Summary:

- Disney is a buy for contrarian investors who can hold for at least two years.

- Short-term catalysts include the reinstatement of dividends, the return to normalcy of air travel that will boost profits from the Parks and Experience segment even further, and Disney+ achieving profitability.

- With an experienced CEO at the helm, investors should feel assured that he will navigate Disney through the current issues and emerge stronger.

- The share price is currently undervalued, providing a margin of safety for investors.

Diy13/iStock via Getty Images

Thesis

I believe that Disney (NYSE:DIS) is a BUY for contrarian investors who are able to hold for at least two years. It will take at least the next two quarters before the positive effects from the catalysts give investors confidence that Disney has gotten itself out of the rut.

In the short term within (six months), the three stock price-boosting catalysts are (1) the reinstatement of dividends, (2) the return to normalcy of air travel coupled with a combination of higher ticket prices and new attractions that will boost revenue from the Parks and Experience segment to new highs, and (3) Disney+ achieving profitability through a combination of cost-cutting and better monetization (increasing Disney+ subscriptions, higher advertising revenue from the ad-tier, Disney+ breaking even and achieving profitability, and higher ticket prices and hotel room rates from the parks). All the above is possible only with the right leadership now, and it is my opinion that Bob Iger is the best person to right the ship. People are forgetful and many investors are disregarding his success at Disney’s helm from 2005 to 2020, when he successfully acquired and integrated Pixar, Marvel, and LucasFilms, and the assets that come with those acquisitions, to lay a strong foundation for the company in the years to come. The noise also drowned out new hires from Netflix (NFLX) like Devika Chawla and Arun Chandra, as well as superstar show creator Ryan Murphy.

However, the near-term headwinds facing Disney are real. Despite the catalysts which I believe will have a high probability of happening, Disney could still see its share price decline from now, and investors who do not have the stomach for it should HOLD off investing in Disney until they see things turning around for the company. Of course, by then when there is less uncertainty in Disney’s prospects, it will also be unlikely to trade in the deep-value territory that it is in right now.

In the article, I will be covering Disney in the following segments.

The first segment is a brief recap of the long litany of challenges that are facing Disney. This segment also presents the bear case, examining the external and internal factors that caused investors to lose confidence in the prospects of the company.

If you are familiar with the dramatic twists and turns surrounding Disney, you can skip that segment entitled “Part 1: A Brief Walk Down Memory Lane“, and proceed directly to “Part 2: Leadership Matters And It Matters A Lot More In A Company In Transition“. A strong, determined leadership is necessary to bring Disney out of the mess, and therefore that is the premise for the successful implementation of future plans, bringing us to “Part 3: The Three Catalysts“. Finally, I will move on to “Part 4: Valuation” before concluding this article with a few more thoughts.

Part 1: A Brief Walk Down Memory Lane

Disney (DIS) has been a storied stock, to say the least. The House of Mouse really needs no introduction. However, it is necessary to highlight its ups and downs to understand why its woes have foregrounded and overshadowed the positive catalysts to the point that they hardly seem to matter to investors now. If you are familiar with these, then fast-forward to Part 2.

2019 – March 2021: Ambitions And Euphoria

Like every other company in the world that depended heavily on paying customers walking through their doors, buying their food, beverages, merchandise, staying in the hotels, and enjoying the cruises, Disney’s parks and cruise line businesses were hurt badly by COVID-19 restrictions in 2020 and 2021.

Unlike these companies, however, Disney’s massive foray into the streaming business with the $71 billion acquisition of 21st Century Fox in 2019 gave investors hope during the terrible months of COVID-19-induced lockdown that Disney with its huge library of movies and decades of movie-making experiences, not to mention their success with the Marvel, Pixar and Star Wars franchise, could easily replicate the success of the streaming giant Netflix (NFLX). Disney+ launched in November 2019 to much fanfare. Then COVID-19 hit the world. Thanks to the unique circumstances surrounding the business of streaming entertainment, Disney’s stock prices rebounded from the low of $88.80 on 18 March 2020 to $201 on 8 March 2021, almost exactly a year later.

March 2021 – September 2023: Turmoil

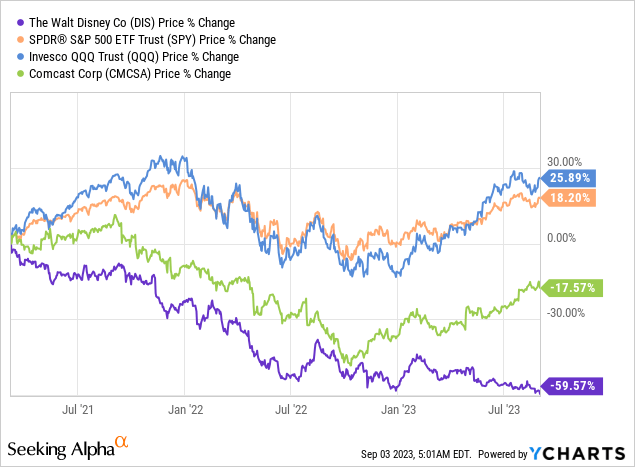

Reality and doubts soon triumphed over euphoria and optimism. Disney soon found out that being a (brief) winner in the COVID-19 lockdown did not guarantee its success for long. A confluence of external factors and internal unrest led to the 59.57% collapse in share price over this period.

Yes, I know that we were in a bear market in 2022 but despite that, the major indexes like SPY and QQQ recovered and have gained 18.2% and 25.89% since 8 March 2021.

Although its competitor, Comcast (CMCSA), with movie entertainment and theme park business, is still underperforming the market at -17.57% lower now than it was at on 8 March 2021, unlike Disney, Comcast has staged a remarkable 55% recovery from its September 2022 lows. You can read my take on CMCSA here.

What are these external and internal factors?

External Factors Affected Park Attendance

Thanks to the Federal Reserve which brought on a 40-year high inflation that slowed down the economy, indirectly increased the costs of living, and pushed credit card debt over $1 trillion for the first time, all of which served to reduce disposable income for the average household. When folks have less cash in their wallets for food, medicine, rent, utility bills, and gas, they will penny-pinch and subscriptions are among the first things to go, and holidays may get postponed too.

The world was a less scary place when the first vaccine, and then subsequent ones were developed and mass-produced. Despite a global lifting of mask mandates and travel restrictions, the fact is these loosening of restrictions happened in different stages for different countries. China removed all COVID-related restrictions barely 9 months ago. Japan just lifted its COVID-19 travel restrictions in April 2023. With international air travel yet to return to pre-COVID levels, that was bad news for Disney’s park and resort business. As of 2022, attendance figures – and revenue contribution – for parks outside the US were still far below pre-COVID levels.

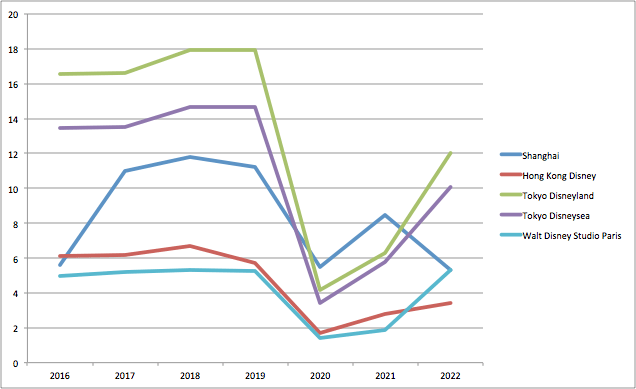

Graph Author’s. 2016 to 2022 Attendance of Parks outside the US (data sourced from Statista and https://queue-times.com)

External Factors Affected Disney+ Subscriber Numbers

These factors affected every company and every individual on the planet. They are unavoidable and are nobody’s fault.

Vaccination was a global success. On the back of the success came winners and losers in the economy. Former losers – think restaurants and malls – were booming again, while former winners – think e-commerce and work-from-home enablers – faltered. Disney’s streaming business falls into the latter group.

Successful mass vaccination worldwide meant that more people were returning to their workplaces and since they were no longer stuck at home, fewer people needed as much entertainment as before and it was no wonder Disney+ subscriber numbers fell for the first time in Q4 2022 and then again in 2023.

To be clear, this is not a Disney+ issue. Disney was not alone in its subscriber woes. Streaming giant Netflix (NFLX) experienced it in 2022 too, before it took measures to address that. More on such measures later.

Wait… Shouldn’t Disney’s Parks and Experiences Benefit?

Yes but not immediately. Due to the reasons mentioned in the earlier segment regarding the uneven rate of return to international air travel and the staggered lifting of COVID-related restrictions like mask mandates, compulsory quarantine, and banning of international travelers to China, Hong Kong, and Tokyo, the revenue contributions from these areas were muted in 2022 and in the first half of 2023. It does not mean that just because China lifted COVID-19 restrictions measures in December 2022, families can travel to Shanghai Disneyland in January 2023. And it does not mean that just because Japan lifted its inbound travel ban in April 2023, families can fly en masse to Tokyo Disneyland in June. Families need to plan their vacations. Employees need to take leave from work.

The lack of revenue boost from the parks coupled with the increasing losses experienced by the streaming division compounded the woes facing Disney from 2022 till today.

Internal Factors

In the latest Q3 2023 earnings call, CEO Bob Iger claimed that,

… we’ve improved our DTC operating income by roughly $1 billion in just three quarters, as we continue to work toward achieving DTC profitability by the end of fiscal 2024.

How many people truly believe that? And who could blame them for their disbelief?

There was plenty of drama going on within Disney and among them is the ongoing lawsuit asserting that Disney’s former management was obfuscating Disney+ growth numbers to mislead shareholders. Besides that, there were many other issues taking up management’s focus and attention, from an activist investor’s self-nomination to Disney’s board, writers’ strike, unionized workers striking and asking for better pay and increasing the cost of doing business in the parks, bad press from Disney’s messaging through its movies, the ongoing dispute between the CEO with the current governor of Florida and California (recently resolved), and the constant disputes with pay-TV carriers like DISH and Charter Spectrum that resulted in Disney channels getting pulled from those networks while fee negotiations were ongoing. This game of chicken has happened before, again and again, so observers know this is just a rite of passage whenever it is time to renegotiate prices and get a better deal but the fact is none of this helps the management to focus on getting the business back on track.

Shareholders need something to cheer about, and there was nothing much to cheer about in 2022 and 2023. Total park attendance numbers are improving but on the whole, were down. Disney+ subscriber numbers have been on the decline for three consecutive quarters after peaking in Q4 2022, falling by almost 18 million. Disney+ kept losing money and the only good news from that division in the latest quarter is it is losing less money.

In short, it’s a mess in the Mouse House. There is so much smoke and fire to put out that it is no wonder many Disney investors are calling it quits.

Part 2: Leadership Matters And It Matters A Lot More In A Company In Transition

Amidst all the flurry of dark clouds and negative sentiments, it can be easy to forget who Disney was, what it achieved for shareholders, what it is capable of doing, and who was behind all that. To do that, examine Disney’s track record from 2002 till 2018, before its 21st Century Fox (TFCF) acquisition.

Of course, I am not advocating an investment approach that is based on a company’s past glory, but history serves as a good reminder of who Disney still is and can be, what it is doing for shareholders, what it is attempting to do to carve a stronger future for itself, and who has been orchestrating and executing these long-term plans. Investors who solely focus on the present quarter-to-quarter numbers and try to extrapolate that to the future without any regard for history are missing a piece of the puzzle, in my opinion.

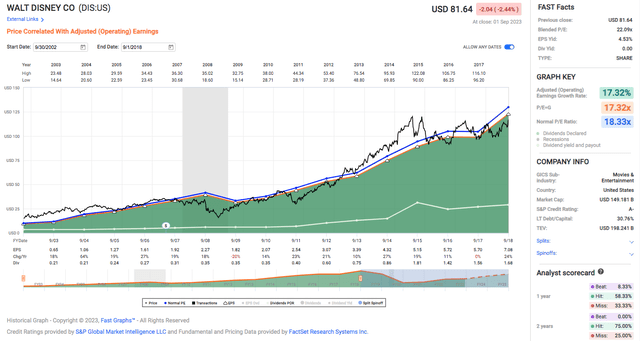

History tells us that Disney had performed marvelously under the previous CEO Bob Iger.

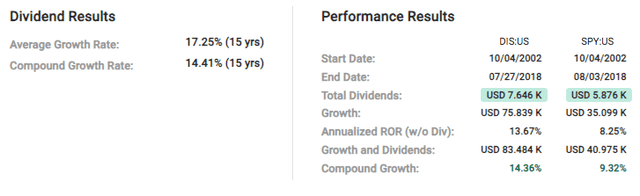

Disney was a reliable, total-return company that provided a double-digit dividend growth rate and a double-digit adjusted earnings growth rate, easily 8x an initial investment over just 15 years, achieving a 14.36% annualized rate of return that easily trounced S&P’s 9.32% over the same period.

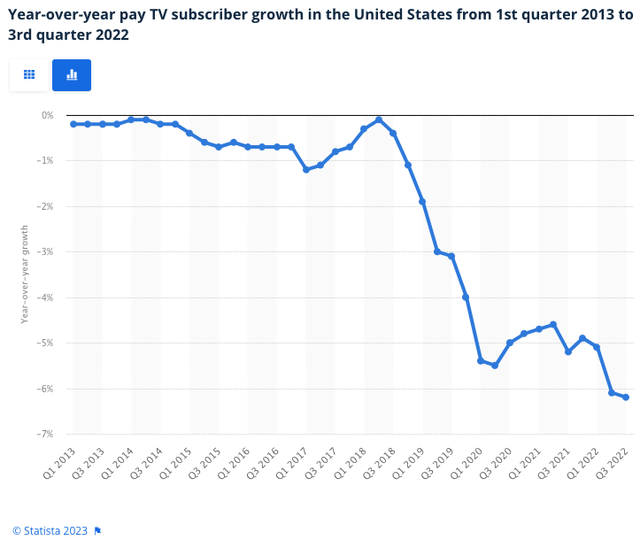

Disney is a company in transition as it moves towards streaming forming a bigger part of its revenue. Almost a decade ago, Bob Iger acknowledged the threat that cord-cutting has to Disney’s Linear Network business, and he had in place a grand plan to address that. In the Q4 2015 earnings call, CEO Bob Iger made the following comment:

I’m struck with something that Steve Jobs once said, when he was asked about technology and how he developed it. And he said that he starts with the consumer and he works backward to technology. And we’re actually doing that, too. We’re thinking about the consumer and the consumer today is a different consumer than before. They don’t just want to sit in the living room on a couch and watch our product on a fixed screen on the wall with a remote control in their hand. They want to do it in many more ways, and they have the authority thanks to technology to make those decisions.

He was clearly envisioning Disney+ back then. Before Disney had its own platform, its products were distributed via other digital platforms like Netflix. Disney was also testing the waters with DisneyLife in the UK and Ireland from 2015 to 2019. Although he was coy about his streaming ambitions when asked about it in Q2 2016, he finally admitted it when he announced a 33% stake in Bam Tech in Q3 of 2016, before fully acquiring the company in 2017.

Management knew that by entering the streaming market it had to contend with the wildly successful market leader Netflix, so its 2019 massive $71 billion acquisition of TFCF to get its massive library of content, and the ending of the distribution of Disney’s content on Netflix, was the final salvo that openly declared war on Netflix. In the Q3 2017 earnings call, CEO Bob Iger said:

Of course, one of the most compelling brands for a direct-to-consumer product is Disney, and to that end, we will launch a Disney-branded streaming service in 2019, which will be unlike anything else in the market. The new service will become the exclusive home in the U.S. for subscription video-on-demand viewing of the newest live action and animated movies from Disney and Pixar, beginning with the 2019 slate, which includes Toy Story 4, the sequel to Frozen, and The Lion King from Disney live-action, along with other highly-anticipated movies.

We’ll also be making a substantial investment in original movies, original television series, and short form content for this platform, produced by our studio, Disney Interactive and Disney Channel teams. Subscribers will also have access to a vast collection of films and television content from our library.

With this strategic shift, we’ll end our distribution agreement with Netflix for subscription streaming of new releases beginning with the 2019 calendar-year theatrical slate. These announcements marked the beginning of what will be an entirely new growth strategy for the company, one that takes advantage of the opportunities the changing media and technology industries provide us to leverage the strength of our great brands.

In his book “The Ride of a Lifetime“, he penned a chapter titled “If You Don’t Innovate, You Die.” In that chapter, he wrote, “We were now hastening the disruption of our own business.” COVID-19, in a strange way, amplified the disruption and pulled forward the subscriber sign-up trajectory to exceed Bob Iger’s initial target of achieving 60 to 90 million subscribers by 2024; analysts in 2019 were projecting 76 million Disney+ subscribers by 2024; it is 146 million as of Q3 2023, 4 years after Disney+ launched.

Let’s remember these before lambasting the CEO for not planning his succession well, taking shots at the company for its declining subscriber growth, Disney being a poor investment because it is trading at a 9-year low, or questioning its massive $71 billion acquisition of TFCF. Prior to Bob Iger, Michael Eisner led Disney for 20 years, and under his leadership, he revived a sluggish animation studio, turned Disney into a media giant, and launched several new parks. Then came Bob Iger who led Disney for 15 years before handing the reins over to his successor after a fantastic 15-year run. Bear in mind that during these 15 years, Bob Iger led the company through various challenges such as the Great Financial Crisis, and the crash of 2018. He saw the writing on the wall (see graph below) regarding cord-cutting years before its massive decline in 2019 and more importantly, took action as early as 2015/2016 with Bam Tech to transit the pay-TV part of the business away from being dependent on cable and into its own DTC platform.

And to anyone who thinks that challenging the supremacy of Netflix is going to be cheap and or easy, that to do well in a much-contested industry with many content distributors beyond Netflix like Paramount (PARA), Warner Bros Discovery (WBD), and Comcast (CMCSA) is going to be a walk in the park, and to top all of that, to ramp up to a 146 million subscriber base and be profitable within five years, they need to rethink that premise.

To find a CEO of an equal or higher caliber to lead a company that is much more complex in today’s fast-paced digital and streaming world than it was just 10 years ago cannot be an easy task.

There is no one I would rather trust today than Bob Iger at Disney’s helm to see his grand strategy come to fruition. And with that, I will segue way into Part 3.

Part 3: The 3 Catalysts

One: The Reinstatement of Dividends and possibly restarting share buybacks.

Many investors are rightly concerned about Disney’s financial situation, and many believe it should focus on paying down debt rather than paying dividends or worse, buying back shares.

At the most recent earnings call, CEO Bob Iger said,

In the midst of the transformative work we have been doing, we are prioritizing long-term free cash flow growth and have generated $1.6 billion of free cash flow in the third quarter. Our balance sheet remains strong with our single A credit ratings reflecting that strength. We have made significant progress deleveraging coming out of the pandemic, and we continue to approach capital allocation in a disciplined and balanced manner, prioritizing investments to generate future growth while also keeping an eye towards shareholder returns.

And to that point, as we’ve mentioned before, we still expect to be in a position to recommend that the Board declared a modest dividend by the end of this calendar year with the intention to recommend increased shareholder returns over time as our earnings and free cash flow power grows.

This is consistent with what was stated by the CFO in the Q1 2023 earnings call:

… we will be on track to declare a modest dividend by the end of this calendar year. The amount will likely be a small fraction of our pre-COVID dividend with the intention to increase it over time as our earnings power grows.

The dividend reinstatement will achieve several things. Firstly, it will send a message of confidence to shareholders that Disney is out of the woods and is generating sufficient free cash flow to start rewarding its shareholders. Secondly, the dividend will give existing shareholders a tangible reason to hold and wait for the share price to recover, thus reducing volatility and relieving some selling pressure on the stock. Thirdly, once it starts paying dividends, institutional investors and money managers of dividend ETFs like SPDR S&P Dividend ETF (SDY) and iShares Select Dividend ETF (DVY) are likely to include Disney again, and the increased demand from their purchases are likely to give an immediate boost to the share price. Fourthly, a dividend-paying Disney will attract income-seeking investors who as a whole are more likely to hold Disney shares for longer periods and hence reduce the kind of volatility that it has been experiencing.

In the past, Disney’s payout ratio has ranged between 9% to 49% of its operating cash flow. Using those as a gauge, with the forecasted operating cash flow in 2024 to be $7.12 per share, and assuming Disney starts from the lowest end of that range to distribute a “modest” dividend that would hopefully ramp up quickly, that works out to be $0.64 per share. $0.64 will just be 36% of the $1.76 dividend per share that was paid out in FY 2019 but it will be a good start at a very manageable and assuring 9% payout ratio. Hypothetically, even if Disney boosts that dividend by a generous 15% per year for each of the next three years, that will work out to be just $0.97 per share in 2026, which is still 9% of 2026’s expected operating cash flow of $10.53 per share.

Then, there is the possibility of a share buyback. Of course, this is just my speculation. In the Q3 2019 earnings call, then CFO Christine McCarthy said this regarding restarting the share repurchase program,

And we will be meeting with them (rating agencies), but our attitude towards share repurchase has always been once we invest in our businesses and we make any acquisitions as we see fit, we look at our dividend capacity. And if all of those still result in excess cash for us, we will return it to shareholders. I don’t think you should anticipate that happening in the near future because we’re still in an investment mode as it relates to our direct-to-consumer activities, and that’s what we’re really focused on right now.

While nothing of the sort has been announced, I believe there is a distinct possibility for the company to restart its share buyback program in 2024. Due to the acquisition of TFCF, Disney suspended its share repurchase program in 2019. Then, as part of its cash conservation plan in 2020, Disney suspended the dividends and the share buyback program continued to be suspended. With the share price at a 9-year low, buying back shares now makes economic sense. Not only will this reward shareholders by boosting shareholders’ equity, but it is also a more tax-efficient way of rewarding shareholders. By retiring more shares, Disney will be able to increase dividend payments per share for subsequent quarters without deploying more cash.

The last clue to Disney possibly restarting its share repurchase program was based on what CEO Bob Iger said in Q2 2019,

… you’re probably also curious about leverage, and we have not recommenced any share buyback because we said we would not be doing that until our leverage ratios came back in line with that of the single A company. So for the time being, you can assume that our share repurchases will be suspended.

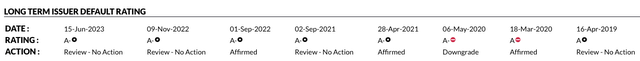

As of Q3 2023, Disney’s credit rating continues to be in the single A- rating with its outlook “stable”. It has yet to return to that coveted “single A” rating as of to date.

Fitch’s Long-Term Issuer of Disney’s Default Rating

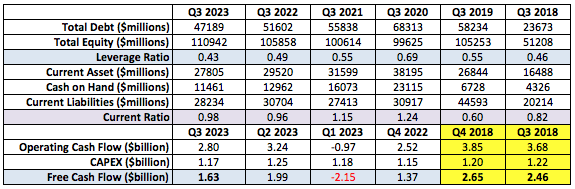

However, Disney has been deleveraging and improving its balance sheet. Total debt has reduced from a high of $68 billion in 2020 to $47 billion by Q3 of 2023. It has more cash on hand now in Q3 2023 than in Q3 2018 and Q3 2019 combined. The company is also free cash flow positive.

Data sourced from Factset, Fast Graph. Table’s author’s

Interim CFO Kevin Lansberry said in Q3 2023’s earnings call,

In the midst of the transformative work we have been doing, we are prioritizing long-term free cash flow growth and have generated $1.6 billion of free cash flow in the third quarter. Our balance sheet remains strong with our single A credit ratings reflecting that strength.

With these improvements, Fitch may up Disney’s credit rating back to a “solid single A”, giving Disney directors and Bob Iger the support they need to restart a share repurchase program.

Two: Higher Revenue From Parks and Experiences, and Consumer Products

Disney’s parks and resorts business is inextricably linked to the state of air travel both domestically as well as internationally. The return to normalcy of air travel coupled with a combination of higher ticket prices for parks in the US, parks in Japan from October 2023, and new attractions will certainly boost revenue from the Parks and Experience, especially for the international parks segment, to new highs.

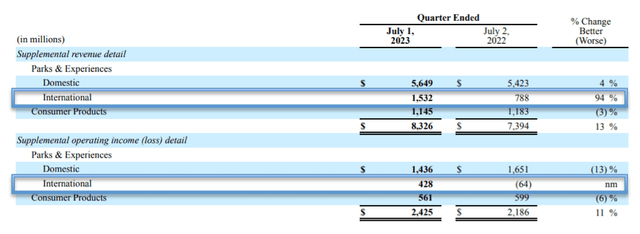

As you can see from the Q3 2023 10K above, revenue and operating income from the international side of Parks and Experiences have ballooned. And that is only the beginning.

Travel restrictions to Hong Kong (Hong Kong Disneyland) were only recently lifted in March of 2023 and in April 2023 for Japan (Tokyo Disneyland and Tokyo DisneySea) respectively so revenue results for the first six months of 2023 could not fully capture the benefits from these relaxations of travel bans, and yet the results are already impressive.

Based on the latest June 2023 data from the International Air Transport Association (IATA) which represents over 300 airlines comprising 83% of global air traffic,

Total traffic in June 2023 (measured in revenue passenger kilometers or RPKs) rose 31.0% compared to June 2022. Globally, traffic is now at 94.2% of pre-COVID levels. For the first half of 2023, total traffic was up 47.2% compared to the year-ago period.

The IATA report concluded with,

As strong as travel demand has been, arguably it could be even stronger. Demand is outrunning capacity growth. Well documented problems in the aviation supply chain mean that many airlines have not taken delivery of all the new, more environmentally friendly aircraft they had expected, while numerous aircraft are parked awaiting critical spare parts.

The Parks segment has always been the company’s cash cow. Of course, Disney has other business units too, but my focus is on the Parks and Experiences, and Consumer Products.

Date from Q3 2023 10Q

The Q3 revenue contribution from Parks and Experiences, and Consumer Products, make up 37.2% of Disney’s total revenue for the quarter. Yet, these two segments form the bulk of Disney’s Q3 2023 operating profit, a whopping 66.7%. The backbone of Disney has always been the Parks and Resorts.

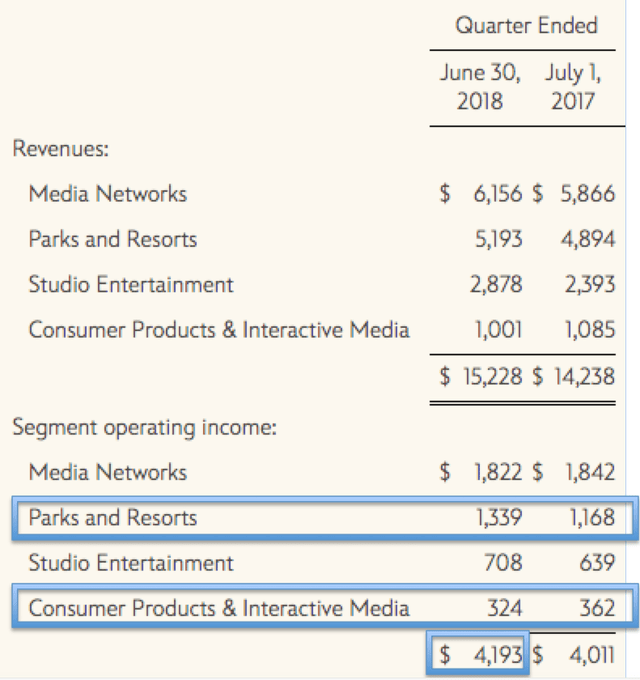

Q3 2018 Disney Operating Income

Even back in 2018, before TFCF and Disney+, the operating income from the Parks and Resorts and Consumer Products and Interactive Media made up 31.9% and 7.7% respectively of the Q3 2018 operating income, a total of $1.663 billion (39.6% of the Q3 2018 operating income). That has increased to $2.4 billion in Q3 2023 and with IATA’s expectation that global air travel will 2019 levels in the second half of 2023 and may even exceed that, I am confident of higher revenue and operating income figures from these two segments in Q4 2023 and Q1 of 2024.

Park admission ticket prices have also been increasing. Disney learned the hard way that it should not increase prices too fast and furious which can backfire, but observers should not be mistaken that prices will stay stagnant.

Domestic ticket prices have increased though not uniformly but based on the popularity of the parks, timing of entry during the day, the day of visit during the week, the number of parks visited (park hopper), and the number of days. Other than Animal Kingdom, there is an increase in the base price of $5-$15 for all the other three parks (Hollywood Studios, EPCOT, and Magic Kingdom), and an increase of $20-$30 for each of those 3 parks.

Shanghai Disneyland increased ticket admission prices in February 2023 by an average of 9%. Hong Kong Disneyland too increased prices to enter the magical land. Tokyo Disneyland and DisneySea are not spared too; the price of ticket admission will increase from October 1, 2023.

While it is important to keep track of the subscriber numbers at Disney+, the dispute between Charter and Disney, and the acquisition of the rest of Hulu from Comcast, what investors should also take heart of is the increasing profitability of the Parks and Experiences and Products segments that continues to improve Disney’s balance sheet and free cash flow while Disney+ finds its footing and achieve profitability.

Three: Disney+ Achieving Profitability Through a Combination of Better Monetization and Cost-cutting

Cost-cutting and better monetization across all business segments (parks, resorts, DTC) have been the mantra. In February 2023, soon after returning as CEO, Bob Iger announced a planned layoff of 7000 employees, or 3% of its workforce as part of the cost savings measure to save $5.5 billion. In the Q3 2023 earnings call, Bob Iger triumphantly announced that his cost-cutting measures have been successful and Disney+ is more profitable.

We aggressively reduced costs across the enterprise and we’re on track to exceed our initial goal of $5.5 billion in savings. And perhaps most importantly, we’ve improved our DTC operating income by roughly $1 billion in just three quarters, as we continue to work toward achieving DTC profitability by the end of fiscal 2024. I’m pleased with how much we’ve gotten done in such a short period of time, but I also know we have a lot more to do.

Looking to Disney Entertainment studios, we’re focused on improving the quality of our films and on better economics, not just reducing the number of titles we release but also the cost per title.

CFO Kevin Lansberry added:

We now expect capital expenditures for the year to total $5 billion. This is lower than our prior guide, primarily due to spending timing shifts for various projects across the enterprise.

The former CFO Christine McCarthy shed more light in the Q2 2023 earnings call on cost-cutting and the timing of when the positive effects will be seen,

But there’s also other things (i.e. other than headcount reduction) that we’re finding more and more opportunities on eliminating redundancies, looking at ways to become more effective by utilizing resources, people and other resources across other businesses. But we’re really leaning into all the opportunities. There’s technology, which we’ve also seen a lot of good progress. Some of it will be, and I say some, will be realized in the balance of this year, really at the end of the fiscal year. But the real impact is going to help us in 2024.

Then there are the pricing changes and the introduction of the ad-free tier, intended to optimize Disney’s “pricing model to reward loyalty and reduce churn, to increase subscriber revenue for the premium ad-free tier, and drive growth of subscribers who opt for the lower cost ad-supported option“. From October 12 2023, prices will increase across almost all its streaming channels, including Disney+ and Hulu.

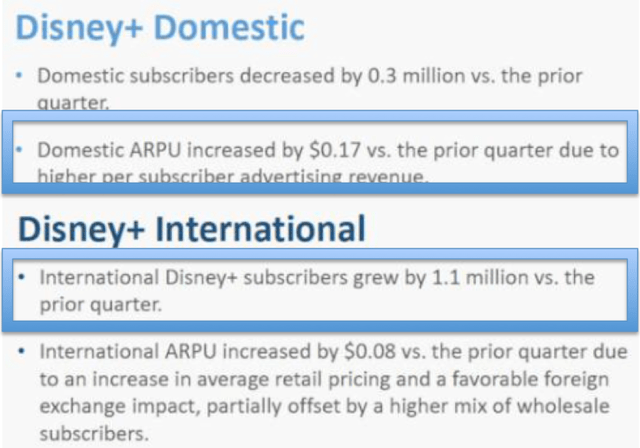

Disney expects these pricing changes and the ad-free tier option will help to migrate and attract many subscribers to the ad-supported tier which will increase advertising revenue. Although the changes are still in the early innings, and Disney is likely to make further adjustments down the road based on the data it collects, there are already some measurable positives from these changes in the Q-on-Q increase in domestic ARPU due to an increase in advertising revenue and the 1.1 million increase in international Disney+ subscribers.

And on top of these structural changes, there are also new hires from Netflix (NFLX) like Devika Chawla and Arun Chandrawill, who will be using their Netflix experience to help turn Disney+ into a profitable business. Superstar show creator Ryan Murphy, also formerly from Netflix who created hit shows like DAHMER – Monster: The Jeffrey Dahmer Story, Mr. Harrigan’s Phone, and The Watcher, is likely to join Disney, and if that pans out, Disney+ subscribers can look forward to great originals in the years ahead.

Valuation

In Part 1: A Brief Walk Down Memory Lane, the litany of challenges that I listed is enough to put investors off a much-loved company and brand like Disney. It is not that Disney bulls have disappeared. It is just that there are so many issues for Disney to handle on so many fronts that some folks have decided to pack up and go. Analysts are people too and they will be influenced by the negativity and uncertainty surrounding Disney.

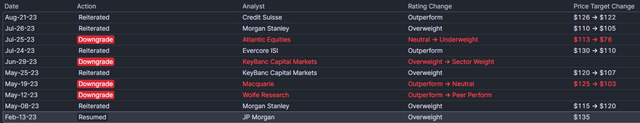

Since May 2023, analysts have been downgrading Disney shares and lowering price targets furiously.

Finviz Record of Analysts’ Actions

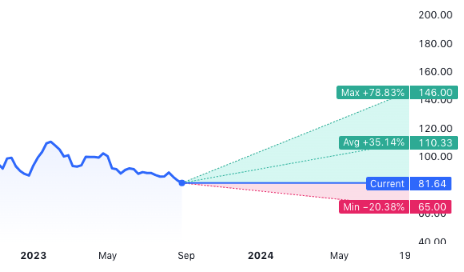

It is normal for analysts to disagree on the valuation and prospects of a company, but when the price target divergence among 24 professional analysts ranged from a low of $65 per share to a high of $146 per share, it says a lot about the lack of certainty they have regarding Disney’s future trajectory.

Analysts’ Disney 1-year Price Targets

When analysts’ valuation differs wildly to two extreme ends of a stock’s intrinsic valuation, that is a sign of (1) mispricing, (2) huge uncertainty, or (3) both. This does not make things easy for us investors but turmoil does spell opportunity.

Morningstar Neil Macker believes that Disney is worth $145 per share. That presents a 77.7% upside from Friday’s closing price of $81.58. I am less optimistic as I want a larger margin of safety.

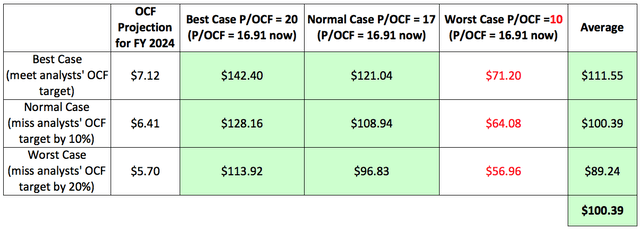

Disney’s stock price correlates well with its operating cash flow, with Disney beating or meeting Factset analysts’ 1-year and 2-year forecasts 67% of the time. These analysts forecast an average operating cash flow growth of 25.65% for the next three years, growing rapidly by 44.61% in FY 2024 before slowing down to 21.02% in FY 2025 and 22.27% in FY 2026.

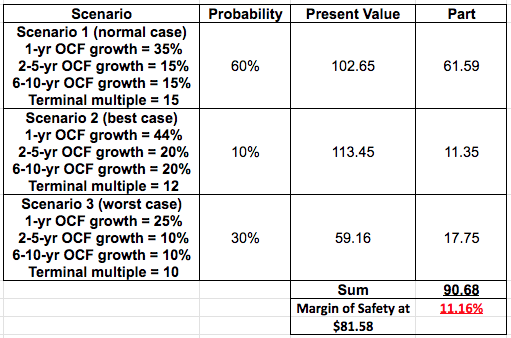

In my best-case scenario, I assume that Disney has a 10% chance of meeting analysts’ operating cash flow expectations. In my normal-case scenario, I assume that Disney has a 60% chance of achieving decent OCF growth which misses analysts’ projections by 20%-25%. In my worst-case scenario, I assume that Disney has a 30% of missing analysts’ OCF projections by 45%-50%. After factoring all these, I came to what I believe is a conservative fair value of $90.68 per share.

Author’s calculations

It bears mentioning that prior to Disney’s acquisition of TFCF, Disney missed Factset analysts’ OCF projections just once and it was only by 6%, so to assume 20% to 50% misses in OCF projections is building in a wide margin of safety.

Then, I modeled different scenarios that consider a range of possibilities, from meeting OCF projections to missing them by 10% and 20%, and considered changes in the P/OCF multiple to reflect the market pricing of Disney shares, and I came to a value of $100.39, which gives a 23% margin of safety from the closing price of $81.58. Only in two very extreme scenarios like Disney shares trading at a P/OCF of 10, which happened very infrequently in its history, and Disney missing OCF targets by 10% or more, that the price possibly see a further downside of 14%-30%.

After considering the three catalysts, I believe there are more upside potential than downside risks at this point in time in Disney’s progress back to normality.

Conclusion

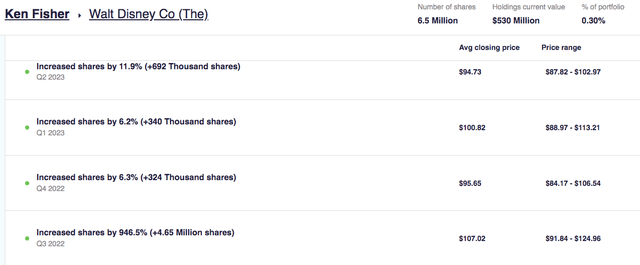

Ken Fisher, an American billionaire investment analyst, the founder and chairman of Fisher Investments, and an author of numerous books, including Beat the Crowd: How You Can Out-Invest the Herd by Thinking Differently, wrote the following:

Contrarians… know the markets are mostly efficient. Not fully, perfectly efficient at every moment – otherwise there would be no opportunities! Contrarians realize markets can be quite irrational in the short term. But over time and on average, prices typically reflect all widely known information. If it’s out there, in the public domain, investors have already considered it and traded on it.

In other words, the market could have already priced in all the negative news and uncertainties around Disney. That could be his belief that led him to increase his holdings of Disney shares from Q3 2022 to Q2 2023.

There are undeniable tons of near-term issues but management is actively addressing them, having resolved some of them (the dispute with the California governor, managing the activist investor) and is close to resolving others (profitability of the parks and Disney+, brought burgeoning costs down). There are other thorny issues remaining, like the mid-term issue regarding post-Iger leadership, on succession, which is more uncertain. However, what is (almost) certain is whoever takes over the reins in 2026 will have some advantages that Bob Chapek, and Disney in 2020, do not possess. Firstly and obviously, there are no more fallouts of COVID-19 to manage; no travel restrictions, no mask mandates, etc. Secondly, Disney’s transition from linear TV to having a profitable DTC Disney+ will be completed. The new CEO will be handling issues on improving margins to match Netflix’s and to chase subscriber growth, but its profitability will no longer be in question.

The question remains: Is Disney a buy, hold, or sell?

I will reiterate what I said at the start of this article:

I believe that Disney (DIS) is a BUY for contrarian investors who are able to hold for at least two years. It will take at least the next two quarters before the positive effects from the catalysts give investors confidence that Disney has gotten itself out of the rut.

If your investment profile does not fit those descriptions, if you absolutely distrust the leadership of the current CEO, if you do not think much of Disney’s prospects, the catalysts mentioned, and the strength and value of its enormous intellectual property, you should not be buying Disney shares.

In the latest earnings call, CEO Bob Iger said:

… our progress will not always be linear. But despite near-term headwinds, I’m incredibly confident in Disney’s long-term trajectory because of the work we’ve done, the team we have in place and because of Disney’s core intellectual property foundation.

As a shareholder, I believe in entrusting capable leaders to do their job. Bob Iger has been a proven and successful CEO at Disney since 2005, and I have no reason not to trust him to navigate the current mess.

Yes, the House of Mouse is on fire and thick, black smoke is billowing out through the windows and doors, and has been since 2020. And because the fire has been raging so fiercely for so long, some investors are ignoring the lone firefighter who is equipped to put out the fire and has the experience to do so. Some do not even see him as he was kept obscure by the thick smoke. They too did not see the expert hired help that had come on board. They also did not see the parts where the fire had already been put out and thought that every part of the house was still on fire. A few do see the progress being made, slowly but gradually, and are cheering him on.

Which one is you

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.