Summary:

- DiDi Global reports strong Q4 2023 results with a 55.4% YoY increase in total revenues and a 65.8% YoY increase in GTV.

- The China Mobility segment shows significant growth, while the International segment reduces losses.

- DiDi maintains a strong balance sheet with a $1 billion share repurchase program and has potential for significant upside in stock value.

Hispanolistic

I first wrote about my investment thesis for DiDi Global (OTCPK:DIDIY) earlier this month. On March 23, 2024, DiDi announced its Q4 and FY 2023 results. For Q4, DiDi maintained its growth momentum and continued to improve operating efficiency. During the quarter, DiDi completed the spin-off of certain smart auto business to XPeng (XPEV) in consideration of XPeng’s stocks. Furthermore, the company authorized a $1 billion share repurchase program. DiDi is still on track to further grow its revenue and improve profitability for 2024 and beyond, yet the market is still not giving any credit for DiDi’s turnaround efforts as the stock is trading significantly below its peers. Therefore, I am maintaining my “strong buy” rating for DiDi stock.

DiDi’s Q4 2023 results

Highlights of DiDi’s Q4 results from the press release are:

- Total revenues for the fourth quarter of 2023 grew 55.4% year-over-year.

- Net income attributable to ordinary shareholders of DiDi for the fourth quarter of 2023 was RMB0.8 billion.

- Adjusted EBITA for the fourth quarter of 2023 was a loss of RMB1.3 billion.

- Core Platform Transactions for the fourth quarter of 2023 reached 3,715 million, an increase of 64.8% from the fourth quarter of 2022.

- Core Platform Gross Transaction Value (“GTV”) for the fourth quarter of 2023 reached RMB93.2 billion, an increase of 65.8% from the fourth quarter of 2022.

Overall, DiDi’s Q4 results are very satisfactory with revenue of RMB49.42 billion yuan, a year-on-year increase of 55.4%, and GTV of RMB93.17 billion, a year-on-year increase of 65.82%. The growth rate is sequentially faster than Q3 mainly due to an easy comp (China relaxed its COVID measure in Q4 of 2022) and the reinstatement of DiDi’s app on major China’s app store. Research and development expenses increased slightly year-over-year to RMB2.4 billion, while SG&A expenses decreased slightly year-over-year to RMB 2.2billion.

DiDi’s income statement is a little bit complicated as there are quite a few other items: interest income for Q4 2023 was RMB 523 million, net investment income for Q4 2023 was RMB 2.05 billion, equity investment income was RMB 240 million, other income was RMB 293 million, and exchange losses were RMB 827 million. Adjusting for these items, adjusted margin for Q4 2023 was -2.6%, versus -4.3% for Q4 2022, a significant improvement of 1.7%.

Overall, on a group lever, DiDi’s revenue has grown significantly. Although the company is still not making profits, the sequential improvement in operating margin is evident.

Segment results

According to DiDi’s press release, segment results and operating metrics are as follows:

- Total revenues from the China Mobility segment for the fourth quarter of 2023 grew 60.9% year-over-year. Transactions for the China Mobility segment for the fourth quarter of 2023 reached 2,932 million, an increase of 71.5% from the fourth quarter of 2022. GTV from the China Mobility segment for the fourth quarter of 2023 reached RMB71.7 billion, an increase of 72.7% from the fourth quarter of 2022. The Adjusted EBITA of the China Mobility segment was a gain of RMB1.4 billion in the fourth quarter of 2023.

- Total revenues from the International segment for the fourth quarter of 2023 grew 33.3% year-over-year. Transactions for the International segment for the fourth quarter of 2023 reached 783 million, an increase of 43.9% from the fourth quarter of 2022. GTV from the International segment for the fourth quarter of 2023 reached RMB21.5 billion, an increase of 46.4% from the fourth quarter of 2022. The Adjusted EBITA loss of the International segment was RMB1.1 billion in the fourth quarter of 2023.

- The Adjusted EBITA loss of the Other Initiatives segment was RMB1.5 billion in the fourth quarter of 2023.

On a segment basis, the most important segment is obvious the Domestic China Mobility segment. DiDi’s domestic business in Q4 2023 benefited from the low base of Q4 2022. What’s a bit surprising is that the adjusted EBITA of the domestic business for Q4 2023 decreased 6.6% from Q4 2022. However, the company explained that “adjusted EBITDA gain in the China Mobility segment decreased by 6.6% YoY, primarily attributable to the expiration of the Value-added Tax exemption policy.” Adjusting for the effect of VAT exemption policy, DiDi’s Q4 2023 EBITA actually increased significantly from Q4 of 2022.

The International segment witnessed impressive growth for Q4 2023. Furthermore, DiDi successfully reduced segment losses significantly in both the International segment and the Other Initiatives segment. I expect further narrowing of segment losses in2024 for both segments.

Balance sheet and share repurchases.

According to DiDi’s Q4 press release, as of December 31, 2023, DiDi has RMB55.6 billion of cash and cash equivalents, restricted cash and treasury investments as of, compared to RMB48.8 billion as of December 31, 2022. Net cash provided by operating activities was RMB1.8 billion for Q4 of 2023.

Along with the earning’s release, the Company also provided an update on its $1 billion share repurchase program, which was announced in November of 2023:

“As of February 29, 2024, the Company repurchased an aggregate of approximately 14.9 million ADSs for approximately US$54.4 million under its share repurchase program.”

Financial projections and valuation

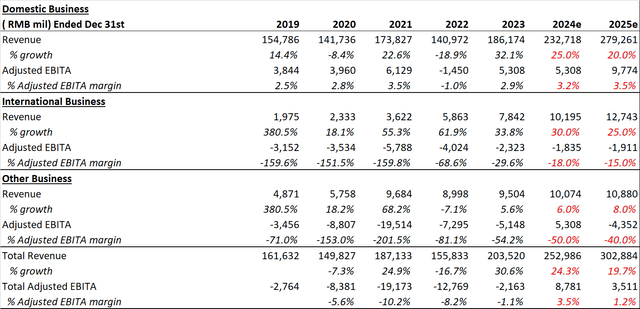

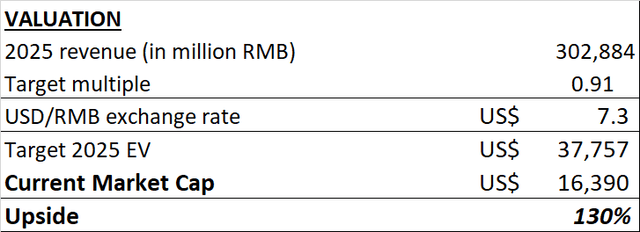

I have updated my financial projections and valuation model for DiDi to reflect the actual 2023 results. I’ve kept my 2024 and 2025 projections because DiDi has performed exactly as I expected.

author’s estimate author’s estimate

At today’s valuation, DiDi is still very cheap, as the stock has more than 130% upside from my 2025 fair value estimate.

Risks to consider

As I have mentioned in my initial write-up of DiDi. The biggest risks for DiDi are regulatory risks and the risk of larger-than-expected losses for the International and Other Initiatives segments. With the spin-off of smart auto business to XPeng, the risk of larger-than-expected loss for the Other Initiatives segment looks more manageable now.

Of course, as DiDi trades on the pink sheet and it is a Chinese ADR, there’s great risk of liquidity and volatility.

Conclusion

DiDi reported satisfactory Q4 2023 results, which validated my investment thesis for the company. DiDi is on its way to further solidify its dominance in China’s ride-hailing market while reducing its costs to improve profitability. However, DiDi’s stock is still trading at a significant discount to my estimated fair value with huge upside. Therefore, I am maintaining my “strong buy” rating for DiDi.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIDIY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.