Summary:

- DiDi Global reported strong Q1 FY2024 results.

- Transactions volume hit record both domestically and internationally.

- DiDi’s stock is still undervalued after recent rally.

Sanya Kushak/iStock Editorial via Getty Images

I first wrote about my investment thesis for DiDi Global (OTCPK:DIDIY) in early March. Since then, the stock has rallied more than 20% on strong earnings and business momentum. I also analyzed DiDi’s FY 2023 Q4’s results in a previous article. On May 29th, DiDi announced its Q1 FY2024 quarterly results on its website. For Q1 FY2024, DiDi maintained its growth momentum and continued to improve operating efficiency. DiDi achieved historical quarterly highs in transactions volume both domestically and internationally. Furthermore, the Company continued to repurchase shares at attractive prices. While DiDi’s stock has risen a bit, I believe investors are not fully appreciating DiDi’s improving fundamentals as the stock is still trading significantly below its peers. Therefore, I am maintaining my “strong buy” rating for DiDi.

FY 2024 Q1 results

Highlights of DiDi’s Q1 results are:

- Total revenue for the first quarter of 2024 grew 14.9% year-over-year.

- Adjusted net income for the first quarter of 2024 was RMB1.4 billion.

- Adjusted EBITDA for the first quarter of 2024 was a gain of RMB1.6 billion. Adjusted EBITA for the first quarter of 2024 was a gain of RMB0.9 billion.

- Core Platform Transactions for the first quarter of 2024 reached 3,746 million, an increase of 30.3% from the first quarter of 2023.

- Core Platform Gross Transaction Value (GTV) for the first quarter of 2024 reached RMB92.2 billion, an increase of 26.9% from the first quarter of 2023.

Overall, DiDi’s Q1 FY2024 results are in line with my expectations with almost 15% of revenue growth and very good profitability improvement. The revenue growth rate is sequentially lower than Q4 of 2023. However, Q4’s growth rate was abnormally high. As a recap, DiDi grew its revenue by 55.4% and GTV by 65.8% in Q4 of 2023 due to an easy comparison from Q4 of 2022 and the reinstatement of DiDi’s app on major China’s app store.

In terms of profitability, DiDi’s GAAP net loss in the first quarter was RMB1.1 billion, this was mainly due to the market price change of DiDi’s equity stake in XPeng’s ordinary shares. Adjusting for this investment loss, DiDi‘s net income for the quarter was RMB1.4 billion.

On a corporate level, both R&D expense and SG&A expenses decreased year-over-year, indicating management commitment to improving efficiency.

Overall, on a group lever, DiDi’s revenue grew steadily and the Company has continued to improve profitability.

Segment results

- Total revenues from the China Mobility segment for the first quarter of 2024 grew 14.1% year-over-year. Average daily transactions volume reached 32.5 million, a record high for DiDi. GTV from the China Mobility segment for the first quarter of 2024 reached RMB71.4 billion, an increase of 21.1% from the first quarter of 2023. The Adjusted EBITA of the China Mobility segment was a gain of RMB2.1 billion in the first quarter of 2024,which increased by RMB1.1 billion year-over-year.

- Total revenues from the International segment for the first quarter of 2024 grew 43.9% year-over-year, primarily driven by the increase in the number of transactions. GTV from the International segment for the first quarter of 2024 reached RMB20.8 billion, an increase of 51.4% from the first quarter of 2023. The Adjusted EBITA loss of the International segment was RMB0.3 billion in the first quarter of 2024, which increased RMB 0.2 billion from the first quarter of 2023.

- The Adjusted EBITA loss of the Other Initiatives segment was RMB0.88 billion in the first quarter of 2024, which narrowed from a loss of RMB1.43 billion the first quarter of 2023.

On a segment basis, the International segment maintained its impressive growth momentum for Q1 FY2024 mostly because of DiDi’s strong performance in Brazil and Mexico. Revenues from the China Mobility segment increased steadily year-over-year. The revenue growth rate was lower than GTV growth rate as DiDi ramped up spending on consumer incentives. Most importantly, DiDi’s profitability for the domestic business continued to improve and the Company continued to cut losses in the Other Initiatives segment.

Balance sheet and share repurchases

As of March 31, 2024, DiDi has RMB53.8 billion of cash and cash equivalents, restricted cash and treasury investments as of, compared to RMB55.6 billion as of December 31, 2023. Net cash provided by operating activities was RMB1.8 billion for Q1 of 2024.

In terms of share repurchases, according to the earnings release, “as of May 24, 2024, the Company had repurchased a total of approximately 37.1 million ADSs for approximately US$152.4 million under this share repurchase program, including approximately 22.2 million ADSs that were repurchased for approximately US$98.0 million between March 1, 2024 and May 24, 2024. ”

Financial projections and valuation

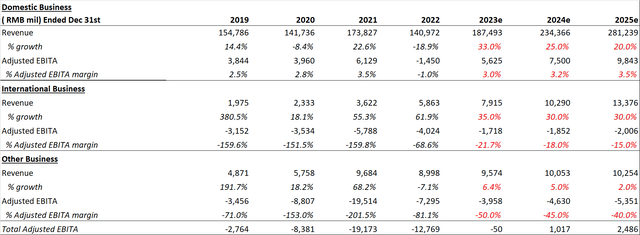

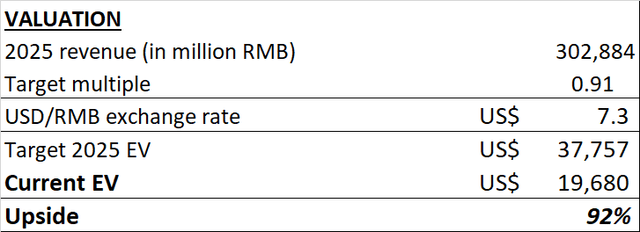

I have updated my financial projections and valuation model for DiDi to reflect Q1 FY2024 results. I’ve kept my 2024 and 2025 financial projections because DiDi‘s fundamentals are in line with my expectations.

author’s estimate author’s estimate

At today’s valuation, DiDi is still undervalued as the stock has more than 90% upside from my 2025 fair value estimate.

Risks to consider

As I have mentioned in my previous articles, the biggest risk for DiDi is regulatory risk. Howerver, the Company has taken significant steps such as communicating more with the regulatory bodies to mitigate this risk.

Another potential short-term risk is related to the supply of drivers. If China’s economy improves dramatically, the amount of drivers on Did’s platform will likely to decrease, which will impact DiDi’s bargaining power for drivers.

Finally, there’s great risk of liquidity and volatility for DiDi’s stock as DiDi still trades on the pink sheet and it is a Chinese ADR.

Conclusion

DiDi reported very good Q1 FY2024 results, which again validated my investment thesis for the company. In the next few years, I think DiDi will continue to grow its revenue and profits. However, DiDi’s stock is still trading at a significant discount to my estimated fair value with considerable upside. Therefore, I am maintaining my “strong buy” rating for DiDi.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIDIY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.