Summary:

- DVN’s FQ2’24 results deliver a much improved hedging result, significantly aided by the still elevated crude oil and natural gas spot prices.

- This is on top of the higher production volumes and the additional high-margin volumes from the soon-to-be-completed Grayson Mill Energy acquisition.

- DVN’s strategic capital allocation across the balance sheet deleveraging, shareholder returns, and acquisitions have worked out extremely well indeed.

- Combined with the (projected) higher for longer commodity spot prices, we believe that opportunistic investors may still wait for its eventual capital appreciation while being paid rich dividends.

Rangsarit Chaiyakun

We previously covered Devon Energy (NYSE:DVN) in June 2024, discussing the market’s over-reaction to the higher FQ1’24 hedging losses and the resultant impact on its top/ bottom lines. This was on top of the mixed optics arising from the lower total dividends and the ongoing speculation surrounding its failed acquisitions.

Even so, we had believed that the stock remained a Buy as the management continued to execute prudently in bolstering its balance sheet at a time of uncertain macroeconomic outlook and higher borrowing costs, with optics likely to slowly improve in the intermediate term.

Since then, DVN and the wider market have both trade sideways, as the former is moderated as a result of the ongoing Permian Basin probe and the latter attributed to the ongoing market wide correction since mid-June 2024.

We shall discuss why the stock remains a Buy for opportunistic investors looking to buy an undervalued oil/ gas stock with the potential for a great upside, upon the speculative re-rating in its valuations.

DVN’s Oil/ Gas Investment Thesis Remains Robust, As Management Delivers Exemplary Capital Allocation

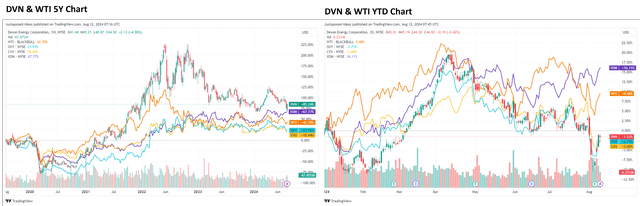

DVN 5Y/ YTD Stock Price

The correlation between DVN’s stock prices and the WTI crude oil spot prices cannot be ignored indeed, with it mirroring other integrated oil/ gas majors, including Chevron (CVX), Exxon Mobil (XOM) and Occidental Petroleum (OXY).

This is especially since the WTI spot prices remain elevated at $77.45 per barrel by the time of writing (-3.3% MoM/ -4.6% YoY/ +35% from 2019 averages of $56.99), triggering DVN’s higher FQ2’24 realized prices at $78.95 (+5% QoQ/ +10% YoY/ +39.9% from FY2019 averages of $56.41).

At the same time, with gas comprising half of DVN’s total oil equivalent production, the producer’s prospects have been significantly aided by the elevated natural gas liquids spot prices of $0.715 per gallon (-15.3% QoQ/ -3.1% YoY/ +31.9% from FY2019 averages of $0.542 per gallon).

This development has triggered the higher NGL realized prices at $19.71 (-4.9% QoQ/ +10.7% YoY/ +16.7% from FY2019 averages of $16.88), well balancing the lower natural gas (Henry Hub) spot prices/ realized prices.

Combined with the higher production output (thanks to numerous acquisitions), it is unsurprising that DVN has benefitted from the higher oil/ gas prices in FQ2’24, which resulted in the double beat earnings call with revenues of $3.91B (+8.9% QoQ/ +13.3% YoY).

Readers must also note that its results are significantly aided by the oil, gas, and NGL derivatives playing out as expected as a net positive, compared to the losses reported in FQ1’24.

Combined with the stable expenses on a QoQ basis, we can understand why DVN has reported a robust adj EPS of $1.34 in the latest quarter (+42.5% QoQ/ +25.2% YoY), partly aided by the lower shares outstanding of 628M (-4M QoQ/ -11M YoY).

This is why we believe that the management’s exemplary cash flow allocation across shareholder returns through share retirement/ dividends and balance sheet deleveraging have yielded impressive results, as observed in the lower net-debt-to-EBITDA ratio of 0.6x (compared to 0.7x in FQ1’24/ FQ2’23 and the peak of 1.4x in FQ1’21).

Investors may also enjoy a rather rich FQ2’24 total dividend payout of $0.44 (+25.7% QoQ/ -10.2% YoY) and the resultant yields of 4.5%, compared to the 5Y average of 2.91% and the sector median of 4.43%.

Lastly, we expect DVN’s robust payouts to continue for a little longer, with the US Energy Information Administration [EIA] already expecting the Brent price will return to $85-90 per barrel by the end of the year, compared to the current $79.10 per barrel and 2019 averages of $64.28 per barrel:

Rising crude oil prices in our forecast are the result of falling global oil inventories. We estimate global oil inventories decreased by 400,000 b/d in first-half 2024 and will fall by 800,000 b/d in second-half 2024. Inventory withdrawals stem in part from ongoing OPEC+ production cuts.(Oil & Gas Journal)

Finally, An Acquisition

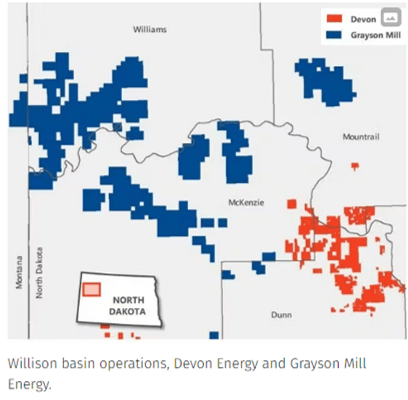

At the same time, readers must note that DVN has finally announced an acquisition after numerous failed attempts, with the Williston Basin business of Grayson Mill Energy closed at $5B.

Given the additional estimated volume of 100,000 boe/d comprising 55% in oil, we are looking at an approximate net addition of $2B in annualized sales upon completion.

DVN’s Acquisition

DVN

The close proximity in the Williston basin operations underscore why DVN has expected to achieve up to $50M in cash savings from the improved operational and marketing efficiencies as well.

This development may also be why the new asset is deemed as highly profitable, with the “estimated free cash flow yield of 15 percent at an $80 WTI oil price” well exceeding its existing properties’ yield at 11%.

This further demonstrate why the management has touted the acquisition as an “excellent strategic fit for Devon that allows us to efficiently expand our oil production and operating scale while capturing a meaningful runway of highly economic drilling inventory.”

However, One Note Of Warning.

This acquisition may unwind some of DVN’s deleveraging and share retirement efforts, based on the $3.25B of cash (partly supported by debt)/ $1.75B of stock dilution and the guidance of “net debt-to-EBITDAX ratio of approximately 1.0 times upon closing.”

We are not overly concerned about this development, since the acquisition is expected to be top/ bottom line accretive with minimal risks to its relatively rich total dividend payouts.

However, dividend oriented investors should also temper their intermediate term expectations, since we expect the fixed portion of DVN’s quarterly total dividends at $0.22 per share to be stagnant over the next two years, as the management seeks to allocate “up to 30 percent of its annual free cash flow towards reducing $2.5 billion of debt over the next two years.”

Lastly, with the US election campaign still ongoing, we may see more fluctuation to the crude oil spot prices, with an industry veteran Dan Pickering, chief investment officer of Pickering Energy Partners, already highlighting that:

Trump is friendlier to the industry and riskier to the commodity price, while Harris is riskier for the industry and more bullish for price. (Wall Street Journal)

Combined with the uncertain impact from the ongoing hostilities in Gaza and the speculated Fed Pivot, oil/ gas investors may want to brace for more H2’24 volatility indeed.

So, Is DVN Stock A Buy, Sell, or Hold?

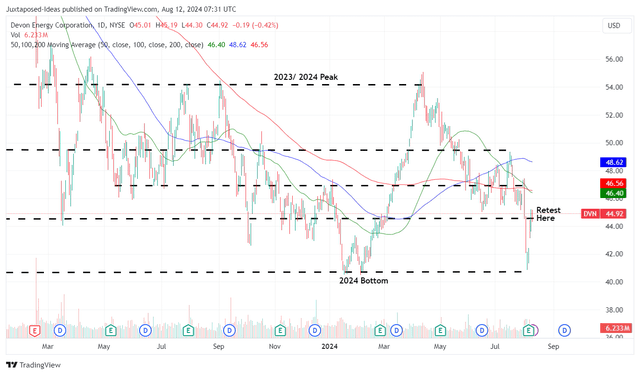

DVN 1Y Stock Price

For now, DVN has been temporarily affected by the ongoing Permian Basin probes, with it apparent that the bulls continue to support the 2024 bottom of $41s as the stock promptly recovers to the $44s.

With the consensus estimates still stable since our last article and the stock still trading at stable FWD P/E valuations of 8.41x (compared to the previous article at 8.21x), we are reiterating our base-case 3Y price target of $49.50.

This is on top of the speculative re-rating in DVN’s FWD P/E valuations nearer to its 3Y pre-pandemic means of 18x, implying an extremely bullish long-term price target of ~$108.

This number is not overly aggressive indeed, since the management’s strategic allocation across debt deleveraging, shareholder returns, and acquisitions have been highly competent, despite the fluctuations in its total dividends.

This is especially since DVN’s standalone debt leverage of 0.7x and pro forma debt leverage of 1x remain well within the Oil & Gas E&P average of 1.07x and not too far from its integrated oil/ gas major peers, such as OXY at 1.43x, CVX at 0.47x, and XOM at 0.22x.

As a result of the still attractive risk reward ratio across capital appreciation and dividend incomes, we are reiterating our Buy rating here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.