Summary:

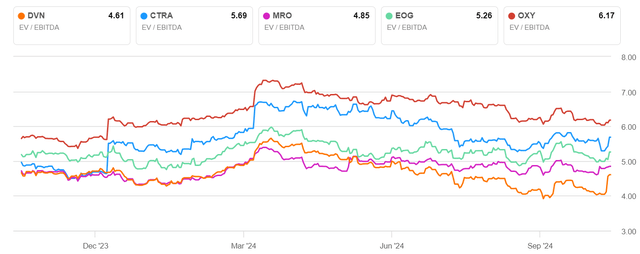

- Devon Energy Corporation is trading at low multiples and growing its production.

- Shale companies are oversold in the current market and are primed for a rebound when a catalyst emerges.

- Investors looking to scoop up a well covered 15%+ free cash yield should carefully consider if DVN meets their risk profile.

omgimages/iStock via Getty Images

Introduction

Let’s all understand something about Devon Energy Corporation (NYSE:DVN). They have amply demonstrated that they can deliver ample cash flow in an upper $60’s to $70.00 WTI (CL1:COM) environment to sustain corporate objectives. The company is currently trading at a 15% FCY, which will only go higher as the share count is reduced. Confusion about the Grayson Mill deal, along with the general malaise afflicting the upstream industry thanks to low gas prices and the perception of low oil prices, have put the stock of DVN in the penalty box.

This is short-sighted in my view. Operators like DVN are doing just fine and are setting themselves up for a return to 2022. By which I mean, I expect a readjustment in pricing expectations once Permian output inevitably dips.

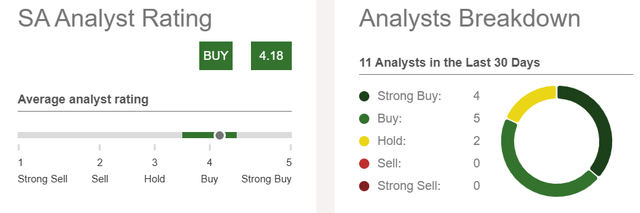

Most authors on Seeking Alpha rate the company as a strong buy or buy at current levels, and I concur, leaning toward the Strong Buy. I don’t do many public articles on DVN, but rate them as a strong buy for low multiples, depth of Tier I, and Tier I convertible inventory, and the ability to maintain shareholder returns in the current price scenario.

DVN analyst ratings (Seeking Alpha)

All of that said, DVN is certainly a bit bruised up by the market. I think that represents opportunity now, which will manifest at some point in the future when the mood shifts on product prices. I have no idea when that will be, but view it as being inevitable that Devon will be loved.

Note-if you’re under 40 you’ve probably never heard the Linda Ronstadt classic, from which I took the title of this piece. Give it a listen. You will have to look long and hard to find a more enchanting voice.

I think DVN belongs in every investor’s portfolio for growth and income. As debt declines and share prices rebound, there will come a tipping point where free cash will go to the dividend, boosting yield on cost for stock obtained at current levels. For example, if the entire free cash hoard in Q3 had gone to the dividend, the effective yield would have risen from 5% to nearly 15%. I am always up for a yield in that range and have added recently to my DVN position.

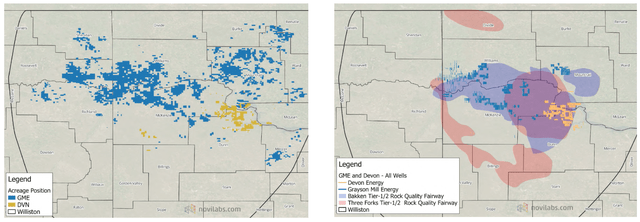

A quick word on the Grayson Mill deal

Brandon Myers at Novi Labs put this graphic together in an overall assessment of the deal, with some remarks about the acreage quality coming from Grayson Mill and the long-term impact of the deal for Devon. While they feel the deal is accretive, it’s not a home run due to declining inventory quality as the core locations become exhausted. Home runs are nice, but getting on base opens other opportunities. I think DVN gets at least to second base here.

For $5 bn Devon is getting the desperately needed increased scale (123K acres to 430K acres) in the basin that is essential to long-term shale economic production. DVN estimates the deal lands out at 4X EBITDAX, and boosts their overall annual production by 100K BOEPD of 55% oil-weighted production to 765 BOEPD. The key features for DVN is that it comes with 500 new locations, 300 refrac candidates, and 950 miles of oil/gas/water midstream assets that Novi figures will improve netbacks by $5-6.00 per barrel-no mean feat.

On the downside Novi notes that while the Grayson acreage competes within DVN’s portfolio, only about 43% is in the Tier I, II Bakken fairway in Williams and Mountrail counties, and only 13% lies within the Three Forks fairway, and has been getting progressively gassy. Further, to maintain output Grayson (and DVN) had to aggressively upspace (200 ft) recently, meaning fewer wells to get higher per foot productivity. Essentially, front-loading the value of the deal.

Longer term, as development goes west, Novi noted the longer lateral and operational efficiencies that DVN flagged as being a key part of the deal’s rationale, may be challenging to achieve as the Three Forks pinches out as you go west. Further, DVN may have a learning curve on 12,000′ laterals in the basin.

DVN’s Grayson Mill pickup (Novi Labs-used with permission)

My take here is while I defer to Novi’s overall assessment of the deal, the increased locations, and scale put arrows in DVN’s quiver in this basin. Things seem to be going well with the Grayson pickup, thus far. With three rigs in the basin, DVN is planning to maintain output this year, backed up by $150 mm in capex. In Q-4, production from the new assets is expected to exceed their initial expectations slightly, delivering approximately 100,000 BOE per day.

Devon is figuring on 2- and 3-mile laterals and, what the company terms, “tactical refracs” to supplement the base production. The refracs can add low-cost production by restimulating older wells with modern techniques. Part of the rationale for Grayson was enhanced scale in the basin that would drive additional capital efficiencies, operational improvements and marketing synergies. The acquisition also adds 500 undrilled locations, further enhancing near term balance sheet and cash flow statements.

Q-3, 2024 and Guidance

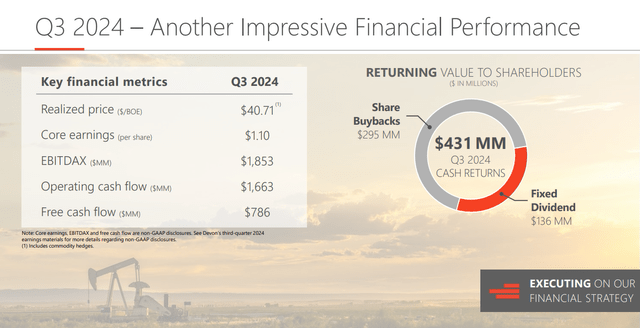

DVN knocked out total production averaging 728,000 barrels of oil equivalent per day, including 335,000 barrels of oil per day in the quarter. This represents a 12% year-over-year growth per share. Rick Muncrief, CEO, commented-

We now expect to produce about 730,000 BOE per day for 2024, an increase of 12% to this year’s budget. This phenomenal performance enabled us to generate $786 million of free cash flow in the third quarter and return $431 million of it back to shareholders. As a result, Jeff will be providing preliminary 2025 guidance that is actually better than we had previously communicated.

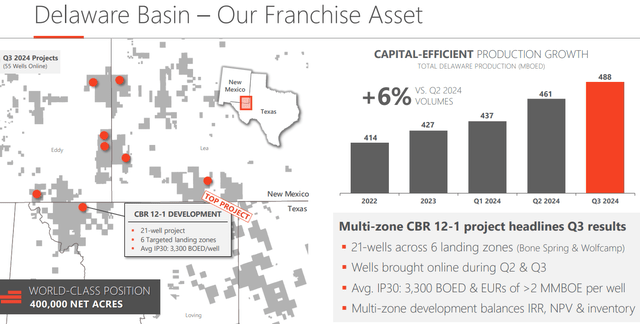

My take is that the Delaware Basin delivers project after project to DVN. On a quarterly basis, we hear about a multi-well development knocking down 3-4,000 BOEPD. The Wolfcamp, Avalon, and Bone Spring formation in the Delaware were again the primary contributors this quarter to the company’s results. Production volumes outpaced the prior quarter by 6%, achieving output of 488,000 BOE per day. To accomplish this feat, 55 new wells were hooked up. 30-day rates of more than 3,100 BOE per day per well, outpaced the company’s preliminary expectations.

The company highlighted one of the primary contributors from this quarter, the CBR 12-1 development in the Stateline area. This project co-developed the Wolfcamp A, Wolfcamp B and shallower zones in the Bone Spring, with six different landing zones targeted. IP-30’s on this 21-well package averaged 3,300 BOE per day per well. The company projects estimated recoveries could exceed 2 million BOE per well.

Clay Gaspar, President-commented on the importance of the Delaware in the call:

As we continue to balance the triple mandate of returns, NPV and inventory, 12-1 gives us additional confidence of this winning strategy. Our team continues to derisk multiple secondary targets across our core development areas in the Delaware Basin. The great work that the team is doing in balancing the near-term performance with the long-term inventory considerations confirms our confidence in a multiyear runway of outstanding performance from the Delaware Basin.

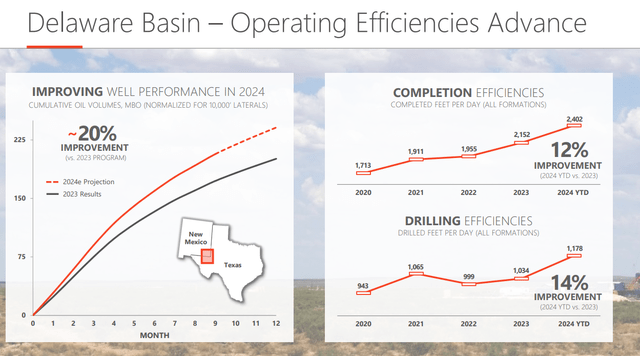

DVN operating efficiencies (DVN)

These assets are being well managed. This YoY improvement normalized for 10K foot laterals (left graph) reveals daily output maintaining a growth curve (upward slope) well beyond typical shale wells. As a part of process improvements-logistics, increased non-stop pumping time, they have improved completion efficiency by 12% YoY. The drilling curve looks even better. Are we approaching the Technical Limit here? Plans are to go from 16 rigs in 2024 to 14 in 2025, while not backing off production goals.

Q3 2025 highlights

Devon reported net earnings of $812 million, in Q-3, 2024. Adjusted for one time events, core earnings were $683 million. Devon’s operating cash flow totaled $1.7 billion in the third quarter, an 8 percent increase versus the prior quarter. This funded DVN’S capital requirements and left $786 million of free cash flow for the quarter, for stock buybacks, dividends, and debt reduction.

In Q-3, Devon issued $2.25 billion of 10 and 20 year debt, and took a $1 billion term loan. These instruments funded the Grayson Mill acquisition.

Devon’s financial position remained solid, and retained its investment-grade credit rating. LT debt totaled $8.9 billion, with a net debt-to-EBITDAX ratio of 1.1 times. The company also made progress on its debt reduction goals by retiring $472 million of maturing debt. DVN had $676 mm in cash at the close of the quarter.

Q4 2024 guidance

Devon is boosting its production forecast higher in the fourth quarter to a range of 811,000 to 830,000 BOE per day., If this is achieved it will be a 13 percent increase compared to the third quarter.

Incremental production from the company’s Williston Basin acquisition-known henceforth as the Rockies Business Unit, is targeted at 110k BOEPD in Q-4. The midpoint of the capex outlook was adjusted upward to $950 million for the upcoming quarter, pulling in the $150 million of incremental capex for the new Williston Basin activity.

Your takeaway

Devon has been punished by the market for plenty of reasons, some of which are valid-if you are only looking at the next quarter or two. The metrics compared with peers speak for themselves. If they hit increased production targets, the Flowing Barrel comparison could hit $42K per bbl.

DVN is very investible at current levels and as previously noted I have added to my own position recently.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not advice to buy or sell this stock or ETF in spite of the particular rating I am required to select in the SA template. I am not an accountant or CPA or CFA. This article is intended to provide information to interested parties and is in no way a recommendation to buy or sell the securities mentioned. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to do their own due diligence before investing their hard-earned cash.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.