Summary:

- When DiDi Global debuted on the NYSE in 2021, I found the company dominating the fast-growing Chinese ridesharing industry with a market share close to 95%.

- During the period in which DiDi’s mobile apps were removed from app stores, a few aggregator platforms aggressively took market share from DiDi.

- These aggregator platforms, mostly owned by large-scale tech companies, have leveled the playing field in China’s ridesharing sector, limiting DiDi’s growth potential.

- DiDi will remain relevant in the foreseeable future, but there is reason to believe that growth will come under pressure.

4X-image

When I am looking for investment opportunities, there is nothing more attractive than a company that dominates a fast-growing market segment. More often than not, these companies continue to hold on to their market share in the long run, rewarding long-term shareholders handsomely in the process. DiDi Global Inc. (OTCPK:DIDIY), when it debuted on the NYSE in 2021, was the market leader in China’s booming ridesharing sector, accounting for almost 95% of total ridesharing revenue in the 12 months leading up to the IPO. I was immediately attracted to the company as DiDi’s market leadership promised to steer the company in the direction of sustainable long-term profits. Unfortunately, though, DiDi found itself in a whirlwind of regulatory scrutiny soon after the IPO, alongside other Chinese tech giants such as Alibaba Group Holding Limited (BABA).

Unlike Alibaba, which, I believe, is one of the best bargains in the market today, DiDi may never achieve its former glory as increased regulatory scrutiny has paved the way for a dramatic shift in the competitive landscape, giving birth to aggregator platforms that threaten to eat into DiDi’s market share. Although I acknowledge DiDi’s efforts to turn the company profitable despite decelerating growth and the possibility of a jump in stock price resulting from a potential Hong Kong listing, as a growth investor, I no longer find DiDi attractive.

The Rise Of Aggregator Platforms Has Permanently Impaired DiDi’s Growth Potential

The rising competition in China’s ridesharing industry has already had an impact on DiDi’s growth. DiDi’s market share has slipped to around 70% from a high of close to 95% four years ago, with the primary threat coming from the rise of aggregator platforms. There are a few notable aggregator platforms in China today.

- Amap, owned by Alibaba.

- Baidu Map.

- MeiTuan Dache.

In addition to these aggregator platforms, ridehailing and ride-pooling platforms such as Dida Chuxing, Cao Cao Mobility, and T3 Go also pose a threat to DiDi. However, the rise of aggregator platforms marks a fundamental shift in the way Chinese consumers book rideshares.

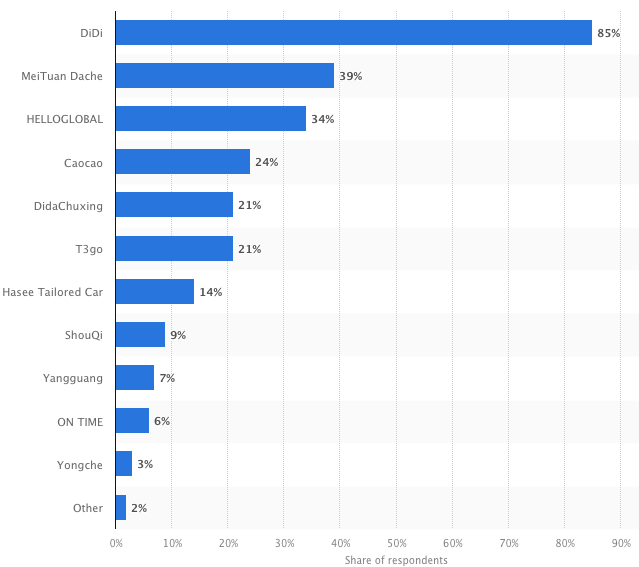

China’s ridesharing market is massive. As of 2023, there were 528 million ridehailing users in China. To add some context, the total U.S. population stands at 345 million today. To cater to this massive market, a plethora of ridesharing companies have popped up in recent years. According to data from China Internet Watch, there were 337 registered ridesharing companies in the nation as of 2023. DiDi, not surprisingly, is the most popular ridesharing platform in China today.

Exhibit 1: Ridesharing usage by brand in China

Statisa

Historically, the vast majority of ridesharing platforms in China have failed to gain traction due to their financial inability to develop high-quality mobile applications to compete with DiDi. However, the rise of aggregator platforms – intermediaries that connect drivers with riders – has removed this major barrier as smaller companies can now use these platforms to reach a massive audience.

According to data from China’s Ministry of Transportation, aggregating platforms handled 232 million rides in April 2024, accounting for 26% of total orders. For comparison, in April 2023, aggregator platforms accounted for 18% of total orders. This stellar growth highlights the growing importance of aggregator platforms, and I believe this marks the beginning of a new era in China’s ridesharing sector where users feel more comfortable with familiar aggregator apps owned by big tech companies.

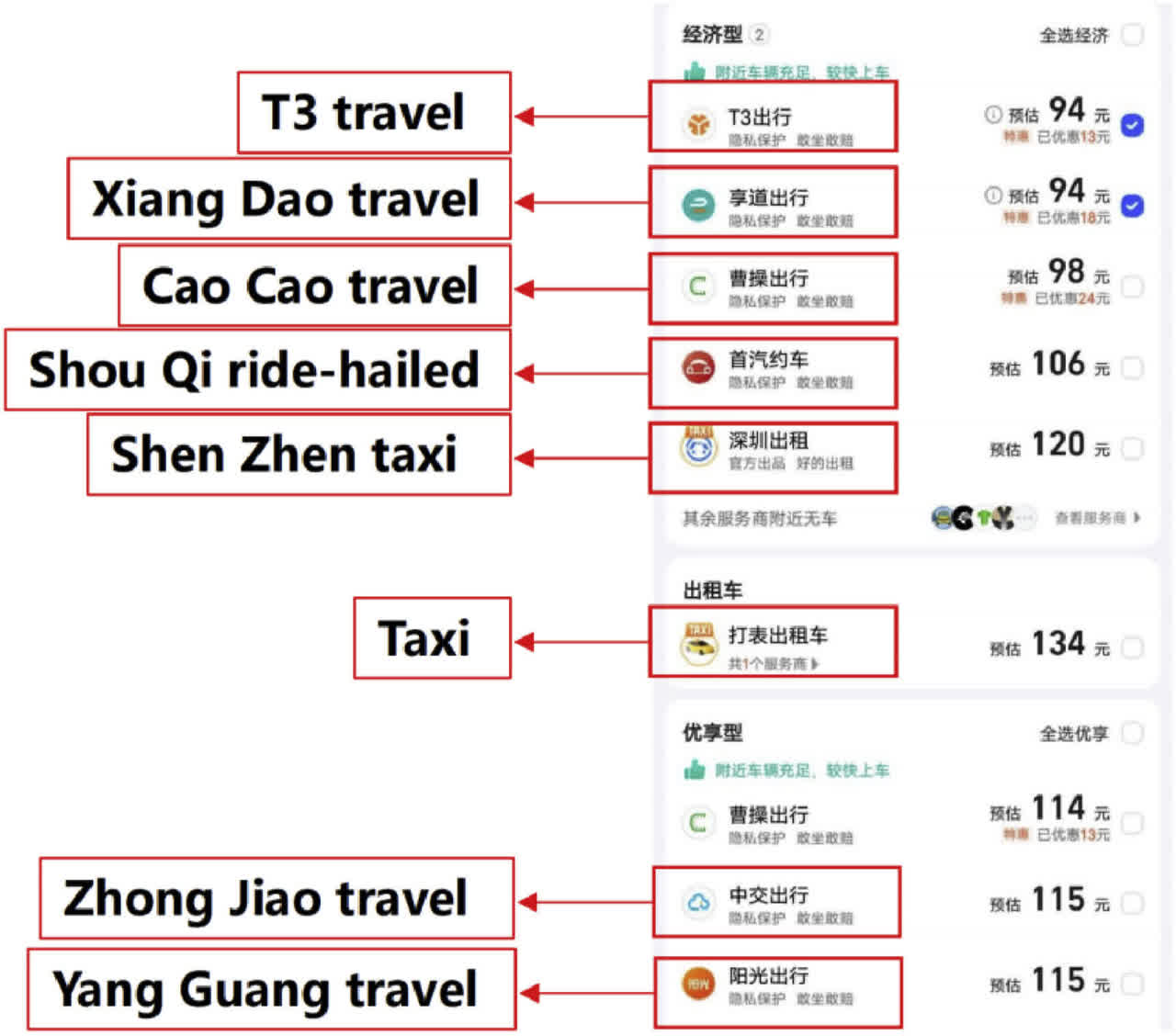

DiDi has already identified the threat posed by aggregator platforms. The company is now offering similar aggregator solutions by allowing competing ridesharing companies to offer their services within the DiDi mobile app. However, in Beijing, DiDi still offers only four options for riders compared to more than 60 for Alibaba-owned Amap.

Exhibit 2: Ridesharing interface of Amap

Economics of Transportation

When we dig deeper, we find that DiDi’s massive early success was driven in large part by its aggressive acquisition strategy. A key deal was the Uber China acquisition in 2016 for approximately $35 billion. One way to thwart the threat of increasing competition from aggregator apps is to acquire second-tier ridesharing companies. However, given the regulatory scrutiny faced by DiDi, the company is highly unlikely to be allowed to consolidate its market share through acquisitions in the foreseeable future.

With little possibility of regulatory approval for a deal to acquire a second-tier ridesharing platform, DiDi is left with no option but to compete with rising aggregator platforms on its own. Making matters worse, a notable increase in competitive threats is likely in the coming years when aggregator platforms address common concerns raised by ridesharing customers such as low vehicle compliance rates and safety hazards. Although I do not believe DiDi faces an existential threat, I am convinced that aggregator platforms will limit DiDi’s long-term growth potential.

DiDi Will Remain Relevant

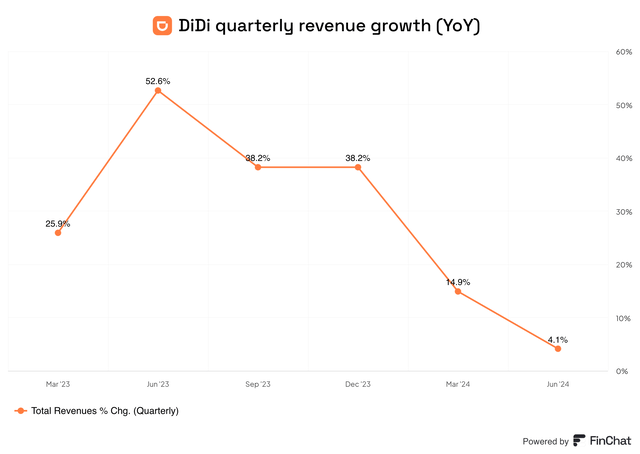

As the largest and most popular ridesharing platform in China, DiDi will continue to remain relevant and will likely see steady revenue growth. As illustrated below, growth has decelerated in recent quarters, which, I believe, is a result of increased competitive threats and the maturing ridesharing market in China.

Exhibit 3: DiDi quarterly revenue growth

FinChat

DiDi, since January 2023 when its mobile apps were allowed on popular app stores, has seen a dramatic improvement in financial performance. The company broke through to profitability on an adjusted basis in 2023 with its operating margins turning a corner coinciding with stellar revenue growth last year.

Although I believe DiDi will continue to enjoy a meaningful share of China’s ridesharing market, this alone is not a good enough reason for me to invest in the company given my expectations for a prolonged period of single-digit revenue growth due to competitive pressures and market saturation.

Takeaway

DiDi Global, the leading ridesharing company in China, is under pressure from aggregator platforms that offer users a seamless, efficient way of booking taxis and hailing rides from dozens of service providers. DiDi’s market share has meaningfully declined in the last few years, and I believe the company will continue to lose market share in the next five years. Although DiDi may be attractively valued compared to global ridesharing leader Uber Technologies, Inc. (UBER), I believe growth investors should avoid DiDi stock given the growth challenges the company may soon face.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long UBER.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.