Summary:

- DiDi Global’s Q3 2024 results show slower volume growth in China but improved profitability, with record-high operating profits and increased monetization rates.

- The change from U.S. GAAP to IFRS suggests a potential Hong Kong listing.

- DiDi’s balance sheet remains robust, with significant cash reserves and strong operating cash flow, enabling substantial share repurchases.

- DiDi’s improved margins and financial projections indicate a 25% upside, justifying a continued “buy” rating for DIDIY.

xcarrot_007

DiDi Global (OTCPK:DIDIY) released its Q3 2024 results on November 29th. The results are consistent with the recent quarterly trend of slower volume growth in China but improved profitability across all three segments. Overall, I think DiDi had a good quarter. The slower volume growth in China is entirely expected, while DiDi’s monetization rate increased, which resulted in faster revenue growth and record-high operating profits. During the quarter, DiDi changed its accounting standard from U.S. GAAP to IFRS, which could be a signal of a Hong Kong listing. Meanwhile, DIDIY is still trading below my fair value estimate. Therefore, I am maintaining my “buy” rating for DIDIY.

DiDi‘s Q3 Earnings Results Highlights

According to DiDi’s Q3 results earnings release, highlights of the quarter include:

- Core Platform Transactions increased 15.1% year-over-year.

- Core Platform Gross Transaction Value (“GTV”) increased 13.1% year-over-year on a constant currency basis.

- Platform Sales increased 22.7% year-over-year.

- Adjusted EBITA (Non-IFRS) for Q3 2024 was a gain of RMB1.7 billion, compared to a loss of 0.3 billion in Q2 of 2023.

Overall, DiDi’s Q3 results are consistent with my expectations. While volume growth and transaction value growth have declined, DiDi was able to grow its sales much faster than transaction volume and value as DiDi continued to improve its monetization rate in the China market.

Segment Results

In Q3 of 2024, the average daily transaction volume for DiDi’s China’s Mobility segment reached a record high of 34.6 million, which grew 10.5% from 31.3 million in Q3 of 2023. GTV for the China mobility segment only rose 7.8%, indicating a lower ARPU during the quarter. However, total platform sales from the China Mobility segment for Q3 grew by 23.7% year-over-year. The higher growth rate for platform sales is driven mainly by the increase in DiDi’s monetization rate (total platform sales/gross transaction value), which has reached 20.6% in China for Q3 of 2024. The Adjusted EBITA of the China Mobility segment was a gain of RMB2.5 billion, which increased 69% from Q3 of 2023.

The operation and financial performance of DiDi’s international segment is the exact opposite of that of China. Total transactions from the International segment for Q3 increased 33.4% year-over-year. GTV from the international segment also grew by 33.4% on a constant currency basis. However, the platform sales growth for the international segment was only 16.5%. DiDi’s monetization rate (total platform sales/gross transaction value) for the international segment is only 10.6%, significantly lower than 20.6% for the domestic Chinese market. It’s clear DiDi is still competing aggressively for market share in the international market, especially in Latin America. The Adjusted EBITA loss of the International segment narrowed to only RMB 0.3 billion from a loss of RMB 0.8 billion in Q3 of 2023.

The Adjusted EBITA loss for the Other Initiatives segment was RMB 0.44 billion for Q3 of 2024, which narrowed from a loss of RMB 1 billion in Q3 of 2023. DiDi explained that the decrease in loss was “primarily attributable to the decrease of investments for the smart auto business as the sale of certain smart auto business to XPeng was completed during the fourth quarter of 2023.”

On a corporate level, R&D expense decreased by 6.4% during Q3, and the cost of revenue is flat year-over-year. Both sales and marketing expenses and general and administrative expenses increased 8.5% year-over-year, which is much slower than the growth rate of platform sales. DiDi continues to make great progress in improving operating efficiency.

Accounting Standard Change

A major event for the third quarter of 2024 is the change of accounting standards from U.S. GAAP to IFRS. DiDi stated in the earnings release that “the Company has adopted IFRS from the third quarter of 2024, and the date of transition to IFRS was January 1, 2022“. This change in accounting standards raises speculation that DiDi is ready to issue shares in Hong Kong as IFRS is the required reporting standard for the Hong Kong Exchange. As I’ve stated before, I think a re-listing in Hong Kong for DiDi is a matter of time. However, it’s not clear what will happen to DiDi’s U.S. ADSs, which trade over the counter.

Balance Sheet and Share Repurchases

DiDi’s balance sheet remains very strong. At the end of Q3, DiDi had RMB 47.9 billion of cash and cash equivalents on the balance sheet. DiDi also generated RMB 1.9 billion in operating cash flow during the quarter, which is very strong. DiDi used the strong cash flow to repurchase shares. As a recap, DiDi announced the $1 billion share repurchase program in November 2023. During the past year, DiDi has spent $627 million to repurchase 151.3 million ADSs at an average price of $4.14 per share. Per DiDi’s Q3 earnings release, between August 1 and November 27, DiDi spent $253 million to repurchase 61.1 million ADSs, with an average repurchase price of $4.14 per ADS. The company can still repurchase $373 million of shares under the existing share repurchase program.

Financial Projections and Valuation

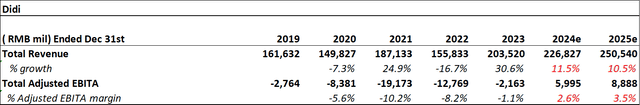

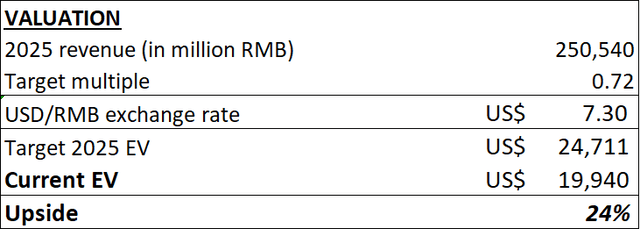

I have updated my financial projections and valuation work for DiDi to incorporate DiDi’s Q3 2024 actual results. Specifically, I’ve revised my adjusted EBITA margin for both 2024 and 2025 as DiDi’s margin continued to improve.

In terms of valuation, I’ve applied a TTM EV/Sales multiple of 0.72 times, which is a 66% discount to the sector median of 2.1 times. This discount reflects the China risk and liquidity risk. At today’s valuation, DIDIY is still undervalued, as the stock has about a 25% upside from my 2025 fair value estimate.

Conclusion

DiDi’s Q3 FY2024 results continue to validate my investment thesis for DIDIY. I think by now, there shouldn’t be much doubt on DiDi’s turnaround. DiDi’s change in accounting standards sends a signal that a potential Hong Kong listing could be sooner than the investor’s expectation. Meanwhile, the stock is still trading at a discount to my conservative fair value estimate. Therefore, I am maintaining my “buy” rating for DIDIY.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIDIY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.