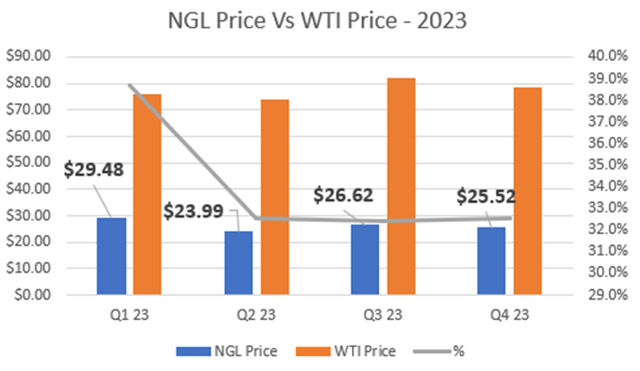

1. The projected NGL realized price is guided to be between 20-30% of WTI prices. At the midpoint, this equates to $19.39/barrel for Q1. This is significantly lower in both absolute terms, and percent of WTI prices when compared to 2023. The lowest price in 2023 was $23.99/barrel (at $73.76/barrel WTI) and traded at roughly 32% of WTI prices.

The guidance provided by DVN is the same as what was provided for Q4, so it would appear that DVN is being conservative on this metric. This would imply a moderate amount of upside worth approximately $60 million of additional FCF.

NGL Vs Crude Prices (DVN 10-K)

2. Devon has guided for a tax rate of approximately 22%. In 2023, the company achieved a tax rate of 18%. This would again have a material impact on the financial results from the model presented above.

Both of these factors have the potential to be a positive development for shareholders.

Devon Energy’s Stock Valuation

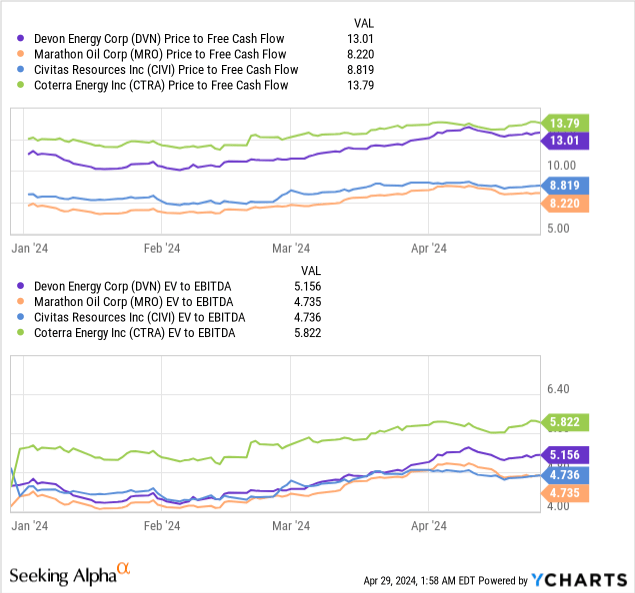

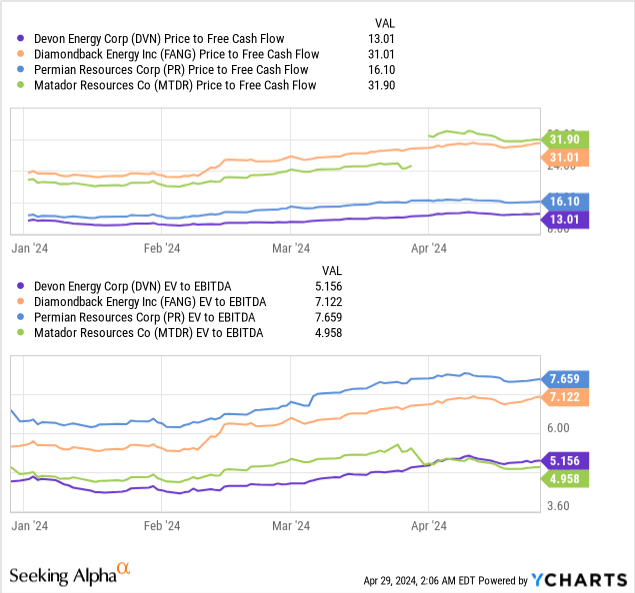

There are two ways I like to evaluate Devon Energy’s stock price. The first is to use price to FCF, which is an indication of the price paid for every dollar of profit generated by the company. The second metric I also use is Enterprise value to EBITDA, which factors in the value of the company’s cash and debt balances compared to total earning potential.

Since Devon’s production comes from a multitude of basins, but predominantly the Permian, I have developed two peer groups to compare using these metrics.

1. Multi-basin competitors

2. Permian focused competitors.

When compared to the strictly Permian producers, DVN trades at a significant discount, trading at the lowest multiple in both EV:EBITDA and Price:FCF. The competition tightens somewhat when compared to the multi-basin peers.

Multi-Basin Peer Group

Permian Peer Group

Considering both peer groups, DVN appears to be generally in line with the multi-basin peer group, but is a cheaper option compared to the strictly Permian producers. Considering the nearly 30% improvement in share price since late January, it appears that a significant portion of the near term value has been realized.

In general, I am a buyer of DVN shares below $50.00/share. My most recent purchase was on 2/28/24 for $44.00/share.

That said, I would still expect the share price to rise/fall with WTI prices. Should WTI breach into the $90 range, the stock will follow suit. Investors should be cautious to chase the commodity price and instead invest counter-cyclically.

Risks

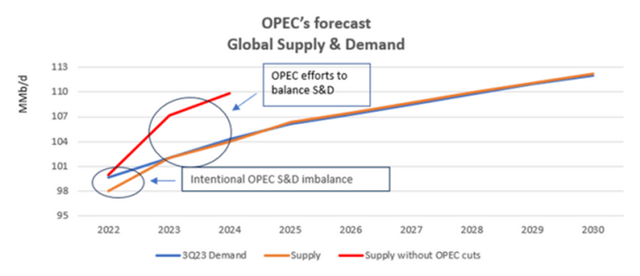

With over 80% of Devon’s revenue tied to crude sales, any impact to the supply and demand balance has the potential to dramatically affect future profitability. The current driver that is keeping a price floor on crude is OPEC’s production cuts. These cuts are keeping the crude market balanced. This balance has been effective in not allowing crude prices to drop below $70/barrel since the beginning of 2023. As shown below, OPEC is withholding as much as 10% of global supply.

Global Crude Supply (East Daley Analytics)

While I don’t want to dismiss this risk outright, it does make logical sense for all parties to keep the status quo. In the 2014-2018 time frame, price wars between US shale and OPEC proved to be very costly from a profitability standpoint. WTI prices floated between $40 and $60 per barrel for several years (remember the days of $2/gallon at the pump?). Market share was pursued at the expense of profitability.

I do not expect any changes in market dynamics in the foreseeable future. Not only does the current market allow for oil to be sold at a healthy rate of return, but the consistency in price also ensures the economies of OPEC countries enjoy financial stability, not previously afforded by engaging in price wars.

It’s not exactly scientific, but I’m betting OPEC goes with the “leave well enough alone” strategy here.

Key Takeaways

Despite headwinds in Q1, Devon Energy remains capable of generating healthy levels of FCF, generating an estimated total cash yield of 4.7%. I believe this analysis to be conservative based on historical NGL pricing and taxation rates.

The second half of the year should also be significantly more profitable due to increased production levels coupled with dramatically lower CAPEX spending. I believe the current WTI rally is sustainable in the near term as we enter peak driving season, leading to even greater returns.

I believe the bulk of the near term profits for DVN have been realized, and the shares are fairly valued. In a cyclical business, I believe it is prudent to be disciplined when selecting an entry point. Investing counter-cyclically is paramount. I continue to hold my position in DVN, but would be looking to add below $50/share to compliment my most recent purchase of $44.00/share.

Investors should continue to monitor the policies implemented by OPEC+ for potential supply and demand imbalances. Should OPEC begin to increase production, the oil market could realize sizable price impacts and decrease the DVN’s profitability.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.