Summary:

- Devon Energy Corporation stock has underperformed the S&P 500 significantly since my previous downgrade, as I urged caution.

- The collapse in natural gas prices justifies a substantial de-rating in DVN’s valuation.

- Devon Energy’s business model remains more exposed to oil and gas cyclicality, suggesting investors must be careful about adding at cycle peaks.

- However, I explain why DVN could be close to a cycle bottom, in line with my observation of the favorable price action in crude oil futures.

- It’s timely for me to finally turn bullish, encouraging investors to buy the dip before the rest of the market gleans the opportunity.

FG Trade

I last updated Devon Energy Corporation (NYSE:DVN) investors in November 2023, arguing they should reconsider trying to catch the falling knife on DVN. I enunciated that the downtrend bias on DVN hasn’t waned, as buying sentiments remained tepid in oil and gas stocks. That thesis has panned out as DVN has underperformed the S&P 500 (SPX) (SPY) significantly since my downgrade to a Sell.

Despite that, I’ve always kept my eye on DVN, as I recognize Devon Energy is a market leader with world-class acreage in the Delaware Basin. As a result, it has been able to capitalize on the surge in oil and gas prices in 2022 as its operating performance reached a cycle peak. However, given the collapse in natural gas prices (NG1:COM) as NG1 continues to hover at its May 2023 lows, Devon’s revenue performance has also suffered.

Observant investors should recall that Devon posted a natural gas segment revenue of $1.05B in Q3’22, accounting for more than 20% of its total revenue base. However, Devon’s natural gas revenue contribution fell to $342M in Q3’23, accounting for just 9% of its Q3 quarterly revenue base. Therefore, I assessed that the market had justifiably de-rated DVN, given its highly cyclical revenue exposure to the uncertain dynamics in the natural gas market. Further, it lacks a more diversified business model similar to big oil like Exxon Mobil (XOM) and Chevron (CVX). Accordingly, these major oil corporations can rely on “refining and petrochemical operations to provide natural hedges against oil price fluctuations.”

Moreover, the recent decision by the Biden Administration to put a hiatus on approvals for LNG export licenses also led to significant downside volatility in NG1. It led to a marked capitulation in NG1 prices, suggesting the market might be less enthusiastic about Devon Energy’s upcoming fourth-quarter release on February 27.

As a reminder, Devon Energy posted flat sequential production growth in Q3, reaching 665K boe per day. Analysts expect the company to guide for flat production growth in 2024, suggesting Devon Energy may need to depend on more favorable oil and gas prices to drive a valuation re-rating. However, the potentially increased supply growth from Exxon and Chevron could put a dampener on brighter prospects for Devon, given its narrower E&P focus. Despite that, I also assessed that DVN’s valuation multiples may have accorded significant pessimism at the current levels, which could attract long-term dip-buyers back into the fray.

DVN is valued at a forward EBITDA multiple of 4.5x, well below its peers’ median of 5.2x (according to S&P Cap IQ data), suggesting relative undervaluation. Although NG1 could continue to come under more pressure, I gleaned that the consolidation in WTI oil futures (CL1:COM) should provide more clarity on Devon Energy’s oil revenues in 2024. Consequently, I gleaned that DVN seems to be bottoming out, marking its current cycle low and priming for a growth inflection from 2024/25. While the impetus for a 2022 cycle peak will not likely occur, the lack of an economic recession forecast suggests that the global economy has remained resilient. As a result, it should put less pressure on a further downward de-rating on DVN’s already battered valuation.

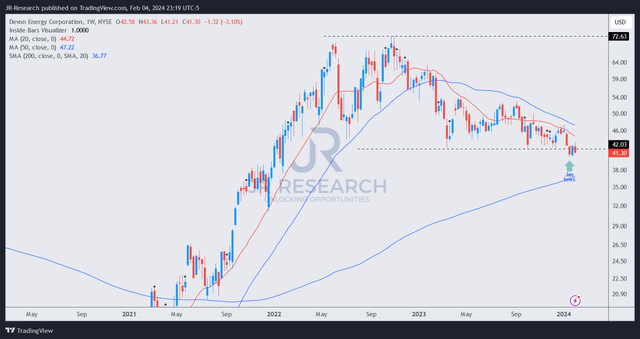

DVN price chart (weekly, medium-term) (TradingView)

DVN is still in a medium-term downtrend, but appears well-supported at the $40 level. As long as that level of support holds robustly, DVN’s long-term uptrend bias shouldn’t be in danger of being scuppered.

I also observed a validated bullish reversal two weeks ago, suggesting that buying sentiments have continued to be constructive. As a result, I view DVN much more favorably than in November. As explained previously, the more optimistic underpinnings from the macro environment and bottoming CL1 prices should bolster a re-rating in DVN moving ahead.

Notwithstanding my optimism, investors should note that the ongoing uncertainties in the natural gas market could deter a more pronounced upward re-rating. However, I believe much of it has been reflected. Also, demand uncertainties emanating from China could put a dampener on E&P stocks like Devon Energy, given their more exposed revenue cyclicality on commodity prices.

Rating: Upgraded to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!