Summary:

- A strong portfolio, operational efficiency, and rising oil prices support Devon Energy, making it a key player in the US onshore market.

- Despite production declines, DVN’s EPS of $1.41 and revenue growth highlight its resilience and potential for future growth.

- Devon’s valuation metrics indicate it is undervalued compared to peers, offering a solid investment opportunity for value-focused investors.

- Risks include commodity price fluctuations, operational hazards, and reserve depletion, but the company’s diversified portfolio and strategic growth mitigate these concerns.

Editor’s note: Seeking Alpha is proud to welcome Shariq Khan as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

spooh

Thesis Summary

Devon Energy Corp. (NYSE:DVN) is a leading independent energy company with a market capitalization of around $24.65 billion, making it a key player in the oil and gas sector. Specializing in the exploration, production, and development of oil, natural gas, and natural gas liquids, the company operates primarily across high-quality onshore regions in the United States, including the Delaware Basin in Texas and New Mexico.

Recently, Devon Energy announced its second-quarter earnings report, which highlighted a slight decrease in production due to lower-than-expected output from key sites. Despite this, rising oil prices have provided support to the stock, preventing a significant decline. The company reported an Earnings Per Share (EPS) of $1.41 in Q2 2024, as strong production volumes and efficient cost management allowed it to enjoy the benefit of rising oil prices in the quarter. Investors remain intrigued by Devon’s strong portfolio and the long-term potential of its production assets, making it a stock worth watching closely in the energy market.

Recent Quarterly Highlights

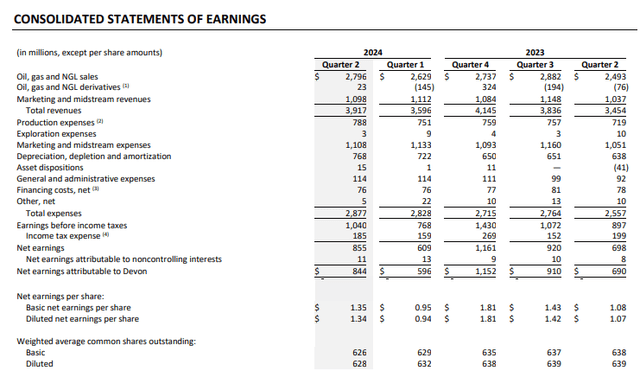

Devon’s revenue in Q2 2024 was $3.9 billion, indicating a rise from $3.45 billion in the same quarter of last year. The company’s net income stood at $844 million, increasing from $596 million in Q1 2024. This led to basic EPS of $1.35, up from $0.95 in Q1 2024 while showing a slight decline from $1.43 in Q2 2023. While revenues have been volatile, the company’s capacity to make steady revenues, and keep expenses in check, gives it a significant advantage. With a slight increase in oil and gas prices, investors may remain optimistic about the rest of the year’s operations.

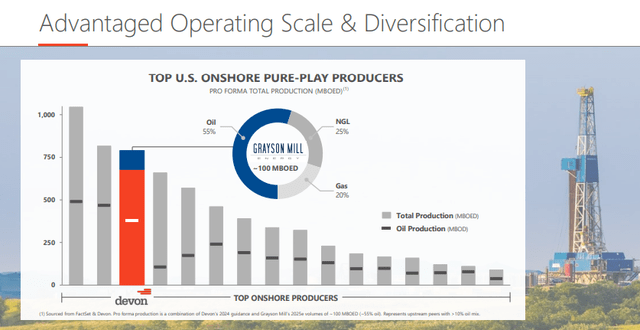

Devon Energy is aiming to become one of the leading players in US onshore production. The company’s production portfolio is well diversified, comprising oil, NGL and gas, with oil accounting for 55% of the production. The recent addition of Grayson Mill, which adds 100 MBOED to the company, has strengthened Devon’s production portfolio and ranked it among the top U.S. onshore pure-play producers. This scale can be achieved with a large operational leverage, which should lead to an increase in efficiency and a decrease in cost in the future when market conditions become more stable.

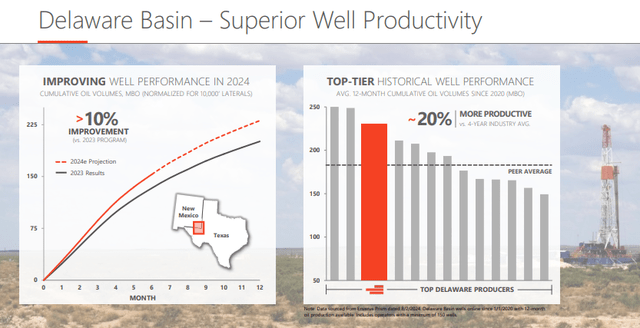

The Delaware Basin remains one of the key growth areas for Devon, as highlighted in the following performance. In the region, performance has been impressive, with a more than 10% increase in the 2024 projections as compared to the 2023 actuals. Such an improvement proves that Devon is capable of enhancing its performance and corresponds to the general trend of the company’s development. Based on performance history, Devon’s wells stand 20% better than the industry average for the past four years. This productivity edge is important, especially as companies struggle to capture market share in the growing shale environment.

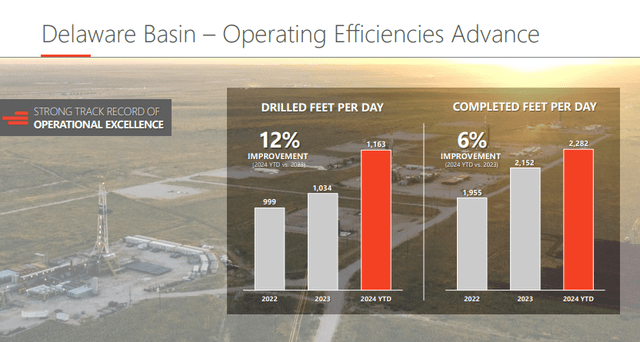

The company’s operational efficiency is well illustrated by Devon’s performance in the Delaware Basin. The company stated that it achieved a 12% increase in drilled feet per day and a 6% increase in completed feet per day for the year 2024 as compared to the year 2023. This operational efficiency goes a long way in cutting the cost per well and cycle times, hence allowing Devon to bring production online. This, coupled with enhanced drilling and completion metrics, is a key to the company’s long-term growth plan and increases its profitability prospects in an unpredictable oil and gas environment.

The Case For Gas And Devon

Now is a great time to begin investing in gas, in my opinion. A steady performance is being portrayed by Devon Energy due to its diverse production portfolio as well as efficiency in the Delaware Basin. Drilling and well completion efficiencies remain major areas of investment for the company, and the results are already starting to show promising signs for future growth. Hence, considering both the acquisitions and the efforts towards increasing productivity, Devon is set to continue as one of the leaders among its US counterparts. There are even more prospects for increasing production and decreasing the costs of maintenance, and thus, investing in Devon will provide good access to the energy sector.

Peer Comparison

In the competitive oil and gas industry, one company that has outperformed the others is Devon Energy, with a forward P/E of 7. 98 and a trailing twelve months (TTM) P/E of 7. 22, which is not as high as some of the other companies we have looked at today; however, it is not too far off either. Relative to its peers such as EQT (EQT) it has a forward P/E of 30. 29, a low P/E ratio indicates that the market has a conservative way of valuing Devon’s earnings. On the other hand, Texas Pacific Land (TPL) has a P/E ratio of 39.46 forward and 40.88 TTM. The company’s premium positioning is probably attributable to its business model. This high variation in P/E ratios within the group suggests that the markets have different expectations of the future growth of these firms.

Based on Price-to-Sales (P/S), Devon’s figure stands at 1. It is on the lower side, which means that it may be undervalued compared to Diamondback Energy (FANG) at 3.45, and EQT at 3.12. Texas Pacific Land, on the other hand, again enjoys a much higher ratio of 27.25, which gives it a special position but at the same time may indicate the presence of overvaluation risks. It is therefore evident that, based on the low P/S of 0.87, investors who pay attention to the company’s revenue efficiency may find Devon’s stock cheaper.

Referring to the revenue growth, Devon has a 3-year CAGR of 23.84% and a 5-year CAGR of 12.48% are solid. However, Coterra Energy (CTRA) has a 3-year CAGR of 50%, which is a notch higher than the average. An analysis of EQT revealed that the company’s revenue also reduced over five years, at a negative 0.63% CAGR, owing to problems it faces in the natural gas industry. As for growth, Devon is not at the very top, but is above the industry average, which makes it a rather safe bet.

Seeking Alpha

From a profitability point of view, Devon has a Return on Equity (ROE) of 29.69%, ranking it among the best, which suggests efficient capital utilization. This ratio is higher than that of rivals such as Diamondback Energy (21.34%) and Coterra (10.20%) but lower than Texas Pacific Land’s 42.76%. Devon’s high ROE is a good sign that it is making good returns on its equity base, which is very important to investors who are interested in profitability.

Lastly, in terms of cash generation, Devon’s leveraged free Cash Flow (FCF) margin of 13.20% aligns well with its peers. It’s slightly behind Coterra (14.28%) and well below Marathon Oil’s (22.02%) stronger margin, but remains comfortably above EQT’s (2.77%). Texas Pacific Land’s exceptional 47.82% FCF margin is the clear leader here, benefiting from its unique asset-light business model.

In summary, Devon Energy has a robust and stable position in the industry as it has moderate debt and valuation levels indicating that the company is not overvalued or overly dependent on debt, which makes it a reliable investment in the energy market.

Valuation

Devon Energy has demonstrated steady financial performance despite fluctuations in the broader energy market. The company’s Non-GAAP P/E (TTM) of 7.11 is below the sector median of 10.01, indicating that Devon trades at a -29.02% discount compared to its peers. Similarly, its forward Non-GAAP P/E of 7.56 remains -31.74% below the sector average of 11.07. These figures reflect that Devon is relatively undervalued, making it an appealing option for value-focused investors.

However, Devon’s Price-to-Sales (TTM) ratio of 1.72 is higher than the sector median of 1.29, presenting a 32.73% premium. This suggests that while earnings are strong, the market is placing a higher value on Devon’s revenue compared to some peers. The company’s forward P/S ratio of 1.61 also shows a 23.15% premium above the sector’s 1.31, indicating expectations for revenue growth or greater revenue stability moving forward.

The forward P/E ratio of Devon Energy is 7.56, while the sector average is 11.07, which means that the stock is undervalued. This could be due to investors’ expectation of earnings volatility in the oil and gas industry, which is always subject to cyclical factors occasioned by fluctuating commodity prices and regulatory factors. The market may consider Devon’s future earnings potential as less predictable, which could explain why the valuation multiple is lower. Also, the P/E ratio could be low due to cost concerns or the requirement of capital expenditure in sustaining production, lowering the expectations for earnings growth.

On the other hand, Devon’s P/S ratio of 1.61 is higher than the sector average of 1.31, which means that the market values the company’s ability to generate revenues more than the sector average. This implies expectations of sustained top-line growth or relatively stable revenues due to Devon’s efficient operations or hedging policies. Investors may be willing to pay more for each dollar of sales because they believe that Devon can continue to produce a steady cash flow regardless of market conditions.

When it comes to income generation, Devon’s Dividend Yield (TTM) of 2.10% falls short of the sector median of 3.93%, reflecting a -46.54% difference. While this lower yield may not appeal to income-focused investors, Devon’s strength lies in its value-driven metrics like its EV/EBITDA (TTM) of 4.10, which is -32.66% below the sector median of 6.09, demonstrating efficient earnings generation. Overall, Devon Energy is a solid choice for investors prioritizing undervalued stocks with strong cash flow and growth potential.

Seeking Alpha

Risks

Like any other resource company, Devon Energy faces potential risks. These include internal challenges, industry-related issues, and external factors beyond its control.

Commodity price fluctuations are a major threat for energy companies like Devon, as they can greatly impact revenue. Operational risks, such as unexpected hazards, are also a concern. Devon’s debt levels could pose a problem, especially during economic downturns.

Another key factor is the depletion of reserves. For a company like Devon, maintaining or growing reserves is crucial to sustaining value.

Devon also operates in a highly competitive market. To stay relevant, it needs to maintain a competitive edge. Other risks could include technological challenges, leadership dependence, infrastructure limitations, legal issues, and economic challenges.

Conclusion

Analysis of Devon Energy’s ratios, risks and relevance reveals that the company has a strong position in the energy sector. Its peer valuation also indicates a balanced standing in the industry. Even though the oil and gas industry’s volatility presents inherent risks, Devon’s debt levels are manageable, and the company enjoys a diversified production portfolio. Overall, Devon’s focus on operational efficiency and strategic growth ensures it remains a promising player, securing value for its investors in the energy market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.