Summary:

- Devon Energy is undervalued with high profitability, trading at less than 8 times forward earnings and 9 times FCF, making it an attractive investment.

- DVN’s strong Q2 performance, increased production guidance, and enhanced capital return program, including a $5 billion buyback, support a bullish outlook.

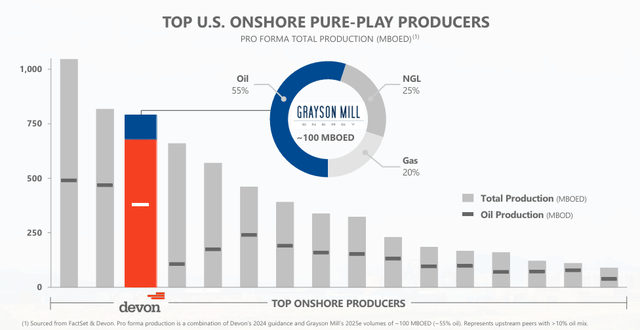

- The Grayson Mill acquisition adds significant assets, boosting production capabilities and profitability, positioning DVN for future growth.

- Despite political and economic risks, DVN’s efficient operations, high margins, and growing dividends make it a compelling choice for dividend income and capital appreciation.

PM Images

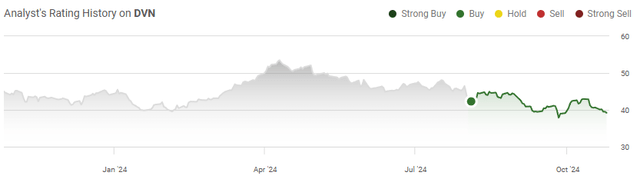

2024 started well for Devon Energy Corporation (NYSE:DVN), which made new 52-week highs of $55.09, but since April, shares have declined almost -30%. I thought the bleeding would have stopped in August as shares got close to $40, but since then, shares have dipped below $40 at least 4 times. This used to be a strong level of resistance, as $40 was tested several times in January and February, and then again in August. Now, the big question is whether earnings will provide enough firepower for shares to get back above $45 or if shares will retrace further into the $30s. Short Sellers have been increasing their bearish bets against oil and gas recently as crude fell into the mid $60s, and commodity traders are waiting to see if Saudi Arabia and other OPEC+ members will increase production in December. While oil production state side continues to operate at all-time highs, Saudi Arabia is producing around 18% less oil than in the summer of 2022. I believe that the uncertainty around OPEC+ is an opportunity for investors to grab DVN at an attractive valuation and dividend yield. DVN is firing on all cylinders and has become a major player in several of the most sought-after basins. I believe that DVN will come in with a strong earnings report as oil spent the majority of the quarter above $70 and a decent amount of time above $75 per barrel.

Following up on my previous article about Devon Energy

In my previous article about DVN (can be read here), I discussed why I felt DVN was interesting heading into Q2 earnings. DVN was trading at $41.44 when the article was released, and since then, shares have retraced by -5.43% while the S&P 500 has increased 12.75%. After the dividends are taken into account, DVN’s total return is still -4.38%. My investment thesis revolved around the Grayson Mill acquisition and the synergies it would create with DVN’s asset base. I wanted to update my thesis heading into Q3 earnings as the macroeconomic environment has changed a bit, and we have more data from upstream producers to digest. I am upgrading my view on DVN to very bullish because of how profitable their asset base is and because of their ability to return capital to shareholders. I think there is an opportunity in the energy sector, and DVN is an interesting play in American energy.

Risks to investing in Devon Energy

While I am bullish on DVN, there are several risk factors to consider. I try not to get political in my articles, but there are political risk factors that should be considered by both sides of the aisle. If we have a change in administration, many people think it would be great for the oil and gas industry, but I am not so sure about that. Former President Trump has been very vocal about reducing regulations and increasing drilling activity for liquid gold. Oil has been a significant part of his message, as he wants to lower energy prices and utilize our oil reserves as a tool to reduce debt. During the Trump administration, pre-covid, oil didn’t get above $75 and spent a significant amount of time below $60. Oil Supermajors such as Exxon Mobil (XOM) traded for well under $100 per share, and their revenues were nowhere near where they are today. The combination of OPEC+ potentially increasing oil production and a new administration making it easier for upstream producers to increase their drilling capabilities could negatively impact the price of oil, which could lead to lower share prices for exploration and production companies.

On the other side of the aisle, Vice President Harris seems to have changed her stance on the oil and gas industry, and while she has been vocal in the past about banning fracking, it looks like she is taking the approach of not being in a position to depend on foreign oil. Whether this holds true or not, only time will tell, but the oil industry could find itself under pressure if a Harris-Walz administration is elected. There could be increased regulations and investments into green energies, including additional incentives for solar and EVs. Outside of the political risk factors, we could see an economic slowdown, which decreases the demand for energy in addition to other sources becoming more abundant, such as nuclear, which reduces the cost of energy. I am bullish on DVN, but these risk factors should be considered in an investment thesis.

Devon Energy came in with a strong Q2 and I think they will beat on the consensus estimates in Q3

DVN proficiency was on full display in Q2 as they beat the consensus estimates on the top and bottom line. DVN generated $3.92 billion in revenue, coming in $30 million ahead of estimates, as it produced 13.6% YoY growth to the top line. This allowed DVN to generate $1.41 in Non-GAAP EPS when the street was looking for $1.27. DVN reached an all-time high throughout Q2 as their oil production came in at 335,000 bpd, which exceeded their guidance by 3%. This provided DVN with the ability to deliver $1.5 billion in operating cash flow from its asset base, which was an increase of 9% YoY. On a profitability level, DVN generated $587 million in free cash flow (FCF) and $844 million in net income after expenses. DVN’s ability to generate large amounts of cash from its operations puts it in a position to reinvest in itself while returning more capital to shareholders.

DVN allocated $828 million toward its upstream capital spending program during Q2. This allowed DVN to place 114 gross-operated wells online at an average lateral length of 9,300 feet. The capital allocation program, which averaged 22 operating drilling rigs and 6 completion crews, was a big reason its asset base was able to increase oil production by 3% YoY. When its oil production is combined with the rest of its operations, DVN averaged 707,000 Boe per day during Q2. This came in at a 7% increase in production YoY, and DVN is increasing its 2024 production forecast to a range of 677,000 – 688,000 Boe per day, which is the second guidance increase this year. DVN will look to increase its capital spending in Q3 to around $900 million with a goal of producing an average of 325,000 bpd, which is at the upper end of its guidance.

The Greyson Mill acquisition was huge for DVN as it will add over 300,000 net acres with 500 undrilled locations in the Bakken and Three Forks locations. DVN acquired Greyson Mill for $5 billion, which was funded by 65% cash and 35% stock. This deal should continue to enhance DVN’s profitability and commodity mix. Currently, DVN’s production costs in Q2 averaged $12.25 per Boe, which was a 1% reduction from Q1. DVN has a solid cost structure that allows them to operate at 56.47% gross margins with a profit margin of 38.58%. With the price of oil remaining above $70 for the majority of Q3, I believe that DVN will come in with better-than-expected results, considering they are raising production guidance and lowering their production expenses. From a long-term perspective, I believe that the acquisition of Greyson Mill will allow DVN to significantly increase its output while recognizing further synergies and cost-cutting initiatives across the combined company.

Devon Energy looks significantly undervalued compared to other upstream producers and continues to return a tremendous amount of capital to shareholders

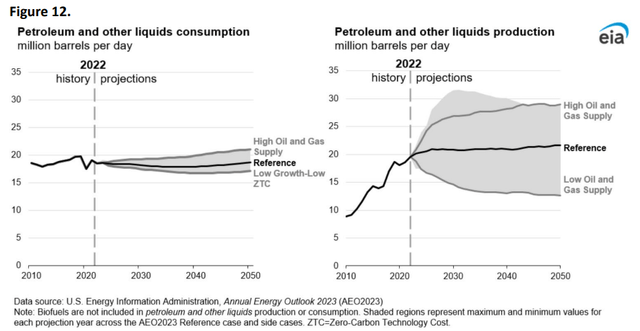

I am bullish on the oil patch because as the global population grows and the energy demand increases, we will likely need more energy from several sources. I don’t think the U.S. Energy Information Administration (EIA) took into consideration the impact AI would have on data center growth when the last study was released. In the latest International Energy Outlook, which was published in October 2023, the EIA projected that global GDP will double through 2050. This is expected to increase the amount of energy needed to facilitate global activity by 1/3rd. The EIA is also projecting that petroleum and other liquids will see increased production through 2050 in their latest reference case, and in a high oil and gas supply scenario, we could see almost a 50% increase in production across the board.

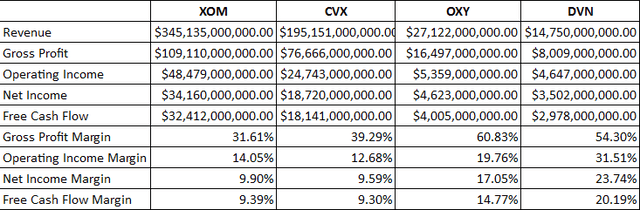

I’m looking for upstream producers that are efficient at driving profitability from their asset base, with growth capabilities on the horizon. I compared DVN to Exxon Mobil (XOM), which I am a shareholder in, Chevron (CVX), and Occidental Petroleum. From a profitability standpoint, DVN is much more efficient than the larger producers on a TTM basis. XOM generated $345.14 billion in revenue over the TTM, while CVX generated $195.15 billion, OXY generated $27.12 billion, and DVN generated $14.75 billion. DVN had the 2nd largest gross profit margin of 54.30% as they trailed behind OXY’s 60.83%. DVN shined in profitability as they operated at a 31.51% margin, drove 20.19% FCF from each dollar generated, and had a 23.74% bottom-line profit margin. OXY was the next best company, with an operating margin of 19.76%, a FCF margin of 14.77%, and a net income margin of 17.05%. Both XOM and CVX operated at less than a 15% margin and didn’t exceed a 10% margin in either profitability metric. From an efficiency standpoint, DVN is operating at high margins, which, I believe, will allow it to increase profitability and its return of capital to shareholders.

Steven Fiorillo, Seeking Alpha

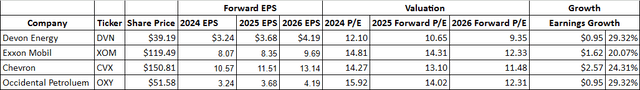

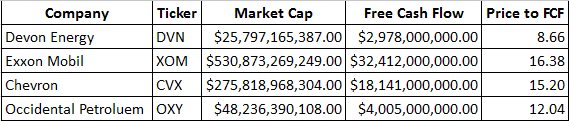

When I look at valuations, DVN looks very undervalued in addition to being the most profitable on a percentage basis. DVN is expected to generate $4.96 of EPS in 2024, placing them at a forward P/E of 7.9. XOM, CVX, and OXY are trading at P/E ratios ranging from 14.27 to 15.92. DVN is expected to grow its EPS over the next 2 years by 7.26% to $5.32 in 2026, placing its 2026 forward P/E at 7.37. When I look at these companies based on FCF, DVN trades at 8.66 times its current FCF while OXY trades at 12.04 times, CVX trades at 15.20 times, and XOM trades at 16.38 times. DVN has the least growth on the horizon, but the estimates may not include the Grayson Mill assets. Even if they do, I think that paying less than 8 times earnings and 9 times FCF is a steal for DVN.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

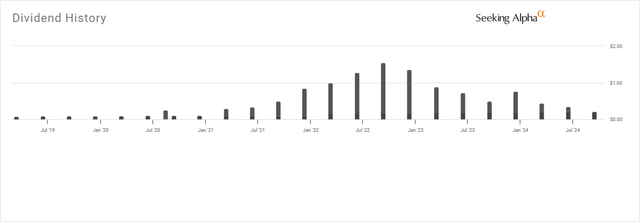

In Q2, DVN repurchased 5.2 million shares for $256 million, then paid $138 million in fixed dividend payments and an additional $138 million in variable dividend payments to shareholders. The board increased its share buyback program by 67% to $5 billion, which should be very positive for shareholders as it will add to the 54.7 million shares repurchased since 2021. There is now $2.3 billion remaining in DVN’s buyback program, and each share they repurchase will improve their forward EPS and reduce the amount of capital allocated toward dividends. Currently, DVN is paying a base dividend of $0.88 per year, which has been increased for the past 6 years. DVN has been paying special dividends from its FCF since 2020, and since 2021, the special dividends have been every quarter and have also increased YoY. I think that DVN is in a great position to increase the amount of capital allocated to shareholders as profitability increases.

Conclusion

Investing in the oil patch isn’t for the faint of heart, but DVN looks like an exciting investment as it trades around its 52-week lows. DVN’s operations exceed a 50% gross profit and 20% profit margin. Their ability to drive profitability out of each dollar is significantly better than that of the supermajors, and there could be a lot of growth on the horizon after the Greyson Mill deal closes, which could lead to a rerating. DVN is trading at less than 8 times forward earnings and 9 times the FCF it produces. I think that the shares are inexpensive for the profitability of DVN. DVN increased its production guidance for 2024 while increasing its buyback program. DVN has a forward dividend yield that exceeds 5% when the special dividends are factored in, and the dividends continue to grow. I think that DVN can be a good investment for dividend income and capital appreciation as the demand for energy increases as the years progress.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I plan on starting a position in Devon Energy before Q3 earnings

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.