Summary:

- DiDi Global’s current market valuation of around $14 billion on the OTC market does not accurately reflect its true underlying value, creating a significant discrepancy.

- The strong moat created by DiDi in the Chinese ride-sharing market, through its dominant market share and network effects, has helped solidify its position and deter competition.

- Factors such as the re-listing of DiDi’s stock on a major exchange like the Hong Kong Exchange could unlock DiDi’s value and reward investors with a 2x return.

Editor’s note: Seeking Alpha is proud to welcome LM Investments as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Hispanolistic

Investment Thesis

The market valuation of Chinese ride-hailing giant DiDi Global (OTCPK:DIDIY) on the OTC market, which is currently around $14 billion as of 06/15/2023, does not accurately reflect the true value of its underlying business. This creates a significant discrepancy between the perceived value of DiDi by market participants and its actual intrinsic value. However, when DiDi lists on the Hong Kong stock exchange in the future, this discrepancy will be resolved and DiDi has indicated such a plan in the past.

Investors who purchase DiDi shares at the current valuation are exposed to limited downside risk. And when market eventually adjusts and recognizes DiDi’s intrinsic value, there is a possibility of substantial rewards, potentially doubling the current investment.

DiDi’s moat in China’s ride sharing market

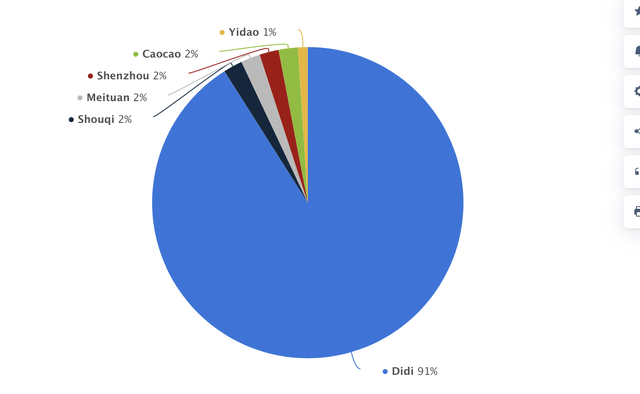

DiDi has successfully operated its ride-sharing business in China for a decade. During this time, it has established itself as the market leader by capturing the largest market share in the country. DiDi’s strong presence and dominance in the ride-sharing industry have created a robust flywheel network, contributing to its continued success and making it challenging for competitors to challenge its position. According to Statista, DiDi had a 91% market share in the Chinese ride-hailing market at the end of 2018.

DIDI market share in 2018 (Statista)

The network effect created by DiDi’s platform are twofold and mutually benefits each other.

- More drivers lead to decreased wait times and costs for riders. As more drivers join the DiDi platform, the availability of rides increases. This, in turn, reduces the wait times for riders, making the service more convenient and efficient. Additionally, with a larger pool of drivers, the competition among them can lead to potential cost reductions for riders as drivers strive to attract more customers.

- More riders help lower operating costs for drivers. When the number of riders using the DiDi platform grows, it increases the potential customer base for drivers. With a larger pool of riders, drivers have more opportunities to receive ride requests, maximizing their earning potential. This can help drivers optimize their operations and potentially reduce their operating costs as they can generate more income by serving a larger number of riders.

DiDi established its flywheel network moat through a strategic series of acquisitions during its early years, which played a significant role in propelling the company to its market leader position in China. The following events highlight the sequential growth of DiDi:

- Kuaidi Dache and Didi Dache Merger (2015): DiDi initiated a merger with its domestic rival Kuaidi Dache in early 2015. This consolidation brought together two major players in the Chinese ride-hailing industry, enabling DiDi to expand its user base, driver network, and service coverage.

- Uber China Acquisition (2016): In 2016, DiDi acquired Uber China, the Chinese unit of the global ride-hailing giant Uber (UBER). This strategic move allowed DiDi to further solidify its market dominance by integrating Uber China’s operations and customer base into its own platform.

In 2021 and 2022, DiDi faced a significant test to its network moat when the Cyberspace Administration of China initiated a cybersecurity review of the company. As a result, DiDi’s mobile app was delisted from app stores, and the company was unable to register new users until January 2023. Despite these challenges, DiDi still managed to maintain a remarkable market share of 70% in 2021. The fact that DiDi held a 70% market share in 2021, even amidst the cybersecurity review and restrictions, speaks to the strength of its network effects and the loyalty of its existing user base. Despite being unable to acquire new users, DiDi’s existing drivers and riders continued to utilize the platform, contributing to the company’s market dominance.

Despite its strong moat, DiDi’s share price has started the downward trend since the cybersecurity review event.

Why DiDi’s stock has been trading at these low valuations?

After going public with a valuation of $68 billion in 2021, DiDi faced significant challenges when the Cyberspace Administration of China initiated a cybersecurity review, resulting in the temporary removal of its mobile app from app stores. These events had a notable impact on DIDIY stock price, which has steadily declined since then. As of 06/15/2023, DiDi’s market valuation stands at $14 billion.

The cybersecurity review and subsequent delisting of the app had a lasting impact on investor sentiment towards DiDi. This event created a sense of uncertainty and caution among investors, leading to diminished demand for DiDi’s stock. Despite the completion of the cybersecurity review and the relisting of DiDi’s app in January 2023, the scars left by the incident have contributed to the persistently low demand for the stock.

Another factor contributing to DiDi’s lower stock valuations is because DiDi is trading on OTC market. It is worth noting that a significant number of institutions may impose restrictions on stock ownership in this market. Such restrictions often stem from considerations related to liquidity, risk management, and compliance requirements. This further restricts the demand for DiDi’s stock.

What factors or events could potentially unlock DiDi’s valuations in the current situation?

The re-listing of DiDi on a major stock exchange, such as the Hong Kong exchange, has the potential to trigger a significant revaluation of the company’s stock. DiDi’s recent voluntary release of its 2022 annual report in May 2023 suggests a clear intention to pursue a re-listing on a prominent stock market, as the disclosure of financial information on the OTC market is typically voluntary.

Re-listing on a major stock exchange would offer DiDi several advantages. It would enhance the company’s visibility and credibility among investors, attracting a wider investor base. The listing on a reputable exchange would also likely increase liquidity and trading volumes, positively influencing the stock’s valuation. In case of that event, I expect investors could get their share value doubled or tripled from current valuation.

DiDi’s stock fair value calculation

One approach to determining Didi’s fair value is to consider the valuations of its peers in the United States, such as Uber and Lyft (LYFT). Since none of these ride-sharing companies are yet profitable, we will use price-to-sales (P/S), price-to-book (P/B), and enterprise value to sales (EV/S) ratios to determine DiDi’s valuation.

To obtain a more accurate fair value estimate, it is crucial to use the latest financial reports that are not significantly impacted by the COVID-19 pandemic. These reports can provide a clearer picture of the company’s financial performance and prospects. As a result, I used DiDi’s 2019 revenue to calculate the price-to-sales ratio.

|

DIDI |

UBER |

LYFT |

|

|

Revenues |

$21.63 billion (FY2019) |

$31.88 billion (FY2022) |

$4 billion (FY2022) |

|

Current valuation (06/15/2023) |

$14 billion |

$80 billion |

$4 billion |

|

P/S |

0.64 |

2.5 |

1 |

|

P/B |

1.08 |

11.37 |

9.65 |

|

EV/S |

0.45 |

2.73 |

0.70 |

Based on the information provided above, we can estimate DiDi’s valuation range using these valuation methods by taking Uber’s multiple as the maximum and Lyft’s multiple as the minimum.

|

Valuation Method |

Min Fair Valuation |

Max Fair Valuation |

|

P/S |

$21.63 billion |

$54 billion |

|

P/B |

$125 billion |

$147 billion |

|

EV/S |

$19 billion |

$63 billion |

As we can see, DiDi’s current valuation of $14 billion is underestimated, with a minimum fair valuation of $19 billion and a maximum fair valuation of $147 billion. It is worth reiterating that DiDi has a much stronger business than Lyft, so when the market turns, DiDi’s multiples should be significantly higher than Lyft’s.

Taking into account DiDi’s continued growth and its market share in the ride-sharing industry, it is reasonable to assume that its growth will be aligned with the overall expansion of the ride-sharing market. According to SNS Insider analysis, the ride-sharing market will double by 2030.

Making a conservative assumption that DiDi’s revenue will grow by 50% by 2030, reaching $30 billion and using a conservative price-to-sales (P/S) ratio of 1.5, the fair value of DiDi at the end of 2030 is estimated to be $45 billion.

DiDi’s risk

Despite the cheap value and strong business model, there are a couple of risk factors that investors need to be aware of.

The long-term shift towards robot-taxis has the potential to greatly influence the operations and business models of companies such as Uber and DiDi.

This shift could allow these companies to reduce or eliminate the driver’s share of revenue, leading to increased profitability. Additionally, robot-taxis can help reduce operational complexities associated with managing human drivers, such as recruitment, training, and dealing with driver dissatisfaction or turnover. Moreover, the rise of robot-taxis opens doors for new entrants in the ride-hailing market, including specialized autonomous vehicle technology companies like Waymo or Cruise, thereby intensifying competition for Uber and DiDi.

It is important to acknowledge that the widespread adoption of robot-taxis is currently in its early stages, and there are significant technological, regulatory, and societal hurdles that need to be addressed. The precise impact on companies such as Uber and DiDi will be contingent upon the speed and success of autonomous vehicle technology deployment, as well as how these companies adapt their strategies and business models in response to this transformative shift.

The re-listing on any major stock exchange is not certain.

DiDi’s recent voluntary release of its 2022 annual report in May 2023 indicates a potential intention to pursue a re-listing on a significant stock market. DiDi is too big and too successful to be traded on the OTC market. However, it’s crucial to note that DiDi has not publicly disclosed any information regarding its re-listing plans, and the specific timeline for its relisting still remains uncertain.

The thesis about DiDi’s relisting in Hong Kong is based on previous indications that the company had explored listing on the Hong Kong exchange before opting for the OTC market. The plan encountered obstacles due to a cybersecurity review conducted by the Cyberspace Administration of China. It is worth noting that the cybersecurity review of DiDi has been concluded, signaling a potential resolution to the regulatory scrutiny it faced. Additionally, the statement by the head of China’s central bank, expressing that the government’s crackdown on tech giants is essentially finished, suggests a shift towards fostering the healthy development of the technology industry.

Summary

The market valuation of Chinese ride-hailing giant DiDi does not accurately reflect the true value of its underlying business. When market eventually adjusts and recognizes DiDi’s intrinsic value, there is a possibility of substantial rewards, potentially doubling from the current investment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIDIY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.