Summary:

- I am positive on DiDi Global’s new $1 billion share repurchase plan, and another favorable corporate action for DIDIY going forward could be a potential Hong Kong listing in 2024.

- DiDi Global’s recent partnerships and investments have favorable read-throughs for the growth prospects of the company’s autonomous driving business.

- DIDIY delivered a good set of results for Q3 2023, considering its first positive quarterly net income in 10 quarters and its robust quarterly operating cash flow.

- I assign a Buy rating to DiDi Global, taking into account the multiple catalysts for the stock.

Haiqing Zhong

Elevator Pitch

My investment rating for DiDi Global Inc. (OTCPK:DIDIY) is a Buy. I am bullish on DIDIY, as there are a number of catalysts for the stock such as favorable corporate actions, positive developments pertaining to autonomous driving, and the company’s financial performance improvement.

Readers should be aware that DiDi Global’s shares are traded on the Over-The-Counter or OTC market with the DIDIY ticker symbol. The trading liquidity of DiDi Global’s OTC shares is reasonably good, considering its three-month average daily trading value of roughly $8 million as per S&P Capital IQ data.

Company Description

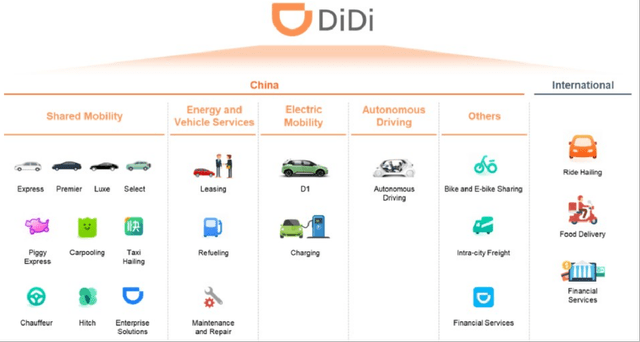

Didi Global calls itself “a leading technology platform for shared mobility, with operations in China and 15 other countries” in the company’s fiscal 2022 20-F filing. DIDIY is often referred to as “China’s largest ride-hailing company” according to reports by Reuters and other media publications.

An Overview Of DIDIY’s Key Services

Didi Global’s FY 2022 20-F Filing

DIDIY derived 90%, 6%, and 4% of its 9M 2023 revenue from its China Mobility, Other Initiatives (e.g. financial services, bike sharing, etc.), and International business segments, respectively as disclosed in its Q3 2023 earnings release.

Watch Potential Hong Kong Listing And New Share Buyback Plan

There are corporate actions that might help to drive up DiDi Global’s share price in the short to medium term.

One such corporate action is a potential re-listing on a stock exchange.

DiDi Global’s stock was previously listed on the New York Stock Exchange between June 30, 2021 and June 10, 2022, and the company’s shares began trading on the OTC market since June 13 last year.

Earlier in mid-October 2023, Bloomberg published an article highlighting that Didi Global “aims to list shares on the Hong Kong stock exchange next year” according to its sources. Didi Global’s current market capitalization is around $18 billion based on DIDIY’s last done share price of $3.77 as of December 8, 2023. In comparison, Didi Global’s market capitalization was as high as $67 billion during the time of its NYSE listing based on its IPO price at that point in time.

It will be reasonable to assume that DiDi Global can command a higher valuation as a company listed on a stock exchange, as opposed to being an OTC-traded stock. As such, a successful Hong Kong listing in 2024 could be the major re-rating catalyst that the stock needs.

Another corporate action that has a positive impact on DiDi Global is share repurchases.

Last month, DiDi Global issued a 6-K filing announcing that it “authorized a share repurchase program under which the Company may repurchase up to US$1 billion of its shares over the next 24 months.”

DiDi Global might have possibly sent a signal with its new share repurchase plan that it has the intention to support its share price ahead of a potential Hong Kong listing for the following year.

This buyback plan is meaningful, as $1 billion is equivalent to more than 5% of DIDIY’s current market capitalization. Even assuming that DiDi Global doesn’t list its shares on a stock exchange next year, sustained share buybacks will likely limit the downside for DiDi Global’s shares to some extent.

In a nutshell, I view corporate actions like a new buyback plan and a potential listing on the Hong Kong Stock Exchange as potential catalysts for the stock.

Recent Corporate Developments Relating To Autonomous Driving Are In The Spotlight

Chinese state media The Global Times reported on December 5, 2023 that “China announced safety guidelines for the use of autonomous vehicles in public transport” which is seen as a “move to encourage autonomous driving.” This piece of regulatory news brings recent partnerships and investments for DiDi Global that are associated with autonomous driving into the spotlight.

In its Q3 2023 results release, DIDIY highlighted that it has “made significant progress” in “developing autonomous driving technology”, and the company’s statement seems to be supported by the latest corporate developments.

On October 12 this year, China Daily, a Chinese state media publication, published an article mentioning that DiDi Global’s autonomous driving business arm secured a “$149 million investment” from Guangzhou Automobile Group’s (OTCPK:GNZUF) (OTCPK:GNZUY) [2238:HK] “wholly-owned subsidiary GAC Capital Co Ltd and Guangzhou Development District Investment Group Co Ltd.” Earlier on August 27, 2023, Chinese electric vehicle maker XPeng (XPEV) revealed in a media release that it is partnering with DiDi Global “in a number of areas” such as “Robotaxi.”

The Chinese government appears to be supportive of the growth of autonomous driving in the country, and this means that Chinese autonomous driving plays will likely gain favor with investors in the foreseeable future. Taking into account its recent corporate developments, DiDi Global has the necessary financing (e.g. investments from other automotive players) and relevant partners (e.g. collaboration with leading EV maker) to drive its expansion in the area of autonomous driving like Robotaxis. Being recognized as a beneficiary of the growth in China’s autonomous driving market will help to push up DiDi Global’s share price in the future.

Business Turnaround In Q3 2023

There are positive read-throughs from DiDi Global’s latest quarterly financial results, which indicate that the company is in the midst of a turnaround.

Firstly, DIDIY registered the company’s first positive earnings in 10 quarters with its Q3 2023 results. DiDi Global has been loss-making since the second quarter of 2021 as per S&P Capital IQ data. For the recent third quarter of this year, DiDi Global managed to achieve a net income attributable to shareholders of RMB107 million. In the company’s Q3 2023 results release, DIDIY credited the positive profit for the recent quarter to “improved operating efficiency” and “fixed cost leverage.”

Secondly, DiDi Global recorded a strong operating cash flow of RMB2.72 billion for the third quarter of the current year. The company also delivered a similarly robust operating cash flow of RMB2.74 billion in Q2 2023. In contrast, DIDIY was suffering from negative operating cash flow in 2022, and its Q1 2023 operating cash flow was a more modest RMB0.33 billion. Apart from a positive operating performance, DiDi Global’s operating cash flow also benefited from better working capital management.

Thirdly, the company’s cash and investments increased from RMB48.8 billion as of end-2022 and RMB53.8 billion at the end of the second quarter of 2023 to RMB54.6 billion ($7.7 billion) as of September 30, 2023. It is encouraging that DiDi Global is accumulating cash from its business operations and has made efforts to maintain a balance between maintaining its financial strength and returning excess capital. As mentioned earlier, DIDIY has put in place a new share repurchase plan with the potential to buy back $1 billion of its shares in the next two years.

Key Risk Factors

I have touched on a number of catalysts for DiDi Global in this article, but it is also important to pay attention to some of the major risks relating to the stock.

The first key risk factor is a failure to achieve a successful listing on the Hong Kong Stock Exchange in 2024. The positives associated with a potential Hong Kong listing would have been priced into DiDi Global’s shares to some extent, so it is very likely that the stock will experience a meaningful pullback if a listing doesn’t materialize. Also, remaining as an OTC-traded stock will translate into relatively lower trading liquidity and weaker valuations.

The second key risk factor relates to regulatory headwinds. If there are negative regulatory developments that affect DIDIY’s core ride-hailing business in China, the company’s financial performance and share price will likely be adversely impacted.

The third key risk factor is the inability of DiDi Global to achieve sustained profitability. Investors are increasingly placing a greater emphasis on companies’ profitability as opposed to top line growth. If DIDIY can’t continue to deliver positive earnings in the quarters ahead, the market might choose to assign a lower valuation multiple to the stock.

Closing Thoughts

DIDIY is now valued by the market at a trailing twelve months’ Enterprise Value-to-Revenue multiple of 0.69 times or below 1. Given DiDi Global’s status as a leading player in China’s ride-hailing market and the presence of multiple catalysts, I am of the view that DiDi Global deserves a higher valuation and a Buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Asia Value & Moat Stocks is a research service for value investors seeking Asia-listed stocks with a huge gap between price and intrinsic value, leaning towards deep value balance sheet bargains (i.e. buying assets at a discount e.g. net cash stocks, net-nets, low P/B stocks, sum-of-the-parts discounts) and wide moat stocks (i.e. buying earnings power at a discount in great companies like “Magic Formula” stocks, high-quality businesses, hidden champions and wide moat compounders). Sign up here to get started today!