Summary:

- WTI oil prices continue to hover near $80, while Henry Hub natural gas prices have rallied above $2, offering some hope for Energy E&P stocks.

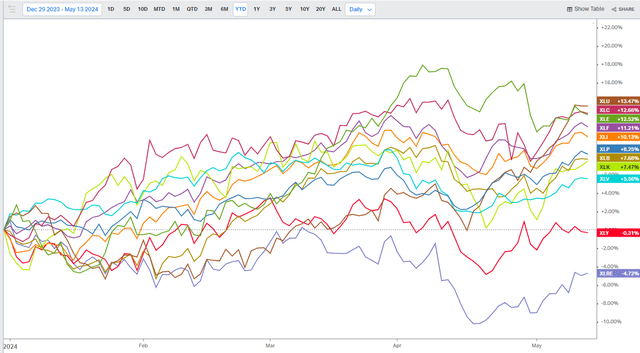

- The Energy sector sports relative strength in the stock market so far in 2024, with high free cash flow yield and attractive price-to-earnings multiples across the oil & gas space.

- I reiterate a buy rating on Devon Energy given an optimistic outlook on production, a strong valuation case, and better share-price momentum trends.

- With improved momentum compared to much of 2023, I highlight key price levels to monitor.

Monty Rakusen/DigitalVision via Getty Images

It has been a tale of two markets in the oil & gas space so far this year. While WTI has wobbled in the upper $70s to low $80s lately, Henry Hub natural gas has rallied, clearing the psychologically important $2 mark. All the while, 2024’s broad-based stock market gains have featured some relative strength among Energy-sector equities. It comes as the Energy sector sports a very high free cash flow yield and a continued attractive price-to-earnings multiple, not to mention hefty share buybacks from the niche’s key players.

I reiterate a buy rating on Devon Energy (NYSE:DVN). Following an EPS beat reported earlier this month and with an increased production outlook, DVN’s momentum has waned in the near term, but the chart looks better longer term.

The Energy Sector is Among the Leading S&P 500 Areas in 2024

According to Bank of America Global Research, DVN is an independent energy company that explores for, develops, and produces oil, natural gas, and natural gas liquids in the United States. It’s a diversified large-cap US E&P company. The firm’s asset base is spread throughout onshore North America and includes exposure to the Delaware, STACK, Eagle Ford, Powder River Basin, and Bakken regions. At year-end 2023, net production totaled roughly 658 thousand boe/d, of which oil and natural gas liquids made up roughly three-quarters of production, with natural gas accounting for the remainder, per Morningstar.

Back in early May, Devon reported a decent set of quarterly results. Q1 non-GAAP EPS of $1.16 topped the Wall Street consensus forecast by a nickel while revenue of $3.6 billion, down 6% from year-ago levels, was about in line. The stock was little changed in the session after the earnings announcement, but that was better than the trend of very poor reactions to profit reports. Implied volatility has now dropped to just 21%, according to data from Option Research & Technology Services (ORATS).

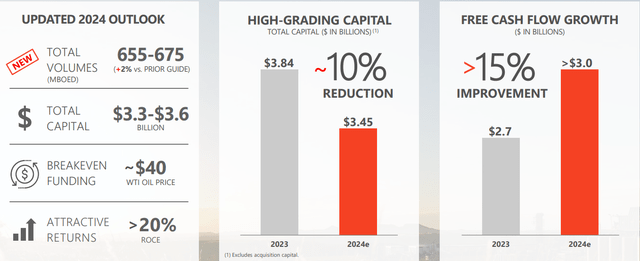

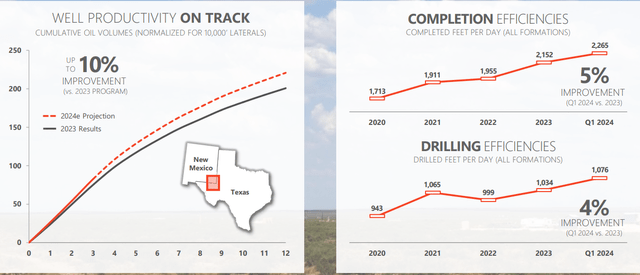

But digging into the Q1 release, there was some optimism to go around. The management team raised its FY 2024 production forecast by 2% to a range of 655,000 to 675,000 boe/d without the need for additional capex. The sanguine outlook came after healthy output in the Delaware Basin, which represents about two-thirds of Devon’s production and, according to Morningstar, is among the cheapest sources of oil in the country. And with improved drilling efficiencies and well productivity, higher production can come without much extra financing requirements. That leaves room for further shareholder-friendly activities.

Production Outlook in 2024

Delaware Basin – Operating Efficiencies Advance

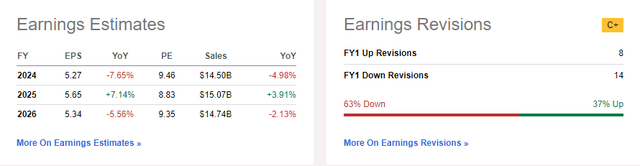

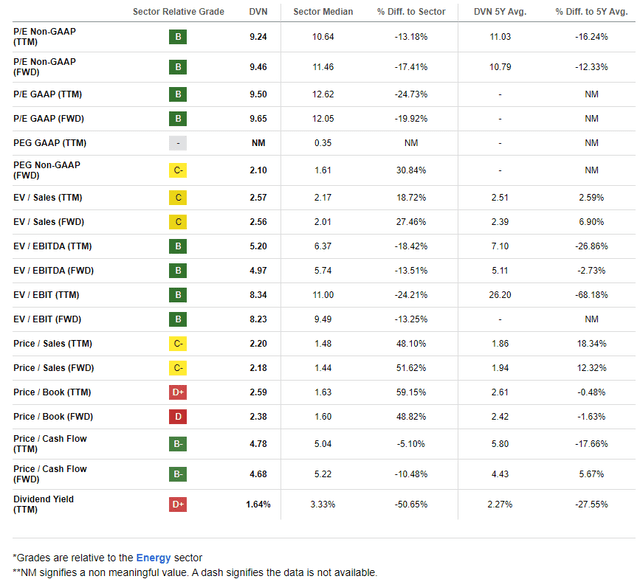

On valuation, the current Seeking Alpha consensus forecast calls for a sizable EPS drop this year but then a comparably sized recovery in the out year. Per-share earnings are then expected to drop to just $5.34 by 2026. There have also been several EPS downgrades in the past 90 days, which is not an encouraging sign.

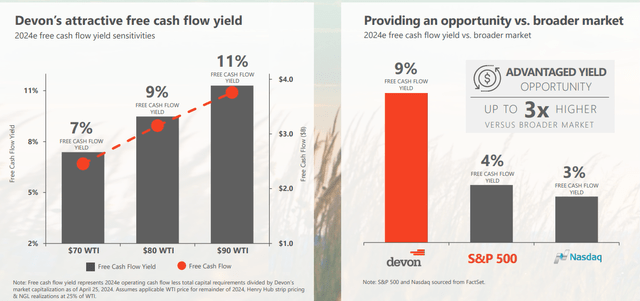

Still, DVN sports a free cash flow yield on a trailing 12-month basis of close to 9% while its dividend yield is 1.7%. The firm notes that it’s targeting 70% cash return to shareholders in 2024 and is prioritizing its $3.0 billion share repurchase program. In terms of the balance sheet, Devon’s management team says it is focused on retiring debt and increasing cash balances.

EPS Seen in the $5 to $6 Range Through 2026

Significant Free Cash Flow Generation

If we assume normalized EPS of $5.50 and apply the stock’s 5-year average of 10.8, then shares should trade near $59. While that is a lower valuation compared to when I last reviewed the company in late 2023, it still leaves plenty of room for upside.

DVN: Still a Compelling Value Story

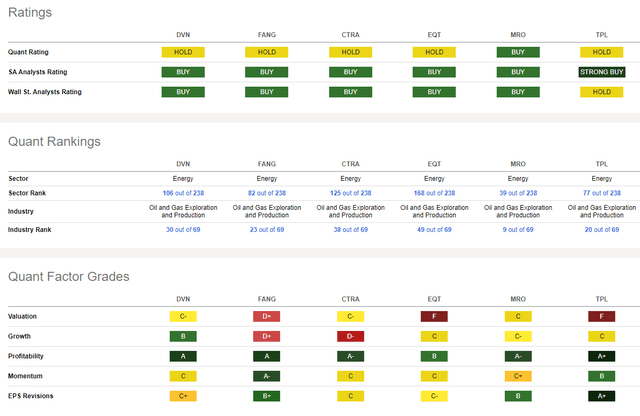

Compared to its peers, Devon sports a soft valuation rating, but its growth trajectory is healthy. What’s more, profitability trends are very strong. But after a lackluster last two years of price action, DVN is by no means a momentum stock, even after the notable rally from $40 to $55 during the February through early April stretch.

Competitor Analysis

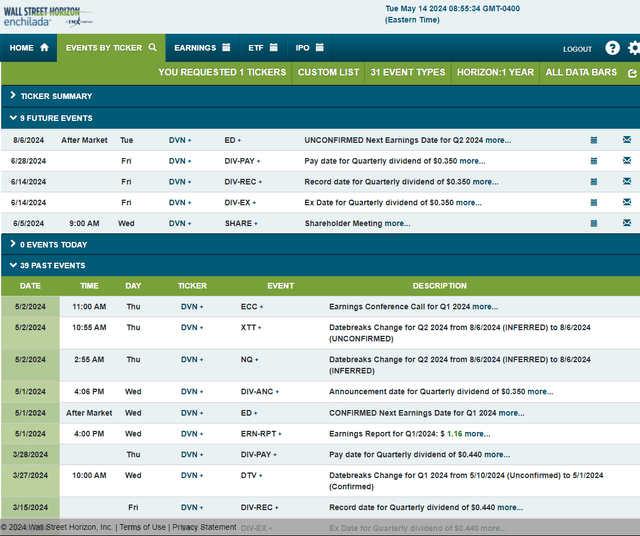

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q2 2024 earnings date of Tuesday, August 6 AMC. Before that, the company holds its annual shareholder meeting on Wednesday, June 5, which could also draw some stock price volatility. DVN trades ex a $0.35 dividend on June 14.

Corporate Event Risk Calendar

The Technical Take

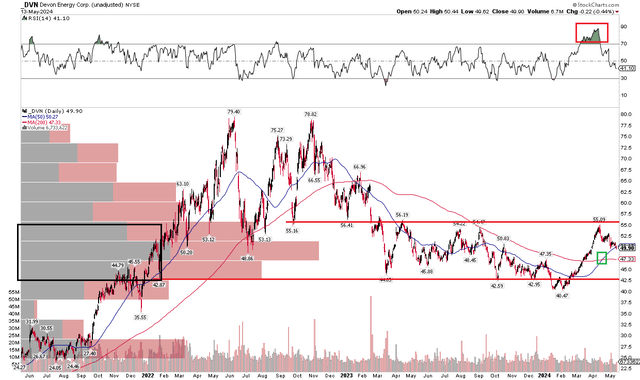

With a mixed fundamental situation, marked by an uncertain earnings outlook but shareholder accretive moves, DVN’s chart has undergone some improvement. Notice in the graph below that a bullish false breakdown took place under the $42 mark. The stock then rallied to resistance in the mid-$50s as the RSI momentum oscillator stretched to extremely overbought conditions.

Also take a look at both the short-term 50-day moving average and the long-term 200dma. A bullish golden cross pattern occurred, whereby the 50dma moved above the 200dma. Furthermore, the 200dma has gone from negatively sloped to flat, suggesting that the bears have lost some control over the primary trend. Still, $55 remains important resistance and a key test for the bulls.

Overall, the chart has turned range bound after a protracted downtrend off the June 2022 all-time high.

DVN: Bullish False Breakdown Leads To a Test of Resistance, Flat 200dma

The Bottom Line

I reiterate a buy rating on Devon Energy. I see shares as undervalued, but with a mixed earnings forecast. DVN’s momentum has generally improved, though, perhaps setting up for a bullish base and higher prices down the road.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.