Summary:

- Devon Energy’s shares are consolidating despite rising petroleum prices due to OPEC+ production cuts. Production curbs should lead to improved earnings and free cash flow prospects.

- OPEC+’s decision to extend supply cuts has positively impacted petroleum prices.

- Free cash flow upside translates into stronger capital return potential.

- Devon Energy is undervalued at a P/E ratio of 8.2X and has revaluation upside.

ClaudioVentrella

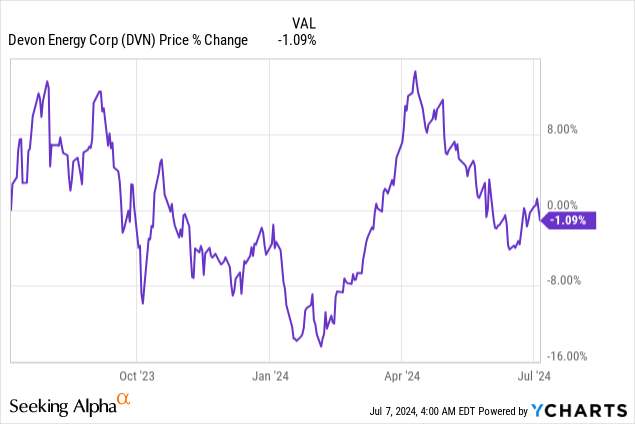

Shares of Devon Energy (NYSE:DVN) started to consolidate in April, although petroleum prices have seen new upward momentum after OPEC+, led by Saudi Arabia and Russia, decided to curb supplies in a bid to support energy markets. As a result, Devon Energy faces improved earnings and free cash flow prospects. In an improving pricing environment, Devon Energy also has the potential to accelerate its capital returns and return more cash to shareholders in the coming quarters. With shares trading at 8.2X forward earnings, Devon Energy is undervalued and has an improved risk profile.

Previous rating

I rated shares of Devon Energy a hold in April after they reached my fair value estimate of $53. New price support from OPEC+ countries, however, and an undeserved consolidation have improved the value proposition for the production company again. In my opinion, significant production curbs on the part of OPEC+ are why the outlook for petroleum prices is better now than at the beginning of the second-quarter. For Devon Energy investors, this could imply accelerating capital returns and a higher dividend going forward.

Shale-oriented production play with potential for free cash flow growth

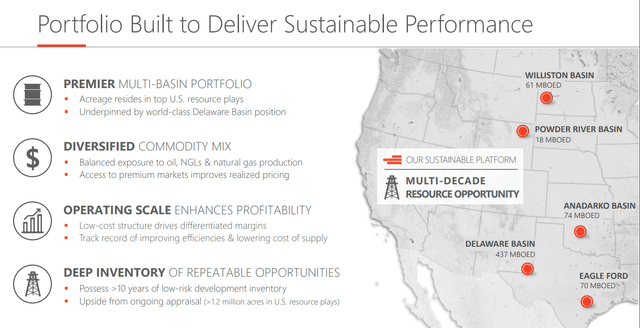

Devon Energy is an independent exploration and production play with considerable investments in key shale locations in the U.S.: the energy company has energy investments in the Williston, Powder River, Anadarko, Delaware, and Eagle Ford basins which creates a multi-year production run-way for the company. The largest production area for Devon Energy is the Delaware basin, which is where the company owns about 400k acres and where it produced 437 MBOED in the first fiscal quarter.

Devon Energy

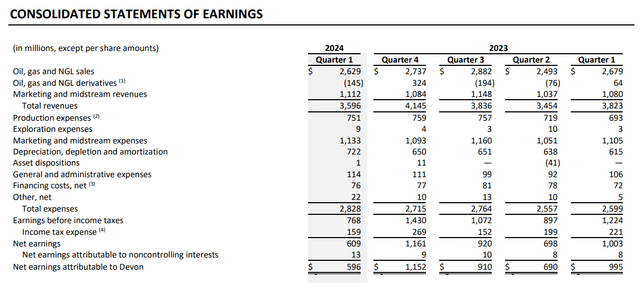

Devon Energy has been consistently profitable in FY 2023 as well as in Q1’24 which is due in large part to the upsurge in petroleum prices following Russia’s invasion of Ukraine in 2022. Devon Energy achieves the majority of its revenues from oil, gas and natural gas liquid sales ($2.6B in Q1’24) and has benefited from higher average prices in its business in 2023 especially.

Devon Energy

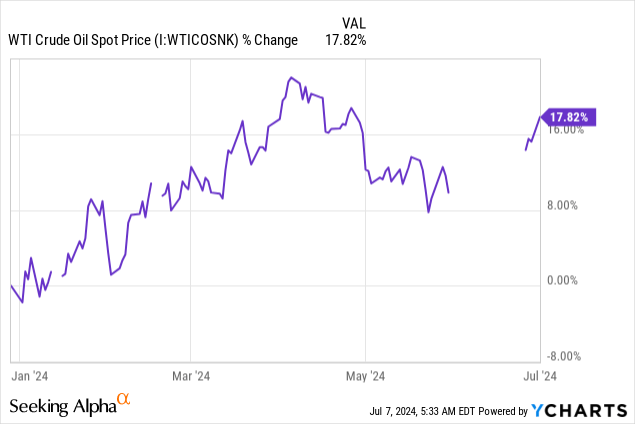

OPEC+ countries, led by Saudi Arabia and Russia, made the decision in the second-quarter to prolong production curbs in a bid to support petroleum prices: OPEC+ said that it would seek to cut 3.7 million barrels per day from supplies until the end of FY 2025. The announcement has had a positive impact on petroleum prices, as one would expect, and WTI petroleum is currently trading at a price above $84 per barrel.

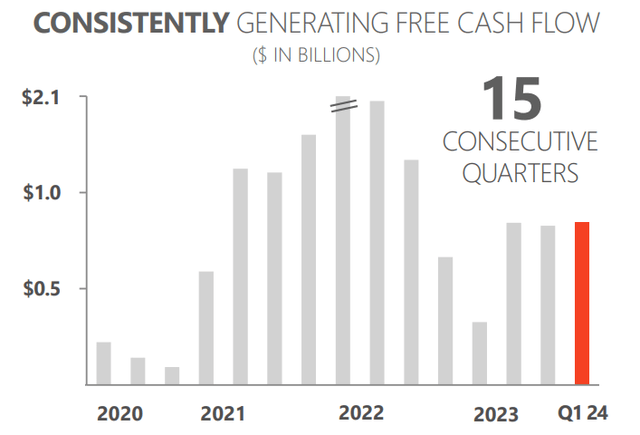

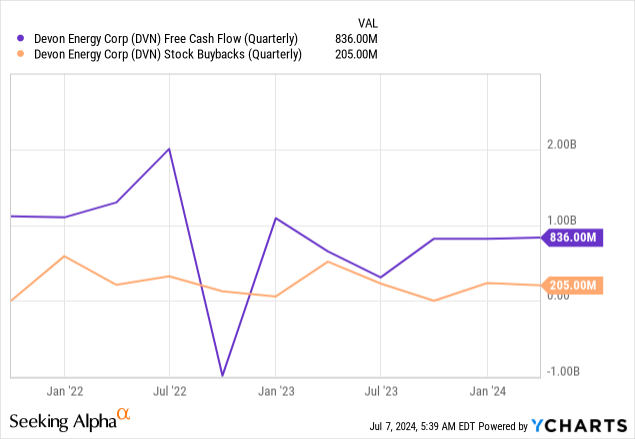

In my last work on Devon Energy, I drew attention to the company’s strong free cash flow profile that is set to become even more attractive in a rising-price market. In Q1, Devon Energy earned $844M in free cash flow, showing 27% year-over-year growth. With OPEC+ limiting supplies, my best guess is that Devon Energy will continue to benefit from upside momentum in its earning and free cash flow. As per the company’s Q1’24 forecast, Devon Energy looks to grow its free cash flow to more than $3.0B in FY 2024, which implies a year-over-year growth rate of 15%.

Devon Energy

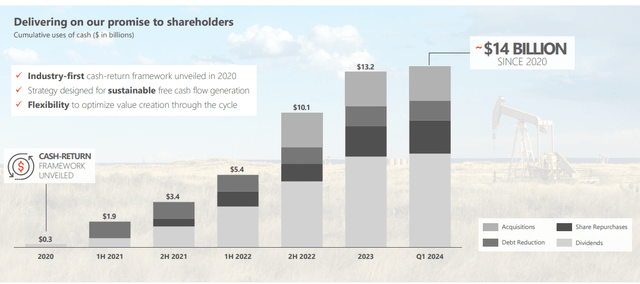

What makes Devon Energy an especially attractive investment choice for investors is that management has committed to accelerating capital returns if prices rise. Devon Energy has a multi-pillar capital return framework in place that includes acquisitions (which are evaluated based off of a transaction’s earnings accretion), debt repayments, stock buybacks and dividends. Since FY 2020, Devon Energy returned a massive $14.0B of its free cash flow to shareholders, the majority of which came in the form of dividends and stock buybacks.

Devon Energy

With the company’s free cash flow now having a potent catalyst, the production company could indeed accelerate its capital returns. This is because Devon Energy has said that it wants to return 70% of its adjusted free cash flow (adjusted for accrued capital expenditures) going forward as dividends (both fixed and variable) and stock buybacks.

Devon Energy’s valuation

I am upgrading Devon Energy back to buy, due to an improving earnings and free cash flow picture in a higher-price world, while at the same time, investors can grab Devon Energy out of the bargain bin for less than they are worth.

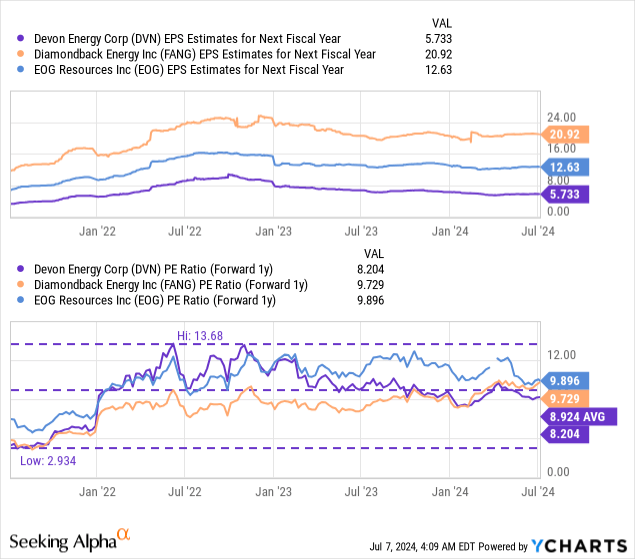

Devon Energy is trading below my April fair value estimate of $53, which, in the context of an improving price environment, is making a rating upgrade to buy necessary. Devon Energy is currently trading at a P/E ratio of 8.2X, while rivals like Diamondback Energy (FANG) and EOG Resources (EOG) trade at a P/E ratios closer to 10.0X.

Devon Energy is also currently trading below its 3-year average P/E ratio of 8.9X, as well as below the industry group P/E ratio of 9.3X. If Devon Energy were to revalue to the industry group average price-to-earnings ratio of 9.3X, shares could have a fair value of ~$53.30 which would be about equal to my previous fair value estimate for DVN. This is a conservative estimate of Devon Energy’s fair value, as shares of the energy producer traded at a near-14.0X P/E ratio at the height of the petroleum price boom in FY 2022.

Risks with Devon Energy

The biggest risk for Devon Energy is a consolidation in the petroleum markets and lower average selling prices for its oil, gas and natural gas liquid products. This, however, does not seem to be an imminent risk, mainly because OPEC+ countries backed firm output cuts in June 2024, which is supportive of prices and indicates lower free cash flow risks. As a result, I believe the overall risk profile for production-focused energy companies like Devon Energy has improved considerably.

Closing thoughts

Devon Energy is a well-run independent exploration and production company and OPEC+’s decision to curb production has had a positive impact on petroleum pricing, which will benefit Devon Energy’s earnings and free cash flow and could potentially lead to an acceleration of the company’s capital returns. Devon Energy has said that it wants to return 70% of its adjusted free cash flow to shareholders, so any boost to FCF would immediately translate to higher dividend payments and stock buybacks, which are a part of Devon Energy’s long-term capital return framework. With shares also trading at a low P/E ratio (as well as below my fair value estimate of $53), I believe the risk profile is skewed to the upside again and shares are worthy of an upgrade to buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.