Summary:

- When was the last time you spun a rotary phone? Times have changed.

- Many retirees use methods from the ’80s instead of adapting with the times.

- Your portfolio is your greatest asset, and likely the source of the most wasted potential.

wolv/iStock via Getty Images

Co-authored by Treading Softly

I recently visited a museum of history with my family and was a little disturbed when I realized that, as part of their historical inventions, they included that “ancient” technology: a rotary phone. I can clearly remember moving from a rotary phone to a touch-tone phone to a digital phone to a cell phone to a smartphone. The youngest generation in my family doesn’t even remember flip phones and the rotary phone is an antique.

Alexander Graham Bell invented an amazing piece of technology to communicate over long distances. That technology made the world smaller and eventually provided the backbone for the internet. Nowadays, most of us carry a phone in our pocket that is stronger than the computer we used to land the Apollo spaceflights on the moon.

Once the primary role of phones was for talking, today talking is a secondary feature for most phones. Data usage of phones has continued to climb as consumers consume more and more data and more and more information through their cell phones than almost any other tool available.

When it comes to the market, I don’t want to be exposed to consumer trends or fads. I would rather own the infrastructure that is adapted to the evolving tastes of the consumer. The telecommunication market has consolidated and is now controlled by a few major players, as the technology has adapted.

Today, I want to take a moment to look at one of those major players and how you can dial into some high-level income.

Let’s dive in!

Can You Hear Me Now?

Verizon Communications (NYSE:VZ), yielding 6.6%, is the largest U.S. telecom company by 2023 revenues, with 115 million wireless retail connections, 9 million total broadband connections, and 3 million Fios video connections. While 5G and fiber expansion have been the biggest opportunities and focus areas for telecom companies in recent years, VZ is notably making strides in its business segment with innovative deployments of private 5G.

In FY 2023, Verizon Business represented ~22% of the revenue mix ($30.1 billion) with 30 million postpaid wireless connections, and 2 million broadband connections. Within VZ Business, the enterprise and public sector constitutes 50% of the business where VZ provides network services, advanced communication services, core telecom services, and IoT services. Private 5G is a significant growth opportunity allowing telecom companies to expand internationally without the requirement to bid for spectrum. Recently, VZ partnered with Audi to build a state-of-the-art private wireless network and tech-testing environment at Audi’s automotive test track in Neustadt, Germany. VZ is also deploying private 5G in US National Hockey League (‘NHL’) arenas with solid use cases like video coaching, cashless checkout, and facial-recognition-based entry for attendees. Private 5G is a significant growth opportunity, and early reports hint that VZ has closed more deals in 2024 than all of last year, with the pipeline essentially doubling.

Investors in U.S. telecom companies are generally worried about debt, especially amidst elevated interest rates. Despite having $150.7 billion net debt, only $3.6 billion of VZ’s unsecured debt matures this year. The company maintains an investment-grade A- balance sheet with a net debt to adjusted EBITDA of 2.6x, and its effective interest rate for 2023 was 3.7%. Given the small amount maturing this year, we don’t expect interest expenses to significantly rise.

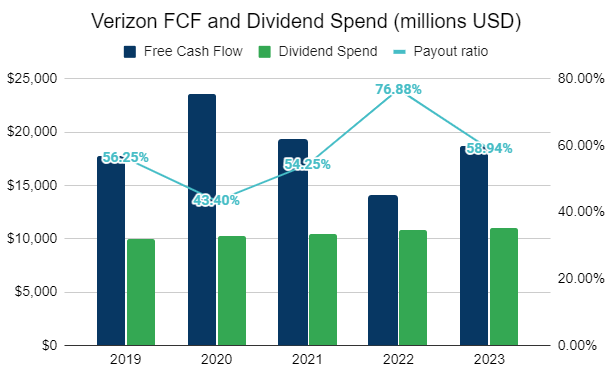

VZ delivered its 17th annual dividend raise during Q3 2023, and its current $0.665/share quarterly payment calculates to a 6.6% yield. Notably, VZ spent $11 billion on dividend payments in FY 2023, a sum adequately covered by the company’s $18.7 billion free cash flow (a 59% payout ratio) and $47.8 billion adjusted EBITDA.

Author’s Calculations

With a 1-3% guidance for adj. EBITDA growth, and 8.6% lower capex for FY 2024, we expect FCF to be higher during the fiscal year. VZ’s projected adjusted EPS for 2024 is between $4.5-4.7 and would comfortably support another 3% dividend raise at the same payout ratio. At an 8.4x forward PE, VZ is a steal at current prices, and you can collect a healthy 6.6% qualified dividend to wait for the valuation reversal as all the 5G and fiber investment translates into soaring FCF.

Conclusion

Today, we reviewed one of the most influential and largest telecommunication companies in the United States. Other countries may have a more competitive landscape when it comes to choices between what cell phone service provider or Internet service you decide to use. However, the United States is heavily an oligarchy between a few major players and smaller players who use the service of the major players – essentially they pay for the ability to access their networks and provide a lower quality of overall service than the higher cost alternatives. VZ can provide strong income today but also continue to comfortably raise their dividend going forward, all while paying qualified dividend income, which receives beneficial tax treatment.

When it comes to retirement, the last thing that you want to be worrying about is whether your money is going to come in on time. Many retirees decide to liquidate their assets in an orderly manner to be able to pay for retirement, gambling in the hope that they won’t run out of money before they die. I would rather have money left over that I can pass on as an inheritance or donate to a worthy cause than live in constant fear of running out of money. I also don’t want to have a retirement that is filled with living in squalor simply because I’m afraid of running out of money, even though I have the assets available to enjoy a retirement marked by abundance.

Like the man in the Verizon commercials who takes a step and asks can you hear me now? I hope that today our message is clear: Your retirement can be as amazing as you dream it to be if you decide to use the right method to solve the problem. Like a child who tries to multiply 1050 by 2020, You could sit there and add 2020, 1050 times, or you could learn how to multiply. When it comes to the market and your retirement, you can choose to slowly sell your assets like the kid doing addition, or you can learn how to income invest and learn to multiply.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, PendragonY, and Hidden Opportunities all are supporting contributors for High Dividend Opportunities. Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Model Portfolio and our current Top Picks, join us at High Dividend Opportunities for a 2-week free trial.

We are the largest income investor and retiree community on Seeking Alpha with +8000 members actively working together to make amazing retirements happen. With over 45 picks and a +9% overall yield, you can supercharge your retirement portfolio right away.

We are offering a limited-time sale for 17% off your first year. Get started!

Start Your 2-Week Free Trial Today!