Summary:

- Disney’s 2024 fiscal year showed robust profitability and revenue growth, driven by improvements in the DTC business and strong performance in Parks and Experiences.

- The firm’s economic moat is wide, supported by its iconic franchises, extensive media portfolio, and a successful transition to DTC streaming.

- Disney’s current valuation appears fair according to my DCF, with an IV per share of $119.

- Risks include competitive pressures, cyclical market conditions, and sociopolitical backlash, but Disney’s financials and strategic direction remain encouraging for long-term growth.

- We issue a Hold rating.

JHVEPhoto

Investment Thesis

Disney (NYSE:DIS) had a robust 2024 fiscal year, with marked profitability gains and solid revenue growth being achieved by the firm.

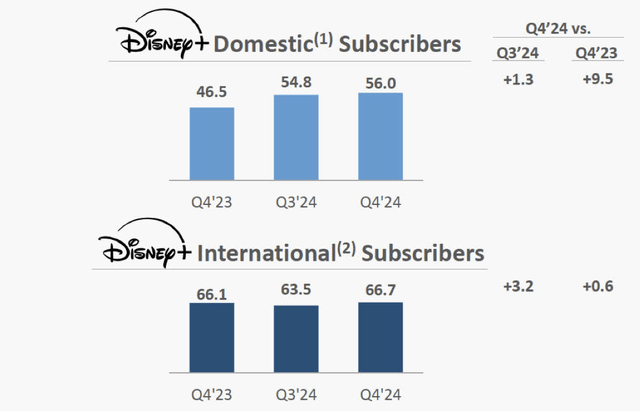

Improvements in the number of subscribers and average ticket per customer in the DTC business have allowed the firm to begin clawing back some of the margin that has been lost during the DTC streaming transition.

Parks and Experiences continue to be popular among consumers, with their portfolio of international destinations seeing particularly robust visitor numbers.

Nevertheless, the current valuation appears to value shares fairly, with my DCF implying just a 3% undervaluation at present time.

As a result, I must downgrade my rating to a Hold and cannot advocate for the purchasing of additional sales. However, given the positive long-term outlook for The Walt Disney Company, I won’t be selling any either.

Business Overview & Economic Moat

Disney is perhaps the most well-known entertainment company in the world. From their headquarters in Burbank, CA, Disney manages an empire of television, media, gaming and leisure businesses which have made the company an unavoidable and often beloved part of the lives of millions of people across North America, Europe and Asia.

The firm’s business of producing television and film content rests at the very core of Disney’s entire operational structure. Through the creation and acquisition of hugely popular franchises and characters, The Walt Disney Company has engineered multiple avenues for monetisation of their lucrative content IPs.

With this in mind, I firmly believe Disney is first and foremost in the storytelling business. By engaging viewers with cinema that excites and resonates on an emotional level, Disney is able to create a powerful connection with their audiences through the characters forming the stories.

It is this connection that enables the company to attract guests to their theme parks, cruise ships, and resorts, which form another massively profitable element of Disney’s business structure.

Historically, it is exactly storytelling that the company has done best. Iconic franchises such as Toy Story, Mickey Mouse and friends, Frozen, Pirates of the Caribbean, Winnie the Pooh and The Lion King were all either forged or popularized by Disney.

An increased catering towards more mature audiences through the acquisitions of Marvel and Lucasfilm’s Star Wars franchises have further increased the overall demographic Disney is able to attract with their content and products.

I also feel compelled to mention that Disney has made some missteps when it comes to storytelling. By pursuing ideology-driven content and through excessive reliance on remakes and old franchises, Disney has attracted negative press and critique, which has dampened appetite among some customers.

Disney must therefore refocus their attention back to the telling of exciting, engaging and family-friendly stories that can be enjoyed by guests of all ages, backgrounds and cultures.

Disney also has a truly massive portfolio of auxiliary entertainment products such as ESPN, ABC News and Hulu which complement their core media business very well. I’ve identified ESPN as perhaps the most important non-IP related asset, as the increasing popularity of direct sports streaming presents a real opportunity for Disney to expand their market share in.

ESPN in particular has a powerful role in helping the company to succeed in its transition from linear TV to a DTC model with their Disney+ service. While ESPN is available to purchase as a standalone subscription, the bundling of this service with Disney+ could help further expand the reach of their creative content, too.

I analyze the degree of moatiness for entertainment companies based on the popularity, stickiness and ensuing earnings power generated by their IPs.

With this in mind, Disney has proven over the last fifty years to be incredibly capable of creating enduring media franchises that allow the company to forge multiple revenue streams for their IPs. Furthermore, many IPs have become so iconic (think of Mickey, Winnie and Frozen) that their presence in the form of licensed merchandise is everywhere, from pyjamas to luggage and even kitchenware.

Disney’s growth has allowed the company to become such a massive organisation with reach and scale that is incredibly difficult to replicate. While rivals such as Comcast (CMCSA), Netflix (NFLX) and Warner Bros. (WBD) are powerful in their own rights, no single entertainment business currently can match Disney’s level of influence.

Therefore, I confidently assign Disney with a wide economic moat rating and believe the breadth of their operations combined with their ability to create and maintain hugely successful franchises provides the firm with a set of competitive advantages that are essentially impossible to recreate.

Fiscal Analysis – Q4 & FY2024

Disney posted their Q4 and full-year 2024 results just one week ago, with my overall impression being very positive indeed.

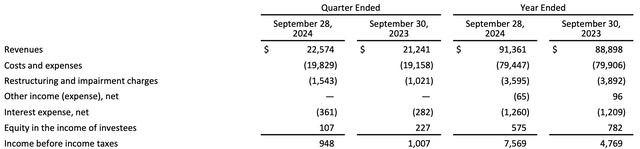

The Walt Disney Company posted revenues of $22.6 billion for Q4, which were up 6% on a YoY basis. Total year revenues grew YoY by 3% to just shy of $89 billion.

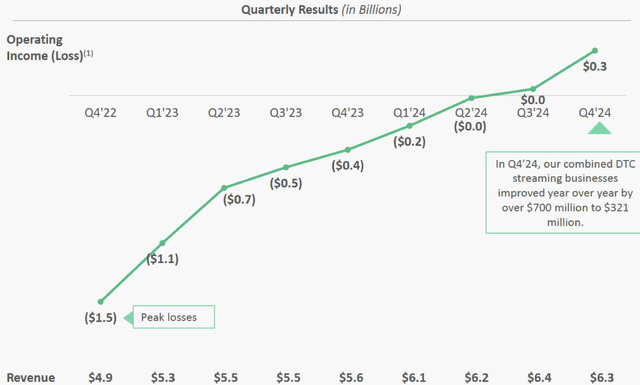

DIS FY24 Earnings Presentation

Such robust revenue growth came thanks to a real improvement in the DTC business, thanks partly to increased advertising revenues and subscription volume and pricing growth.

Revenue growth can be challenging for businesses such as Disney, especially without any major developments such as new park openings or particularly successful movies releases. With this in mind, Disney’s ability to continue expanding the DTC business all the while essentially maintaining the level of linear TV revenues flat YoY supports my hypothesis in earlier articles that Disney are absolute experts at growth monetization.

Disney’s revenue growth was complemented with the realization of a plethora of cost efficiency initiatives that have allowed the firm to reduce unnecessary expenditures at their parks, cinema divisions and of course the DTC business.

DIS FY24 Earnings Presentation

Indeed, the DTC business managed to grow revenues by 15% YoY and, perhaps, even more impressively, completely transform the profitability of the unit by producing $253 million in operating income.

While this does still mean the unit is operating at a pretty dismal 4.3% operating margin (especially compared to the once historic 40% margin being achieved in the linear networks unit), I see a few avenues for Disney to reach greater profitability in their DTC operations.

As an immediately actionable activity, Disney should and appears to be focusing heavily on increasing the amount of adverts being broadcast on their DTC platforms. While the advent of streaming sites such as Netflix originally marketed themselves as “ad-free” alternatives to mainstream cable, the reality is that these DTC services have simply become a more effective platform for media distribution.

Therefore, it seems likely that Disney (along with all their competitors) will increase the amount of advertising taking place on the platform so as to increase the profitability of these services.

Disney also has the opportunity to bundle ESPN services with Disney+ so that the platform will appeal to a much larger demographic of customers. By providing live content on the platform, Disney will be able to distinguish their service better from those of competitors, while also drawing a greater focus onto their traditional creative entertainment portfolio.

While a 40% margin would most certainly be a tough goal, my long-term estimate for the operating margin at Disney’s DTC business is around 25-30%. This should be achievable through advertising revenues and a higher ticket per customer through bundling.

I also suspect that the price for subscriptions will increase slightly faster than inflation once less successful streaming platforms get absorbed into the largest players and companies such as Disney, thus achieve greater pricing power.

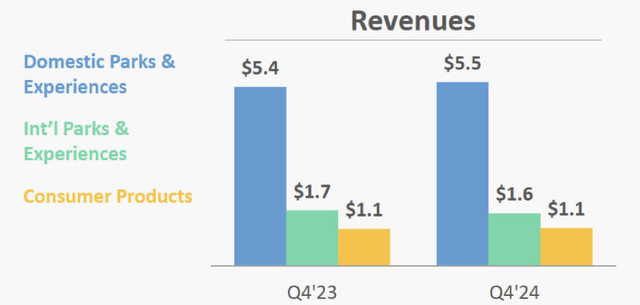

Disney’s Experiences division also managed to grow revenues by 1% YoY to $8.2 billion in Q4, thanks primarily to surprising parks demand from international markets.

DIS FY24 Earnings Presentation

Despite the relatively upmarket positioning of Disney holidays (be it cruises, a stay at the parks or leisure visits to their resorts), the draw for customers appears robust and suggests that for a majority of guests, significant appeal still lies in the vacation products offered by the company.

Full-year revenues for the Experiences segment were flatline as slight growth in the domestic parks was offset by an equal drop in annual international visitors.

Growing visitor numbers and averages of tickets on the back of an inflationary period and during a macroeconomic era of higher interest rates would be very difficult. As a result, I view the annual flatline parks revenues as largely positive.

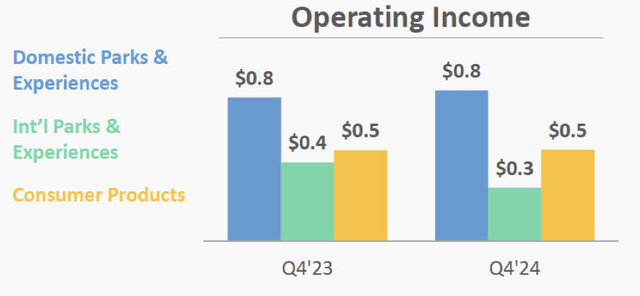

DIS FY24 Earnings Presentation

Q4 operating income in the experiences division reduced by 6% YoY as a result of an inflationary supply side environment in international markets, impacting segment operating margins by almost 5pp.

On an annualised basis, Experiences operating income increased 4% YoY, mainly thanks to such a relative comparison being impacted by the poor 2023 results.

It is also critical to note that the 32% YoY Q4 decrease in operating income for international experiences products was also the result of massive tech and development spending, with Disney’s European and Asian theme parks being prepped for significant expansions.

The last item I want to highlight from the earnings report comes from the tone and goals being discussed by management in the earnings call.

Much like in the Q1 and Q2 results which I covered earlier in the year, Iger and his team appear to have taken to heart the importance of returning content to a middle-ground when it comes to political and ideological motivations.

The damage to brand and reputation done by controversial movie releases placed undue pressure on the company and has resulted in a muted box office landscape for much of the last five years.

I am happy to report that management identified with transparency that missteps were made in the production pipeline and gave assurances that upcoming releases will be firmly centred around creative storytelling.

While I do not expect much of these changes to be realised until late-2025 onwards due to the time lag between production and final release, it is a positive outlook for the future of the company.

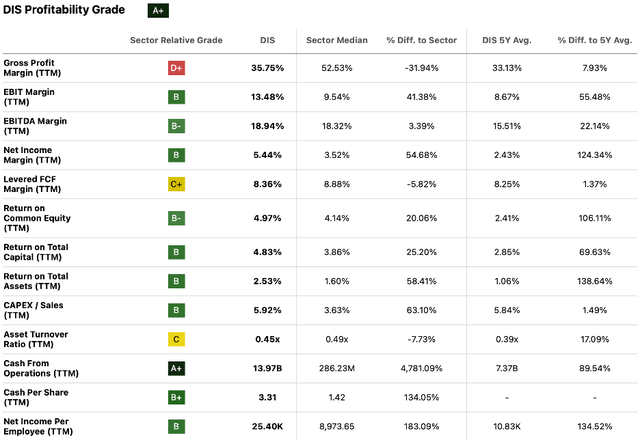

Seeking Alpha | DIS | Profitability

Seeking Alpha’s Quant rates Disney’s profitability an “A+” at present time, which, I believe, is an accurate representation of the firm’s overall situation.

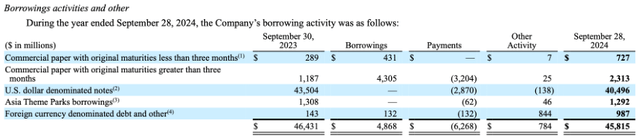

Disney’s balance sheet remains robust, with the firm exhibiting what I consider to be a sound capital allocation strategy.

The entertainment giant currently has a quick ratio of 0.54x and a current ratio of 0.73x due to a significant number of accounts payables items and a relatively hefty $3.8 billion current portion of LT debt.

Nevertheless, Disney’s ability to generate significant FCF to the tune of $8.9 billion should allow the company to meet any current liabilities without having to leverage their balance sheets further.

On the contrary, Disney remains committed to reducing their debt burden, with the firm paying-off maturities as they arise. The company’s debt to equity ratio of 0.48x is very low and a result of Disney’s historic reputation of delivering significant value to shareholders through dividends and stock repurchase schemes.

As a whole, I am quite impressed with Disney’s profitability, capital allocation structure and their outlook for 2025 and beyond. It certainly seems to me that the full-year results are evidence that Disney has made concrete improvements since 2023 and appears to be on track to produce solid long-term results.

Valuation

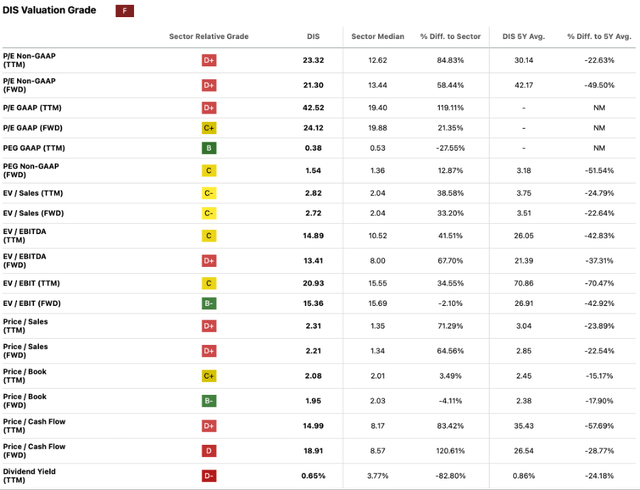

Seeking Alpha | DIS | Valuation

Seeking Alpha’s quant assigns DIS with an “F” valuation grade at present time. The letter grade is a little pessimistic in my opinion and almost certainly skewed due to the comparison of Disney to the communication services sector as a whole, which tends to be a mature industry with lower relative valuations.

The P/E non-GAAP TTM of 23.32x is in this instance more accurate than the GAAP measure due to some once-off penalties that impacted results in FY24. The ratio is also quite low, both on an absolute scale and relative to Disney’s 5Y average of 30.14x.

A P/S TTM of 2.31x is also significantly below the 5Y average of 3.04x, even despite the recent rally in DIS stock thanks to the much-improved sales figures at the firm.

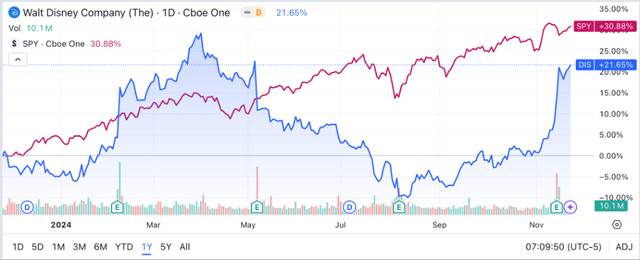

Seeking Alpha | DIS | 1Y Advanced Chart

DIS stock has been closing-in on the TTM gains generated by the S&P500 tracking SPY (SPY) ETF, with the recent resurgence in share prices coming on the back of the strong Q4 results.

Considering that the valuation metrics remain quite low even with the recent rally, there may still be more room for the stock to rise should the upcoming Q1 FY25 results continue to see Disney improve profitability and steadily grow revenues.

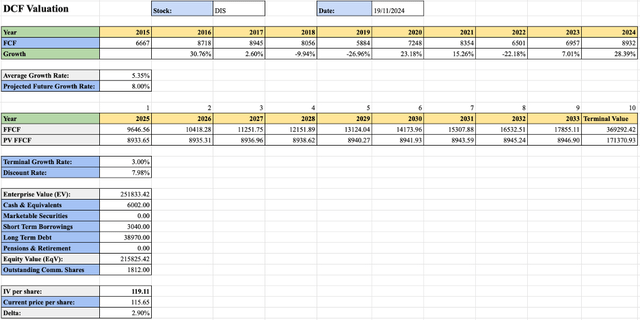

I also conducted a DCF valuation into the stock in order to obtain a quantitatively derived understanding of any value that may still be present in the stock. I use DCFs as a rough guide for value by calculating what the present value is of all future cash flows at Disney from now until judgement day.

I sourced all cash flow and balance sheet related items from Seeking Alpha’s wonderful Financials tab for DIS. I consider Disney’s 10Y average growth rate of 5.35% to be slightly too pessimistic, as the period is impacted significantly by the DTC transition and COVID-19.

I therefore raised my projected future growth rate for FCF to 8%. I used a 3% terminal growth rate to approximate what I suspect will be a slightly hot U.S. economy moving forwards. The discount rate of 7.98% reflects the average annualized return produced by the S&P 500 over the last 92 years.

With these inputs, my IV estimate for DIS came out to $119 which implies a 3% undervaluation. I consider any value figure within 10% of the current price to suggest a fair valuation at present time, due to the inherent uncertainties involved with projecting future cash flows.

Given the fair valuation, I suspect short-term (1-12 months) trends for DIS stock price will depend on the prevailing macroeconomic trends and the relative successes of ensuing earnings reports.

In the long run (1-10 years), I feel much more confident about Disney’s trajectory. The firm’s robust financials combined with a more universal business strategy should allow for significant shareholder returns both through stock appreciation and growth, but also through share repurchases and dividend payments.

Disney Risk Profile

Considering Disney’s position at the top of the entertainment business, I see the firm facing threats mainly from competitive forces, cyclical market conditions and some sociopolitical and governance risks.

Despite Disney’s massive scale of operations and vertical integration in the entertainment industry, rivals such as Warner Brothers, Paramount, Netflix and even Apple are constantly vying to attract viewers not only to their content, but to their proprietary DTC platforms.

The massively competitive nature of the so dubbed “streaming wars” continues to present challenges for Disney, with the excessive number of players reducing margins and profitability at the firm.

While I do think that Disney is in a position to create a sustainable business in the DTC market, the firm must continue to produce great content for their Disney+ platform. Without great quality TV and movies, consumers simply won’t purchase subscriptions.

Disney also faces some pressure from cyclical market conditions, with the effect of decreased discretionary spending by consumers impacting their experiences segment in particular. The impact a recessionary environment could have on parks and resort income may be amplified at the present time due to the relatively expensive nature of these attractions for a majority of Americans.

Finally, the firm is still facing some sociopolitical backlash from their more politically motivated content. Movies and TV that have emphasized values more traditionally associated with liberal groups have caused controversy among conservative circles. While Disney appears to be moving toward a more socially neutral political position, some criticism may remain for a few more years to come.

A similar threat could be amplified should the firm continue to produce particularly liberally themed content in what is an increasingly conservative U.S. social and political system. I want to emphasize that I am not making any particular comment on Disney’s political ideologies, but rather highlighting the risk a more conservative and authoritative governance structure in America could have on Disney’s operations.

Considering these threats and the associated impacts to profitability and reputation, I consider Disney to harbor a high level of risk. Of course, I strongly urge all readers to conduct their own research into the risks associated with Disney, should they be of concern.

Summary

The year 2024 has been a transformative one for Disney. Successes in streaming, growth in their parks and experiences divisions and delivery of relatively successful movies and media appears to have finally convinced the markets that Disney is on the right track once again.

A challenging consumer environment and massive competition in the DTC business has been navigated by Disney with precision and excellence, which is truly wonderful to see. However, risks still remain, with the ultimate profitability of the DTC business largely a deciding factor in how much value might exist in DIS stock.

My valuation suggests the stock is trading around a fair valuation relative to the discounted present value of all future cash flows. This suggests that unless Disney is able to significantly outperform my expected 8% annualized rate of cash flow growth, there may not necessarily be an outsized opportunity for investors in the stock.

I therefore downgrade Disney to a Hold at present time and will maintain my own position in the stock. Personally, I will be looking for at least a 20% undervaluation relative to IV before I would feel comfortable adding more shares to my position.

As a closing remark, I really like the direction of the business but do not see sufficient excess value to be present in the stock to warrant building or expanding a position in DIS shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and do not solicit any content or security. Opinions expressed in my articles are purely my own. My opinions may change at any time and without notice. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.