Summary:

- Devon Energy shares have dropped significantly since October 2022, but are trading at less than 10 times earnings with a 19.3% FCF yield.

- The acquisition of Grayson Mill assets is expected to boost DVN’s production, earnings, and FCF, making it one of the largest domestic onshore upstream producers.

- DVN’s valuation is cheap, trading at 7.92 times 2024 earnings and almost yielding 5% on the dividend, making it an attractive investment opportunity.

PM Images

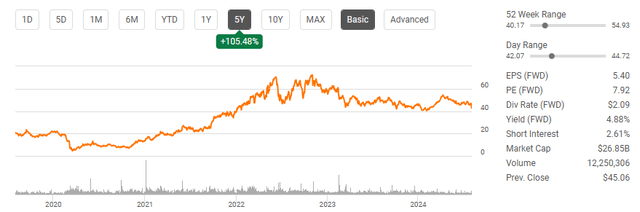

While shares of Devon Energy (NYSE:DVN) are up 105.48% over the past 5-years, its share price is significantly lower than its 2022 highs. Since October of 2022, shares of DVN have lost -40.40% of their value after falling from $71.79 to $42.49. Over the past year, shares have tried to rebound as they made it back into the mid $50s, but since April, shares of DVN have been stuck in a downward spiral as they retraced by more than 22%. I think there is an opportunity here as DVN is trading at less than 10 times earnings, and has a free cash flow (FCF) yield of 19.3%. I think the deal to acquire Grayson Mill’s Williston Basin business will prove to be beneficial for shareholders as the demand for energy is expected to increase over the coming years. AI has kept technology companies in the headlines, but there are likely to be 2nd and 3rd derivative investments that will benefit from the expanding infrastructure to support AI. I think oil and gas companies have been cheap for some time, and as the Fed starts to cut rates, investors may become more interested in the sector as they carry strong dividend yields and trade at low valuations. As the demand for energy grows, I think we could see further consolidation in the oil patch and a premium valuation placed on DVN’s assets.

Seeking Alpha

Following up on my previous article about Devon Energy

I previously wrote an article about DVN back in July of 2022 (can be read here), and since then, this investment hasn’t worked out. Shares of DVN have declined by -15.60% while the S&P 500 increased by 41.40%. DVN’s dividend hasn’t been able to pad the losses, as the total return when the dividend is factored in has been -12.88%. I had discussed why I felt DVN’s concept of allocating more FCF to the dividend as profitability expanded would be bullish in addition to their future drilling prospects. Since then, we have had a lot of challenges in the macroeconomic environment, and shares of DVN have not responded well. I am following with another look at DVN heading into Q2 earnings because I still believe there is a lot of future potential for shares of DVN.

Risks to investing in Devon Energy

DVN is an upstream production company in the oil and gas industry, so there are always headwinds to consider. Political headwinds about drilling are always a consideration, especially heading into an election year. DVN faces external competitive factors as billions of dollars are being poured into R&D to advance renewable forms of energy. There is also commodity pricing risk to consider, and crude oil is trading at $73.52 per barrel, which is well off its 52-week high of $94.99. As pricing declines, it will impact DVN’s margins and potentially impact future wells from coming online. If the global demand for oil and gas shifts, that could also be a headwind to consider, as upstream production could see reduced demand. While I think the oil and gas industry is undervalued in general, there are many external forces trying to reduce our carbon footprint, and there are a number of scenarios that could negatively impact the sector from an investment perspective. Anyone who is interested in making an investment in DVN should consider these risk factors.

The Grayson Mill acquisition is coming at a great time, and this should benefit shareholders in the future

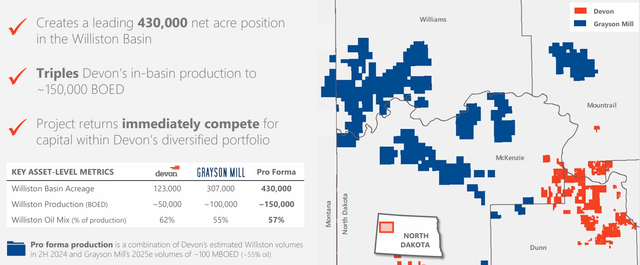

DVN hasn’t just underperformed the market, it’s underperforming its peers as well, considering The Energy Select Sector SPDR Fund ETF (XLE) is up 5.44% YTD while DVN is down -4.83%.DVN’s acquisition of the Grayson Mill assets in the Williston Basin will transform DVN’s asset base in the region. After tripling DVNs production in the region to 150,000 BOED, the deal immediately became accretive to the financials. The newly acquired assets are expected to expand DVN’s earnings, cash flow, FCF, and net asset value (NAV) from day 1. DVN is acquiring the Grayson Mill assets at less than 4x EBITDAX, and at an $80 WTI price point, DVN’s FCF would expand to 15%. DVN’s senior leadership team and board of directors are extremely bullish on the deal and have increased the share buyback program by 67% to $5 billion through the middle of 2026.

The deal also enhances the scale of DVN’s operations and creates synergies throughout their North Dakota asset base. DVN will now own and operate 430,000 acres in the Williston Basin as they add 407,000 acres. This will boost its production by 100,000 barrels of oil equivalent per day, of which 55% is oil in 2025. By incorporating these assets into DVN’s network, they should create $50 million in annual savings while increasing their total oil production to 375,000 bpd and reaching an average of 765,000 barrels of oil equivalent across their portfolio. This deal will make DVN one of the largest domestic onshore upstream producers in the oil patch as it expands its footprint and production. There will also be future opportunities to expand production as there is substantial growth potential with future drill sites within Grayson Mills acreage. In an economic landscape where the demand for energy is increasing, this deal should be celebrated as it should increase shareholder value by improving DVN’s financial performance, boosting its overall production, and increasing future drilling opportunities.

Devon Energy

I am very bullish on this deal because it will add significant assets to DVN’s infrastructure as we enter a time when more energy will be needed. On the recent Meta Platforms (META) earnings call, Mark Zuckerberg discussed how their Llama 4 model will need 10x the amount of compute to train compared to their Llama 3 model. He also increased the bottom end of their 2024 CapEx spend to $37 billion from $35 billion and announced that there will be significant CapEx spending in 2025 as they support AI research and product development. On the Alphabet (GOOGL) conference call, Ruth Porat (GOOGL CFO) discussed how they spent $13 billion on CapEx, which was largely due to technical infrastructure, and when they look ahead, they expect to spend at least $12 billion per quarter for the rest of the year. We’re currently living through an AI arms race, and the weapon everyone is fighting over are GPUs from NVIDIA Corporation (NVDA). According to Forbes (can be read here), every data center that powers AI utilizes the same amount of power as a small city, and there are estimates that 21% of the energy produced globally will be utilized by computing and communications technology. By 2027 there are expectations that Nvidia will ship 1.5 million AI server units annually and their Blackwell product line is expected to be introduced at the end of August when NVDA reports earnings.

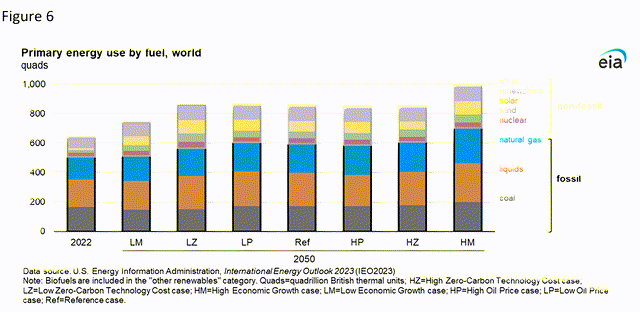

Prior to all of the CapEx being allocated to GPU’s the U.S. Energy Information administration (EIA) released their International Energy Outlook in October of 2023, and in every reference case through 2050, they expect the amount of energy needed on a global scale to expand in both fossil fuels and non-fossil fuels. Natural gas and oil are expected to grow their footprint and when I look through the EIA’s Annual Energy Outlook, which was released in March 2023, it indicates that domestic production of oil and gas will expand through 2050. When I cut through the noise and look at the data, it looks like we will need more energy, and fossil fuel production in the U.S. will expand over time. This is why I am very interested in DVN here, as they are expanding their footprint, production, and earnings potential. There is likely to be a big increase in demand, and that could cause DVN’s NAV to be valued at a premium or a larger company, such as one of the supermajors to take an interest in expanding their operations by acquiring DVN. I think this is an interesting time to invest in the oil patch, and DVN is a name that could gain a lot of interest as the months progress.

EIA

I am bullish on Devon Energy’s valuation and capital allocation heading into earnings

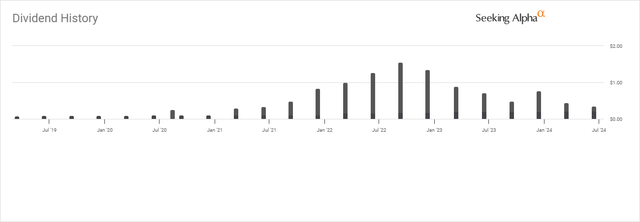

At the upcoming earnings call, I expect management to discuss the acquisition they just announced and how it will be accreditive to DVN’s overall business. DVN has been paying a special dividend in addition to the regular quarterly dividend since the beginning of 2021, and in the past 12 months, they have returned $2.05 to shareholders. This is a yield of 4.79% based on the current share price. In 2024 alone, DVN paid $0.44 in quarterly dividends and an additional $0.35 in special dividends to its shareholders. The acquisition is expected to also be accretive to the DVN’s dividend payout in 2025, so I would expect to see the quarterly dividend increase and potentially see an increase in the special dividends as well. Management is very pro-shareholder when it comes to dividends and buybacks, and I think investors who are looking to redirect capital from the sidelines will get interested in a dividend policy that pays a larger dividend when FCF increases, especially with a company such as DVN.

Seeking Alpha

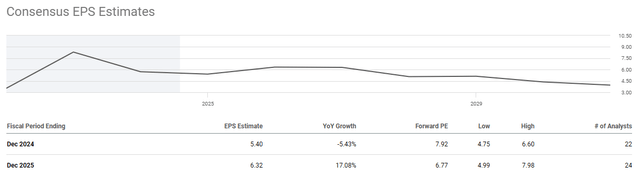

It’s going to be interesting to see how DVN’s valuation changes when the deal finalized, but heading into the closing of the acquisition, I think that the valuation is extremely cheap. DVN trades at 7.92 times 2024 earnings and 6.77 times 2025 earnings. There is a tremendous amount of value in DVNs shares for investors and potentially for a larger company looking to expand their on-shore operations. DVN operates in the top basins, including the Eagle Ford, Delaware, Anadarko, Powder River, and Williston Basin. From a valuation standpoint, pre-acquisition, DVN is generating $14.41 billion in revenue and operating at a 53.95% gross profit margin and a 30.88% operating margin. I think that shares are significantly undervalued, especially as buybacks are being increased and shares are almost yielding 5% on the dividend.

Seeking Alpha

Conclusion

I am looking forward to DVN’s upcoming earnings and think that shares are near a bottom. Since breaking through the $40 level in 2022, shares have retraced several times but found a floor at $40. I think that as analysts get more information on the Grayson Mill acquisition, we will see upgrades hit the street as the deal supercharges DVN’s production in a time when fossil fuel expansion is expected. DVN’s 30.88% operating margin generates large amounts of FCF that support buybacks, dividends, and debt repayments. They have many high-quality assets, and there has been an underinvestment in the oil and gas sector, so a premium could be placed on their assets in the future. I think their fixed dividend with a variable special dividend will be very beneficial over the next 5-years as DVN has a lot of opportunities to increase FCF and bring new wells online.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.