Summary:

- Devon Energy is a $25.5 billion market cap oil E&P company. Its base dividend yields 2.3%, and it also repurchases shares and has paid a variable dividend in the past.

- Devon is operating well, and its results will be enhanced as it begins reporting production and reserves from its $5 billion Grayson Mill acquisition.

- However, the company is disadvantaged by the near-zero prices for its substantial volumes of Permian basin natural gas.

grandriver

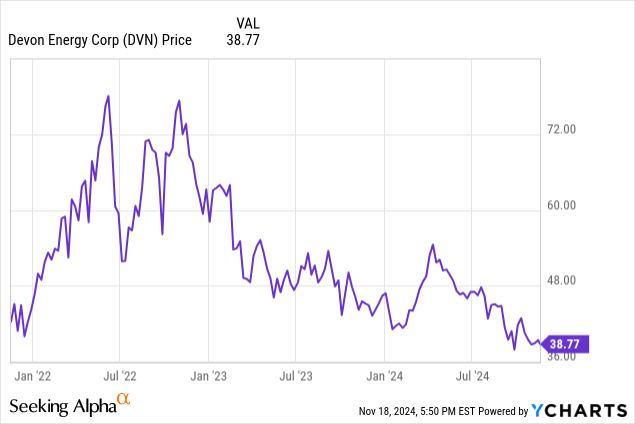

I am ranking Devon Energy (NYSE:DVN) as “hold.” I like its efficient drilling operations and its acquisition of Bakken producer Grayson Mill is a non-obvious and beneficial move. However, Devon is exposed to relentless price pressure for its Permian natural gas production. Moreover, its fixed dividend is paltry. While the variable dividend has provided outsized returns in prior years, this policy seems to be fading as the company redirects free cash flow toward share repurchases instead.

Value investors might note the company is at the low end of its 52-week range at a time when much of the rest of the market is extraordinarily high. Devon also has attractive current and future price/earnings ratios.

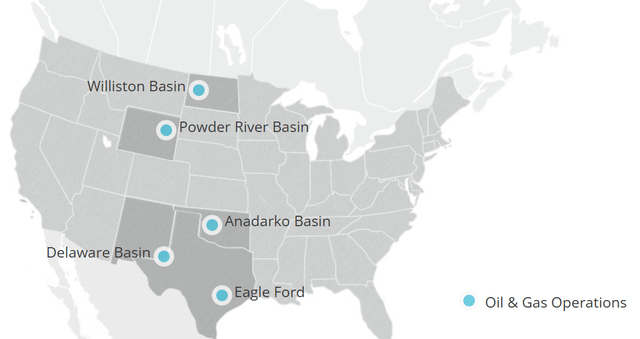

www.devonenergy.com/operations

Macro

The results of the election, with Chris Wright proposed for the head of the US Department of Energy and the Elon Musk/Vivek Ramaswamy team looking at government efficiency suggest potential big changes. Chris Wright is better known as the CEO of pressure pumping (fracking) oil field services company Liberty Energy (LBRT). Moreover, with North Dakota (think Bakken) governor Doug Burgum nominated for Department of the Interior and Lee Zeldin for head of the Environmental Protection Agency, the shift toward less onerous, (and less costly) but more effective and efficient energy regulation is expected.

Most immediately, lifting the permitting pause on liquefied natural gas terminal construction would widen opportunities for US producers to supply consumers in Europe and Asia.

Overall, the expectation is that Trump policy will be to encourage affordable energy additions, by incentivizing more hydrocarbon supply AND demand.

As Trump encourages global conflict reduction, oil prices may decline. However, with AI increasing the demand for electricity (and in the near term thus for natural gas), natural gas prices could firm.

From the Federal Reserve side, interest rates continuing at current levels would continue to set a high competitive bar vis-à-vis dividends.

Devon’s Grayson Mill Acquisition

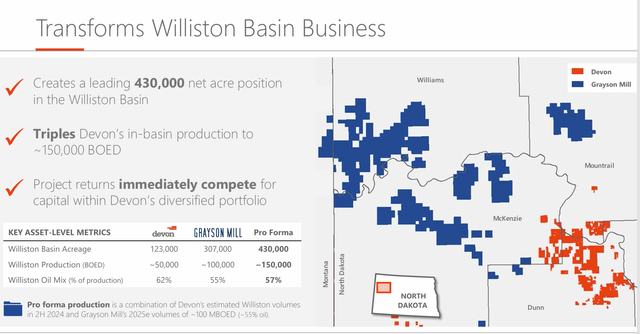

On July 8, 2024, Devon Energy announced that it was acquiring the private (and private-equity-backed) company Grayson Mill Energy for about $5 billion, consisting of $3.25 billion in cash and $1.75 billion in stock. The acquisition closed September 27, 2024, and had an effective date of June 1, 2024.

Grayson Mill is a significant Bakken (North Dakota) producer: the acquisition moves Devon from tenth to fourth largest in the Bakken basin. Grayson Mill’s production will be included in 4Q24 results and forward: at the time of the announcement, it was estimated to add 100,000 BOE/D of production, 55% oil.

The acquisition includes 307,000 net acres at an average 70% working interest, along with 500 gross locations and 300 re-frac opportunities. So altogether Devon has a 430,000 net acre position in the Bakken and has tripled its production there. Per the company, Devon will have an inventory life of ten years at a 3-rig development pace.

Devon will also benefit from Grayson Mill’s midstream assets: 950 miles of gathering systems, a disposal well network, and crude storage terminals.

investors.devonenergy.com

3Q24 Results and Guidance

In the third quarter of 2024, Devon reported net earnings of $812 million or $1.30/share, compared to 3Q23 net earnings of $910 million or $1.43/share.

Operating cash flow totaled $1.7 billion. Free cash flow was $786 million.

In 3Q24, Devon averaged 728,000 barrels of oil equivalent (BOE) per day, of which 46% (335,000 BPD) was oil, 27% was natural gas liquids, and 27% was natural gas. About two-thirds (488,000 BOE/D) of the production came from the Permian Delaware sub-basin.

The company had 20 drilling rigs and 5 completion crews working.

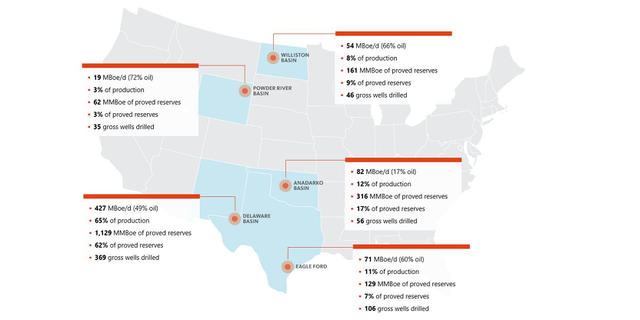

By basin, Devon’s 3Q24 production was:

- as noted, Permian 488,000 BOE/D, 47% oil

- Eagle Ford 75,000 BOE/D, 59% oil

- Anadarko 82,000 BOE/D, 16% oil

- Williston Basin 60,000 BOE/D, 57% oil

- Powder River Basin 19,000 BOE/D, 74% oil

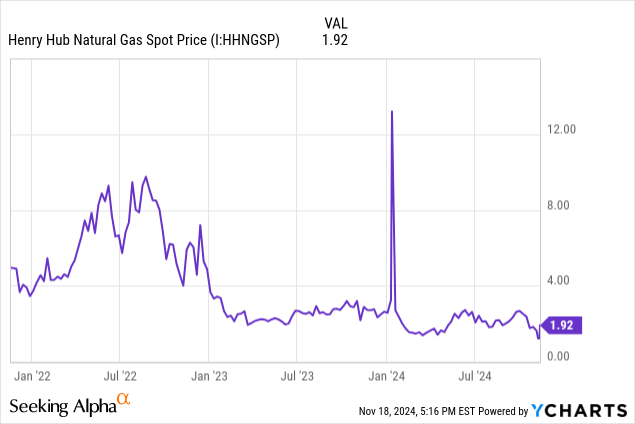

The very serious challenge for Devon Energy in 3Q24 was its Delaware (Permian) basin natural gas price. Natural gas represented 26% of the company’s Permian production of 488,000 BOE/D. However, its average price was a mere $0.04/MCF, down from $1.94/MCF in 3Q23. (With derivatives, the realized price was higher.) And, in truth, the just-above-zero price likely represented several periods of negative prices, as companies with Permian gas, especially in the Delaware sub-basin, have experienced the last several months.

In future quarters, the company will combine its Williston and Powder River production into one “Rockies” number. Also, importantly, future quarters will include the contribution from Grayson Mill.

According to the company, “In the third quarter, Devon issued $2.25 billion of senior notes through a combination of 10- and 30-year offerings and entered into a $1 billion term loan. Proceeds from the senior notes, the term loan and a portion of the company’s cash on hand funded the cash portion of Devon’s previously announced Grayson Mill acquisition.”

For the fourth quarter of 2024, the first to fully include Grayson Mill results, the company expects production to average 811,000-830,000 BOE/D (oil of 382,000-388,000 BPD) and to make capital expenditures of about $915-$985 million.

Notably, the company expects its overall (all basins) natural gas prices will only average 20-30% of the Henry Hub reference price in 4Q24, continuing to be dragged down by the Permian gas price.

Although production numbers are larger, this diagram from the company’s February 2024 10-K shows relative sizes of operations by basin, pre-Grayson Mill.

Devon Energy 10-K

Oil and Natural Gas Prices

EIA Short-Term Energy Outlook

EIA’s Short-Term Energy Outlook

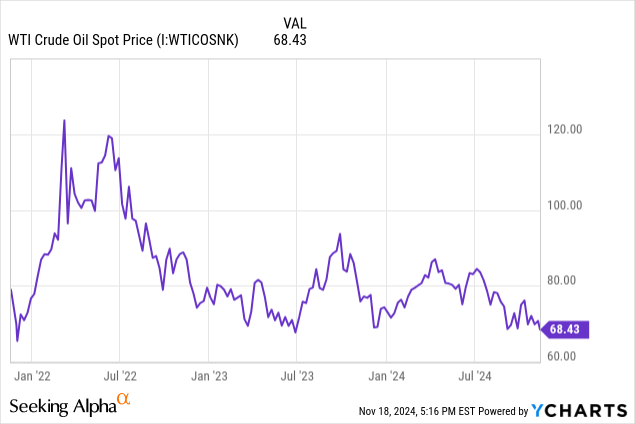

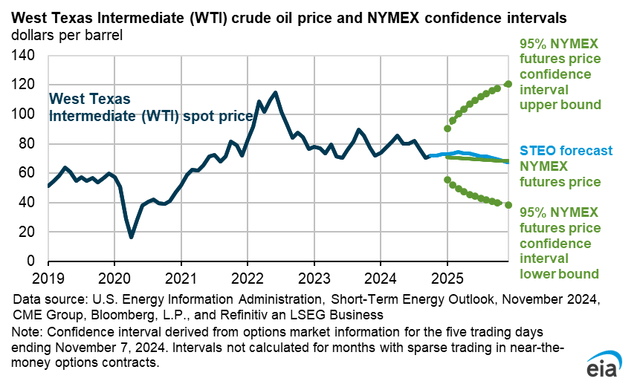

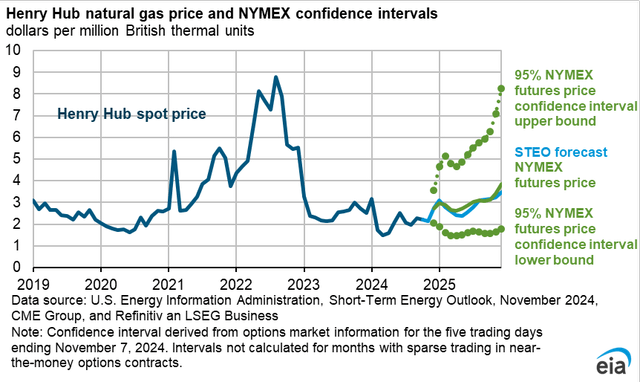

On November 17, 2024, West Texas Intermediate oil futures price (for December 2024 delivery) was $69.16/barrel. The Henry Hub natural gas futures price, also for December 2024 delivery, was $2.95/MMBTU.

The 5-95 confidence interval chart above shows a year-end 2025 WTI price range between $40/bbl and $120/bbl and a year-end 2025 Henry Hub gas price range between $1.80/MMBTU and $8.20/MMBTU.

Natural gas prices have been affected by relative oversupply and by the Biden administration pause on new LNG terminal permits. For Devon and companies like it operating in the Delaware sub-basin, there is an added issue of limited takeaway (pipeline capacity), despite the opening of the 2.5 BCF/D Matterhorn Express. The often-struggling Waha (west Texas) gas price, which is frequently NEGATIVE (e.g. a cost), was -$0.83/MMBTU on November 13, 2024. Even this was an increase of +$1.63/MMBTU since the prior week’s price was -$2.46/MMBTU.

Reserves

The SEC PV-10 metric for Devon’s reserves at year-end 2023 was $19.3 billion. This compares to a reserve value of $31.3 billion at year-end 2022.

Note that this value and these volumes do not reflect recently acquired Grayson Mill reserves.

The prices used for the calculation were lower than the previous year:

$76.29/bbl for oil vs. $93.53/bbl the prior year;

$1.74/MCF for natural gas vs. $5.41/MCF the prior year;

$20.43/bbl for natural gas liquids, vs. $34.58/bbl the prior year.

Of the 1.817 billion BOEs of year-end 2023 proved (developed and undeveloped) reserves, oil was 786 million BOEs or 43%, natural gas liquids were 500 million BOEs or 28%, and natural gas was the remaining 29% (3.182 trillion cubic feet or 530 BOE).

Competitors

Devon’s headquarters are in Oklahoma City, Oklahoma.

Because Devon operates in the Eagle Ford (south Texas), Bakken/Williston (North Dakota), the Delaware sub-basin of the Permian (west Texas), the Powder River Basin (Wyoming), and the Anadarko (Oklahoma), it competes with virtually every US E&P company.

As well, companies in the Midland sub-basin of the Permian compete with those like Devon that operate in the Delaware sub-basin.

Governance

At November 1, 2024, Institutional Shareholder Services ranked Devon’s overall governance as a 2, with sub-scores of audit (6), board (1), shareholder rights (7), and compensation (2).

In this ranking, a 1 indicates lower governance risk and a 10 indicates higher governance risk.

On October 31, 2024, shorts were 3.3% of the stock float. Insiders owned a small 0.74% of shares.

Devon’s beta of 2.07 indicates significant volatility relative to the overall market, aligning with the fluctuations in oil and gas prices.

On September 30, 2024, the three largest institutional stockholders, some of which represent index fund investments that match the overall market, were Vanguard (11.5%), Blackrock (7.3%), and State Street (6.1%).

Blackrock and State Street are signatories to the Net Zero Asset Managers initiative, a group that manages $57.5 trillion in assets worldwide and which limits hydrocarbon investment via its commitment to achieve net-zero alignment by 2050 or sooner.

Financial and Stock Highlights

At a November 18, 2024, closing price of $38.77/share, Devon’s market capitalization is $25.5 billion. This closing price is near the low end of the 52-week range of $37.77-$55.09/share (70% of the 52-week high) and 75% of the one-year target of $51.46/share.

Trailing twelve months (TTM) earnings per share (EPS) is $5.40 for a price/earnings ratio of 7.2. The averages of analysts’ 2024 and 2025 EPS predictions are $4.79 for both years, for a forward price/earnings ratio of 8.1.

Trailing twelve months’ operating cash flow is $6.67 billion and leveraged free cash flow is -$1.57 billion.

TTM return on assets and equity are very good at 10.7% and 26.3%, respectively.

On September 30, 2024, Devon had $15.8 billion of liabilities including $8.9 billion in long-term debt and $30.3 billion of assets for a liability-to-asset ratio of 52%.

The company’s dividend and share repurchase policy is described separately below.

Average analyst rating is 2.1, or “buy,” from thirty analysts.

Dividends and Share Repurchases

Devon’s dividend policy is fixed-plus-variable, an additional way—as with share repurchases–of dealing with volatile oil prices. For 2024, the total dividend was $1.45/share or 3.7%. The fixed portion of the dividend is $0.88/share annually, or 2.3%/year

Specifically, the variable dividend is up to 50% of quarterly excess cash flow. “Excess cash flow” is defined by the company as operating cash flow less capital expenditures and the fixed dividend. As a glance at 2024 quarterly dividends shows, “variable” means variable, from $0.22/share in one quarter to no variable dividend payment in another.

At the same time the company announced its acquisition of Grayson Mill in July, it also announced that it was increasing its share repurchase authorization by 67% to $5 billion. At March 31, 2024, it had repurchased $2.5 billion of shares. In its most recent earnings call, the company indicated that it would be leaning more into share repurchases than variable dividends.

Notes on Valuation

Devon’s book value per share of $21.70 is well below the market price, indicating positive investor sentiment.

As noted, SEC PV-10 reserve value was $19.3 billion on December 31, 2023. Market capitalization is $25.5 billion. Enterprise value is $33.8 billion. The ratio of enterprise value to EBITDA is very much a bargain at 4.4, far below the maximum of 10.0.

Positive and Negative Risks

Investors should consider their oil and natural gas price expectations as the factors most likely to affect Devon. Devon is most profoundly affected by its large Permian position—including substantial production of low-priced natural gas. Overall, generally, competition in the Permian is especially fierce.

The change in energy policy under the new administration is a positive risk. The direction toward lower regulatory costs, more supply, and the encouragement of demand will allow better long-term, sustainable planning for all energy sources.

As with any merger or acquisition, Devon faces the challenges of integrating Grayson Mill’s operations.

Although the positive risk of the variable dividend is that it provides a cushion against changeable oil and gas prices, Devon appears to be moving toward a preference for share repurchases rather than large variable dividends.

Despite the opening of the Matterhorn Express, Permian natural gas takeaway capacity remains tight, pushing gas prices toward, and below, zero. Moreover, Permian gas oversupply may continue as oil (and associated gas) volumes increase, companies seek to limit any flaring or emissions, and the wells themselves gradually develop higher gas-oil ratios, as happens when they mature. The west Texas gas price at Waha to which Devon, like APA Corp. (APA) is exposed is particularly discounted relative to the Henry Hub futures price, and has frequently been negative (e.g. a cost).

Recommendations for Devon Energy

This is a challenging call that really depends on an investor’s assessment of the trajectory of Permian natural gas prices. While LNG export and electricity growth fueling due to AI data centers—and even European preference for US LNG, along with a change toward more even-handed regulation of hydrocarbons relative to other energy sources are all positives, Devon’s stinging exposure to the low West Texas gas price (and the quite ferocious Permian competition) remains a negative.

Still, investors shouldn’t overlook the hidden asset value of private-company Grayson Mill that will start becoming apparent in 4Q24 results and the SEC year-end reserve values.

Devon is at the low end of its 52-week stock price range. It has attractive price-earnings and EV/EBITDA metrics. Yet, the company’s fixed dividend is only 2.3%, and it is orienting away from its variable dividend and toward share buybacks.

I rank Devon as a hold. Investors may want to revisit if Permian gas takeaway constraints ease, or in the spring when natural gas prices trend seasonally lower and after a few quarters of Grayson Mill results.

I own Devon stock.

www.devonenergy.com

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.