Summary:

- On Friday the 22th, Digital World will hold a meeting of shareholders to vote the merger with Trump Media.

- After this, the merger could be closed quickly and the resulting company with stock symbol DJT could commence trading on the Nasdaq next week.

- The potential media coverage could result in significant volatility and a large price movement.

- Over the long term, I simply do not see this company becoming a decent investment, but in the short term, traders could make money during upcoming events.

Torsten Asmus

The Trump SPAC Digital World Acquisition Corp. (NASDAQ:DWAC) is planning on merging with Trump Media & Technology Group. On Friday the 22th, DWAC will hold a meeting of shareholders to vote on the approval. This merger was already announced in 2021, but since then, it has finally received SEC approval. The merger could already happen next week.

After approval of its shareholders, shares of Digital World Acquisition Corp., currently traded on the Nasdaq, will trade under the symbol DJT, a reference to the initials of the former president. SPAC mergers usually close within a few days, so it is likely that the company will be trading as DJT already at the start of next week. Trump’s 90% stake in TMTG could theoretically be valued at more than $3 billion if DJT shares continue trading for the current DWAC share price.

This merger has received relatively little media attention but is likely to be an event coupled with some very high volatility.

In this article, I will focus on the likely volatility resulting from this event and the future prospects, but I will not look too deeply into the (lack of) profitability of the underlying company and the platforms. For more information about this, I’d suggest this article by Seeking Alpha analyst Stone Fox Capital.

Dilution, obstacles and potential delays

Theoretically, DWAC shareholders could still block the deal on Friday. I believe this is very unlikely though, because DWAC itself has been long looking forward to this deal and shareholders have already expressed their discontent with the slow pace of the SEC while looking into the lawsuits.

But there are still a couple of hurdles to overcome. Co-founders of DWAC lately filed a lawsuit because of stock dilution resulting from this merger. I believe this is number one item that could still delay the merger. DWAC has extended the date by which it has to complete the merger to June 8 from March 8. This means that if this lawsuit leads to additional delays, the company still has some time.

Also, a lawsuit on insider trading of DWAC shares could theoretically derail the merger, but I believe this is not likely. If the merger is approved this Friday, it is quite likely to follow through, even with the continuing legal trouble. DWAC could theoretically still announce a delay because of the dilution lawsuit, but if that happens, the company needs to act fast.

After the merger, the stock will be diluted. Currently, 37.2M shares are outstanding, but after the merger this number will increase to 135M. Of course, this would normally mean that current share value would be reduced by almost three quarters. But by market logic, a post-merger SPAC could be worth more than a pre-merger SPAC, since this takes away some of the risks of the merger not happening (DWAC states in its financial report that it might not survive without the merger). But it is not at all certain that share prices follow the laws of arithmetic. Also, a large part of the dilution resulting from the merger will likely already be priced in by the market.

Lock-up period

It is no secret that Donald Trump is in dire need of cash currently, and the DWAC merger might just provide the lifeline he needs.

Post merger, there is a 6 months lock-up agreement in place during which shareholders of TMTG who own more than 10% of stock are not allowed to sell or exchange. This period could be reduced to 150 days in case the closing price of DWAC stock equals or exceeds $12.00 per share for any 20 trading days within any 30 trading day period.

This provision could mean that current and future shareholders have somewhat of an insurance against selling pressure, but for Mr. Trump, there are some ways at which he could still use his new DJT shares to get access to cash. He could for instance transfer his shares to a trust, which can be used as collateral for a loan. Also, being the majority shareholder, it is possible that he will be able to convince the board to let him sell his shares outright. If Digital World waives the provision ‘at or prior to the closing’ of the merger, Trump could do this. But this would almost certainly lead to a quick share price crash which dramatically reduces the amount of cash he could be able to acquire. Also, this probably requires the consent of other large shareholders, so I do not believe waiving the lock-up period would be very opportunistic. In my view, the most likely option is that Trump will try to use his shares as collateral.

On the long term, this stock is an obvious sell

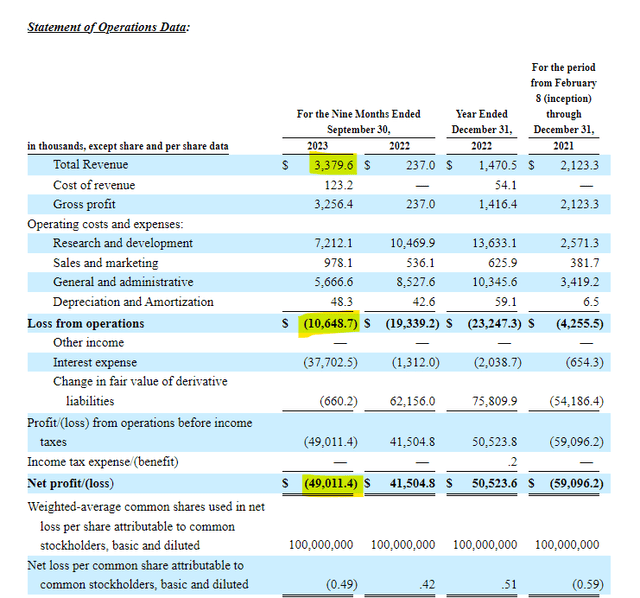

Since the TMTG part of the merger is the part which is generating revenue and selling digital products, I will focus this part of the analysis on TMTG. The proxy statement/prospectus relating to the proposed merger between DWAC and TMTG lists some revealing metrics about TMTG, Truth Social and its financial performance. In the screenshot below you can see the operations data of TMTG of the first nine months of 2023:

Statement of Operations Data (Seeking Alpha)

Most obvious is the data about revenue, which was $3.38M during the first 9 months of 2023. This is quite low, as it implies that Truth Social had a revenue of less than $2 per active user during this period. As a reference, Facebook (META) had a $68 of revenue per user in Q4 2023. In the operations statement of TMTG, both R&D and ‘General and administrative’ costs were higher than total revenue. The total loss was more than $49M, a loss of $0.49 per share. It is also interesting to see that the bulk of this was due to interest expenses. Note that the 2022 revenue was only positive because of a change in fair value of derivative liabilities.

The company has been losing money since its inception, and without some major growth and increase in revenue, it is not likely to turn around this trend.

The prospectus also lists some of the risks concerning post-merged company, which are specifically tied to TMTG, of which I would like to highlight the following two:

If Truth Social fails to develop and maintain followers or a sufficient audience, if adverse trends develop in the social media platforms generally, or if President Trump were to cease to be able to devote substantial time to Truth Social, TMTG’s business would be adversely affected.

TMTG’s independent registered public accounting firm has indicated that TMTG’s financial condition raises substantial doubt as to its ability to continue as a going concern.

The first risk, Truth Social failing to develop and maintain a sufficient audience, is a real risk. With the knowledge from the financial statements, I would probably add here that Truth Social needs to start growing quickly, or achieve a solid revenue model.

At the moment, Truth Social has about 2 million active users and is simply no match for the larger social media platform. As is analyzed in this article, “the most likely outcome is that Truth Social will become a niche platform with a relatively small user base“. So even if the company would be able to achieve a better revenue model, the question is whether it will be worth a valuation in the billions. Also, if president (of TMTG) Trump would become president (of the US) again, it is obvious that he will not be able to devote much time to TMTG anymore.

The second risk is quite worrying, since it states that TMTG’s accountant has substantial doubts in the ability of the company to continue as a going concern. This should be an obvious red flag for any serious investor.

Volatility and why I do not recommend shorting

I am very skeptical of the possibility of DWAC, TMTG and the resulting company DJT becoming decent investments on the long term. I believe it is very likely that the resulting company will lose value because of its weak fundamentals.

One thing that I believe is almost certain though, is that there will be volatility. Large volatility. For one simple reason: Donald Trump.

In 2021, DWAC shares surged a staggering intra-day 400% after news of the planned merger hit the press. Last year, a second round of Trump NFT’s sold out within a day. More recently, Trump’s sneakers sold out within hours.

Currently, I think most of the US citizens are not aware of upcoming closing of the merger between DWAC and TMTG.

Imagine Donald Trump discussing his new stock next week, on Truth Social and maybe even reported on every major news platform. Regardless of fundamentals, it is likely that such an event could lead to a huge inflow of capital.

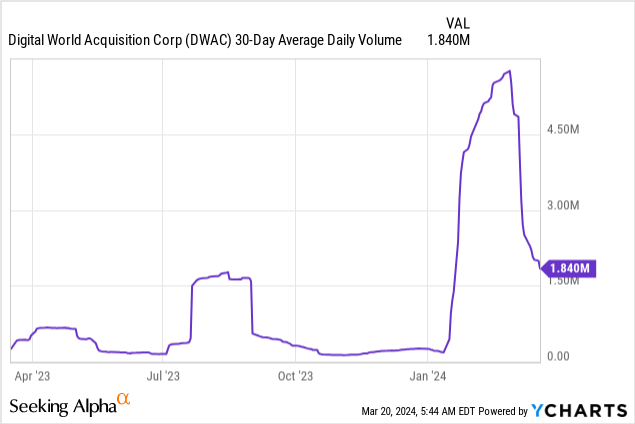

The current 30-day average daily volume of DWAC is only 1.84M shares, which amounts to slightly north of $67M traded per day with a $36.5 share price. As such, I can imagine it does not take extreme amounts of capital to ignite strong share price movements.

Markets are not stupid, and have already been adapting to the possibility of DWAC experiencing major volatility during the coming days. The cost to borrow has recently shot up to 211%. Also, just take a look at this option chain on the Seeking Alpha options page:

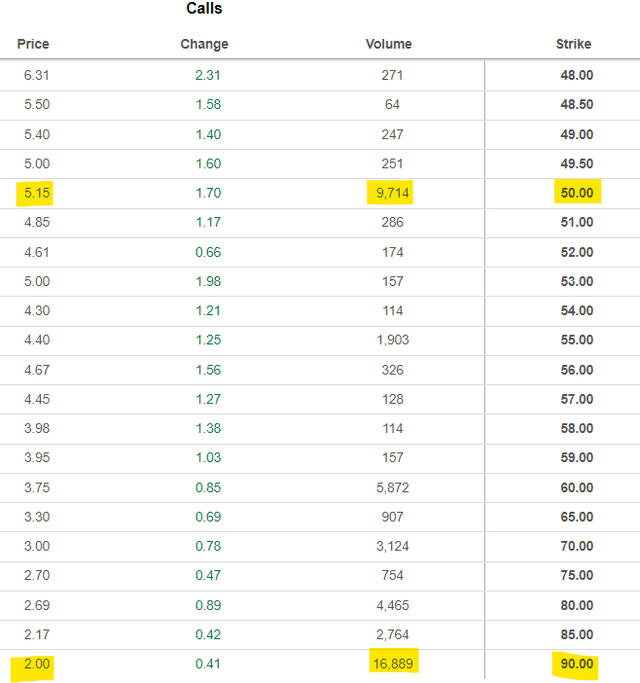

DWAC 28 March Call options (Seeking Alpha)

These are the March 28 DWAC options, and I only showed the higher strike prices that are well out of the money. A call with a strike price of $50 is trading for $5.15, which is 12 percent of the current DWAC share price of $42.90. This is quite a premium for a call expiring in one week. The $90 call, more than twice the current share price, is trading for $2.00. Also note the relatively large trading volumes, especially for the $90 calls.

Options premiums are very high at the moment, which implies that the market also expects large volatility. This makes it more difficult for traders to make money from this event by using calls, since option premiums have already reached such heights. On the other hand, the expected volatility makes it risky to short DWAC, since the past has already shown that the stock could make extreme moves as a result of merger news.

Takeaway

The Digital World and Trump Media & Technology Group merger is likely to close next week. This will result in a company with the stock symbol DJT, likely trading on the Nasdaq. There is a lock-up period of 6 months for existing large shareholders, but Donald Trump still has possibilities of using his shares to raise cash, either by moving them to a trust and using it as collateral for a loan, or convincing DWAC of waiving the lock-up period and selling his shares outright. I believe the former is much more likely, which does not directly lead to selling pressure.

Even if the merger can still possibly be delayed by a lawsuit by DWAC co-founders, volatility is ahead. Option chains and cost to borrow DWAC shares show that the market expects extreme levels of volatility. Regardless of fundamentals, for anyone other than very experienced traders, DWAC is a dangerous instrument to be invested in. On the long term, DWAC and the resulting company DJT do not look like good investments and are a strong sell in my opinion. In my view, DWAC seems to trade more like a popularity contest for Donald Trump than like a serious investment.

But even if long term prospects do not seem bright, traders could make money from DWAC with the upcoming events. But options for DWAC are already trading for high premiums, so this seems like a risky way to speculate on possible moves. Investors who own shares for the long term, which I do not recommend, could be better off by selling calls on their existing position, since the options premiums are very attractive at the moment.

I will not be touching anything related to DWAC, TMTG or DJT myself, but will enjoy observing the almost inevitable volatility from a distance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.