Summary:

- DVN’s hedging in FQ1’24 has not turned out as expected, triggering impacted top/ bottom lines.

- Combined with the management’s intensified focus on balance sheet deleveraging and share count retirement, it is unsurprising that recent dividend payouts have underwhelmed.

- This is on top of its “price discipline as an acquirer,” resulting in DVN missing out on multiple M&A activities observed in the oil/ gas sector thus far.

- However, with current spot prices higher than those observed in Q1’24, we expect things to improve moving forward, further aided by the OPEC+ reiterated production cuts through 2025.

- Investors only need to remain patient for DVN’s eventual upward rerating, while collecting its variable/ fixed dividend payouts in the meantime.

boygovideo

We previously covered Devon Energy (NYSE:DVN) in March 2024, discussing its inherent undervaluation compared to its peers, despite the healthier balance sheet, raised fixed dividends, and sustained share retirement.

With a prospective market re-rating likely to bring forth excellent upside potential as the elevated crude oil prices triggered higher variable dividends, we believed that the stock remained a compelling Buy for commodity investors.

Since then, DVN has traded sideways at -0.4% as the wide market records a +6.2% recovery. It is apparent, by now, that market sentiments surrounding its prospects remain mixed as the higher FQ1’24 hedging losses result in impacted top/ bottom lines.

Combined with the management’s focus on deleveraging and share repurchases triggering the lower variable dividends, we can understand why the stock has lost part of its recent gains, as the market also speculates about its failed acquisitions.

Even so, we believe that DVN remains a Buy as the management continues to execute prudently in bolstering its balance sheet at a time of uncertain macroeconomic outlook and higher borrowing costs, with optics likely to slowly improve in the intermediate term.

DVN’s Recent Performance Underwhelms Compared To Its Peers

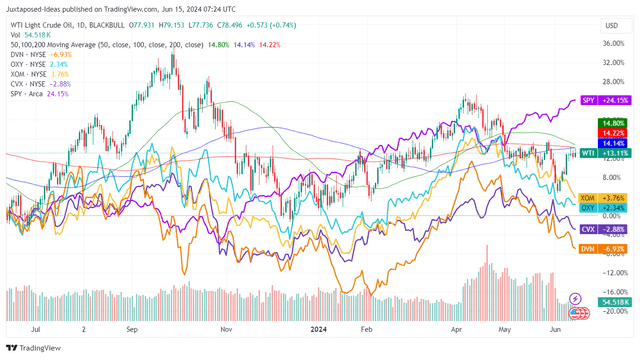

DVN’s 1Y Stock Performance Against Peers

While we have been previously optimistic about DVN’s prospects, it appears that its turnaround may take longer than expected, with the stock’s 1Y performance lagging behind its big oil/ gas peers despite the higher WTI spot prices.

Perhaps part of the pessimism may be attributed to the mixed FQ1’24 performance, with the company recording underwhelming total revenues of $3.59B (-13.2% QoQ/ -6% YoY), Free Cash Flow generation of $844M (+2% QoQ/ +26.9% YoY), and adj EPS of $0.94 (-48% QoQ/ -38.5% YoY).

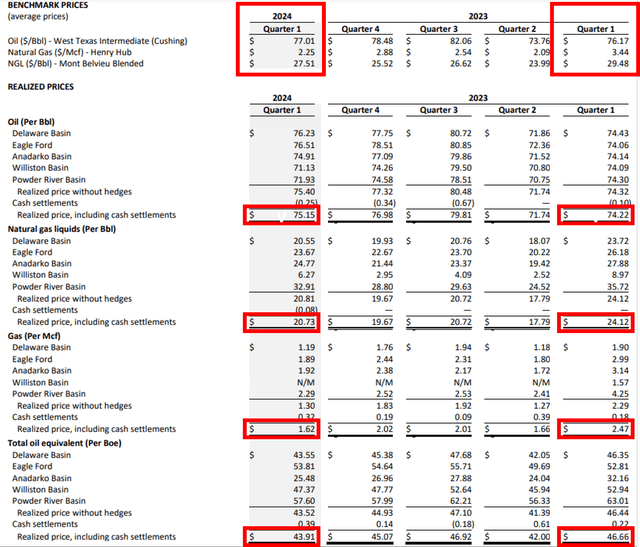

DVN’s Realized Prices In FQ1’24

Readers must note that DVN’s QoQ/ YoY volatility is mostly attributed to the fluctuating fuel spot prices and volatile WTI realized prices at $75.15 per barrel in FQ1’24 (-2.3% QoQ/ +1.2% YoY), Gas at $1.62 per Mcf (-19.8% QoQ/ -34.4% YoY), and NGL at $20.73 per barrel (+5.3% QoQ/ -14% YoY) in the latest quarter.

For now, this headwind has been well-balanced by the increased total oil production at 664 MBoe/d (+0.3% QoQ/ +3.5% YoY).

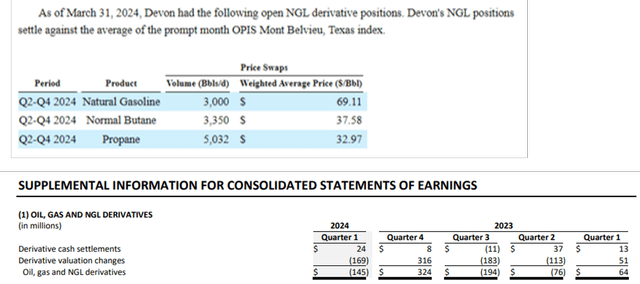

DVN’s NGL Derivative Position

At the same time, DVN’s gas derivative hedging have contributed to a -$145M losses in the quarter (-144.7% QoQ/ -326.5% YoY), naturally impacting its top/ bottom lines.

For context, the producer reports FQ1’24 open NGL derivative positions in Gasoline, Butane, and Propane at different quantities, supposedly allowing the company to hedge its “oil, gas and NGL production to future prices received.”

Unfortunately, this hedging strategy has not worked out in the latest quarter, as how it had in FQ4’23. Even so, we believe that this headwind is temporary, especially since spot prices have risen notably.

FQ2’24 May Bring Forth Improved Numbers For DVN, As Spot Prices Rise & OPEC+ Cuts Continue

At the time of writing, the WTI crude oil prices have risen to $78.48 per barrel at the time of writing (inline MoM/ +13.4% YoY), Gas (Henry Hub) at $2.89 per Mcf (+28.4% MoM/ +5.8% YoY), NGL composite at $6.87 per MMbtu (-2.2% MoM/ -4.7% YoY), and NGL Propane at $0.734 per gallon (+8.7% MoM/ +33.9% YoY), further aided by the sustained OPEC+ cuts ahead.

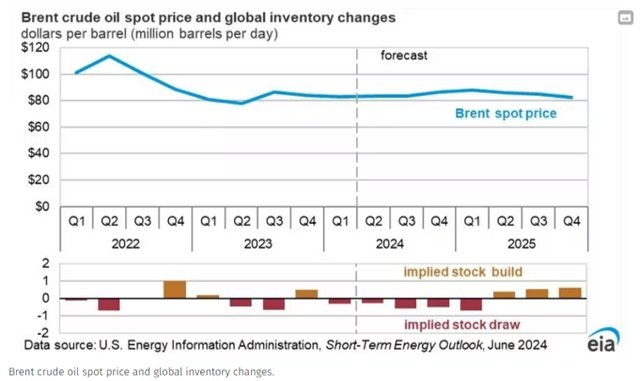

Projected Brent Prices Through 2025

For context, OPEC+ members have previously agreed to cut output by a total of 5.86 MMbpd, or the equivalent 5.7% of the global demand through June 2024.

While the same cuts have been extended through September 2024, it is apparent that things are expected to alleviate moving forward, with the overall cuts gradually phasing to 3.66 MMbpd between October 2024 to September 2025 and remaining so until the end of 2025.

As a result, it is unsurprising that the US EIA has already expected the Brent spot prices to rise to approximately $85 per barrel in Q3’24, $87 per barrel in Q4’24, and $88 per barrel in Q1’25, as the global inventory deficit continues before things moderate from Q2’25.

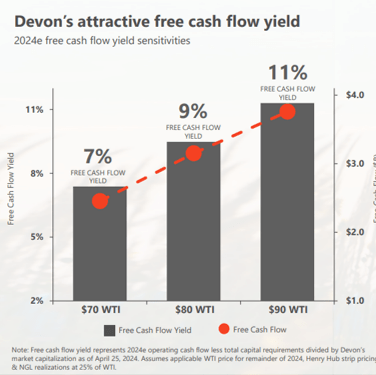

DVN’s Higher Free Cash Flow Generation From Higher Spot Prices

DVN

These developments also imply that the WTI crude oil, Gas (Henry Hub), and NGL spot prices may remain elevated for at least three more quarters, triggering further near-term top/ bottom line tailwinds for DVN.

This is especially due to the increasingly rich spread to the producer’s breakeven WTI funding at $40 per barrel, the raised FY2024 output guidance to 665 MBOED – up by +2.3% from the original guidance of 650 MBOED (inline YoY), and the FY2024 lower capital requirement of $3.45B at the midpoint (-9% YoY).

As a result, we may see DVN record a relatively rich FY2024 Free Cash Flow margin of ~9% (inline YoY).

DVN’s Capital Allocation Remains Focused On Balance Sheet Health

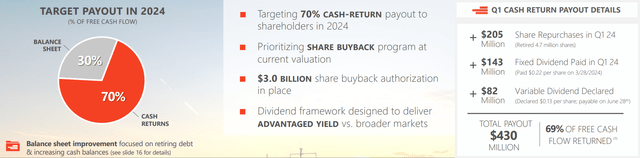

DVN’s Shareholder Return Target

Then again, anyone hoping for rich payouts must also temper their expectations, since the DVN management has highlighted near-term focus on balance sheet improvement, as $472M of its debts mature in September 2024 and another $485M in late 2025.

At the same time, they have guided prioritized share buyback program, with the lower FQ1’24 variable payout implying a similar trend ahead.

Even so, we are highly encouraged by DVN’s well-balanced capital allocation, since it already reports a net-debt-to-EBITDA ratio of 0.7x (compared to 1.4x in FQ1’21 after the WPX Energy merger) and lower share count of 632M (-24M compared to FQ1’21 levels of 656M).

As a result, we maintain our previous conclusion that the management has executed brilliantly, demonstrating why it does not deserve to be beaten down and unappreciated as it has thus far.

DVN Is Inherently Undervalued – Offering Opportunistic Investors With The Dual Pronged Returns

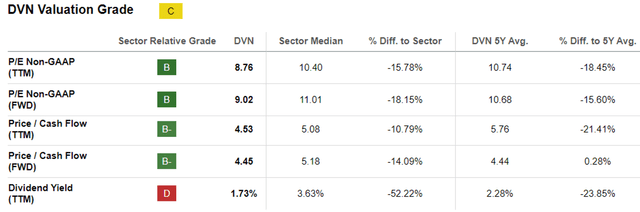

DVN Valuations

DVN’s FWD P/E valuations of 9.02x and FWD Price/ Cash Flow valuations of 4.45x remain discounted compared to its oil/ gas peers, such as Exxon Mobil (XOM) at 12.19x/ 7.77x, Chevron Corporation (CVX) at 12.20x/ 7.27x, and Occidental Petroleum (OXY) at 16.15x/ 5x, respectively.

Most importantly, DVN remains inherently undervalued with an Enterprise Value to Proven Reserve ratio of 18.9x, based on its Enterprise Value of $34.35B at the time of writing and the 2023 proved reserves of 1.81M BOE.

This is compared to XOM at 26.3x, CVX at 26.8x, and OXY at 20.3x, based on their Enterprise Value of $445.07B/ 2023 proved reserves of 16.92M BOE, $297.76B/ 11.1M BOE, and $81.06B/ 3.98M BOE, respectively.

While DVN has admittedly failed to close multiple acquisitions over the last twelve months, we concur with the management’s “price discipline as an acquirer,” since it allows the company to avoid paying the premium observed during the sector’s consolidation party thus far.

This discipline is prudent indeed, as the macroeconomic outlook remains uncertain, and borrowing costs elevated, with the excess Free Cash Flow currently put into good use, as discussed above.

Patience is a virtue here.

So, Is DVN Stock A Buy, Sell, or Hold?

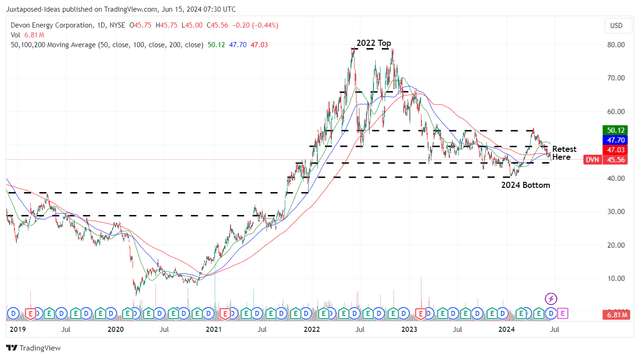

DVN 5Y Stock Price

For now, DVN continues to trade sideways since our previous article, partly attributed to the negative optics arising from its inability to secure acquisitions compared to its peers.

This is also partly attributed to the market’s overreaction from its FQ1’24 hedging losses, intensified deleveraging/ share repurchases, and subsequently impacted variable dividends, compared to the raised dividends offered by its bigger oil/ gas peers.

We can understand why DVN investors may be increasingly impatient indeed, especially since the WTI crude oil prices have been much higher than the pre-pandemic averages of $55s.

Even so, we believe that DVN continues to offer dual pronged prospective returns through capital appreciation and dividend incomes.

For context, we had posited a moderate upside potential to our intermediate price target of $49.50 in our last article, based on the consensus FY2026 adj EPS estimates of $6.04 and the FWD P/E valuation of 8.21x.

This is on top of the speculative re-rating in its FWD P/E valuations nearer to its 3Y pre-pandemic means of 18x, implying an extremely bullish long-term price target of $108.70.

We are maintaining those bullish price targets for now, further aided by DVN’s decent forward dividend yields of 3% based on the FQ1’24 annualized dividends of $0.35.

However, while we are reiterating our Buy rating here, readers must also note that its turnaround may be prolonged until market sentiments surrounding its prospects improve and bullish support is observed in its stock prices.

This is especially since the management has guided that the hedging fluctuations may continue for a little longer, until the Matterhorn pipeline comes online later this year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.