Summary:

- DiDi Global announced positive Q2 earnings with record high transactions and GTV, but domestic transaction volume growth has slowed.

- DiDi’s profitability and operational efficiency continue to improve, with strong performance in the China Mobility segment and international volume growth.

- Despite short-term headwinds, DiDi’s turnaround is progressing well, with the undervalued stock offering over 55% upside potential from fair value estimate.

Robert Way/iStock Editorial via Getty Images

DiDi Global (OTCPK:DIDIY) announced its Q2 2024 results on August 21st. The results are mostly positive with some short-term headwinds on the volume side. DiDi achieved consecutive quarters of positive profitability with both transactions and GTV reaching record high. On the other hand, the growth rate of domestic transaction volume has slowed down sequentially from Q1 of 2024. Overall, I think DiDi’s turnaround is still progressing well as evidenced by the continuing improvement of profitability and operational efficiency. While the stock has recovered a little from the sell-off caused by fears over Baidu’s robotaxi progress, it is still trading well below my fair value estimate. Therefore, I am maintaining my long-term “buy” rating for DIDIY.

Q2 earnings results highlights

According to DiDi’s Q2 results earnings release, highlights of the quarter includes:

- Core Platform Transactions increased 17.4% year-over-year.

- Gross Transaction Value (“GTV”) increased 14.7% year-over-year.

- Platform Sales increased 22.4% year-over-year.

- Adjusted EBITA for Q2 2024 was a gain of RMB1.3 billion, compared to a loss of 0.1 billion in Q2 of 2023.

DiDi’s Q2 results are in-line with my expectations. The growth rate for both transaction volumes and transaction value have come down sequentially from Q1 of 2024. As a recap, in Q1 of 2024, “DiDi’s Core Platform Transactions grew 30.3%, and Core Platform Gross Transaction Value grew 26.9%”. However, DiDi was able to grow platform sales at a much faster pace than both transaction volume and value, indicating DiDi’s improved pricing power in the domestic market. DiDi’s profitability improvement was also impressive, especially with the China Mobility segment.

Segment results

Total platform sales from the China Mobility segment for Q2 grew 22.2% year-over-year. However, the GTV growth rate was much lower at only 8.7% year-over-year. Average daily transactions volume was a record high of 33 million, which is a slight increase of 32.5 million in Q1 of 2024. The faster revenue growth compared to volume growth indicates that DiDi paid less earnings and incentives to drivers. The Adjusted EBITA of the China Mobility segment was “a gain of RMB2.4 billion”, which increased 64.6% from Q2 of 2023.

Total platform sales from the International segment for Q2 increased grew 23.7% year-over-year. GTV from the International segment grew 39.3%. Contrast to the domestic segment, the revenue growth for the international segment was slower than GTV growth, indicating DiDi ramped up driver incentives in the international market. The Adjusted EBITA loss of the International segment unexpectedly widened to RMB 0.53 billion from a loss of RMB 0.24 billion in Q2 of 2023. DiDi explained in the earnings release that the increase of loss was “primarily attributable to relatively lower marketing expenses and incentives for the second quarter of 2023.”

The Adjusted EBITA loss for the Other Initiatives segment was RMB 0.56 billion for Q2 of 2024, which narrowed from a loss of RMB 1.2 billion in Q2 of 2023. DiDi explained that the decrease in loss was “primarily attributable to the decrease of investments for the smart auto business as the sale of certain smart auto business to XPeng was completed during the fourth quarter of 2023.”

I think for DiDi’s investors, the most important metrics to monitor are domestic transaction volumes, domestic profitability trend, and international transaction volumes. During Q2, DiDi’s profitability trend for the China Mobility segment continued to move in the right direction as adjusted EBITA margin (calculated as adjusted EBITA/GTV) reached 3.2%, compared to 3.0% in Q1 of 2024 and 2.1% in Q2 of 2023. Furthermore, DiDi’s international volume maintained very strong growth momentum. However, the growth rate of domestic transaction volume has come down significantly. DiDi did not explain the factors behind the slowdown. My assumption is that it was caused by China’s macroeconomic challenges and abnormal weather during the quarter.

On a corporate level, R&D expense decreased year-over-year, and cost of revenue “remained flat year-over-year.” And both sales and marketing expenses and general and administrative expenses increased at a slower rate than the growth rate of platform revenue. It’s clear that management’s efforts in improving operational efficiency is making good progress.

Balance sheet and share repurchases

DiDi’s balance sheet remained very healthy. At the end of Q2, DiDi has “RMB 53.7 billion of cash and cash equivalents, restricted cash and treasury investments”, compared to RMB 53.8 billion at the end of Q1 of 2024. DiDi’s cash flow is very strong as “net cash provided by operating activities was RMB 3.4 billion for Q2 of 2024”.

The strong operating cash flow enabled DiDi to keep repurchasing shares. DiDi disclosed in the earnings press release that the company “repurchased a total of approximately 53.1 million ADSs for approximately US$221.6 million between May 28, 2024 and July 31, 2024”. DiDi can still repurchase roughly $636 million of shares under the current share repurchase authorization.

Financial projections and valuation

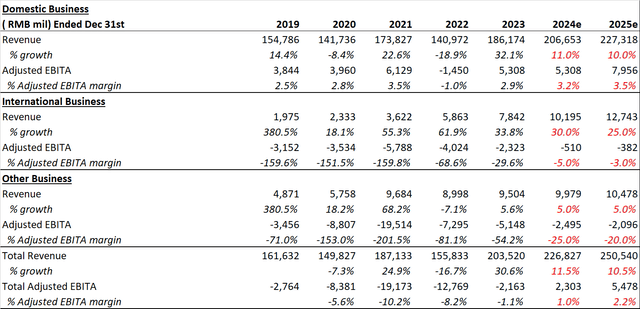

I have updated my financial projections and valuation work for DiDi to account for the Q2 2024 actual results. The most important change was the downward adjustment of growth rate for the China Mobility segment.

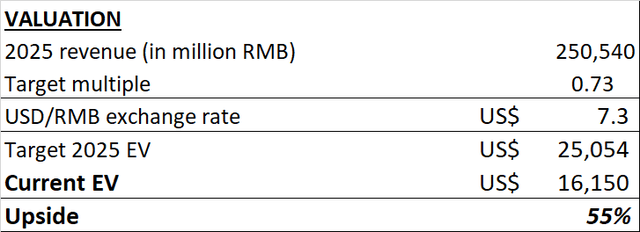

In terms of valuation, I’ve applied a TTM EV/Sales multiple of 0.73 times, which is still a 50% discount to the sector median of 1.46 times. This discount reflects the China risk and pink-sheet risk.

At today’s price, DIDIY is still undervalued as the stock has more than 55% upside from my 2025 fair value estimate.

Risk discussion

As I have mentioned in my previous articles, the biggest risks for DiDi are regulatory risk and ADR risk, which I will not repeat here. Recently there were some concerns over the potential adverse impact of robotaxi on DiDi’s business. I’ve addressed this risk in my previous article. There’s also a report which says “the Commerce Department is expected to propose a rule barring Chinese software in vehicles with Level 3 automation and above in the U.S. and effectively ban testing of Chinese-made self-driving vehicles on U.S. roads.” As DiDi has very limited operation in the U.S and its autonomous driving operation is almost entirely based in China, this potential ban in U.S has no impact on DiDi’s business whatsoever.

Conclusion

DiDi reported very satisfactory Q2 FY2024 results, which confirmed my investment thesis for DIDIY. I think DiDi is on track to achieve healthy growth and continue to improve profitability for the rest of 2024. Meanwhile, the stock is still trading at a large discount to fair value estimate. Therefore, I am maintaining my “buy” rating for DiDi.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIDIY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.