Summary:

- Devon Energy (DVN) is one of our top choices in the energy sector due to its strong financials, operational efficiency, and attractive valuation.

- The company boasts robust margins, low leverage, and a new strategic acquisition, positioning it well for an inevitable downturn, as well as new top line growth.

- The stock’s valuation is compelling, currently trading with significant discounts on key metrics compared to both peers and historical multiples.

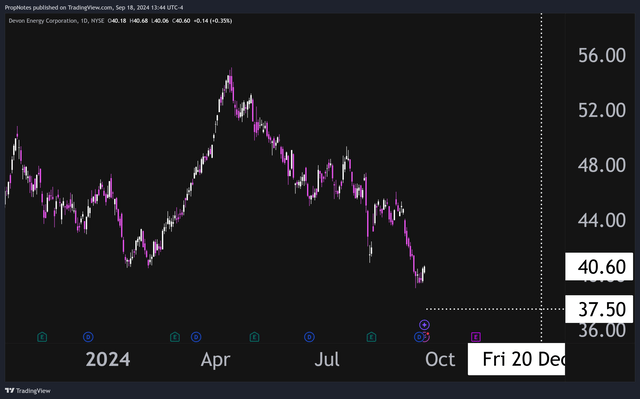

- To boost yield, consider selling the December 20th, $37.50 strike put options for a potential 14.1% annualized return.

- We rate DVN a ‘Buy’.

SimonSkafar

Right now is an interesting time to be considering an investment into the energy sector (XLE).

On one hand, many public oil companies are flush with funds from the recent energy boom. Hundreds of billions of dollars have flowed back to shareholders via buybacks and dividends over the last few years, and many companies have enjoyed strong margins, cash flow, and overall financial results since 2021.

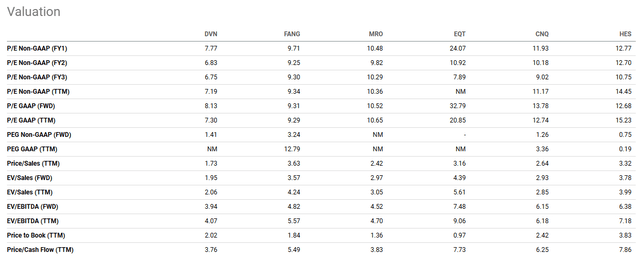

Valuations on these perhaps somewhat ‘elevated‘ financials also appear reasonable, ranging from roughly 7-12x net income across energy majors.

At the same time, the economic outlook isn’t the rosiest it’s ever been, which means that oil demand – and thus prices – could be about to head lower over the next year or so.

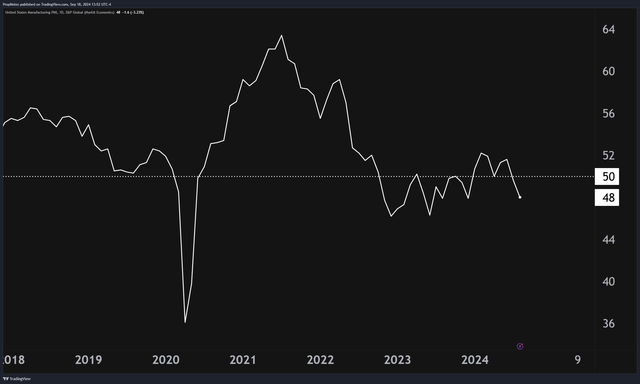

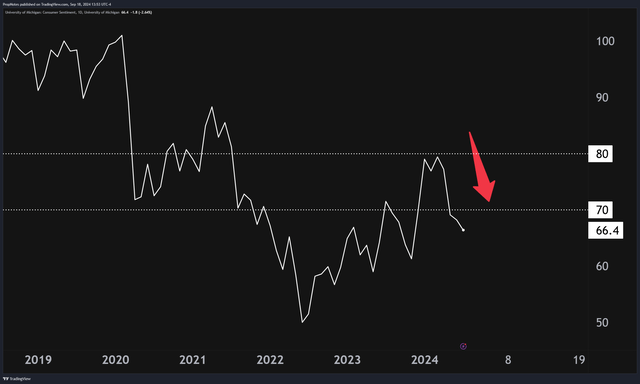

Weak PMIs and consumer sentiment often forecast economic slowdowns, and that’s what we have been seeing over the last couple of months.

If a slowdown does officially ‘arrive’, what would it mean for oil prices? And, by consequence, energy companies? Nothing good.

Thus, from an asset allocation perspective, right now seems like the time to be pulling up stakes from smaller, weaker companies in the space and concentrating capital into the best-of-breed firms that will survive and thrive through the next downturn and beyond.

We believe Devon Energy Corporation (NYSE:DVN) is one of those companies.

With strong margins and ROE, low internal leverage, and a new acquisition that should act as another catalyst for top line growth, we think that DVN is well-positioned to weather the next storm or continue pumping out profits if the sun keeps shining.

Today, we’ll explore DVN, get to know the company a bit better, and explain why we’re bullish on this 5% yielding best-in-class energy exploration and production play.

Let’s dive in.

Devon Energy’s Financials

Let’s start with the financials.

From the top, DVN appears to be a well-run operation.

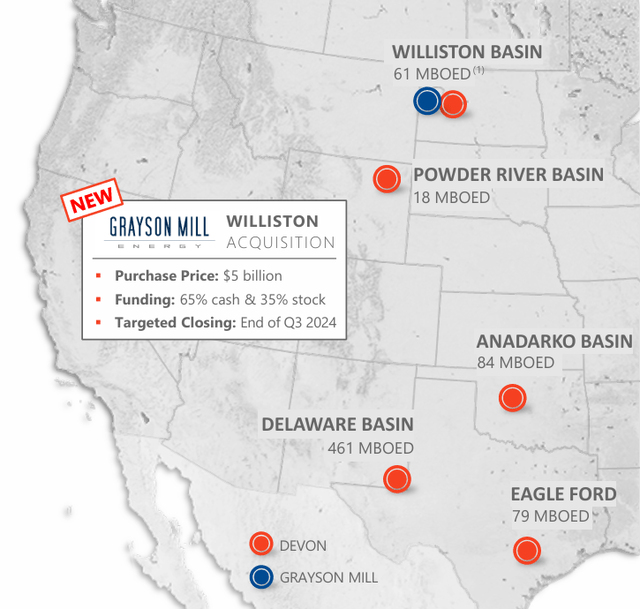

With 5 core U.S. production bases, the company is geographically diversified. Plus, as many of these bases produce both oil and natural gas, the company has exposure to a larger percentage of the energy complex, which should hedge against moves in any single asset produced – WTI, for instance:

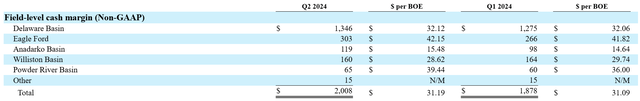

Each of these bases has very strong ‘on the ground’ cash margins, with per-barrel margins in the $20s, $30s, and $40s per BoE, and total gross margins of more than 50%:

This bakes in a lot of operational leverage and gives management significant room to maneuver if energy prices dip. This is one of our favorite things about the company.

Additionally, in the most recent quarter, production growth and margins were bolstered by new well growth, which management was rather excited about:

A key driver of this record-setting oil result was a superb performance we delivered in the Delaware Basin. By leveraging the benefits of a temporary fourth frac crew, we were able to bring online 62 new Delaware Basin wells in the quarter.

Importantly, these efficiencies not only accrue to us in the form of lower well costs, but also save us valuable time and further bolstering our project-level returns.

…

In aggregate, these projects achieved average 30-day rates of more than 2,800 BOE per day with recoveries projected to exceed $1.3 million BOE per well. With improving well costs and impressive performance, I’m confident that this batch of high-impact projects is delivering some of the best returns in the entire U.S.

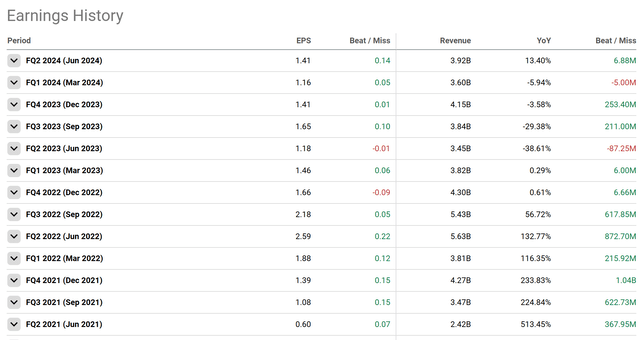

New well performance, alongside solid hedging performance and realized pricing, especially in oil, drove an earnings beat in Q2, alongside a top-line acceleration for the first time since early 2023:

Operational excellence, alongside a solid, efficient asset base, forms the backbone of DVN’s long-term earnings power.

On top of these 5 key production bases, DVN recently acquired Grayson Mill Energy, which is another, smaller producer in the Williston Basin.

Management expects to recognize significant synergies from the transaction and mentioned that the Geoscience team at DVN is excited to have more land to survey in greater depth.

This transaction should also unlock more FCF, which management wants to use to repurchase shares in the open market:

We’re excited about Grayson Mill and getting that closed because that’s going to add some incremental free-cash flow to our company, which is going to allow us to think about even expanding upon that absolute amount of share repurchases that we do on a quarterly basis. So without question, the bias is going to continue to be toward the share repo given what we’re seeing in the market right now.

Finally, when looking at liquidity, DVN is prudently managed. The company has a total debt of ~$6 billion, cash of $1.5 billion, and $1.5 billion per quarter of operating cash flow. We don’t foresee any issues here, even if the price of oil drops.

This, alongside the strong field margins, is another reason why we like the company’s overall financial profile in the event of a downturn.

Devon Energy’s Valuation

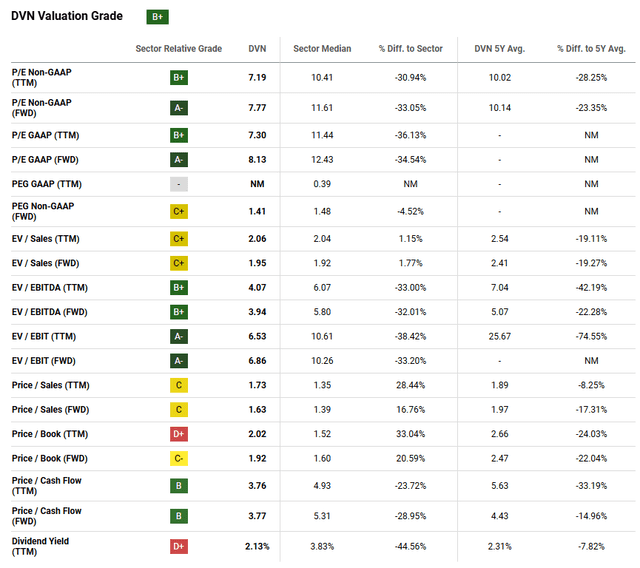

While DVN’s performance has been robust, the valuation appears to be anything but.

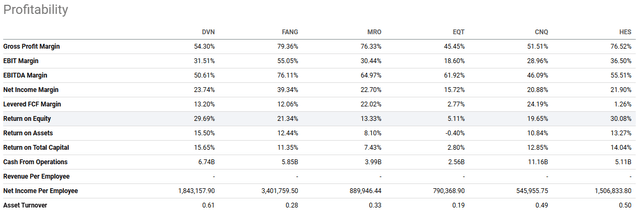

When compared with peers, DVN has some of the strongest profitability metrics around, including the second-best net margin and RoE metrics among the cohort:

At the same time, the company is essentially the cheapest stock of the lot on a number of valuation metrics, including P/E, P/S, and EV/EBITDA:

This shows that the company is a strong relative value, especially considering that trailing growth, when viewed from a macrocycle perspective, should play a smaller part in energy industry stock valuations going forward.

This is because the price of oil is likely to overshadow any operational efficiencies or acquisitions in the near term.

Finally, on a historical basis, the company appears attractively priced vs. itself in the past, with 20% – 40% discounts on key metrics like P/E and P/B over the last 5 years:

The company also appears well priced vs. the industry at large, and boasts a 33% discount on key profit metrics like GAAP P/E and EV/EBITDA.

When you add up DVN’s strong financial position, acquisition, operational talent, and attractive valuation, it’s hard to see the stock as anything other than a ‘Buy’.

Option Overlays

If you’re interested in DVN but would be open to an options play on the stock that would boost your yield considerably as an investor, then consider selling the December 20th, $37.50 strike put options for $1.30 a contract:

This trade would net $130 in cash per contract over the next 93 days, which represents a return on capital of roughly 3.6%. Annualized, that turns into 14.1%.

When you sell a put option, you’re obligated to buy shares of the underlying if the stock finishes beneath the strike price.

Thus, this trade has two potential outcomes:

- DVN finishes above $37.50, in which case you keep the cash free and clear, and your reserved buying power is returned to you. Given current option probabilities, the probability of this happening is about 72%.

- If DVN finishes beneath $37.50, then your reserved buying power goes towards buying the stock at that price, which would put you at an unrealized loss right away, depending on where the stock was trading. That said, you’d be getting a 7.5% discount to where shares are trading today. Plus, you’d still get to keep the $130 (3.6%) in cash per contract.

In our view, these outcomes seem like a win-win – a strong cash yield, or the stock at a better price than you’d be getting now.

It seems like a solid play for those focused on income.

Risks

Either way though, there are still some risks to consider with DVN.

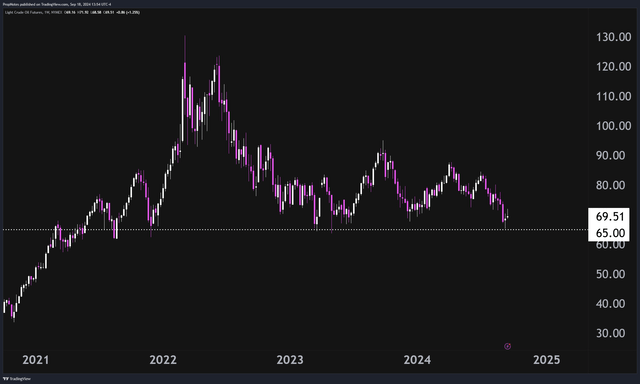

Currently, the key thing to watch is oil prices.

If prices head lower, then it’s a headwind for DVN, even given the drilling efficiency and best-in-class margins.

Oil prices could head lower if the economy is expected to be weaker for longer, which is what leading economic indicators are currently predicting. U.S. PMIs are weak, and consumer sentiment is also in a contractionary zone:

At the same time, oil is trading right at this multi-year support level in the mid-60’s:

If this cracks, then it could be tough going for the global oil industry in the short and medium term.

Summary

That said, we’re bullish on DVN overall. Whether you’re interested in buying the stock outright for the capital appreciation and the above-industry-average 5% yield or selling puts to generate a substantial income through the end of 2024, the company’s operational efficiency, attractive valuation, and strong financial position make it a prime choice for both good times and bad.

Thus, our ‘Buy’ rating.

Cheers!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in DVN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.