Summary:

- Devon Energy is relatively undervalued compared to peers, giving it upside potential from a P/E multiple expansion perspective.

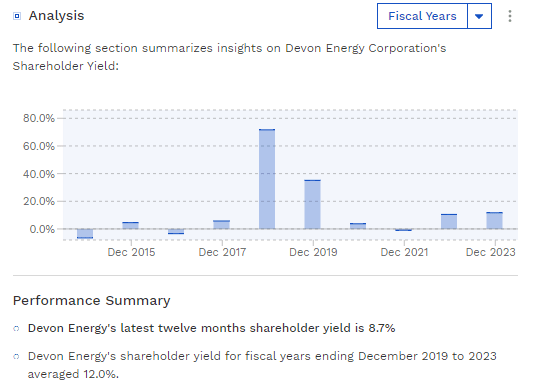

- The company returns significant capital to shareholders via buybacks, dividends, and debt paydown, with a TTM shareholder yield of 8.7%.

- Despite high profitability and Devon’s low breakeven price for WTI oil, the outlook for oil prices is not bullish enough to get me excited.

- Despite the positives and the stock being at a support level, I prefer waiting for an even higher yield before investing in order to compensate for oil’s volatility.

bjdlzx

Devon Energy (NYSE:DVN), an oil and gas exploration and production company, is roughly 50% off its 2022 high. Is it undervalued now? Relatively speaking, yes. Still, while there’s potential for respectable returns from DVN stock based on its relative undervaluation, generous capital returns (a shareholder yield near 9%), and technical setup, I rate the stock as a Hold because I personally only invest in cyclical oil stocks if the opportunity is very obvious to me. Right now, it’s just not obvious enough.

On top of that, while natural gas prices are expected to rise nicely in the next few years, oil prices are forecast to remain relatively steady. Since most of the company’s revenue comes from oil, that doesn’t make me confident in a sustained rebound.

However, I do think DVN is a decent energy stock based on its high net income margin and its low breakeven price for WTI oil, along with the capital returns mentioned above. Further, the company’s acquisition of Grayson Mill Energy is expected to boost its free cash flow. Overall, it’s not a horrible stock, but I’d still prefer a yield that’s a few percentage points higher to compensate for the volatility of oil prices. Without further ado, let’s get into the details.

I Like That Devon Energy Returns Lots Of Capital To Shareholders

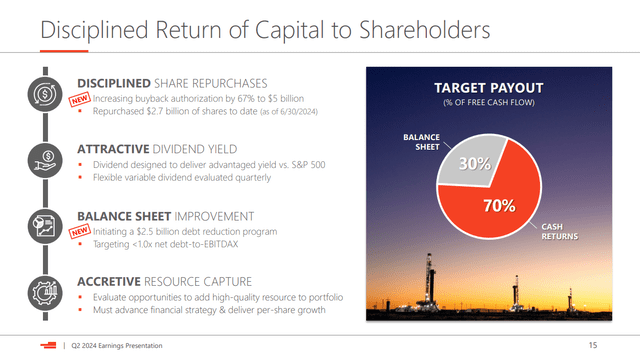

Devon Energy returns capital to shareholders via share repurchases, a regular dividend, a variable dividend, and debt paydown. Its target is to return 70% of its free cash flow to shareholders and allocate the remaining 30% to its balance sheet. Last quarter, it increased its buyback authorization from $3 billion to $5 billion. For reference, its market cap is $26.4 billion.

Devon Energy’s Capital Returns (Q2-2024 Investor Presentation)

As the stock has trended lower, management has become more keen on buying back shares (as it should). In the Q2 earnings call, Devon’s CEO said, “Certainly, the way our equity is priced, we just think it’s a great opportunity right now to be leaning in on the buyback.”

Then, Devon Energy’s CFO, Jeff Ritenour, said it makes sense for the company to spend $250 million per quarter on buybacks. Quote:

…We think the – our bias is going to continue to be to lean in on the share repo. Our approach to that has been to be consistent quarter-after-quarter. We think somewhere in that $250 million kind of spend per quarter makes the most sense. The variable dividend falls out of that, right, as a function of the free cash flow we generate in each period. We take some back to the balance sheet. We make sure we’re paying our fixed dividend and growing that over time. And then the balance is going to be dedicated to the share repurchase program.

He then went on to say that the closing of the Grayson Mill acquisition (which closed last month) would add to the company’s cash flow, allowing the company to think about expanding the size of its repurchases. Just keep in mind that a higher amount of repurchases will likely bring with it a lower variable dividend.

But even if the repurchases stay at $250 million per quarter, that gives shareholders a buyback yield of about 0.95% for the quarter, or nearly 4% for a full year, which isn’t bad. Combine this with the dividends and debt paydown, and the capital returns are nice.

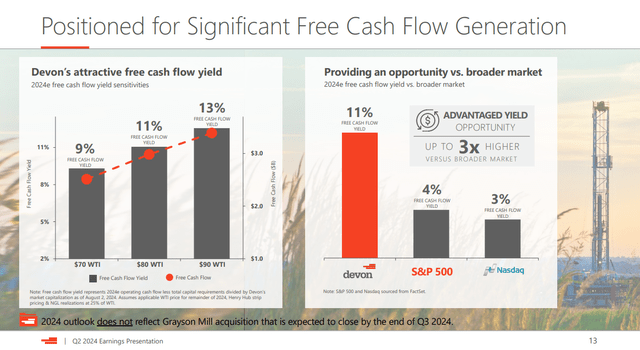

In the last 12 months, its shareholder yield (which takes into account buybacks, dividends, and debt paydown) came in at 8.7%. DVN can afford this, as its TTM free cash flow yield is 11.3%. But it’s worth noting that with oil prices where they are now ($71.37/barrel), the FCF yield will likely drop to 9%, but that’s still high, especially compared to the overall market.

Devon Energy’s FCF Yield Sensitivity (Q2-2024 Investor Presentation)

From Fiscal 2019 to 2023, the shareholder yield averaged 12%. In 2018, it came in at a crazy 71.6%.

Devon Energy’s Shareholder Yield (Finbox)

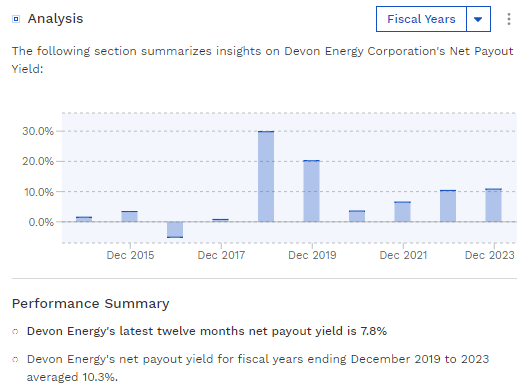

If you remove debt paydown from the equation and just use buybacks + dividends, you get a TTM net payout yield of 7.8% and a 10.3% average from 2019 to 2023. Obviously, these kinds of capital returns can translate to total returns for DVN stock investors over time.

Devon Energy’s Net Payout Yield (Finbox)

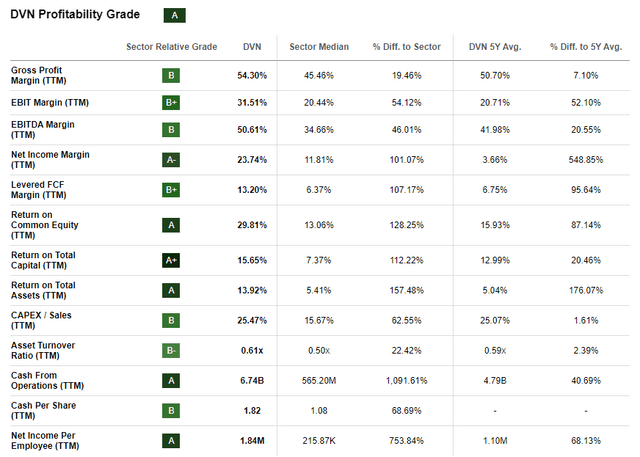

Devon Energy’s High Profitability Is Another Bonus

Devon Energy has good profitability for an oil and gas stock. It has earned an “A” profitability grade on Seeking Alpha. Many of its profitability metrics are better than the section median and an improvement over its own five-year average.

Devon Energy Profitability Grade (Seeking Alpha)

Let’s narrow it down a bit more to six key peers for comparison: ConocoPhillips (COP), Marathon Oil (MRO), Diamondback Energy (FANG), EOG Resources (EOG), APA Corporation (APA), and Occidental Petroleum (OXY). Looking at the figures below, DVN is mostly in the middle of the pack, leading in some metrics and lagging behind in others. However, the numbers are still solid overall.

Devon Energy Peer Comparison (Finbox)

It can achieve this high profitability because its breakeven price for WTI crude oil is around $40/barrel, which is much lower than the current price of crude oil.

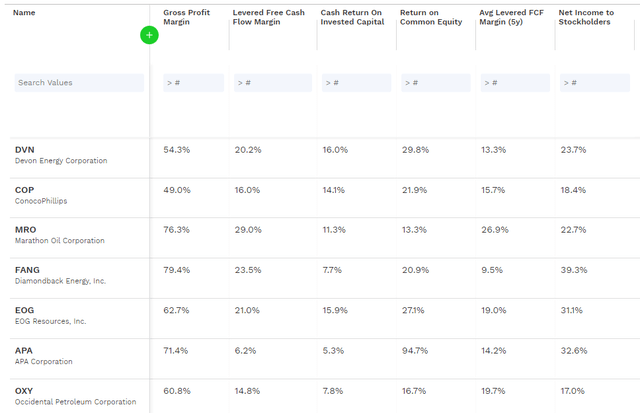

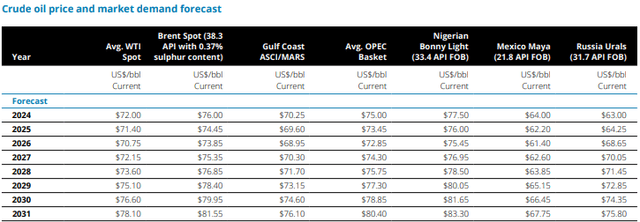

Devon Energy Stock Is Relatively Undervalued

Comparing Devon’s valuation to the same peers listed above shows that it’s relatively undervalued. At one point in 2022, it was close to having the 2nd-highest forward P/E ratio. Now, its forward P/E of 7.74x is the 2nd lowest out of the seven companies.

And it’s not as if companies like MRO, EOG, and FANG, which have higher valuations, are expected to grow much quicker. EOG is estimated to see EPS declines of 1.3% and 2.25% this year and next year, respectively. MRO’s EPS is expected to fall by 8.1% this year and then rebound by 3.8% next year. Diamondback Energy is expected to see a 5.4% decline followed by a 0.4% increase. Meanwhile, DVN’s EPS is expected to fall by 9.2% this year and then remain roughly flat in 2025.

Does that justify such a low valuation relative to peers? Perhaps not. Maybe 9x (or even 10x, as The Asian Investor said in his last DVN stock article) is more reasonable. Therefore, I see upside potential from a relative value standpoint.

DVN Stock Is At A Diagonal Support. A Bounce Could Be Near

Below is DVN’s stock chart (unadjusted for dividends). When looking at it, I couldn’t help but notice that drawing a trendline would connect many points. Right now, it’s supporting off a downward diagonal trendline. This suggests that a short-term bounce could be in the cards. Also, the chart has formed a multi-year flag pattern, which is generally seen as bullish. If it breaks out to the upside (peep the smaller diagonal line I drew), then that could be the start of a longer-term uptrend.

Still, DVN stock’s performance is highly dependent on oil prices remaining elevated or climbing higher. Below, I discuss the outlook for oil.

A Caveat: The Outlook For The Oil Market Doesn’t Inspire Confidence

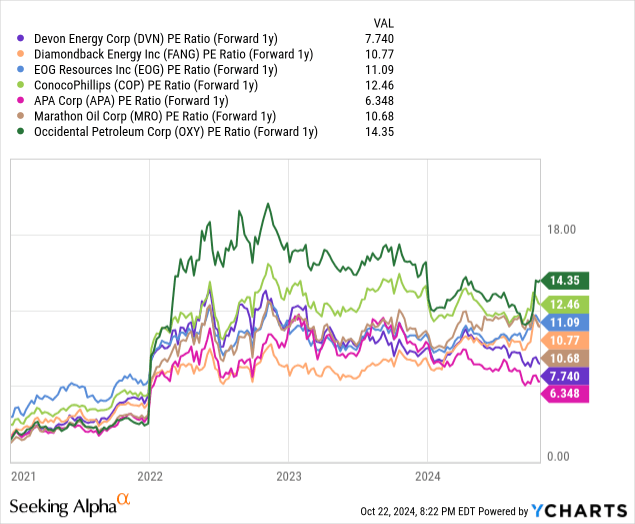

Currently, WTI crude oil trades at $71.37/barrel, as mentioned earlier. The U.S. Energy Information Administration projects an average price of $72/barrel in Q4 and $73.13 in 2025. That’s not much of an increase.

Similarly, Deloitte forecasts an average WTI spot price of $71.40/barrel in 2025 and $70.75/barrel in 2026. The estimates then gradually rise after that, but estimates that far out are probably completely unreliable.

WTI Crude Oil Forecasts (Deloitte)

And obviously, Devon Energy stock is highly correlated with the price of oil. About 82.5% of its total revenue from contracts with customers in Q2 came from oil. If oil prices aren’t expected to sustain much higher prices than where they are currently, then maybe Devon Energy won’t be able to sustain a rebound.

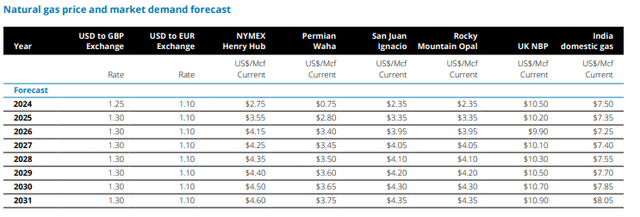

At least, natural gas prices are expected to rise faster. But again, DVN generates most of its revenue from oil, so this won’t move the needle as much.

Natural Gas Forecast (Deloitte)

Nonetheless, it’s important to keep in mind that I’m only using estimates as a guideline, as predicting the price of commodities over a long time frame can be challenging. The actual results from DVN can be materially different from what analysts expect if oil and gas prices unexpectedly change course quickly.

The Takeaway

Overall, I think Devon Energy is a solid energy stock that’s trading at a low price relative to its peers. Also, at current levels, the shareholder yield can continue being near or in the double-digit range, and this is supported by a high FCF yield and the potential for higher FCF due to the recent acquisition.

Additionally, it’s a highly profitable stock, earning an “A” profitability grade, and its chart suggests that a short-term bounce or a longer-term breakout could be in the cards.

However, at the end of the day, Devon Energy’s stock price and profitability are highly influenced by oil prices, which are cyclical. This is something I choose not to expose myself to unless the opportunity is slapping me in the face. Right now, it’s only caressing my face.

The outlook for oil prices is stable rather than highly bullish, and I’d rather wait for an even lower stock price to get in or at least wait for some more clarity on the financial targets post-acquisition before making a purchase. Thus, DVN stock is a Hold for me, although I recognize the value in the stock for those who are bullish on oil.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.