Summary:

- Disney’s direct-to-consumer business is improving, with subscriber growth and increased average revenue per user for Disney+.

- The company’s operating income in the direct-to-consumer segment has turned positive lately, reaching a major milestone.

- Disney’s earnings outlook has been upgraded, with a 25% growth forecast and a target of $8 billion in free cash flow for this year.

- Shares are a bargain on the drop, trading for only 19X FY 2025 earnings.

Colin Anderson Productions pty ltd/DigitalVision via Getty Images

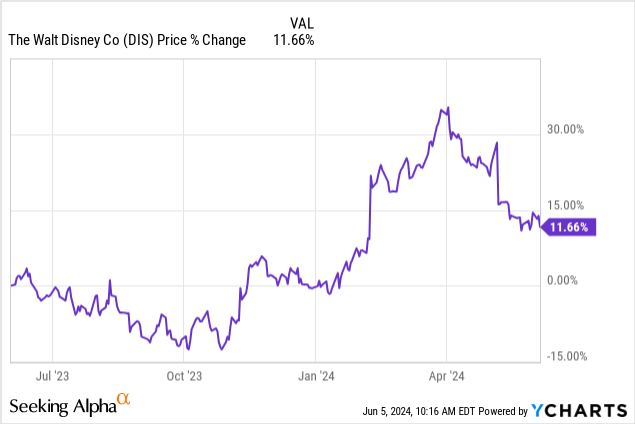

The Walt Disney Company (NYSE:DIS) has had major success in recent quarters in fundamentally improving the trajectory of its direct-to-consumer business, with the company achieving a milestone in Q1’24: it grew its DTC segment to operating profitability for the first time. The Streaming platform also announced that it was accelerating its capital returns including both a $3.0B stock buyback as well as an increased dividend which is set to make the stock more attractive for dividend investors going forward. I believe that Disney’s next catalyst will be the achievement of its very ambitious $7.5B cost savings target that the company laid out last year. The biggest reason for me to add to my position in Disney is that the streaming platform’s shares trade at a very attractive price-to-earnings ratio on the drop!

Previous rating

I rated shares of Disney strong buy in my last work on the streaming company in March 2024, chiefly because the company announced a generous increase in its regular dividend that made Disney attractive as a capital return play. I confirm my rating as Disney’s valuation has become a lot more attractive due to last month’s correction, the DTC business is now also making positive operating income contributions and the company has a chance to return more of its free cash flow to shareholders in the future. I believe there are 3 specific reasons why investors should consider an investment in Disney at this point in time.

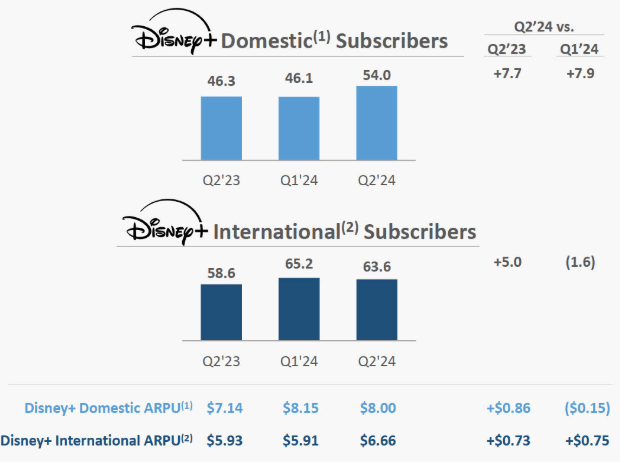

1) Subscriber momentum and ARPU growth for Disney+

Disney continues to grow its domestic Disney+ subscription service which had 54M paying subscribers at the end of the March quarter (Disney’s second fiscal quarter). Disney added a solid 7.7M subscribers to its Disney+ platform year over year and increased its average revenue per user metric/ARPU by $0.86 per-user to $8.00. This figure is often viewed as a key performance metric for streaming companies as it indicates to what extent a streaming platform is actually improving its customer monetization. Disney+ also gained in international markets with its average revenue per user increasing $0.73 per user year over year to $6.66. Momentum in subscribers for the company’s largest subscription offering is key to the kind of progress with have been seeing in the direct-to-consumer business.

Disney

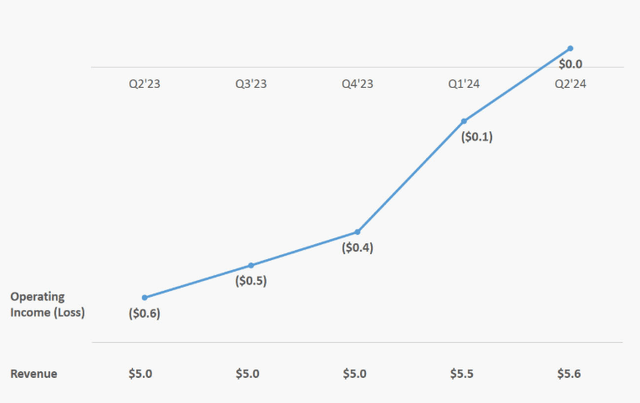

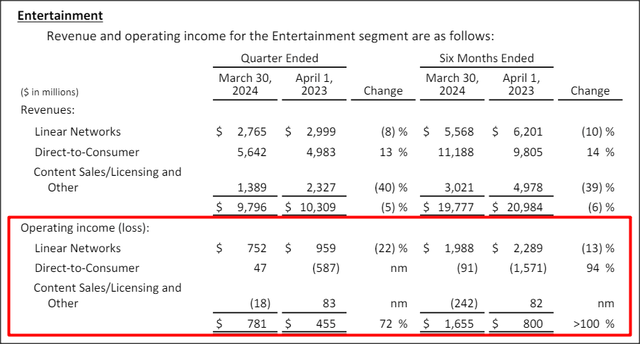

2. The direct-to-consumer business is now profitable

The chart below shows Disney’s operating income trajectory in the last year. Disney has made fundamental improvements to its business, including an aggressive focus applied to cutting costs, which has finally resulted in a major change in the earnings setup for the loss-making direct-to-consumer business.

Disney

Although Disney’s DTC operating income was only $47M in Q2’24, the impact of the company’s upswing should not be underestimated. Compared to last year’s Q2’23, Disney’s streaming business has seen a $634M swing in profitability. DTC has lost money for Disney for years and the jump to positive operating income is a major milestone achievement for the streaming company as well as a narrative change. If the current momentum in subscribers and ARPU growth continues, Disney could be on track to posting half a billion dollars in quarterly operating income in the DTC business by next year. Of course, this will be conditional on Disney continuing to grow its subscriber base both in the U.S. and abroad and delivering ARPU growth.

Disney

3. Higher FCF returns wait for investors

The third reason why Disney has revaluation potential is that subscriber growth in Disney+ (plus ARPU gains) and an improving operating income picture in the direct-to-consumer business are the main reasons behind the streaming company upgrading its earnings outlook: Disney guided for 25% adjusted EPS growth this compared to 20% earlier.

More significant than the earnings growth forecast is the company’s free cash flow guidance, in my opinion: Disney guided for (at least) $8B in free cash flow this year. In FY 2023, Disney had free cash flow of $4.9B which at the time represented a more than 262% increase compared to the year-earlier period. The FY 2024 free cash flow target implies another 63% Y/Y increase compared to FY 2023 and is driven, in part, by the company’s subscriber/ARPU momentum, but also by its ambitious goal to cut $7.5B off of its cost structure.

What this means is that if the company exceeds its cost-cutting target and achieves higher FCF, a higher free cash flow percentage could be returned to shareholders, so there is definitely some upside in capital returns for investors in the next twelve months, in my opinion.

Disney’s valuation

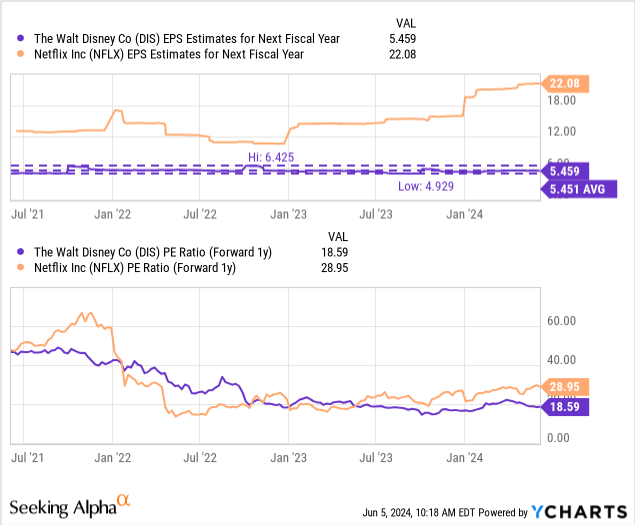

Disney is currently valued at a price-to-earnings ratio of 18.6X which is very reasonable for a streaming company that is expected to grow its earnings by 25% year over year, and then 15% next year. Netflix (NFLX), which is also crushing it right now, especially in terms of subscribers, is expected to grow its EPS 50% this year and 21% in FY 2025. The faster EPS growth, which in part was unleashed due to the company cracking down on password-sharing, is the reason for Netflix’s higher valuation ratio. Netflix has made massive progress in recent years in terms of growing its profitability by raising prices which is reflected in growing EPS estimates.

Disney is still in the midst of a cost restructuring and could raise subscription prices in order to improve its DTC profitability even more. I believe Disney could trade at 30-32X earnings (unchanged from my work in March), under the condition that the company realizes its cost-savings and FCF target and improves its DTC operating income picture. Therefore, I see a fair value range for Disney’s shares of $164-175 per-share.

Risks with Disney

The biggest risk with Disney relates to potential flops at the box office. The company has scheduled a number of releases, including Deadpool & Wolverine, Mufasa: The Lion King and a new Captain America movie. If big releases flop, Disney is going to add to its list of recent movie failures such as Haunted Mansion, Wish or Indiana Jones and the Dial of Destiny. What would change my mind about Disney is if the company lost subscribers in Disney+, failed to achieve its cost target of $7.5B or saw unfavorable operating income trends in DTC.

Final thoughts

Disney has considerable revaluation potential in FY 2024 and beyond as the company builds on its momentum in the streaming segment and continues to grow its average revenue per user figure, a vital metric used to determine whether a company makes progress in terms of customer monetization or not. Disney could also potentially exceed its cost savings target of $7.5B, as the company is driving a hard bargain right now. This, together with earnings upside in the now profitable direct-to-consumer segment, could create positive operating leverage for the company. With $8B in free cash flow expected this year, I also expect Disney to increase its stock buyback authorization and potentially buy back a lot more than $3B in shares this year!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.