Summary:

- Devon Energy investors have underperformed the market as investors chased the AI gold mine.

- The energy sector’s underperformance has affected Devon Energy’s buying sentiments.

- Devon has continued to execute well. Management is focused on share repurchases for its capital return strategies.

- DVN’s relative undervaluation to its E&P peers should help mitigate the potential near-term downside.

- I argue why DVN’s bottom is getting increasingly close, improving opportunities for dip-buyers to add more shares.

zhengzaishuru

Devon Energy Stock Has Underperformed

Devon Energy Corporation (NYSE:DVN) investors have underperformed over the past year as the GenAI-driven hype likely saw investors reallocate their positions out of the energy sector (XLE). Notwithstanding its position as a leading US independent E&P player, DVN posted a flat total return over the past year. However, the AI infrastructure players have helped the VanEck Semiconductor ETF (SMH) outperform as investors chase the AI gold mine. Nvidia (NVDA) stock went on a rapid ascent before surpassing the market cap of Microsoft (MSFT) and Apple (AAPL). As a result, NVDA’s meteoric rise has likely helped to mint more NVDA multi-millionaires who kept their faith in the Jensen Huang-led company.

Consequently, the energy sector’s underperformance was broad-based, as the peak in energy prices in 2022 has likely lowered investor confidence markedly. Devon Energy has also not been spared, underperforming the XLE since late 2022. However, I assessed a bottom in DVN, as highlighted in my previous bullish DVN article in April 2024. Despite that, I urged caution, anticipating potential “selling pressure in the near term.” Hence, I’ve not been surprised by the relative underperformance of DVN against the S&P 500 (SPX) (SPY) since my update. Given the recent pullback, have buying sentiments improved sufficiently to convince investors to consider buying DVN’s dips at the current levels?

Devon: Crude Oil Futures Likely Bottomed

Devon Energy’s Q1 earnings release in early May 2024 was solid. Devon posted a disciplined production report and reported remarkable improvements in well productivity. In addition, Devon raised its full-year guidance, anticipating benefits from capacity growth while leveraging its high-quality and low-cost portfolio. Devon Energy also expects to continue focusing on the Delaware Basin, which represents 60% of Devon’s total resource base. With a low $40 WTI (CL1:COM) breakeven oil price, Devon is well-insulated from unanticipated energy market volatility to drive earnings growth. Moreover, Devon telegraphed a 10% capital reduction amid its upgraded production outlook, underscoring DVN’s ability to improve its operating leverage.

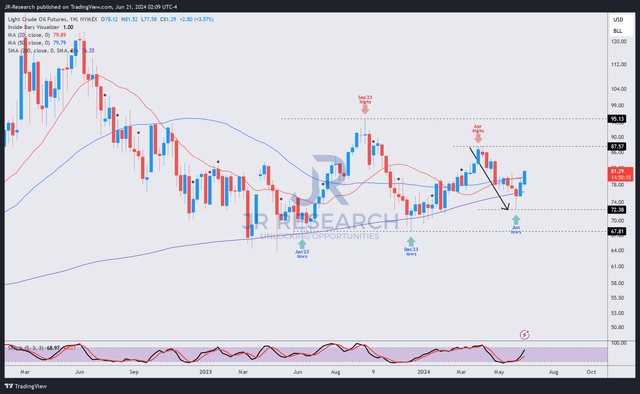

WTI futures price chart (weekly, medium-term) (TradingView)

Devon’s earnings profile is still sensitive to underlying oil price volatility. Management reminds investors that “every dollar increase in WTI translates to approximately $100M of incremental annual cash flow.” As a result, paying close attention to the price action of crude oil futures could unveil clues in assessing DVN’s buying sentiments.

As seen above, Crude oil futures have bottomed above their June 2024 lows ($70 level). Bearish crude oil sentiments attributed to the initial selloff after the recent OPEC+ meeting have reversed markedly. As a result, WTI crude oil futures have also recovered above the $80 level to prices last observed in late April 2024. Therefore, the market’s positioning has remained incredibly robust as I assess WTI crude’s medium-term uptrend bias as still intact.

DVN Stock: Valuation Remains Reasonable

My assessment should improve DVN investors’ confidence in buying the dips. Accordingly, Devon management highlighted its focus on share repurchases in the near term to capitalize on assessed relative undervaluation. Income investors will likely prefer a higher allocation to variable cash dividends. However, total return investors will argue that Devon’s solid balance sheet profile (estimated 2024 adjusted EBITDA leverage ratio of 0.56x) should provide financial flexibility to engage in potentially accretive share buybacks.

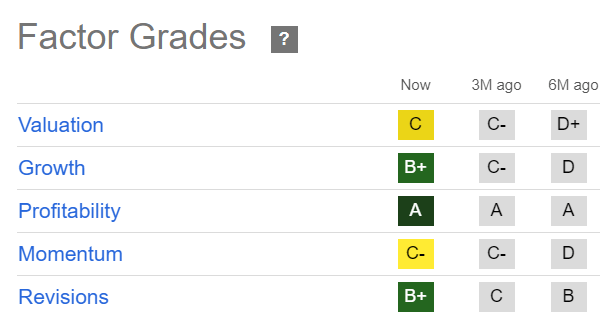

DVN Quant Grades (Seeking Alpha)

DVN is still rated as a growth stock (“B+” growth grade) within the energy sector. Therefore, I assess that its “C” valuation grade is still reasonable. Furthermore, its best-in-class “A” profitability grade underpins the robustness of its fundamentally strong business model.

In addition, DVN’s forward adjusted P/E multiple of 8.7x is markedly below the 10.5x P/E metric of its E&P peers based on consensus forward earnings estimates. Therefore, Devon could see a higher re-rating potential if the underlying oil prices can continue their recovery.

Is DVN Stock A Buy, Sell, Or Hold?

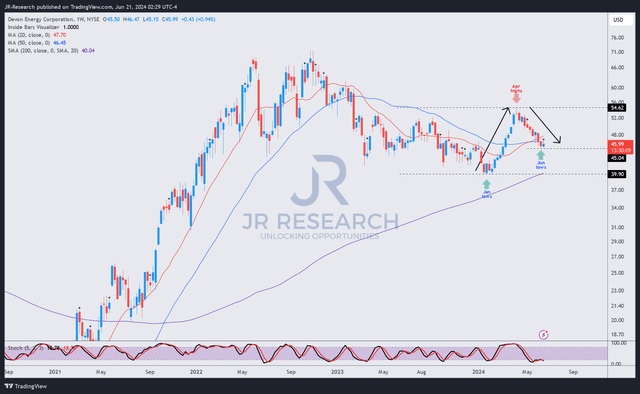

DVN price chart (weekly, medium-term, adjusted for dividends) (TradingView)

DVN’s price chart suggests its recovery thesis has remained on track. DVN is still well above its January 2024 lows while showing signs of bottoming above the $45 level.

As a result, buying sentiments on DVN have demonstrated resilience. It should help improve confidence so that dip-buyers can consider returning more aggressively. DVN’s “C-” momentum grade suggests selling intensity hasn’t intensified, bolstering my confidence that DVN’s $45 bottom is expected to hold robustly.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SMH, MSFT, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!